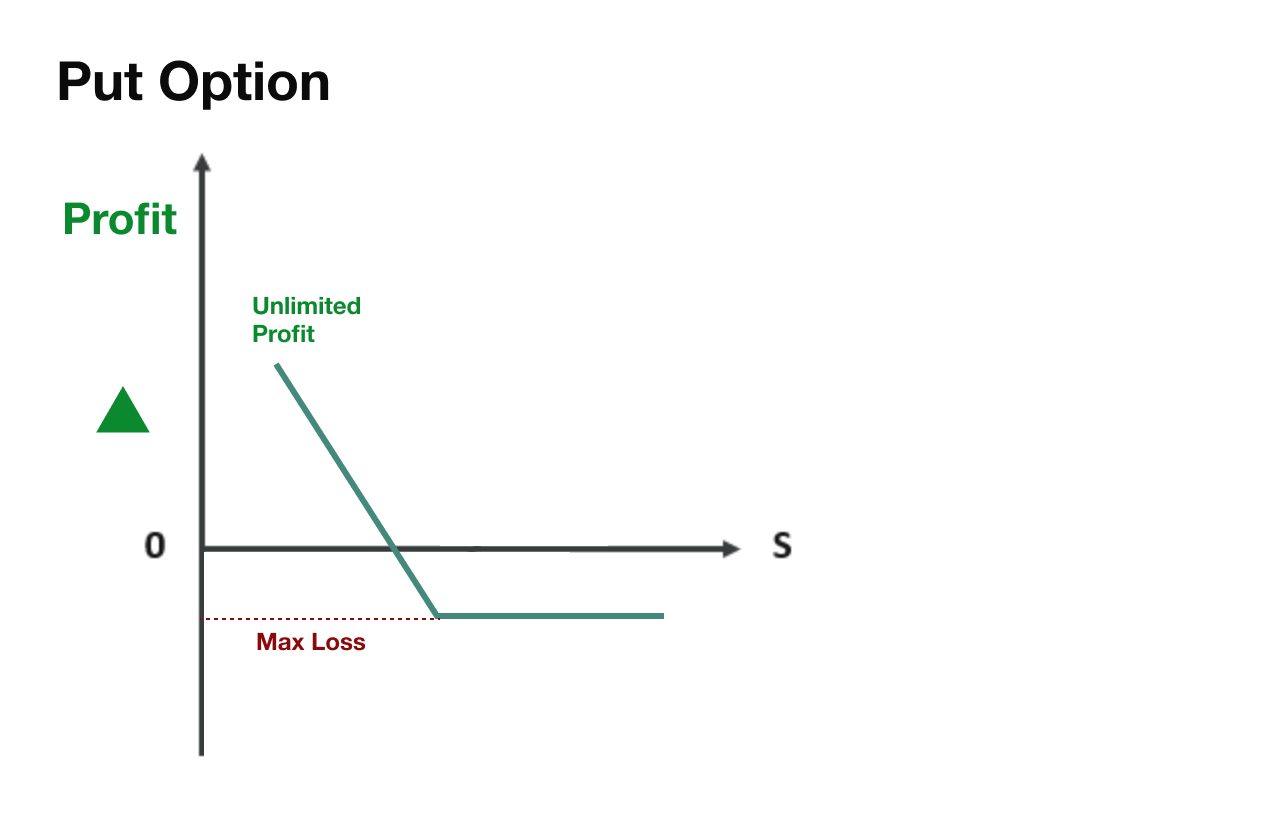

What Happens When Buy Put Option Expires If you bought a put option there are two possible scenarios you will face as the expiration date approaches First the share price is higher than the put option strike price That means the option is out of the money or OTM and it expires worthless Your loss is limited to 100 percent of the premium you paid for the option

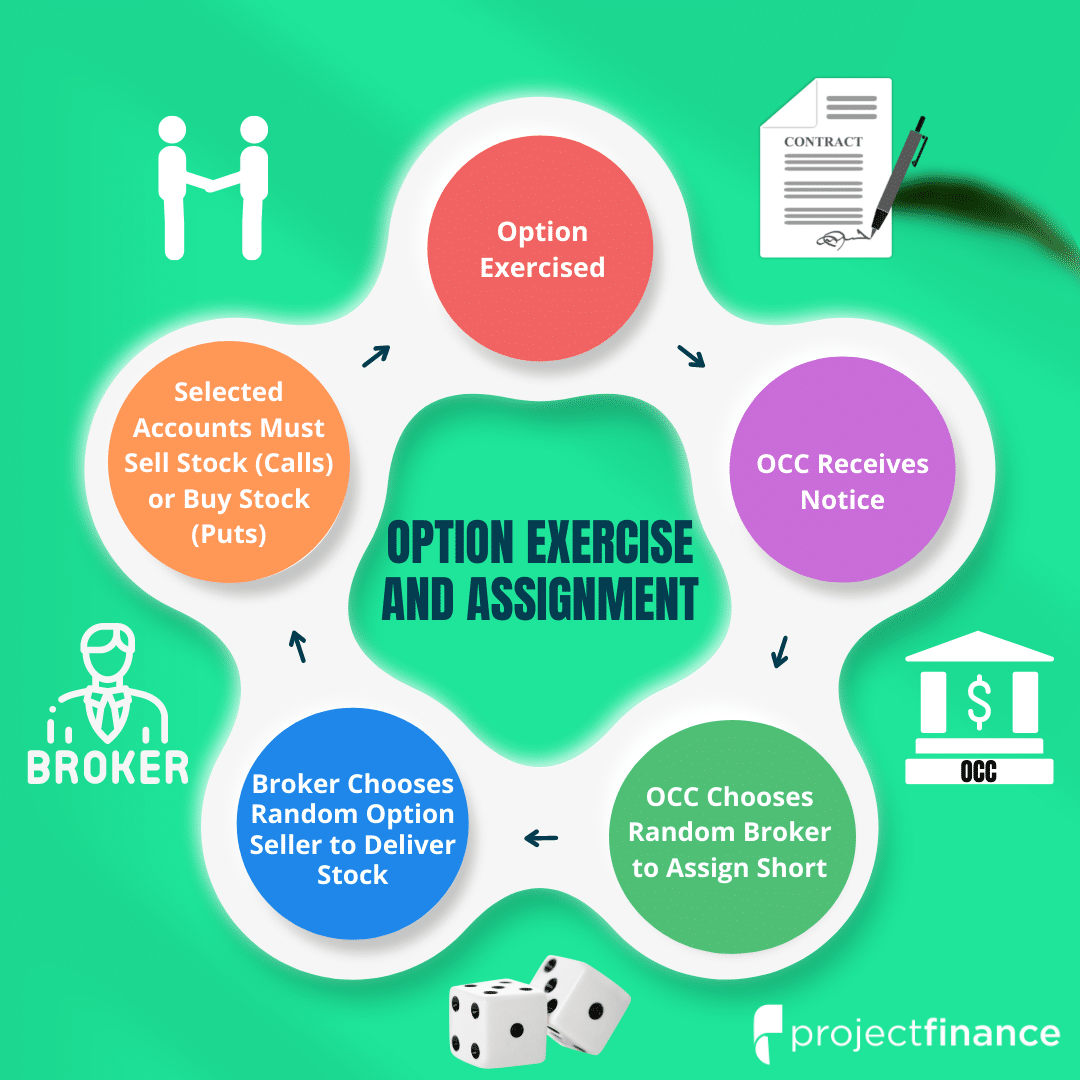

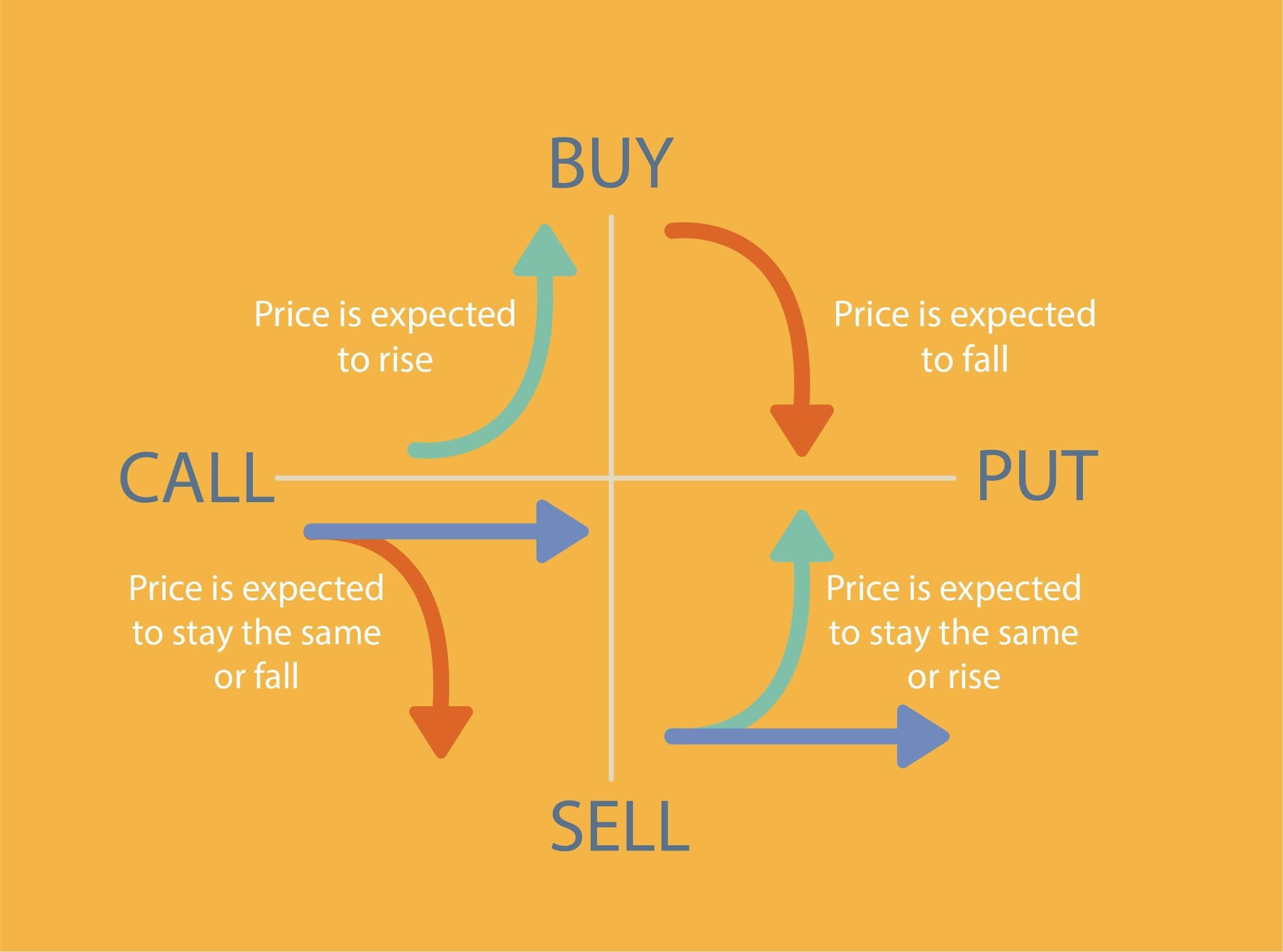

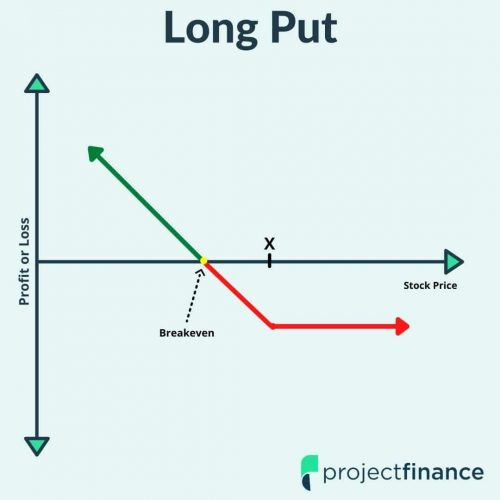

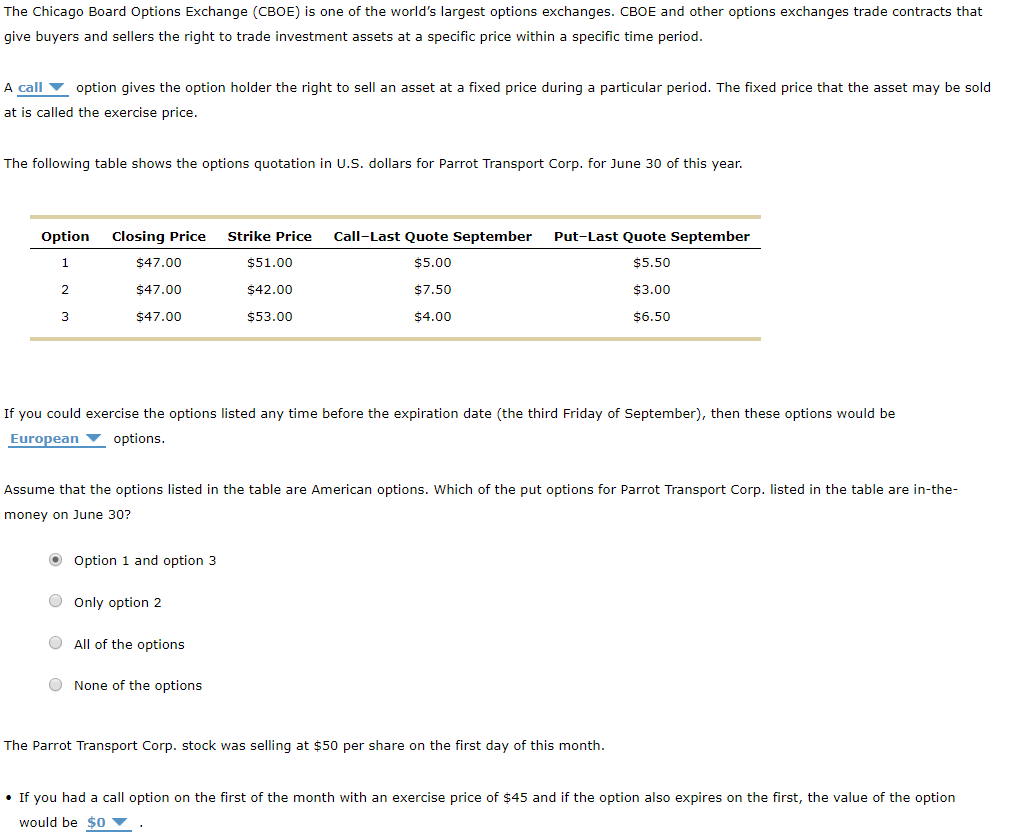

The buyer owner of an option has the right but not the obligation to exercise the option on or before expiration A call option 5 gives the owner the right to buy the underlying security a put option 6 gives the owner the right to sell the underlying security Conversely when you sell an option you may be assigned at any time regardless of the ITM amount if the option owner The buyer owner of an American style option has the right but not the obligation to exercise the option on or before expiration A call option gives the owner the right to buy the underlying security a put option gives the owner the right to sell the underlying security Multiplier When an option holder buys a put or call they pay a

What Happens When Buy Put Option Expires

What Happens When Buy Put Option Expires

https://www.projectfinance.com/wp-content/uploads/2022/03/In-The-Money-Option-at-Expiration.png

Put Options What They Are And How They Work OptionsDesk

https://optionsdesk.com/wp-content/uploads/2021/08/Put-Option.png

What Happens When An Option Expires In The Money

https://financhill.com/blog/wp-content/uploads/2021/09/Untitled-design-94.jpg

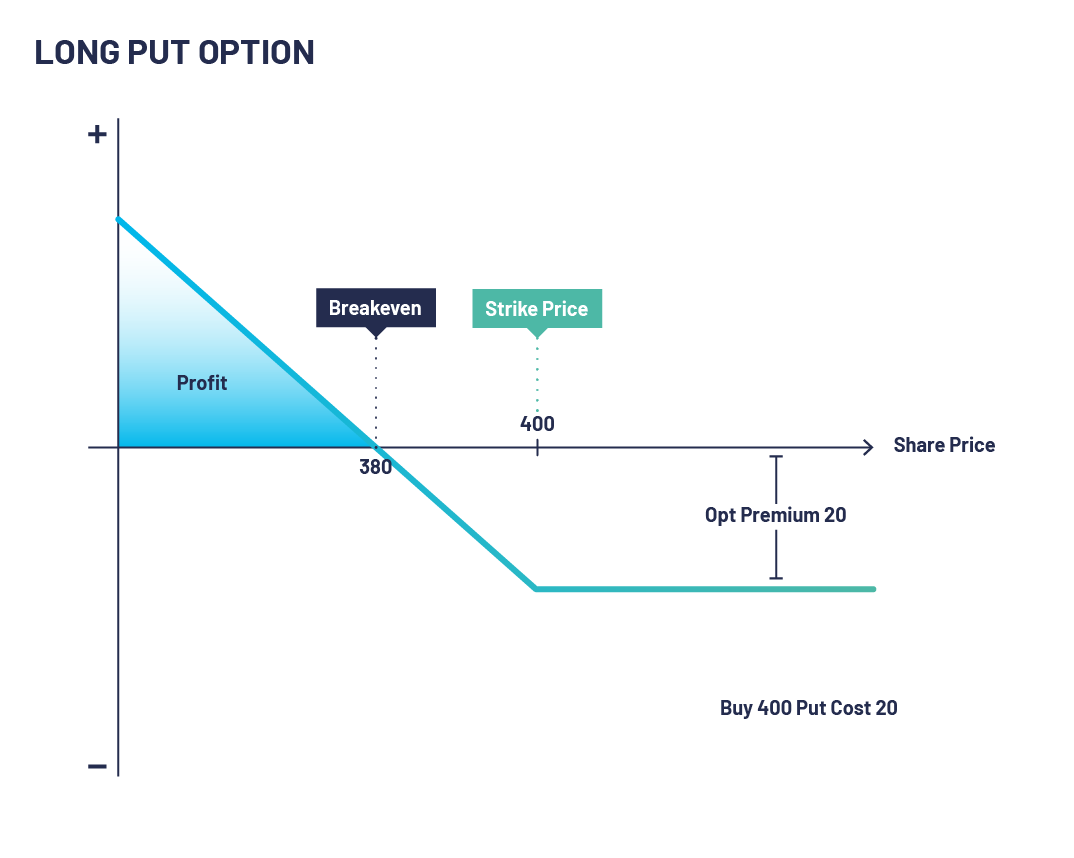

A put option is a contract that gives its holder the right to sell a set number of equity shares at a set price called the strike price before a certain expiration date If the option is A put option put is a contract that gives the owner the right to sell an underlying security at a set price strike price before a certain date expiration The seller sets the

Put Option A put option is an option contract giving the owner the right but not the obligation to sell a specified amount of an underlying security at a specified price within a specified time Assessment If TQE stayed at 54 75 the 55 call options or the short side of the spread will not be in the money This means that if TQE was above 50 but below 55 at expiration there would be a purchase of 5 000 shares and there would not be an offsetting sell of 5 000 shares of TQE The buying power to cover the purchase of TQE would

More picture related to What Happens When Buy Put Option Expires

Put Options Explained Buying And Selling Cheddar Flow

https://www.cheddarflow.com/wp-content/uploads/2022/10/Group-2779.jpg

Options Pt 3 Time Decay And Its Impact On Options Trading Market

https://www.markettradersdaily.com/wp-content/uploads/2020/06/Options-Trading-101-Pt.-2-Buying-And-Selling-Calls-And-Puts22.jpg

How To Buy A Put Shopfear0

https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/60c23d99fdb000d32f0db484_Long Put Payoff Diagram.png

Fair enough Solution 1 Never get down to options expiration with in the money options Be proactive with your trades Solution 2 Close out the in the money option completely This may be difficult into options expiration as the liquidity will dry up and you will be forced to take a worse price Put options are a type of option that increases in value as a stock falls A put allows the owner to lock in a predetermined price to sell a specific stock while put sellers agree to buy the

What Is a Put Option Put options are a type of options contract These contracts allow the owner to sell a security at a specific price before the expiration date listed in the options contract Options on Expiration Day E TRADE from Morgan Stanley 08 14 23 All options have an expiration date It is part of the creation and listing of all new series of calls and puts on the various underlying stocks ETFs indexes and futures on which options are made available to buy and sell The expiration date is the end of the contract the

What Is A Long Put Option Ultimate Guide With Visuals Projectfinance

https://www.projectfinance.com/wp-content/uploads/elementor/thumbs/Long-Put-Updated-pnc0mdx83qpytdn52d2knylakfmw73ylt0dmlz65jc.jpg

Solved If The Call Option Expires In Six Months The Value Chegg

https://media.cheggcdn.com/media/d9c/d9c19153-9020-4368-a2e0-0c4d0fddab02/phpAaD7cU.png

What Happens When Buy Put Option Expires - Put Option A put option is an option contract giving the owner the right but not the obligation to sell a specified amount of an underlying security at a specified price within a specified time