What Happens When Put Option Expires In The Money The Role of Theta in Options Expiration Theta also known as time decay plays a significant role in what happens when options expire As an option gets closer to its expiration date theta generally increases which means the option s value decreases This is because as time runs out there s less chance the option will become ITM if it

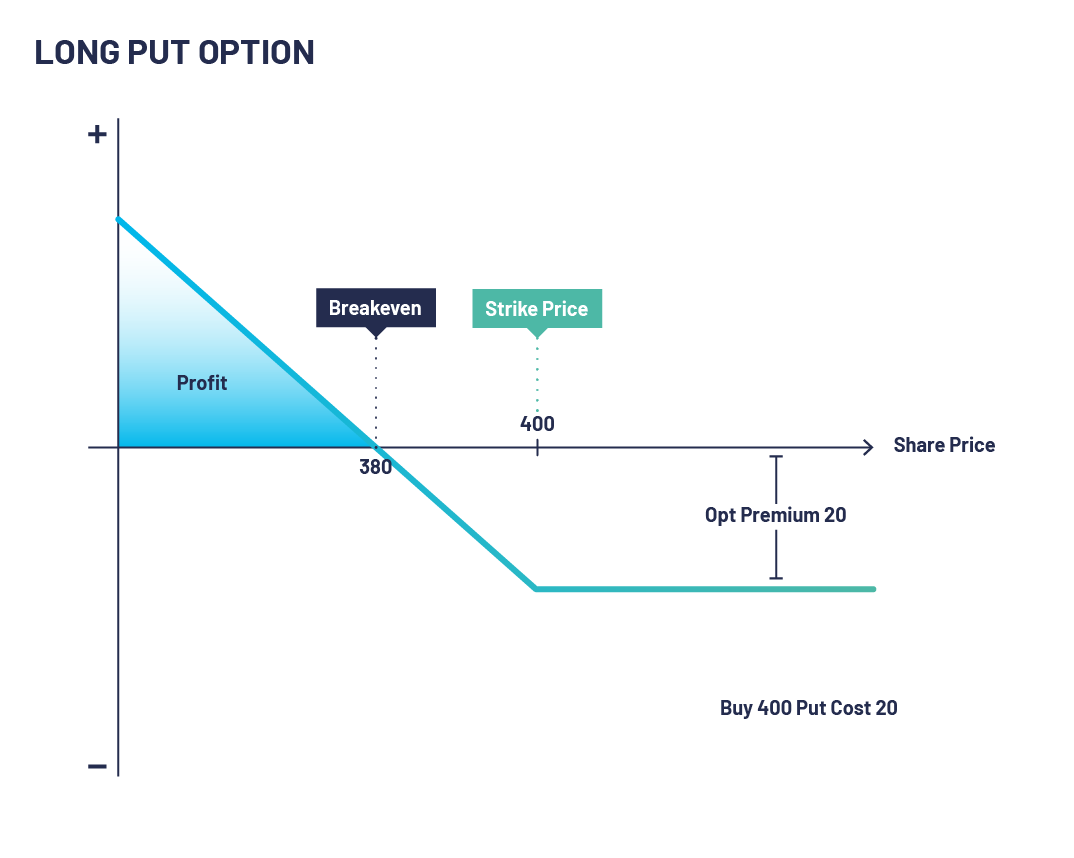

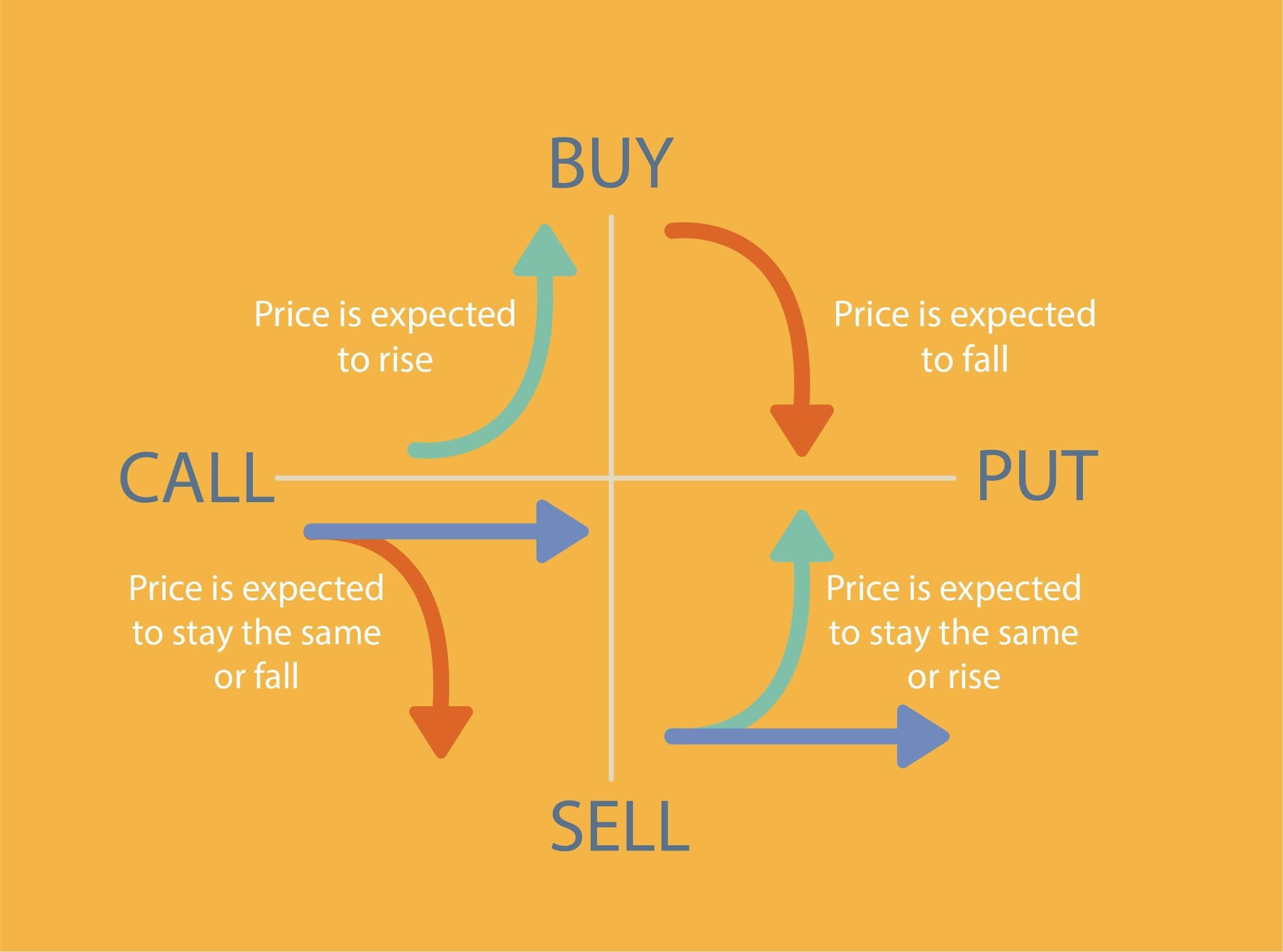

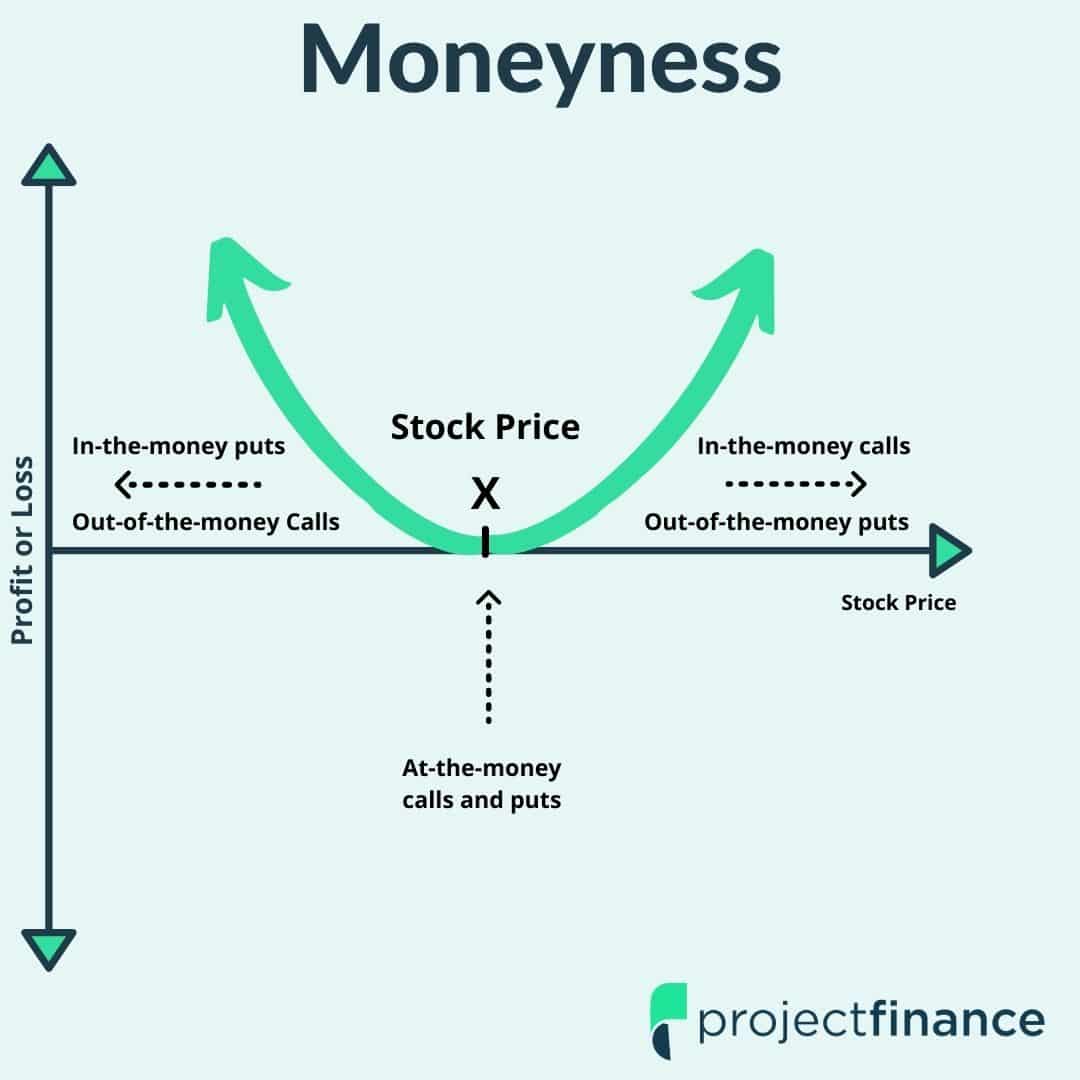

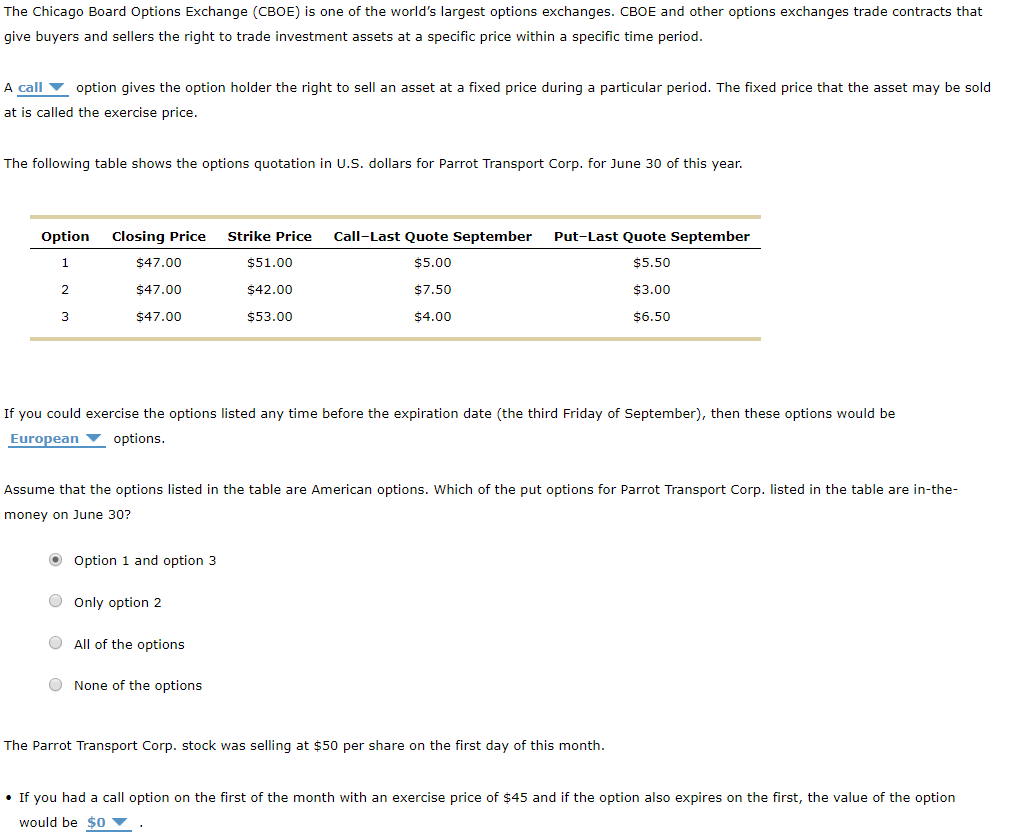

If you bought a put option there are two possible scenarios you will face as the expiration date approaches First the share price is higher than the put option strike price That means the option is out of the money or OTM and it expires worthless Your loss is limited to 100 percent of the premium you paid for the option The buyer owner of an option has the right but not the obligation to exercise the option on or before expiration A call option 5 gives the owner the right to buy the underlying security a put option 6 gives the owner the right to sell the underlying security Conversely when you sell an option you may be assigned at any time regardless of the ITM amount if the option owner

What Happens When Put Option Expires In The Money

What Happens When Put Option Expires In The Money

https://www.projectfinance.com/wp-content/uploads/2022/03/In-The-Money-Option-at-Expiration.png

What Happens When An Option Expires In The Money

https://financhill.com/blog/wp-content/uploads/2021/09/Untitled-design-94.jpg

Put Options What They Are And How They Work OptionsDesk

https://optionsdesk.com/wp-content/uploads/2021/08/Put-Option.png

A put option gives the holder the right but not the obligation to sell a certain amount of the underlying asset or security by a certain date the expiration date at a certain price This price For example if an option is trading for 1 40 the price of one contract excluding fees is 140 or 1 40 x 100 multiplier 140 Expiration Each option has an expiration date which is when the contract expires and ceases to exist Strike price Each option also has a strike price and if the contract is exercised the underlying

Option Auto Exercise Rules Stock options that are in the money at the time of expiration will be automatically exercised For puts your options are considered in the money if the stock price is trading below the strike price Conversely call options are considered in the money when the stock price is trading above the strike price If the option expires unprofitable or out of the money nothing happens and the money paid for the option is lost A put option increases in value meaning the premium rises as the price of the

More picture related to What Happens When Put Option Expires In The Money

What Happens When An Option Expires In The Money On Robinhood YouTube

https://i.ytimg.com/vi/HqqxRiuf6mY/maxresdefault.jpg

Options Pt 3 Time Decay And Its Impact On Options Trading Market

https://www.markettradersdaily.com/wp-content/uploads/2020/06/Options-Trading-101-Pt.-2-Buying-And-Selling-Calls-And-Puts22.jpg

Moneyness Of An Option Explained What You Need To Know

https://www.projectfinance.com/wp-content/uploads/2021/08/Copy-of-Short-Call.jpg

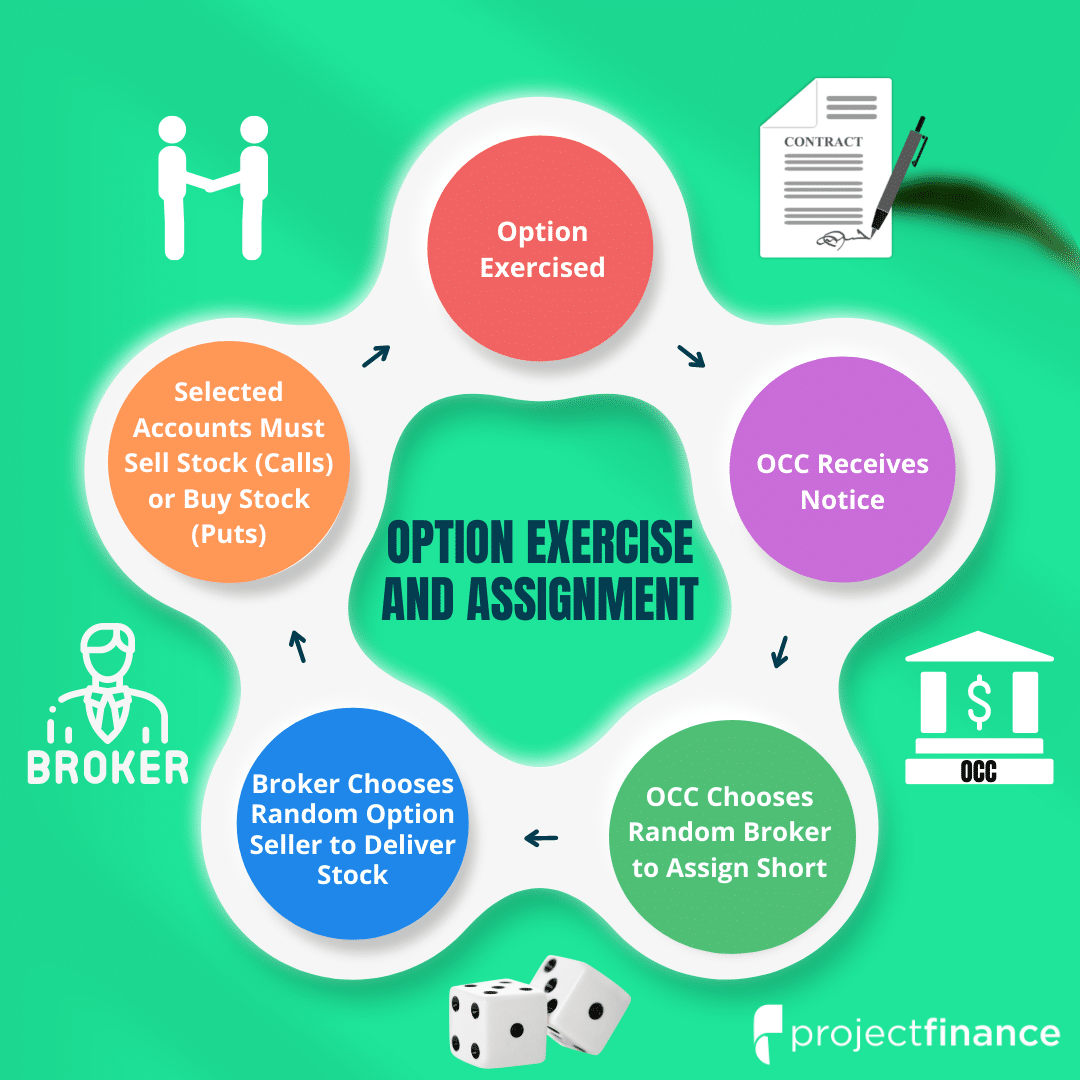

A put option put is a contract that gives the owner the right to sell an underlying security at a set price strike price before a certain date expiration The seller sets the The Options Clearing Corporation OCC will automatically exercise any expiring options that close 0 01 in the money or more on Expiration Day In the money is defined as the stock s official OCC closing price being 0 01 HIGHER than the Strike Price for call options or 0 01 LOWER than the Strike Price for put options

The value of a call option or the value of a put option on its expiration date is its intrinsic value For example if you have a call option with a 50 strike and the stock closed at expiration at 55 then the option contract is worth exactly 5 which is the difference between the strike price and where the stock closed 14 If the stock price falls below 50 before or on the expiration date the investor can exercise the put option and sell the stock at the strike price This allows the investor to benefit from the price depreciation However if the stock price does not fall below 50 before or on the expiration date the put option will expire worthless

Solved If The Call Option Expires In Six Months The Value Chegg

https://media.cheggcdn.com/media/d9c/d9c19153-9020-4368-a2e0-0c4d0fddab02/phpAaD7cU.png

Options Expiration Definitions A Checklist More Charles Schwab

https://www.schwab.com/sites/g/files/eyrktu1071/files/Custom_Options_Expiration_3x2.jpg

What Happens When Put Option Expires In The Money - If the option expires unprofitable or out of the money nothing happens and the money paid for the option is lost A put option increases in value meaning the premium rises as the price of the