What Does A Payroll Manager Do What does a payroll manager do A payroll manager is a business finance and human resources professional who handles all aspects of preparing and distributing employees payments This includes maintaining payroll records calculating taxes balancing payroll accounts and overseeing other members of the payroll staff

What does a payroll manager do As the name implies a payroll manager is responsible for handling all aspects of the payroll process They keep payroll documentation up to date organized and accurate while focusing on compliance with legal and tax requirements This position requires a thorough understanding of payroll rules and software Payroll managers compile summaries of earnings taxes deductions leave disability and non taxable wages into reports They determine the company s payroll liabilities by calculating an employee s federal and state income and Social Security taxes alongside the employer s Social Security unemployment and worker s compensation payments

What Does A Payroll Manager Do

What Does A Payroll Manager Do

https://s3.amazonaws.com/contents.newzenler.com/1134/library/60995ab08f294_1620662960_payroll-analytics.jpeg

Payroll Manager Guide Costs How To Outsource Vs Software

https://www.creative.onl/payrollindex/wp-content/uploads/2022/02/payroll-manager.jpg

Payroll Administrator Job Description Info Job Openings

https://www.myjobsearch.com/wp-content/uploads/2022/07/payroll_administrator_1.jpg

The Payroll Manager will oversee and supervise the organization s payroll functions ensuring pay is processed on time accurately and in compliance with government regulations Supervisory What Does A Payroll Manager Do A Payroll Manager is responsible for overseeing a company s payroll process They ensure that employees are paid accurately and on time Payroll Managers also ensure that all payroll taxes and deductions are handled correctly as well as providing reporting to management on financial and payroll matters

What Does A Payroll Manager Do A Payroll Manager is responsible for overseeing a company s payroll process They ensure that employees are paid accurately and on time Payroll Managers also ensure that all payroll taxes and deductions are handled correctly as well as providing reporting to management on financial and payroll matters What Does a Payroll Manager Do Payroll Managers work in a company s financial department overseeing the allocation and distribution of employee compensation They are primarily responsible for ensuring accurate and timely payroll processing for all employees

More picture related to What Does A Payroll Manager Do

Payroll Manager

https://icanbea.org.uk/media/shapes/original/x-large/0/591/payroll-manager.jpg

How To Get In Contact With Payroll Lifescienceglobal

https://busybusy.com/wp-content/uploads/2018/05/Payroll.jpg

What Does A Payroll Officer Do Payroll Officer Job Description

https://www.pherrus.com.au/wp-content/uploads/2022/01/what-does-a-payroll-officer-do.png

A payroll manager is a professional who oversees and directs payroll procedures within an organization They are responsible for ensuring compliance with relevant laws and tax obligations supervising the payroll team and maintaining accurate payroll records What does a payroll manager do A payroll manager is responsible for various tasks What Does a Payroll Manager Do Payroll managers are responsible for guaranteeing accurate delivery of payroll to organizations workforce The payroll manager job description entails supervising a group of payroll administrators subject to the scale of the company

[desc-10] [desc-11]

The Benefits Of Using A Payroll Service AllBusiness

https://www.allbusiness.com/asset/2018/10/Payroll.jpg

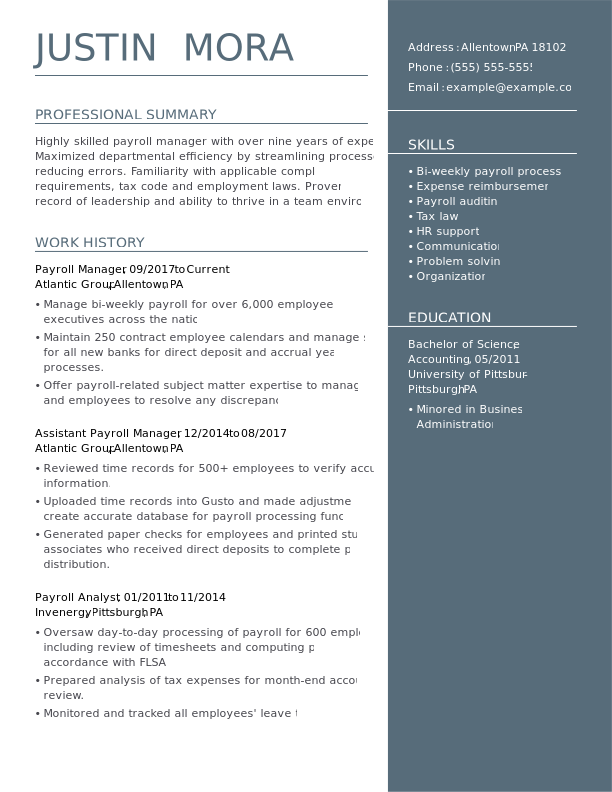

Payroll Manager Resume Example Helpful Tips

https://www.myperfectresume.com/wp-content/uploads/2021/05/Payroll_Manager_Impactful_ComboD_1.png

What Does A Payroll Manager Do - What Does a Payroll Manager Do Payroll Managers work in a company s financial department overseeing the allocation and distribution of employee compensation They are primarily responsible for ensuring accurate and timely payroll processing for all employees