What Does A Payroll Tax Specialist Do What does a Payroll Tax Specialist do Tax professionals provide advice and support related to the payment and reporting of taxes and the completion of tax returns and other tax related documents They assist in the preparation and submission of tax returns for individuals self employed professionals businesses and other entities

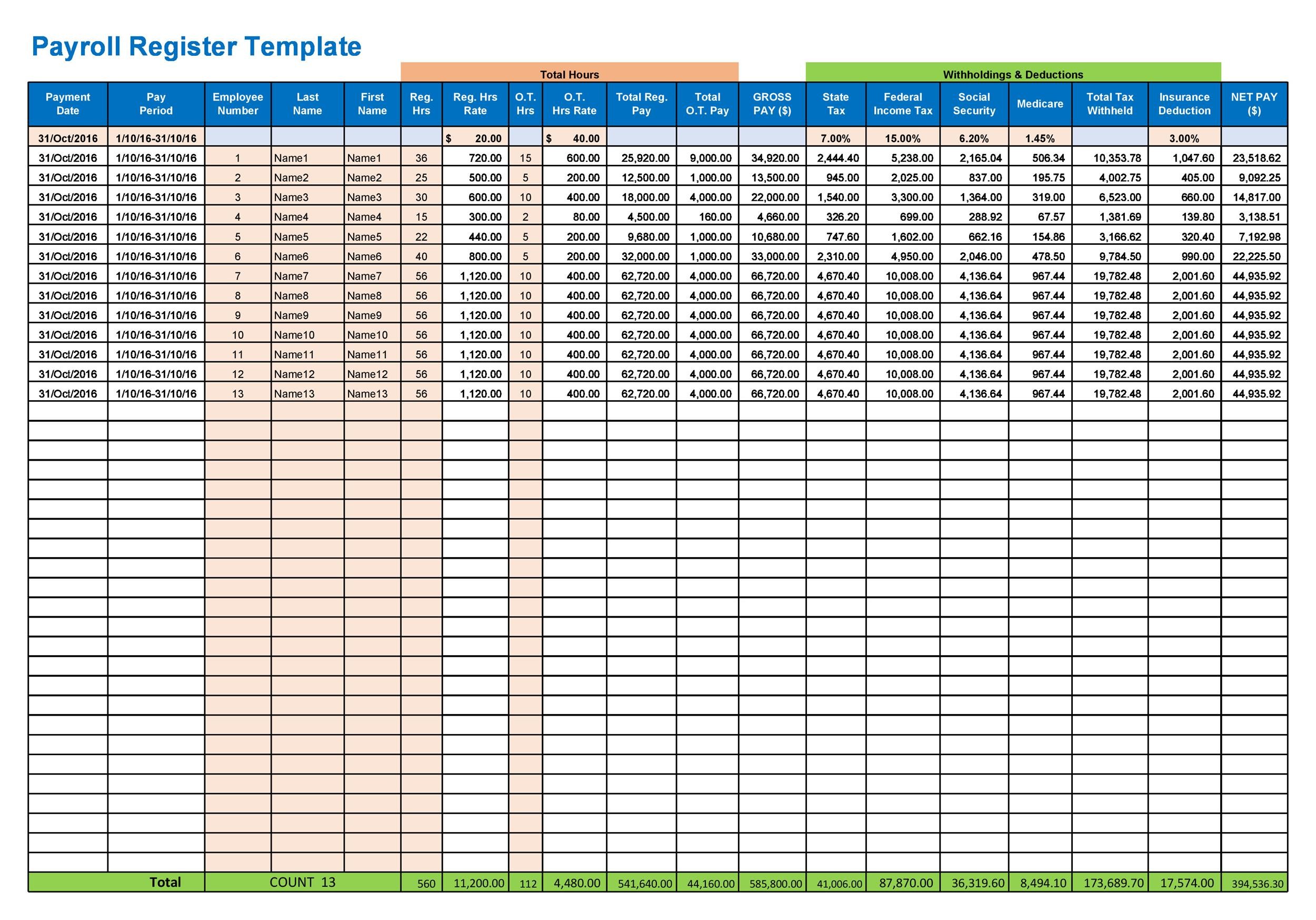

Payroll specialists oversee all aspects of timesheet and payroll processing to ensure payroll processing remains compliant accurate and on time Specific responsibilities may vary based on the size of the company the payroll specialist works for and the industry of the company Typically responsibilities include preparing and submitting paper Payroll Specialist duties and responsibilities Payroll Specialists use excellent mathematical and data entry skills to process pay Duties include Checking timesheets for accuracy Entering data into databases and spreadsheets Handling direct deposit requests and data Processing paper checks for distribution

What Does A Payroll Tax Specialist Do

What Does A Payroll Tax Specialist Do

https://free-template.co/wp-content/uploads/2022/01/1cf53f8084dd3be6/payroll-statement.jpeg

What Does The New Payroll Tax Mean For Connecticut Employees

https://s.hdnux.com/photos/74/37/41/15857732/3/1200x0.jpg

What Is Payroll Definition Processes Solutions

https://razorpay.com/blog-content/uploads/2020/09/Payroll_In_India_Steps_02.png

Payroll Specialist Duties and Responsibilities Payroll Specialists manage employee compensation ensuring that employees receive accurate and timely payment for their work They utilize payroll software and employ a keen understanding of financial and tax regulations to perform their duties This skill is found in 3 9 of Payroll Specialist job postings on Indeed Tax experience Definition Knowledge of or experience with financial taxes such as filing preparation and compliance Years of experience most commonly required 3 4 How common is it This skill is found in 3 7 of Payroll Specialist job postings on Indeed Workday

A payroll specialist uses accounting software to track employee salaries work hours time off and other information Their most common daily tasks include entering data for payroll transactions processing employee information for new hires and changes and managing the overall payroll workflow A Payroll Specialist is a finance professional who is primarily responsible for ensuring that employees within an organization are paid accurately and on time They play a critical role in managing the company s payroll processes which includes calculating wages withholding taxes and ensuring compliance with various federal state and local

More picture related to What Does A Payroll Tax Specialist Do

Payroll Tax Specialist Greenville SC

https://www.propelhr.com/hs-fs/hubfs/Employees and Workforce /AdobeStock_121127797.jpeg?width=7208&name=AdobeStock_121127797.jpeg

What Are Payroll Taxes Types Employer Obligations More

https://www.patriotsoftware.com/wp-content/uploads/2019/12/payroll-tax-rate-2019-1-scaled.jpg

What Does A Payroll Specialist Do YouTube

https://i.ytimg.com/vi/JmnZ7feU59M/maxresdefault.jpg

Work schedule Most payroll specialists work a standard 40 hour workweek but you may be asked to come in earlier or stay later on the days employees are paid You could also be asked to work extra hours when quarterly biannual or annual reports have to be generated A Payroll Specialist s responsibilities encompass a broad range depending on the organization but their main goal is to ensure that employees receive their pay correctly This role handles all aspects of the payment process from tracking employees time through issuing paychecks Since employees depend on a company to pay them accurately

Payroll is a vital function of any business as it ensures that employees are paid accurately and on time and that taxes and benefits are properly calculated and reported How much does a Payroll Tax Specialist make The average Payroll Tax Specialist salary is 87 289 as of June 27 2024 but the salary range typically falls between 77 922 and 98 297 Salary ranges can vary widely depending on many important factors including education certifications additional skills the number of years you have spent in

Indiana Paycheck Taxes

https://www.patriotsoftware.com/wp-content/uploads/2021/08/how_much_employer_pays_payroll_tax-01.png

How Payroll Software Manages HR Functions Of A Business Effectively

https://www.million.my/wp-content/uploads/2018/01/Payroll.jpg

What Does A Payroll Tax Specialist Do - In short an experienced payroll specialist is responsible for all aspects of a company s payroll This includes preparing and issuing paychecks calculating payroll related taxes and deductions and ensuring that employees are paid on time Depending on the company payroll specialists may also keep track of employee hours sick leave and