What Are The Deductions For Employee Payroll Tax Withholding For employees withholding is the amount of federal income tax withheld from your paycheck The amount of income tax your employer withholds from your regular pay depends on two things The amount you earn The information you give your employer on Form W 4 For help with your withholding you may use the Tax Withholding Estimator

In This Article View All Step One Get a W 4 Form From Each Employee Step Two Calculate Gross Pay Step Three Calculate Overtime Step Four Adjust Gross Pay for Social Security Wages Step Five Calculate Federal Income Tax FIT Withholding Amount Calculating Employee Tax Withholding Photo PeopleImages Getty Images Key Takeaways Unsure what is considered a payroll deduction Learn more about what payroll deductions are the different types and how to calculate them with Paychex

What Are The Deductions For Employee Payroll

What Are The Deductions For Employee Payroll

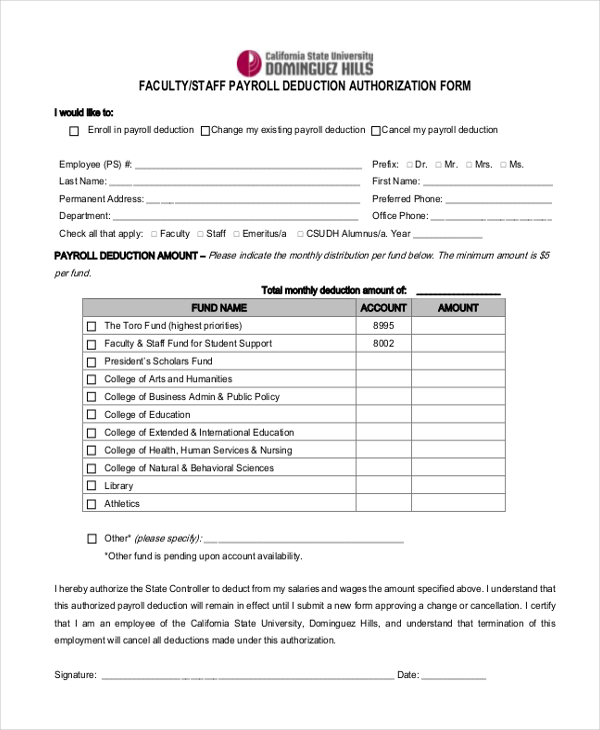

https://images.sampleforms.com/wp-content/uploads/2016/09/FACULTY-STAFF-PAYROLL-DEDUCTION-AUTHORIZATION-FORM.jpg

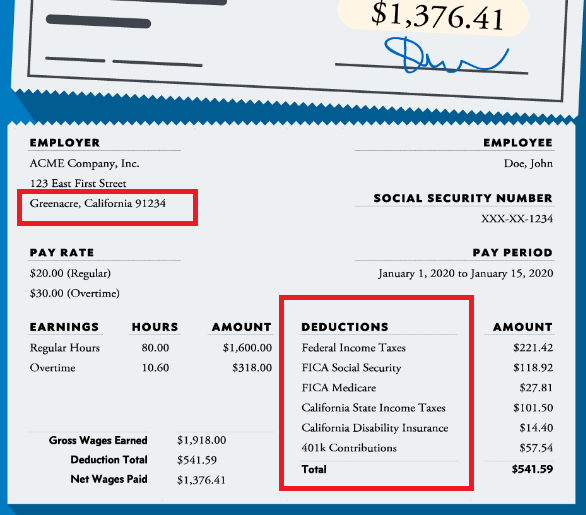

How Much Are Paycheck Tax Deductions In California Unemployment Gov

https://unemployment-gov.us/wp-content/uploads/2022/02/paycheck-deductions-in-california.png

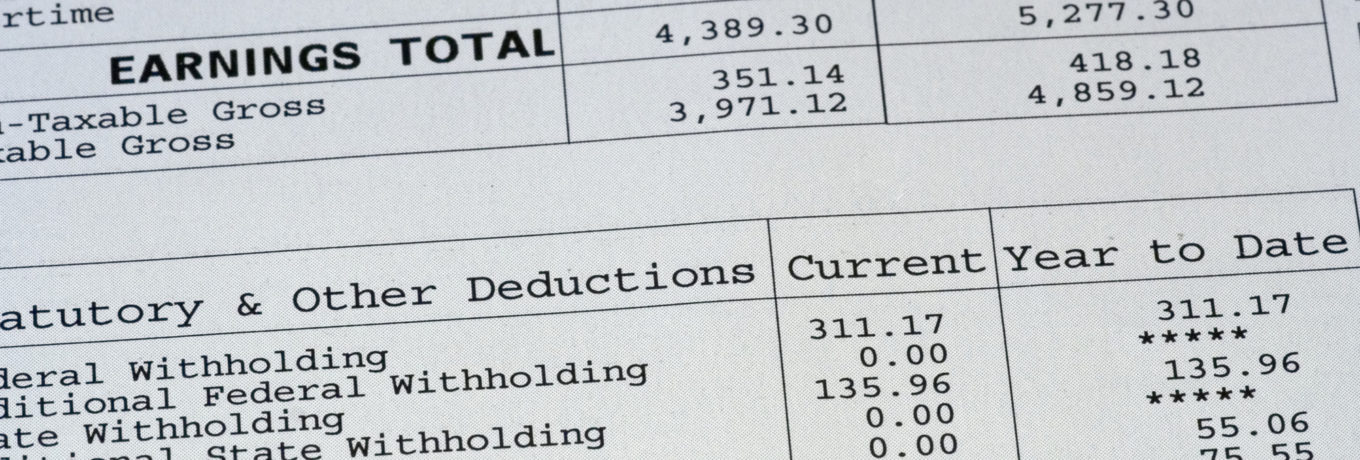

Payroll Deduction Definition What Are Payroll Deductions YouTube

https://i.ytimg.com/vi/FS4xTF4mGqo/maxresdefault.jpg

Payroll deductions are the specific amounts that you withhold from an employee s paycheck each pay period There are two types of deductions voluntary deductions such as health Payroll Deductions Calculator Use this calculator to help you determine the impact of changing your payroll deductions You can enter your current payroll information and deductions

To change your tax withholding you should Complete a new Form W 4 Employee s Withholding Allowance Certificate and submit it to your employer Complete a new Form W 4P Withholding Certificate for Pension or Annuity Payments and submit it to your payer Make an additional or estimated tax payment to the IRS before the end of the year Most taxpayers with simple tax returns claim the standard deduction which reduces their taxable income If you receive your wages solely from an employer as a W 2 employee the standard deduction

More picture related to What Are The Deductions For Employee Payroll

Can You Claim Deductions For Employee Training Glance Consultants

https://glanceconsultants.com.au/wp-content/uploads/2020/02/1.jpg

Standard Deduction 2020 Self Employed Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/standard-deduction-budget-announcements-budget-2018-gives.jpg

Employee Payroll Deduction Form Template Best Template Ideas

https://lh5.googleusercontent.com/proxy/xtnsHbF2gqHLtZQyQJ1rmc6UqQVM56VKE0WGd_FB3d0DePIK5MtnvtZNjegxi6dwINBrwFPGyh1l9JvkFHGjHUQzw4xspDoG-2GgiNS1EQaMIjgiKESr7rKsWQ=w1200-h630-p-k-no-nu

First create a deduction payroll item Here s how Go to the Gear icon and select Payroll Settings Select Deductions Contributions and click Add a new deduction contribution Choose Deduction and enter a name for the deduction item Select a liability account to track the deduction and click OK Next you need to Set up the deduction for the The rates have gone up over time though the rate has been largely unchanged since 1992 Federal payroll tax rates for 2023 are Social Security tax rate 6 2 for the employee plus 6 2 for the

Payroll deductions are wages taken out of employees paychecks to pay for costs like payroll and income taxes employee benefits and more Payroll deductions determine an employee s gross pay the amount of money written in their contract and net pay also known as take home pay Use this tool to Estimate your federal income tax withholding See how your refund take home pay or tax due are affected by withholding amount Choose an estimated withholding amount that works for you Results are as accurate as the information you enter

Understanding Your Paycheck Deduction Codes Lifestyle Mirror

https://www.lifestylemirror.com/wp-content/uploads/2020/03/thehoth76924-1360x460.jpg

Hrpaych reducded Payroll Services Washington State University

https://s3.wp.wsu.edu/uploads/sites/1383/2016/06/checkstub2.gif

What Are The Deductions For Employee Payroll - Payroll Deductions Calculator Use this calculator to help you determine the impact of changing your payroll deductions You can enter your current payroll information and deductions