What Are The Employee Deductions That Are Required For Payroll Mandatory Payroll Deductions Mandatory payroll deductions are required by law regardless of employee consent Some examples include Federal Income Tax Federal income tax withholding is more nuanced than many realize The amount withheld from each paycheck is a function of the W 4 form that employees fill out when first hired

In some cases you may be required to deduct court ordered garnishments for child support alimony or wage attachments 6 Common Types of Payroll Deductions and Withholdings Understanding your employees net pay requires a clear grasp of payroll deductions and withholdings Payroll deductions are portions of an employee s pay that are subtracted from their total compensation to make required payments such as taxes and voluntary investments The two main types of payroll deductions are those made for mandatory requirements tax laws court orders etc and those made voluntarily by an employee

What Are The Employee Deductions That Are Required For Payroll

What Are The Employee Deductions That Are Required For Payroll

https://media.cheggcdn.com/study/0b0/0b0c458c-f7ab-4512-85ce-ff36ba2cc914/image.png

Mandatory Government Deductions From Salary SSS Philhealth Pag Ibig

https://i.ytimg.com/vi/lBO3PaW69Mc/maxresdefault.jpg

Printable Itemized Deductions Worksheet

https://i2.wp.com/www.worksheeto.com/postpic/2011/02/federal-income-tax-deduction-worksheet_472256.jpg?crop=12

Employers are required by law to pay unemployment taxes until an employee reaches 7 000 in taxable wages for the calendar year After that your liability for the year for them is met Payroll deductions may not always be fun but getting them right is an important part of running your business successfully How Do Payroll Deductions Work Employers receive information about an employee s deductions from different sources that are all part of the payroll process Payroll taxes are typically based on the employee s W 4 a required form that assists payroll departments when calculating tax withholdings for an individual Benefit elections might come

On the other hand employers withhold post tax deductions from an employee s net pay Common post tax deductions include wage garnishments and job related costs like travel Types of payroll deductions There are various payroll deductions that can either be mandatory or voluntary Here are eight of the most common 1 FICA taxes Payroll deductions are the specific amounts that you withhold from an employee s paycheck each pay period There are two types of deductions voluntary deductions such as health insurance and

More picture related to What Are The Employee Deductions That Are Required For Payroll

How Much Taxes Are Taken Out Of Paycheck In Michigan Pearly Box Free

https://quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Graphic/payroll-deductions-examples-infographic-us.png

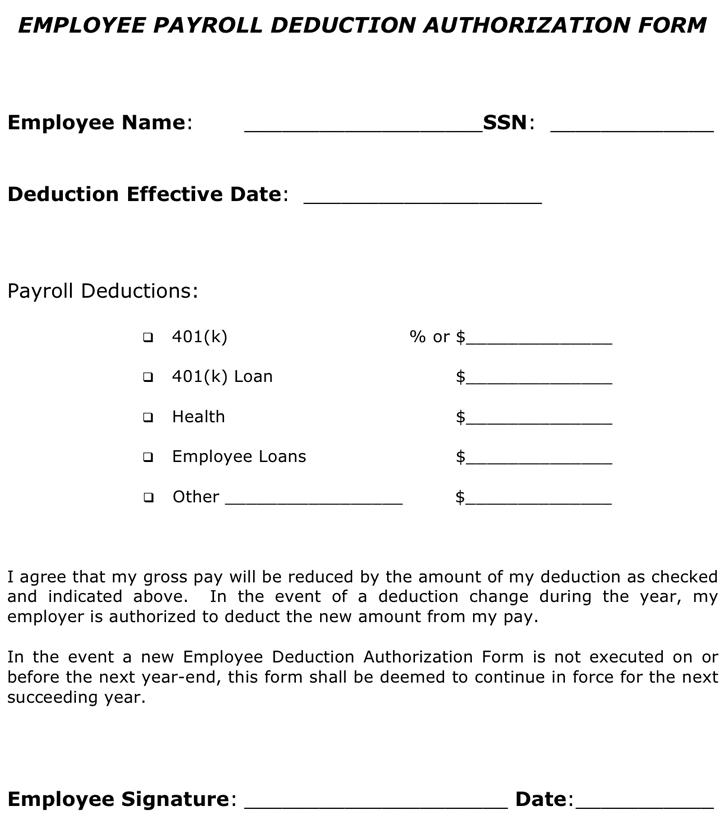

Payroll Deduction Agreement Template PDF Template

https://www.speedytemplate.com/employee-payroll-deduction-authorization-form-1.png

/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)

Payroll Deduction Plan Definition

https://www.investopedia.com/thmb/tuMtQTvWMhZ3VIYxkaoS7Mk6O1Y=/3608x2592/filters:fill(auto,1)/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg

Use this guide to learn about different deductions you can apply to your employee payroll Remember that some are mandatory while others are voluntary and can only be included with the consent of your employees Pre Tax Payroll Deductions Deductions you make on your employees behalf before taxes are withheld are called pre tax payroll An employee s gross pay is different than their net pay or take home pay because of the deductions subtracted There are both mandatory and voluntary payroll deductions Examples of payroll deductions include federal state and local taxes health insurance premiums and job related expenses Mandatory payroll deductions By law employers

[desc-10] [desc-11]

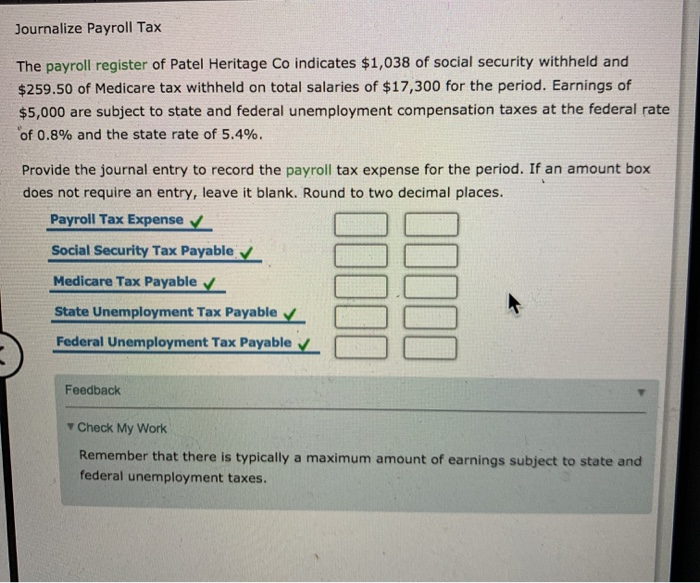

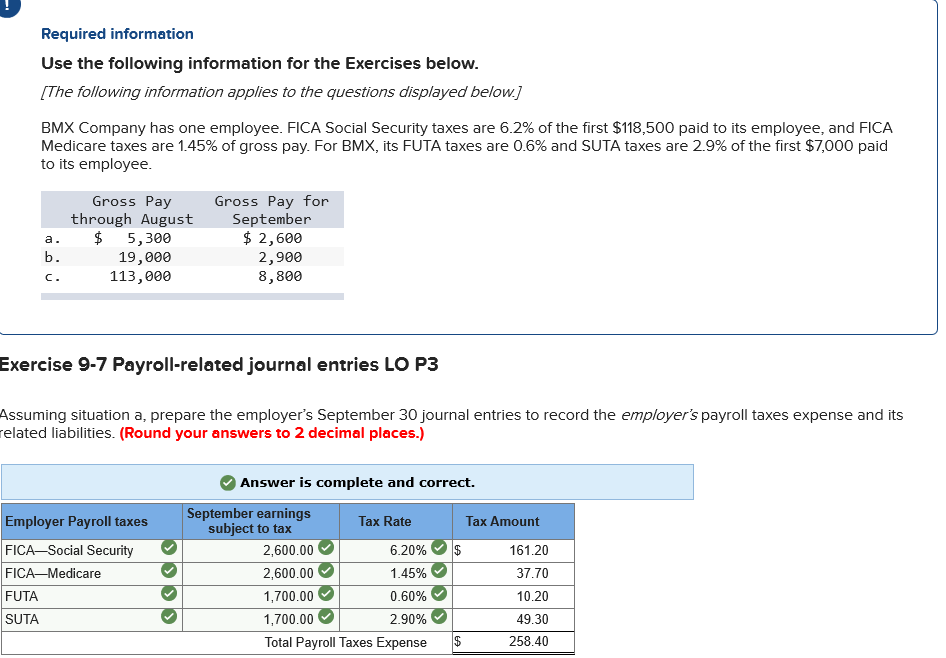

Solved Required Information Use The Following Information Chegg

https://media.cheggcdn.com/media/a17/a17523ab-2f02-4eb1-826a-eaae1f848369/php4NHqjz.png

Payroll Audit Objectives Process Checklist AIHR

https://www.aihr.com/wp-content/uploads/common-payroll-issues-3.png

What Are The Employee Deductions That Are Required For Payroll - On the other hand employers withhold post tax deductions from an employee s net pay Common post tax deductions include wage garnishments and job related costs like travel Types of payroll deductions There are various payroll deductions that can either be mandatory or voluntary Here are eight of the most common 1 FICA taxes