The Remaining Amount After Deductions In Salary The amount remaining after deductions have been subtracted from an employee s earnings are called d net pay Net pay is also known as take home pay and is

Take home pay is the net amount of income after taking out taxes benefits and other deductions Gross pay is the amount of income prior to deductions The Net Pay is the amount remaining after all deductions are taken 1 Many paychecks also have cumulative fields that show the year to date earnings

The Remaining Amount After Deductions In Salary

The Remaining Amount After Deductions In Salary

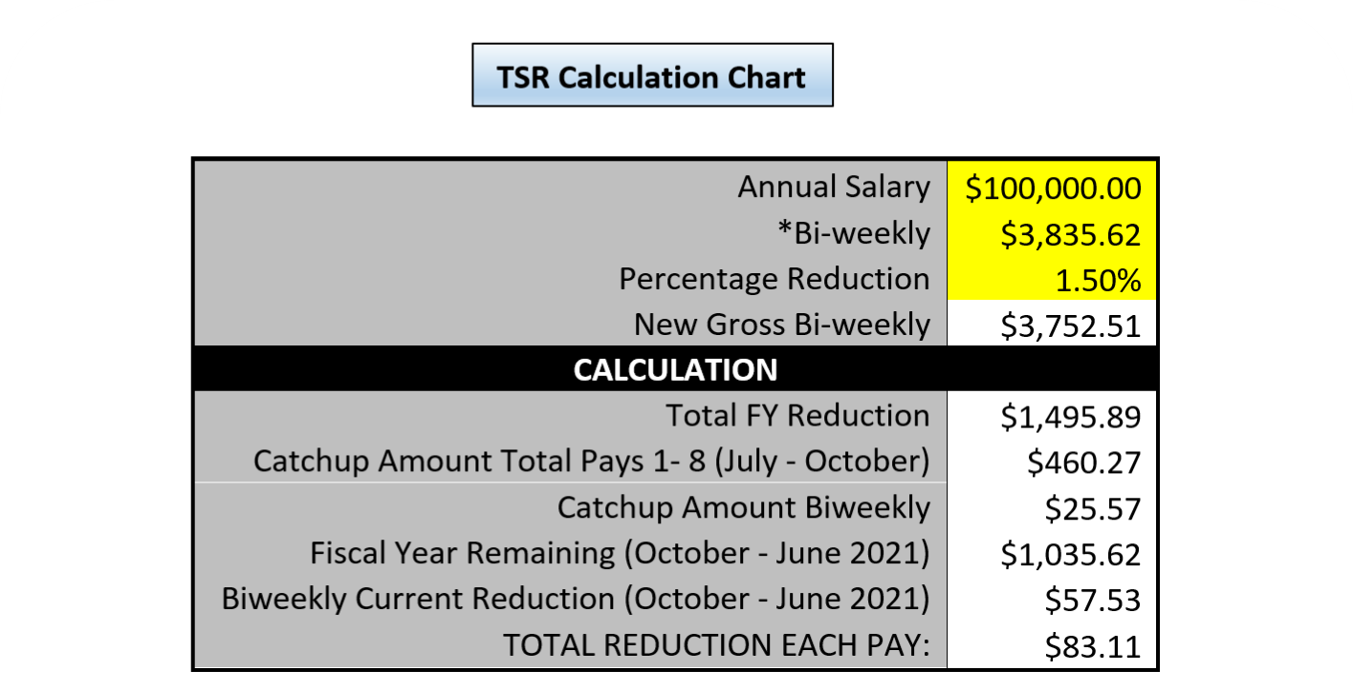

https://hr.umbc.edu/wp-content/uploads/sites/67/2020/09/TSR-Calc-Chart-for-Website.png

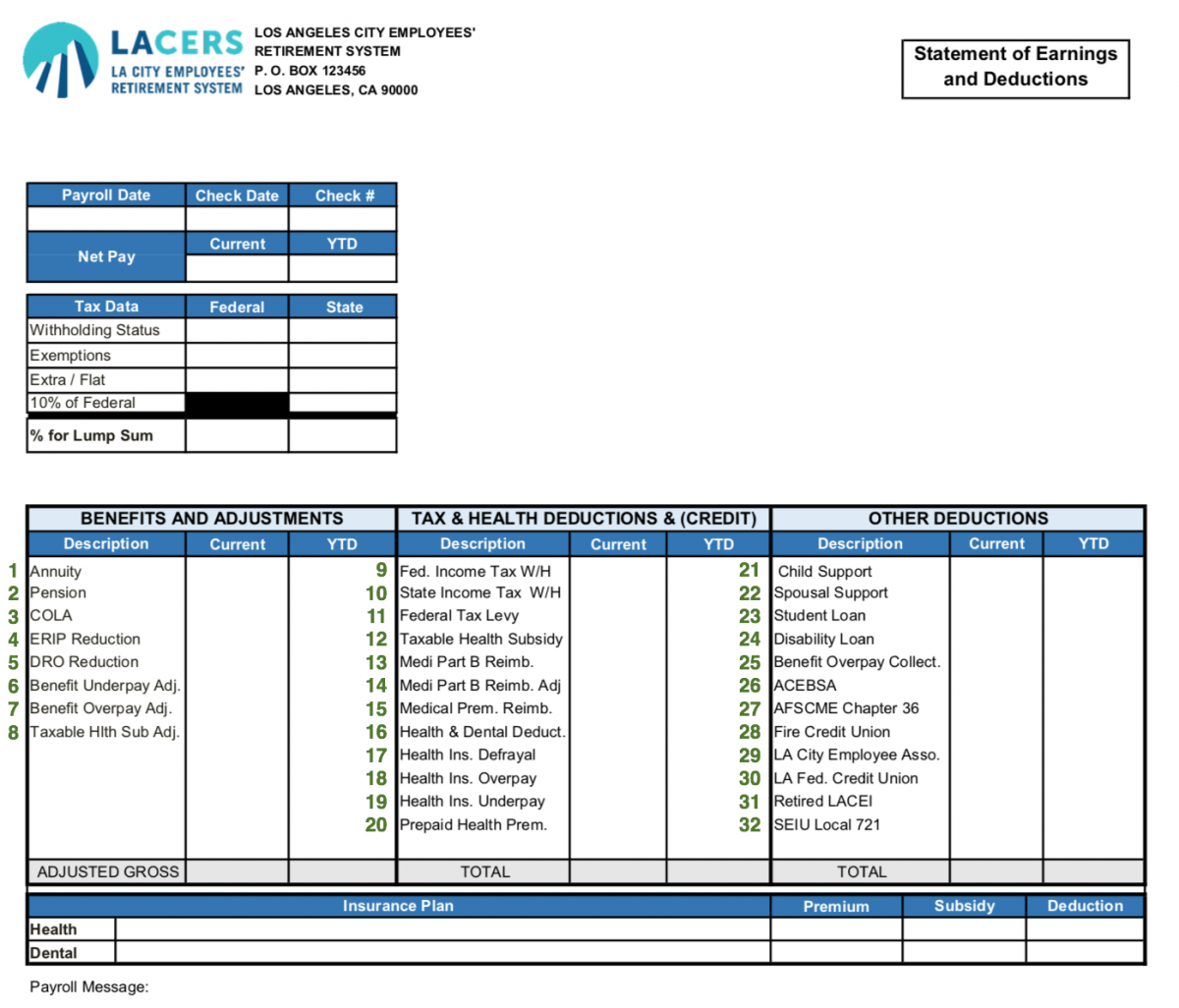

Paystub Codes Defined - Los Angeles City Employees' Retirement System

https://www.lacers.org/sites/main/files/imagecache/lightbox/main-images/screen_shot_2021-03-03_at_11.35.46_am.png?1622561555

How to Calculate Net Pay | Step-by-step Example

https://www.patriotsoftware.com/wp-content/uploads/2018/05/how-to-calculate-net-pay-1.png

The Net Pay is the amount remaining after all deductions are taken 1 Many paychecks also have cumulative fields that show the year to date earnings After deductions have been taken from gross wages the amount remaining and which is paid to the individual is called net pay

Net salary is the amount of take home pay remaining after all withholdings and deductions have been removed from a person s pay Gross pay is the total amount you get paid before tax deductions and your net wages are the dollar amount you receive after taxes

More picture related to The Remaining Amount After Deductions In Salary

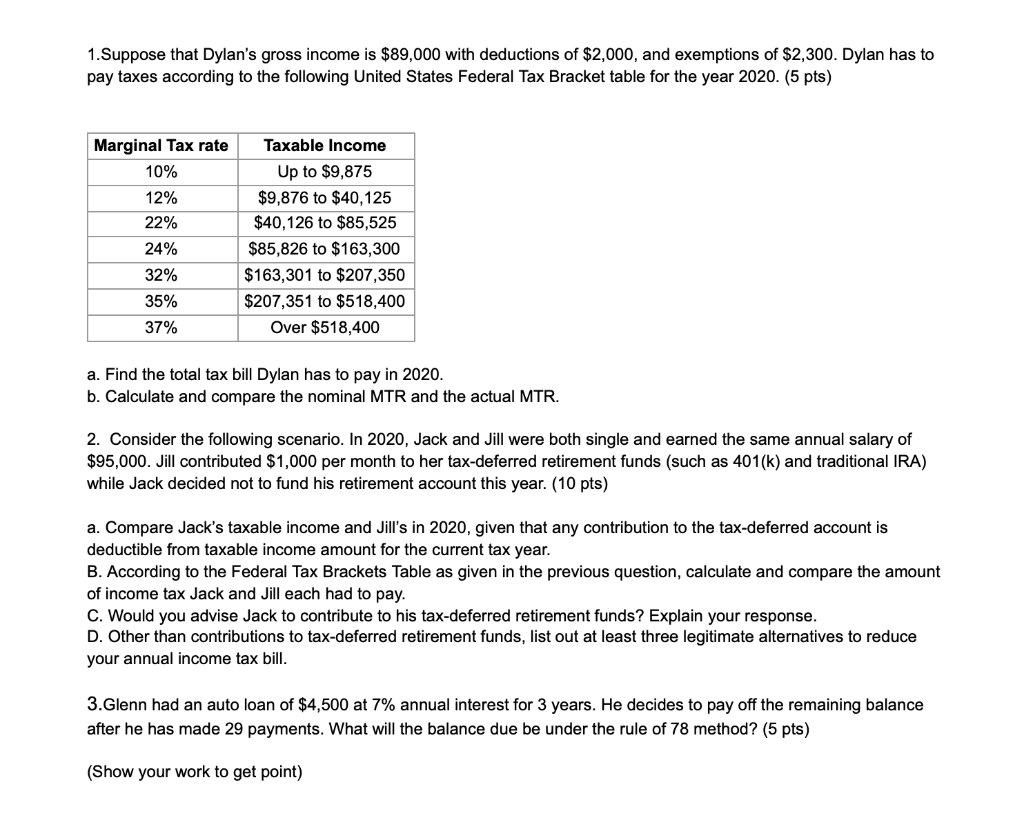

1. Suppose that Dylan's gross income is $89,000 with | Chegg.com

https://media.cheggcdn.com/media/905/9056e6e0-fe36-4d01-b068-485f020fffc5/phphmmZB9

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Net Income After Taxes (NIAT)

https://www.investopedia.com/thmb/lTjRXcqr3aboGv2SUA5lc7NJROE=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg

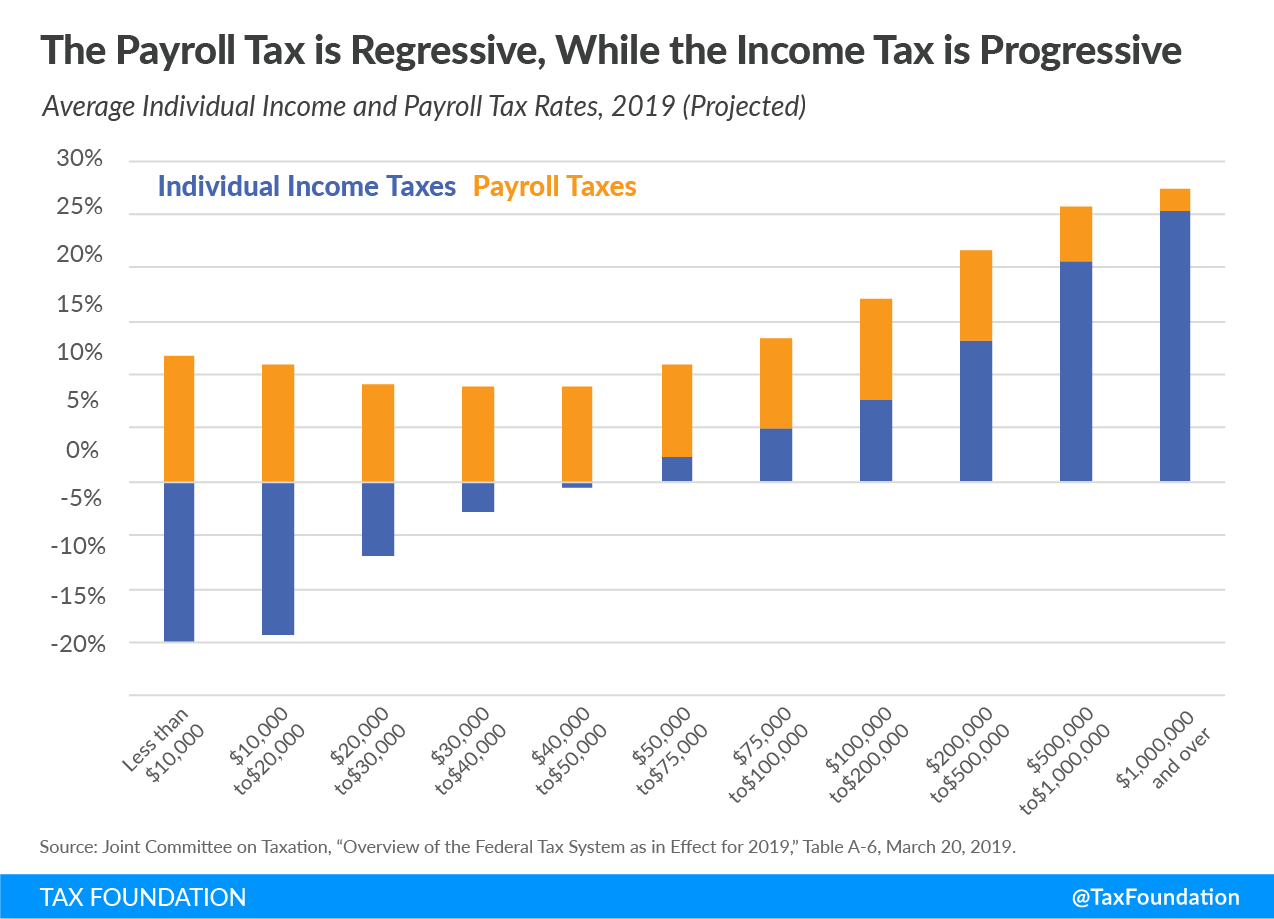

Most Americans Pay More in Payroll Taxes Than in Income Taxes

https://files.taxfoundation.org/20190326171828/Bell-3-26-Chart-21.png

Basic salary also called base salary is the amount of money a salaried employee regularly earns before any additions or deductions are applied to their The second step is to understand the difference between gross and net salary Gross salary is the total amount of money an employee earns before any deductions

Net pay commonly known as take home pay is the income employees receive after deductions and withholdings have been removed from their wage or salary Generally the amount of income you can receive before you must file a return has been increased For more information see chapter 1 later Standard deduction

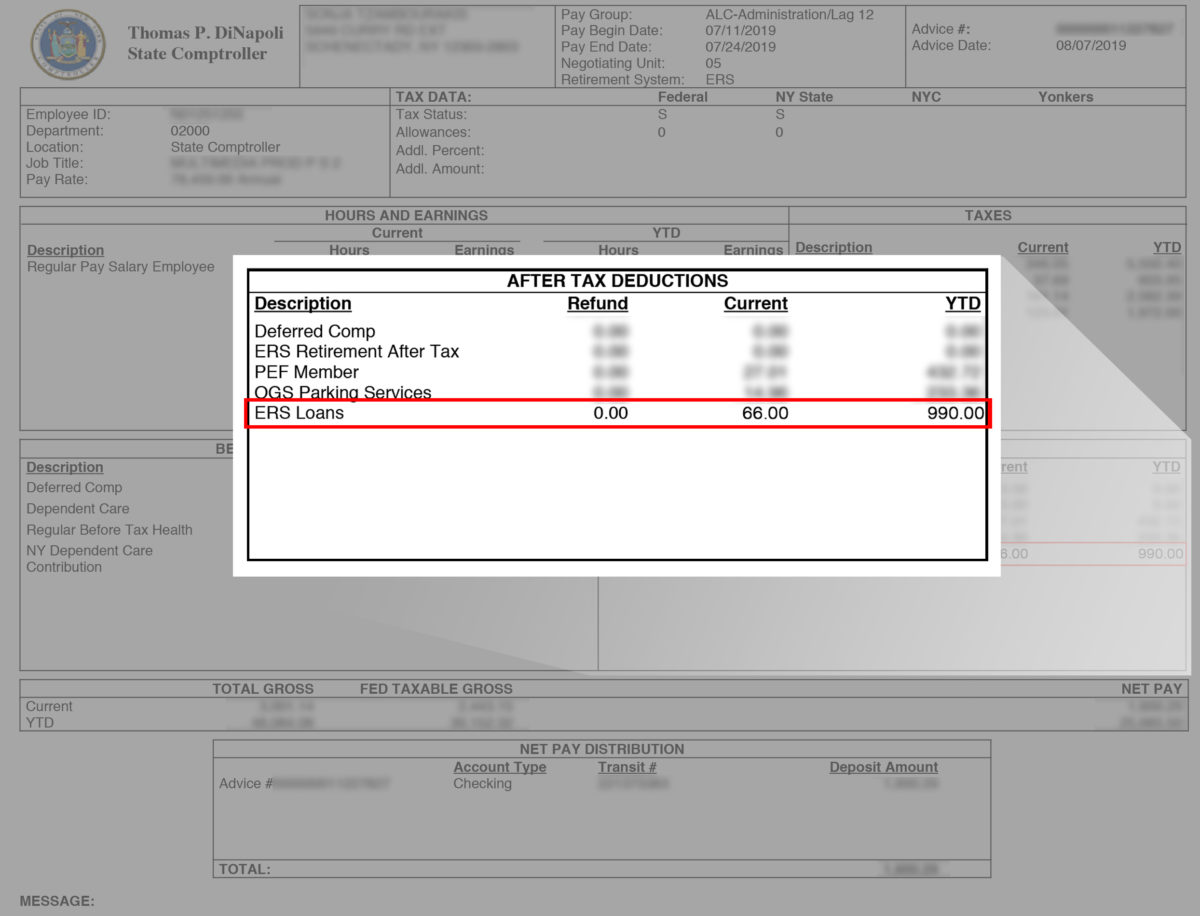

Payroll Deductions and Your NYSLRS Loan - New York Retirement News

https://www.nysretirementnews.com/wp-stuff/uploads/2019/08/paycheck-loans-1200x916.jpg

:max_bytes(150000):strip_icc()/payroll-4191484-3x2-final-1-008077377d4a4d36bec1424f414b0d9d.png)

What Is Payroll, With Step-by-Step Calculation of Payroll Taxes

https://www.investopedia.com/thmb/rGOF-QKE0eYuw246KZxYS2u7wAs=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/payroll-4191484-3x2-final-1-008077377d4a4d36bec1424f414b0d9d.png

The Remaining Amount After Deductions In Salary - From the Employee Self Service homepage select the Payroll tile Remaining Balance The final net pay you are to receive after all taxes deductions