How Much Will I Get Paid After Deductions Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major

Step 6 Your paycheck For the final step divide your net pay by your pay frequency The following is the formula for each pay frequency Daily Your net pay Days worked per week Weeks worked per year Your daily paycheck Weekly Your net pay 52 Your weekly paycheck Age Enter the age you were on Jan 1 2024 Your age can have an effect on certain tax rules or deductions For example people aged 65 or older get a higher standard deduction 401 k

How Much Will I Get Paid After Deductions

How Much Will I Get Paid After Deductions

https://i.ytimg.com/vi/GnvqM4GMolI/maxresdefault.jpg

How Long Does It Take To Get Paid After A Settlement

https://www.shouselaw.com/wp-content/uploads/2022/05/settlement-countdown.jpeg

How Much Will I Get Taxed TaxesTalk

https://www.taxestalk.net/wp-content/uploads/this-new-trump-tax-calculator-shows-how-much-youll-pay-going-forward.jpeg

Some deductions are post tax like Roth 401 k and are deducted after being taxed In our calculators you can add deductions under Benefits and Deductions and select if it s a fixed amount a percentage of the gross pay or a percentage of the net pay For hourly calculators you can also select a fixed amount per hour The average annual salary in the United States is 69 368 which is around 4 537 a month after taxes and contributions depending on where you live However extremely high earners tend to bias averages Likewise average salaries vary state by state such as California s salaries averaging 83 876 a year compared to Florida s at 63 336

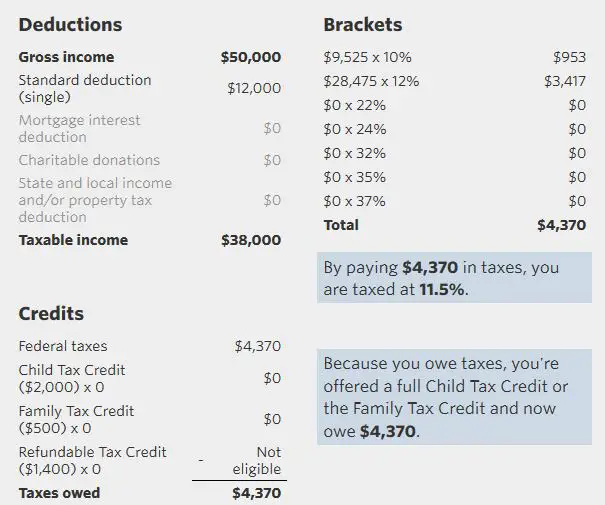

Standard Deduction You need to indicate if you want to take the standard deduction or itemize your deductions The standard deduction reduces your taxable income which reduces the amount of tax you owe Once you have provided all the inputs the paycheck tax calculator will calculate your gross pay tax deductions and net pay To calculate employer taxes use PaycheckCity Payroll Unlimited companies employees and payroll runs for only 199 a year All 50 states including local taxes and multi state calculations Federal forms W 2 940 and 941 Use PaycheckCity s free paycheck calculators withholding calculators and tax calculators for all your paycheck and

More picture related to How Much Will I Get Paid After Deductions

How Much Will I Get For Unemployment UnemploymentInfo

https://www.unempoymentinfo.com/wp-content/uploads/a1arcdesign-how-much-unemployment-will-i-get-in-va.png

How Much Will I Get In Unemployment UnemploymentInfo

https://www.unempoymentinfo.com/wp-content/uploads/wa-state-unemployment-how-much-will-i-get-unemplm.jpeg

VA Mental Health Claims How Much Will I Get Paid YouTube

https://i.ytimg.com/vi/j26a2On8PpU/maxresdefault.jpg

In 2022 your employer will withhold 6 2 of your wages up to 147 000 for Social Security Additionally you must pay 1 45 of all of your wages for Medicare without any limitations If you How to use the Take Home Calculator To use the tax calculator enter your annual salary or the one you would like in the salary box above If you are earning a bonus payment one month enter the value of the bonus into the bonus box for a side by side comparison of a normal month and a bonus month Find out the benefit of that overtime

1 State Our calculator is designed to cater to the specific tax rules of each state Simply select your state to ensure the calculations take into account state specific tax rates and regulations 2 Salary and Salary Frequency Enter your gross salary the total amount of money you earn before any deductions and how often you get paid Use this tool to Estimate your federal income tax withholding See how your refund take home pay or tax due are affected by withholding amount Choose an estimated withholding amount that works for you Results are as accurate as the information you enter

How Much Tax On 401k After Retirement 401kInfoClub

https://www.401kinfoclub.com/wp-content/uploads/how-much-tax-do-you-pay-on-401k-after-retirement.png

How Much Will I Get From My FERS Retirement Government Deal Funding

https://governmentdealfunding.com/wp-content/uploads/2022/06/How-much-will-I-get-from-my-FERS-retirement.jpeg

How Much Will I Get Paid After Deductions - 1 Check your tax code you may be owed 1 000s free tax code calculator 2 Transfer unused allowance to your spouse marriage tax allowance 3 Reduce tax if you wear wore a uniform uniform tax rebate 4 Up to 2 000 yr free per child to help with childcare costs tax free childcare 5