San Jose Paycheck Calculator Use ADP s California Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees Just enter the wages tax withholdings and other information required below and our tool will take care of the rest

The U S real median household income adjusted for inflation in 2021 was 70 784 9 U S states don t impose their own income tax for tax year 2022 How Your Paycheck Works Income Tax Withholding When you start a new job or get a raise you ll agree to either an hourly wage or an annual salary Calculate your California net pay or take home pay by entering your per period or annual salary along with the pertinent federal state and local W4 information into this free California paycheck calculator Switch to hourly calculator California paycheck FAQs California payroll State Date State California Change state Check Date Earnings

San Jose Paycheck Calculator

San Jose Paycheck Calculator

https://i.insider.com/5c5ddbd5dde86747d01713a3?width=1000&format=jpeg&auto=webp

General Schedule (GS) Base Pay Scale for 2022

https://www.federalpay.org/resources/pdf/locality/gs-payscale-2022-base-table.png

Salary Needed to Live Comfortably in the 25 Largest Metro Areas - 2022 Study - SmartAsset

https://dr5dymrsxhdzh.cloudfront.net/blog/images/a52be7263/2022/03/20220215-salary-needed-to-live-comfortably-metro-areas-table.png

Use Gusto s salary paycheck calculator to determine withholdings and calculate take home pay for your salaried employees in California We ll do the math for you all you need to do is enter the applicable information on salary federal and state W 4s deductions and benefits Paid by the hour Switch to hourly Salaried Employee To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 How to calculate taxes taken out of a paycheck

This is the gross pay for the pay period before any deductions including wages tips bonuses etc You can calculate this from an annual salary by dividing the annual salary by the number of pay Our paycheck calculator estimates employees California take home pay based on their taxes and withholdings It automatically calculates key information based on the state your employee resides in and allows you to input additional details necessary to calculate employees pay The following paycheck details are included Federal tax

More picture related to San Jose Paycheck Calculator

American Finances Updates: SNAP Benefits, Salary Paycheck Calculator, Gas Prices...

https://phantom-marca.unidadeditorial.es/c072edd25ef5528d37b3f22d034e5633/resize/1200/assets/multimedia/imagenes/2022/08/23/16612501465668.png

VA Disability Pay Schedule (2022 UPDATE) - Hill & Ponton, P.A.

https://www.hillandponton.com/wp-content/uploads/2020/11/PAY-SCHEDULE-2.png

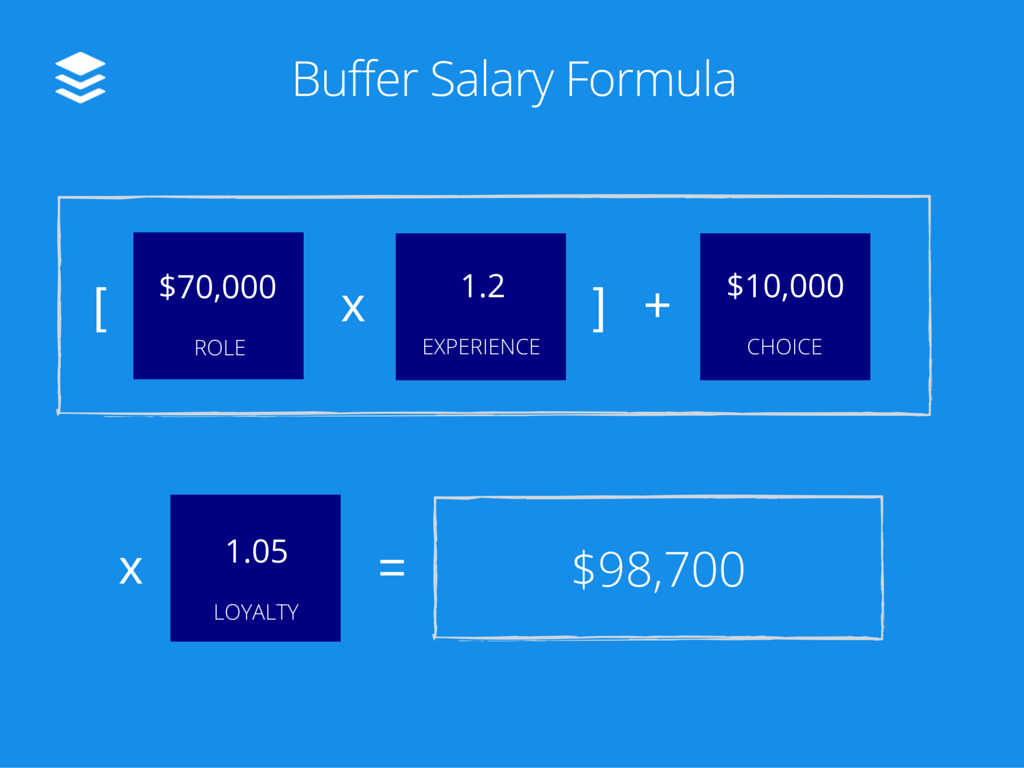

Introducing Buffer's Salary Calculator & New Salary Formula

https://buffer.com/resources/content/images/wp-content/uploads/2016/02/Buffer-Salary-Formula2-1024x768.png

California Paycheck Calculator Calculate your take home pay after federal California taxes Updated for 2023 tax year on Sep 19 2023 What was updated Tax year Job type Salary hourly wage Overtime pay State Filing status Self employed Pay frequency Additional withholdings Pre tax deduction s Post tax deduction s Employer pays in DC Check out PaycheckCity for California paycheck calculators withholding calculators tax calculators payroll information and more Free for personal use

1 Enter job title years of experience 2 Add pay factors like skills education 3 Find your market worth with a report tailored to you San Jose California Jobs by Salary The average salary The state income tax rate in California is progressive and ranges from 1 to 12 3 while federal income tax rates range from 10 to 37 depending on your income This paycheck calculator can help estimate your take home pay and your average income tax rate

Introducing Buffer's Salary Calculator & New Salary Formula

https://buffer.com/resources/content/images/wp-content/uploads/2015/11/calculator-launch.png

American Finances Updates: SNAP Benefits, Salary Paycheck Calculator, Gas Prices...

https://e00-marca.uecdn.es/assets/multimedia/imagenes/2022/09/08/16626249966992.png

San Jose Paycheck Calculator - To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 How to calculate taxes taken out of a paycheck