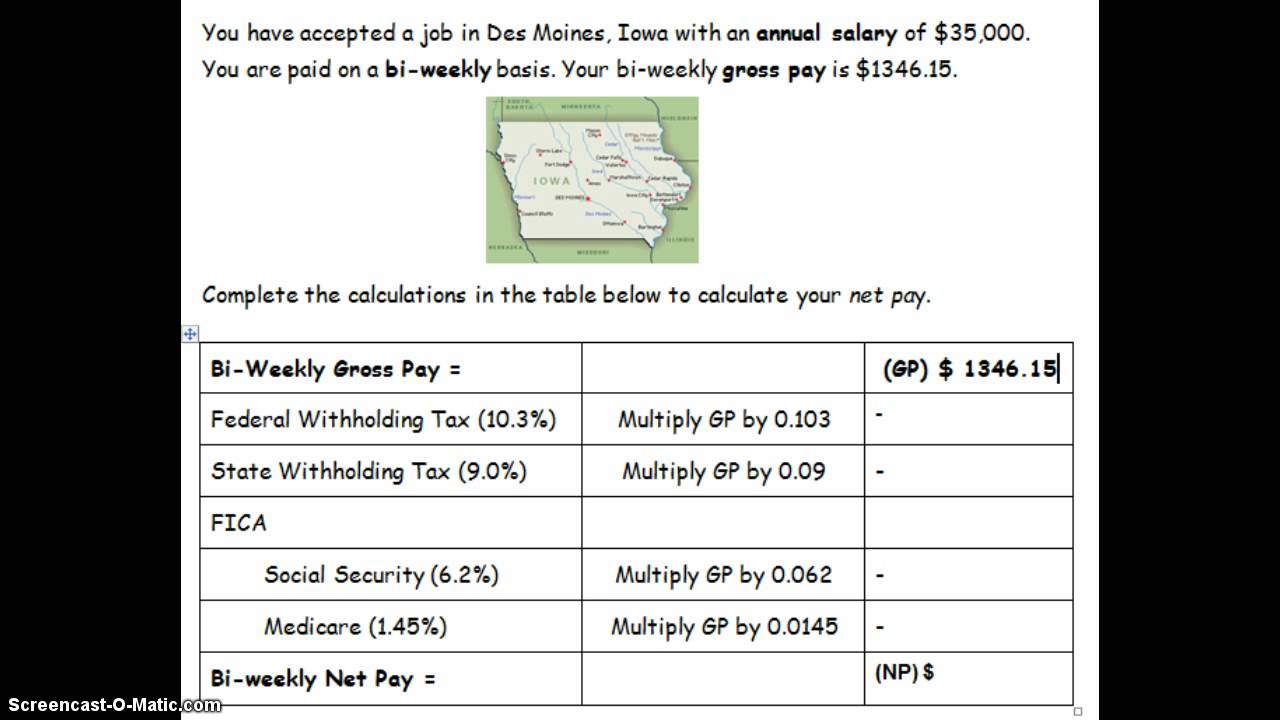

How Do I Calculate My Paycheck Every Two Weeks Use our paycheck tax calculator If you re an employee generally your employer must withhold certain taxes such as federal tax withholdings social security and Medicare taxes from your

Biweekly wage 2 Hourly wage Hours per week We can also express the first formula in terms of the daily wage Considering that Weekly wage Daily wage Days per week Biweekly wage 2 Daily wage Days per week 1 Pretax deductions withheld These are the deductions to be withheld from the employee s salary by their employer before the salary can be paid out including 401k the employee s share of the health insurance premium health savings account HSA deductions child support payments union and uniform dues etc 2 Deductions not withheld

How Do I Calculate My Paycheck Every Two Weeks

How Do I Calculate My Paycheck Every Two Weeks

https://external-preview.redd.it/6CLOKymmPXH2CxKPn7jqwMfuUZcSjEVUj38k4so-gvY.jpg?auto=webp&s=6b606d8b46f21950e12a89c4ce31c9679736aefe

What S My Paycheck Top Tips

https://stimulusmag.com/wp-content/uploads/2022/12/what-s-my-paycheck-1024x649.jpeg

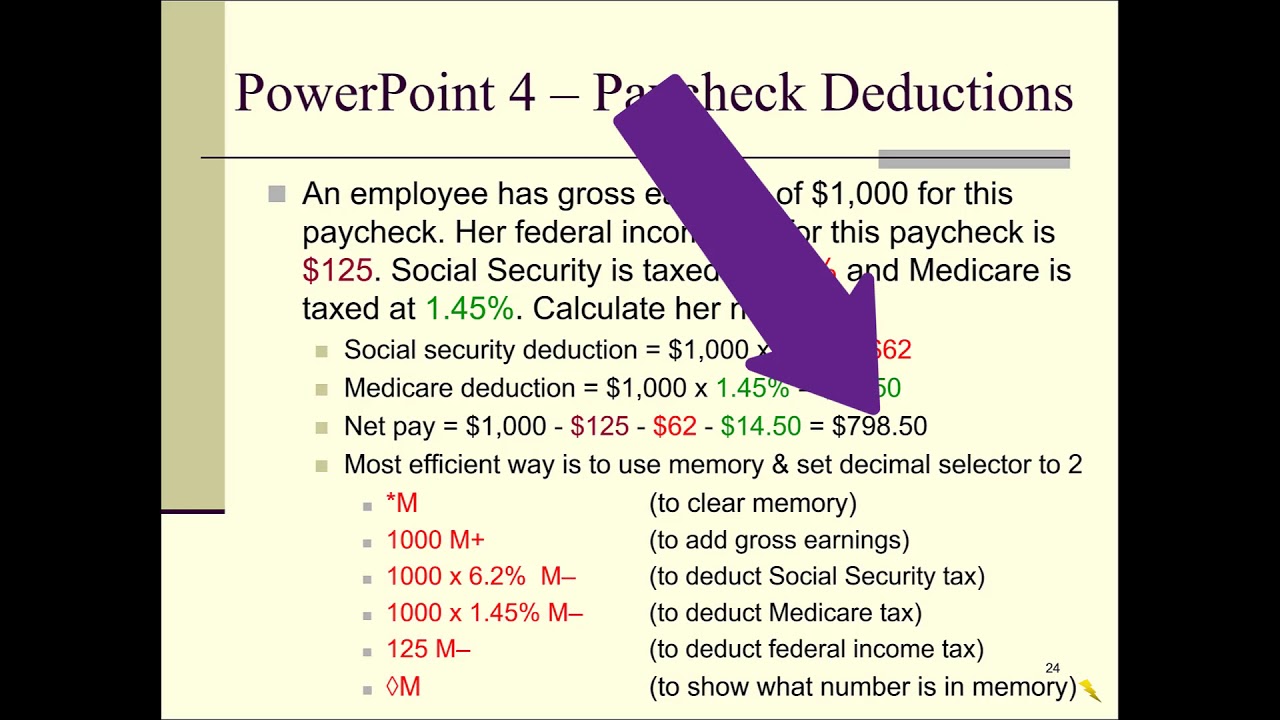

Calculate Paycheck Deductions Net Pay With A Desktop Calculator YouTube

https://i.ytimg.com/vi/Omxh157P-8U/maxresdefault.jpg

United States Weekly Tax Calculator 2024 This tool is designed to assist with calculations for the 2025 Tax Return and forecasting for the 2024 Tax Year If you need to access the calculator for the 2023 Tax Year and the 2024 Tax Return you can find it here Please provide a rating it takes seconds and helps us to keep this resource free for Ask your employer if they use an automated system to submit Form W 4 Submit or give Form W 4 to your employer To keep your same tax withholding amount You don t need to do anything at this time Check your withholding again when needed and each year with the Estimator This helps you make sure the amount withheld works for your circumstance

Source for all charts IRS PDF Most taxpayers with simple tax returns claim the standard deduction which reduces their taxable income If you receive your wages solely from an employer as a W 2 First enter the net paycheck you require Then enter your current payroll information and deductions We will then calculate the gross pay amount required to achieve your net

More picture related to How Do I Calculate My Paycheck Every Two Weeks

lay An Egg

https://pic3.zhimg.com/v2-7595a96e2db57cc0619883bbfc9fe6a2_r.jpg

How To Make Your Paycheck Last Two Weeks My Debt Epiphany

https://www.mydebtepiphany.com/wp-content/uploads/2017/06/time-1558037_1920.jpg

Paycheck Calculation YouTube

https://i.ytimg.com/vi/il-4WwjmCeE/maxresdefault.jpg

For most taxpayers the deadline to file their personal federal tax return pay any tax owed or request an extension to file is Monday April 15 2024 Taxpayers living in Maine or Massachusetts have until April 17 2024 due to the Patriot s Day and Emancipation Day holidays Income tax brackets jumped by 7 for 2023 Income tax is progressive the more you earn the more you pay as a percentage of your earnings Each bracket represents a range of incomes subject to a

Step 1 Gross income First we need to determine your gross income If you are salaried your annual salary will be your gross income If you are paid hourly you must multiple the hours days and weeks The following is the formula for both cases Annual salary Annual salary Gross income In general there are four options you can consider for your payroll calendar which is essentially a schedule that helps you pay your employees You can pay your workers on a weekly

90 Day Bares All Exclusive Caesar Sent Maria 800 Every Two Weeks

https://bossip.com/wp-content/uploads/sites/28/2021/03/16150506397737.png?w=560&h=320&crop=1

How To Avoid Living Paycheck To Paycheck Informational Guide

https://twomillionways.com/wp-content/uploads/2020/02/Living-Paycheck-to-paycheck.jpg

How Do I Calculate My Paycheck Every Two Weeks - Source for all charts IRS PDF Most taxpayers with simple tax returns claim the standard deduction which reduces their taxable income If you receive your wages solely from an employer as a W 2