Often Referred To As A Salary Reduction Plan Key Takeaways Salary reduction contributions represent a percentage of an employee s pay that s deducted and contributed to a retirement plan Salary reduction contributions may apply

Here s what you need to know Salary Reduction Contribution Plans Explained A salary reduction plan helps workers save and invest for retirement through their employer via several types of retirement accounts Key Takeaways A 408 k is an employer sponsored retirement plan akin to a 401 k The plan is also referred to as a simplified employee pension which is a type of individual retirement

Often Referred To As A Salary Reduction Plan

Often Referred To As A Salary Reduction Plan

https://ikase.us/wp-content/uploads/2020/10/sample-50-best-salary-increase-letters-how-to-ask-for-a-raise-salary-increase-proposal-template-excel-1187x1536.jpg

COVID 19 And Business Employee Voluntary Salary Reduction Plan

https://fairwindsmanagement.net/wp-content/uploads/2020/03/FWM-Blog-COVID19_2.png

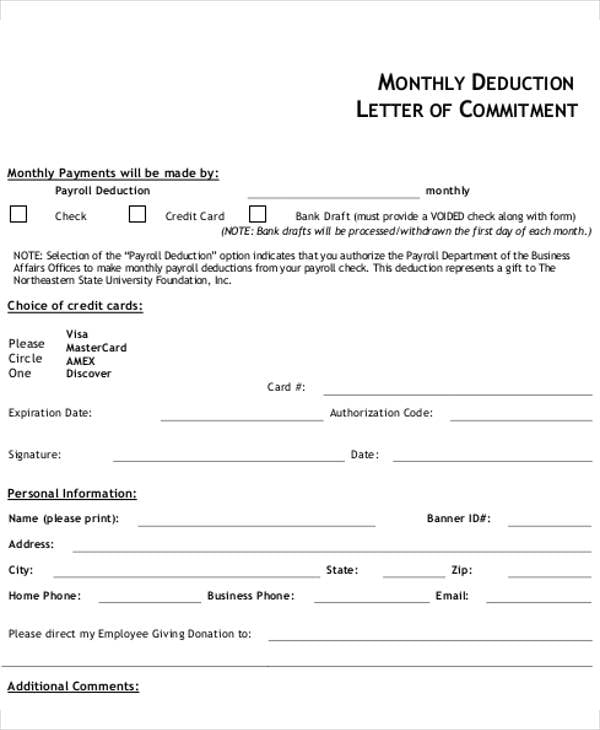

40 Sample Letter Loan Deduction From Salary Letter Of Confession Vrogue

https://www.allbusinesstemplates.com/thumbs/f061880e-9aa5-4004-9445-107f3924b714_1.png

Employers may limit changes to once per month for administrative purposes however according to Benefit Resource Inc BRI an administrator of tax free benefits programs The opposite holds for What is a qualified retirement plan What types of retirement plans are there There are two main categories of retirement plans One category of plan is set up by you the individual taxpayer and is appropriately called an individual retirement account or IRA There are four main types of IRAs traditional IRAs Roth IRAS

Retirement Plans 401 k Plan Fix It Guide 401 k Plan Overview 401 k Plan Fix It Guide 401 k Plan Overview Updated 09 June 2023 What Does Salary Reduction Plan Mean A salary reduction plan is a pension plan that lets employees draw from their salaries to make contributions to their retirement accounts These contributions are typically tax deferred which can make them very appealing to employees

More picture related to Often Referred To As A Salary Reduction Plan

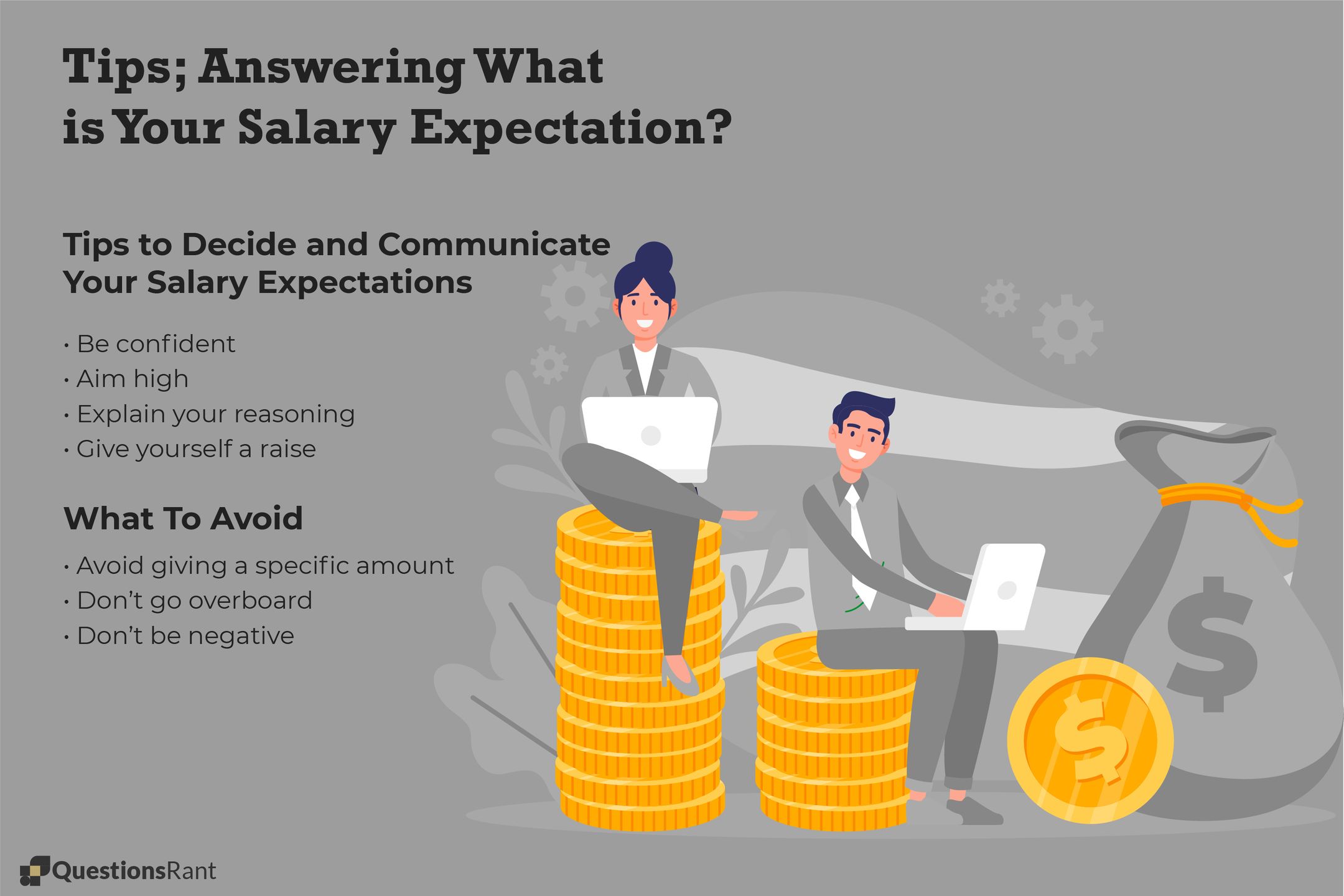

What Are Your Salary Expectations Best Answers QuestionsRant

https://www.questionsrant.com/wp-content/uploads/2019/12/What-Are-Your-Salary-Expectations.jpg

50 Best Salary Increase Letters How To Ask For A Raise TemplateLab

http://templatelab.com/wp-content/uploads/2019/01/salary-increase-letter-34.jpg?w=790

Salary Reduction Simplified Employee Pension Plan SARSEP Stock Photo

https://thumbs.dreamstime.com/z/salary-reduction-simplified-employee-pension-plan-sarsep-desk-173572600.jpg

A defined contribution plan is an employer sponsored retirement plan funded by money from employers and employees The money you save for retirement in a defined contribution plan is invested in At retirement you receive the balance in your account reflecting the contributions investment gains or losses and any fees charged against your account The 401 k plan is a popular type of defined contribution plan There are four types of 401 k plans traditional 401 k safe harbor 401 k SIMPLE 401 k and automatic enrollment

Supplemental Executive Retirement Plan SERP A supplemental executive retirement plan SERP is a nonqualified retirement plan for key company employees such as executives that provides Step 1 View the full answer Step 2 Unlock Answer Unlock Previous question Next question Transcribed image text Ch 17 Assignment Retirement and Estate Planning Term Descriptiorn ERISA Employers contribute company stock to employees as tax deductible gifts and put the stock in trust for them

Salary Notification Template Free Payslip Templates

https://images.template.net/wp-content/uploads/2017/02/27180429/Salary-Deduction-Letter-Template.jpg

Can Your Employer Reduce Your Salary Donovan Ho

https://dnh.com.my/wp-content/uploads/2018/04/Salary-Reduction-940x675.png

Often Referred To As A Salary Reduction Plan - Salary Reduction Plans are an effective way to save for retirement reduce taxable income and improve financial security They offer employees a range of investment options and are often accompanied by employer matching contributions