What Is A Salary Reduction Contribution Any employer including self employed individuals tax exempt organizations and governmental entities that had no more than 100 employees with 5 000 or more in compensation during the preceding calendar year the 100 employee limitation can establish a SIMPLE IRA plan

A salary reduction contribution plan helps workers save and invest for retirement through their employer via several types of retirement accounts Money is typically deposited in a retirement account such as a 401 k 403 b or SIMPLE IRA on a pre tax basis through recurring deferrals aka contributions on behalf of the employee Salary reduction contributions represent a percentage of an employee s pay that s deducted and contributed to a retirement plan Salary reduction contributions may apply to 401 k 403 b or SIMPLE IRA plans The contributions are typically pre tax which reduces taxable income upfront while distributions are taxed in retirement

What Is A Salary Reduction Contribution

What Is A Salary Reduction Contribution

https://d32ijn7u0aqfv4.cloudfront.net/wp/wp-content/uploads/raw/SOIN0221013_1560x880_desktop.jpg

New App WageSpot Exposes Salary Data Across The Country

https://www.gannett-cdn.com/-mm-/389f33b6050a2664d0a5c4c7964c4fab0747cd63/c=0-38-2024-1181/local/-/media/2015/10/26/USATODAY/USATODAY/635814567737908846-salary.jpg?width=2024&height=1143&fit=crop&format=pjpg&auto=webp

:max_bytes(150000):strip_icc()/155152563-57aa8ce25f9b58974a3807c9.jpg)

Is A Salary Reduction Even Legal For An Employee

https://www.thebalancemoney.com/thmb/_6XoXh6ZRDJtGQ6PsbKf8COxHJk=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/155152563-57aa8ce25f9b58974a3807c9.jpg

Salary reduction contributions The amount an employee contributes from their salary to a SIMPLE IRA cannot exceed 15 500 in 2023 14 000 in 2022 13 500 in 2020 and 2021 13 000 in 2019 and 12 500 in 2015 2018 A SIMPLE IRA plan S avings I ncentive M atch PL an for E mployees allows employees and employers to contribute to traditional IRAs set up for employees It is ideally suited as a start up retirement savings plan for small employers not currently sponsoring a retirement plan Choose a SIMPLE IRA Plan Establish a SIMPLE IRA Plan

What is salary reduction A salary reduction or pay cut is when an employer lowers an employee s salary amount for various reasons Reasons for a salary reduction You may reduce an employee s salary because of a decrease in sales or poor employee performance Many businesses find themselves struggling financially at some point A salary reduction contribution is a contribution made to a retirement savings plan that is generally a percentage of an employee s compensation

More picture related to What Is A Salary Reduction Contribution

Can Your Employer Reduce Your Salary Donovan Ho

https://dnh.com.my/wp-content/uploads/2018/04/Salary-Reduction-940x675.png

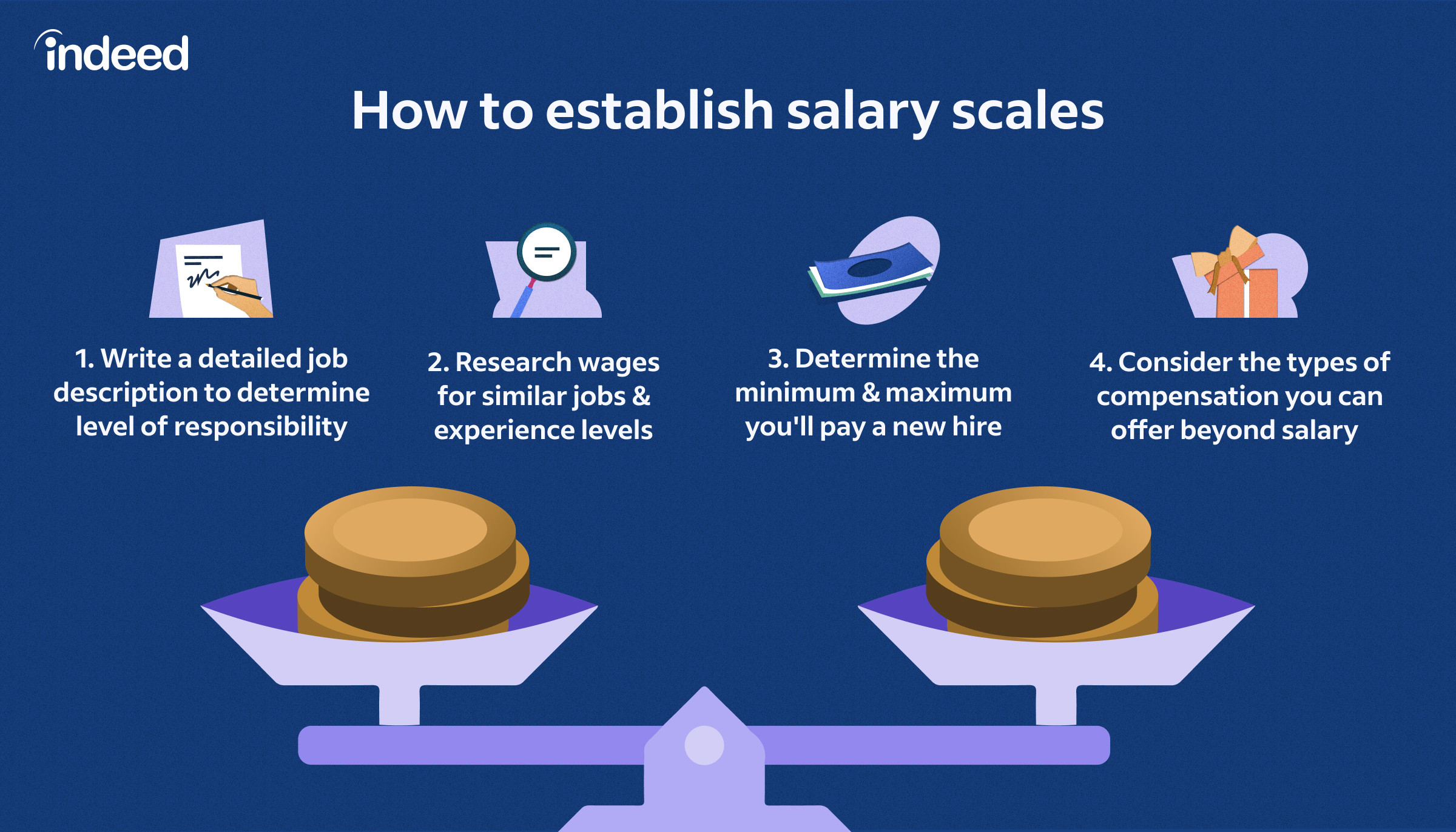

What Is A Scale Of Salary A Guide For HR Professionals

https://d341ezm4iqaae0.cloudfront.net/assets/2020/03/19232728/Salary_Scales01-1.jpg

Handling Salary Reduction For Employees Salary Payroll Software

https://i.pinimg.com/736x/e2/61/24/e261243c9cfa5b711c9d2f2a366c6442.jpg

There are four permissible types of contributions to a SIMPLE IRA plan 1 salary reduction contributions 2 catch up contributions 3 matching contributions and 4 nonelective contributions A salary reduction contribution is a type of contribution that an employee makes to their retirement plan from their paycheck typically on a pre tax basis This contribution is made in addition to any employer contributions that may be made to the plan

A second reason that an employer may offer a salary reduction is when your job changes substantially either by choice or by a demotion The employer may have decided that your work is not meeting standards but they think you have a lot to contribute in a different job You may have decided that you want a job with less responsibility while Salary reduction contributions These are contributions employees make out of their pay Matching contributions of up to 3 of any salary or 2 elective contribution on up to 345 000 in income

Salary Survey For The South African Legal Sector 2017 2018

http://www.golegal.co.za/wp-content/uploads/2018/01/salary-survey.png

SSS Contribution Table 2023 NewsToGov

https://newstogov.com/wp-content/uploads/2023/02/SSS-Contribution-Regular-Employers-Employees.jpg

What Is A Salary Reduction Contribution - What is salary reduction A salary reduction or pay cut is when an employer lowers an employee s salary amount for various reasons Reasons for a salary reduction You may reduce an employee s salary because of a decrease in sales or poor employee performance Many businesses find themselves struggling financially at some point