Net Income Calculator Utah Use ADP s Utah Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees Just enter the wages tax withholdings and other information required below and our tool will take care of the rest Important note on the salary paycheck calculator The calculator on this page is provided through the ADP

For salaried employees the number of payrolls in a year is used to determine the gross paycheck amount If this employee s pay frequency is weekly the calculation is 52 000 52 payrolls 1 000 gross pay If this employee s pay frequency is semi monthly the calculation is 52 000 24 payrolls 2 166 67 gross pay How much taxes are deducted from a 69 000 paycheck in Utah The total taxes deducted for a single filer are 1327 30 monthly or 612 60 bi weekly Updated on Sep 19 2023 Free tool to calculate your hourly and salary income after federal state and local taxes in Utah

Net Income Calculator Utah

Net Income Calculator Utah

https://casaplorer.com/static/img/opengraph/annual-income-calculator.png

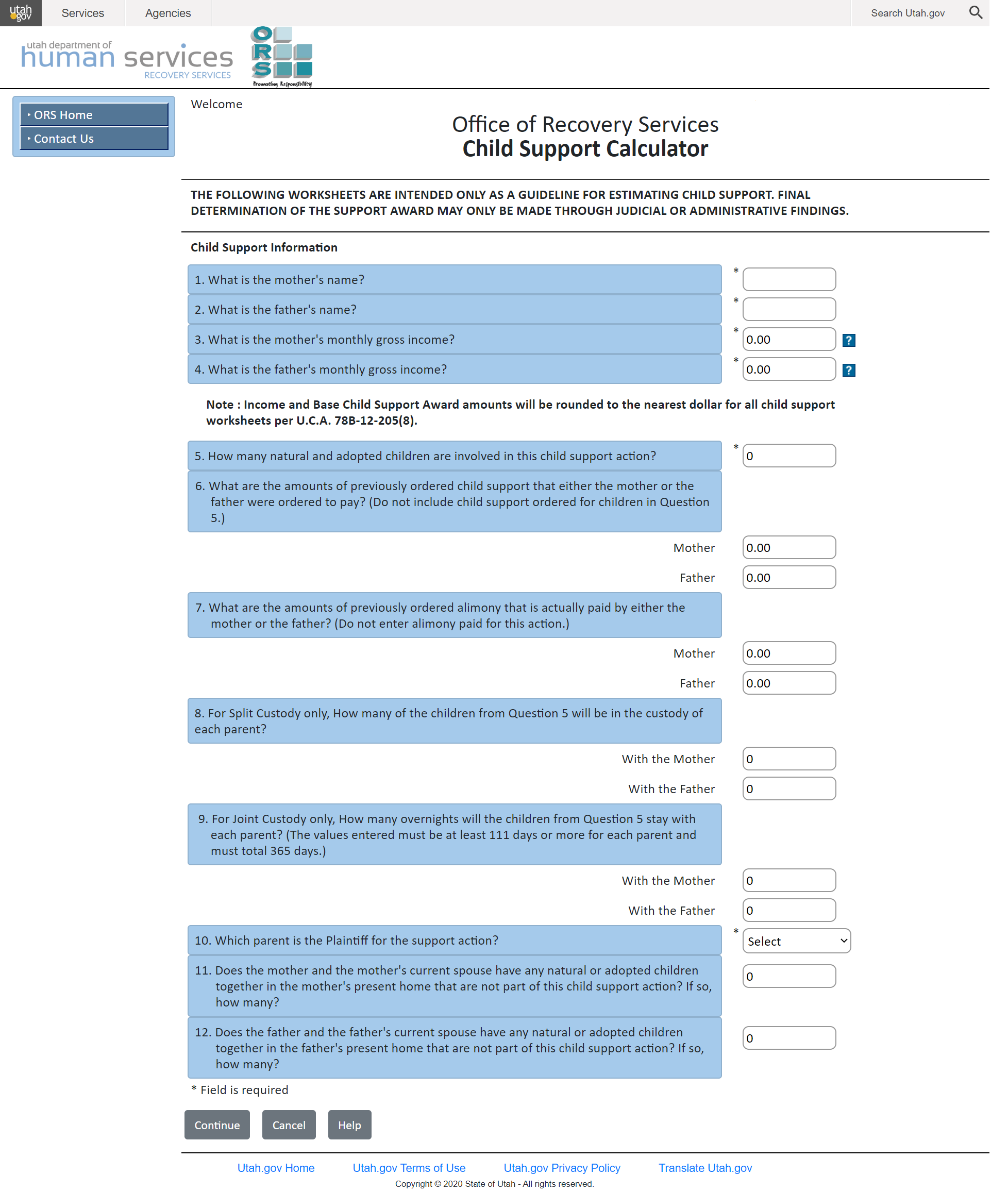

Utah Child Support Calculator - child support calculator sole custody

https://utahdivorce.biz/wp-content/uploads/screenshot-orscsc.dhs_.utah_.gov-2020.07.05-16_25_43.png

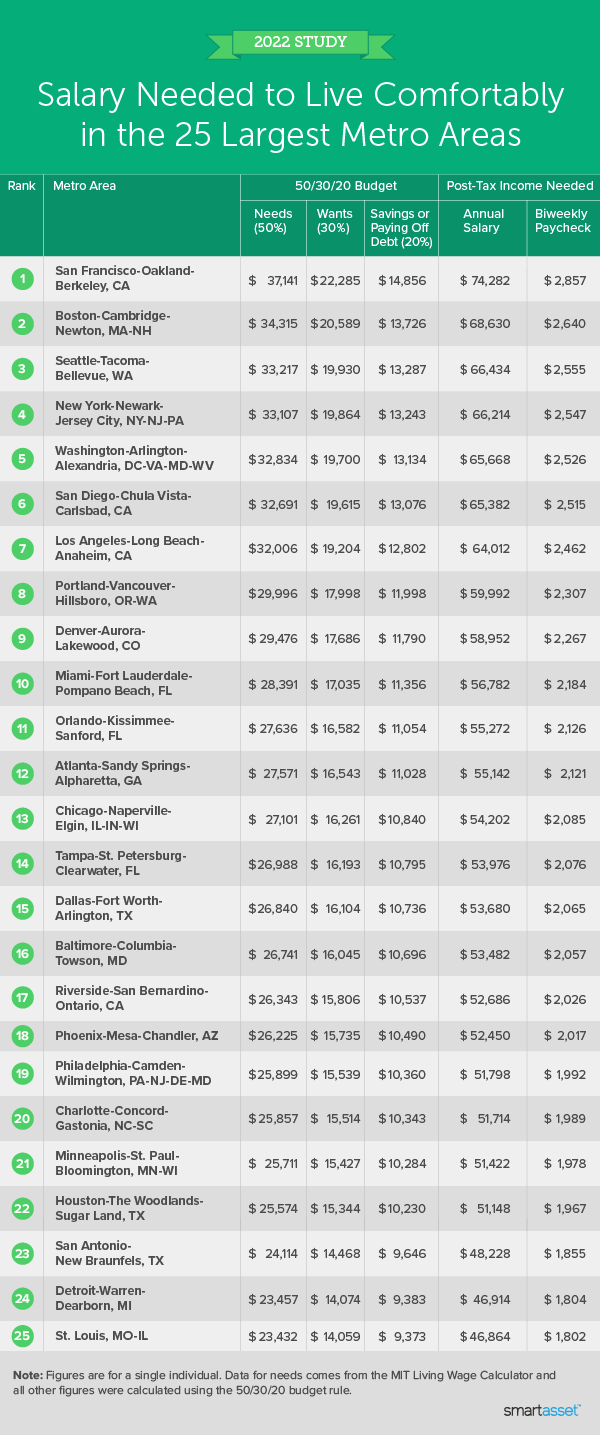

Do you earn enough to 'live comfortably' in Utah and other American cities?

https://dr5dymrsxhdzh.cloudfront.net/blog/images/a1c8616e2/2022/03/20220215-salary-needed-to-live-comfortably-metro-areas-table.png

Find your take home pay in Utah using Forbes Advisor s Paycheck Calculator Your estimated NET Take Home Pay 41 958 04 FICA Social Security 6 2 Employers pay Utah unemployment tax on the first 44 800 of an employee s wages New employers pay at a rate of 1 4 Experienced employers pay at a rate of 0 3 8 3 How often employers pay depends on the amount of tax you withhold in a year Utah s payment frequencies are monthly quarterly annually

Discover Talent s income tax calculator tool and find out what your paycheck tax deductions will be in Utah for the 2023 tax year Income tax calculator Utah an increase of 100 in your salary will be taxed 34 50 hence your net pay will only increase by 65 50 Bonus Example A 1 000 bonus will generate an extra 655 of net Paycheck Calculator Utah Whether you re a resident or planning to work in Utah understanding how your gross salary translates into net pay is crucial Our paycheck calculator for Utah helps you estimate your take home pay considering all state specific taxations Married these rates are for filing separately

More picture related to Net Income Calculator Utah

Calculation of Federal Employment Taxes | Payroll Services

https://payroll.utexas.edu/sites/default/files/Standard%20WH%20Tables%202021_0.png

Utah Salary Paycheck Calculator | Gusto

https://prod.gusto-assets.com/wp-content/uploads/Hiring-and-onboarding%402x.png

Calculation of Federal Employment Taxes | Payroll Services

https://payroll.utexas.edu/sites/default/files/W4%20WH%20Tables%202021.png

The state income tax rate in Utah is under 5 while federal income tax rates range from 10 to 37 depending on your income This paycheck calculator can help estimate your take home pay and your average income tax rate How many income tax brackets are there in Utah The state income tax system in Utah only has a single tax bracket However Utah Income Tax Calculator 2022 2023 Learn More On TurboTax s Website If you make 70 000 a year living in Utah you will be taxed 11 594 Your average tax rate is 11 67 and your marginal tax

The Utah Salary Calculator is your trusted companion in calculating your net pay within the state Designed with user friendliness in mind it s accessible to individuals from all walks of life This calculator focuses on Utah s distinct tax rates ensuring accurate results The result is net income How to calculate annual income To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 How to calculate taxes taken out of a paycheck

Salary Paycheck Calculator: How do you calculate your take home pay | Marca

https://phantom-marca.unidadeditorial.es/eb488a9af934749aed48469e860386db/crop/28x0/1051x682/resize/1320/f/jpg/assets/multimedia/imagenes/2022/09/08/16626249966992.png

Utah Payroll Tools, Tax Rates and Resources · PaycheckCity

https://www.paycheckcity.com/static/ffdd712d68a86edd794fa5165ab26fb6/utah.jpg

Net Income Calculator Utah - Discover Talent s income tax calculator tool and find out what your paycheck tax deductions will be in Utah for the 2023 tax year Income tax calculator Utah an increase of 100 in your salary will be taxed 34 50 hence your net pay will only increase by 65 50 Bonus Example A 1 000 bonus will generate an extra 655 of net