What S My Net Income Calculator Federal Paycheck Calculator Federal income tax rates range from 10 up to a top marginal rate of 37 The U S real median household income adjusted for inflation in 2022 was 74 580 9 U S states don t impose their own income tax for tax year 2023

If you earn over 200 000 you can expect an extra tax of 9 of your wages known as the additional Medicare tax Your federal income tax withholdings are based on your income and filing status For salaried employees the number of payrolls in a year is used to determine the gross paycheck amount If this employee s pay frequency is weekly the calculation is 52 000 52 payrolls 1 000 gross pay If this employee s pay frequency is semi monthly the calculation is 52 000 24 payrolls 2 166 67 gross pay

What S My Net Income Calculator

What S My Net Income Calculator

https://i.pinimg.com/originals/b5/3f/a7/b53fa7e1d7d46cc468c3e046b7281fe4.png

Net Income Formula How To Calculate Net Income Mint

https://blog.mint.com/wp-content/uploads/2022/08/in-post02-net-income-formula.png?resize=740

:max_bytes(150000):strip_icc()/Apple12-29-2018incomestatement-5c537a8fc9e77c0001cff2a8.jpg)

How To Calculate Net Income Example Haiper

https://www.investopedia.com/thmb/YensjMD8yWu66ZKmA4J0LzGvFGA=/910x826/filters:no_upscale():max_bytes(150000):strip_icc()/Apple12-29-2018incomestatement-5c537a8fc9e77c0001cff2a8.jpg

Consider an individual with a gross monthly income of 5 000 facing 800 in taxes and 200 in deductions Using the Net Monthly Income Calculator the net monthly income would be calculated as follows text Net Monthly Income 5 000 800 200 4 000 Therefore the net monthly income for this individual is 4 000 To calculate employer taxes use PaycheckCity Payroll Unlimited companies employees and payroll runs for 1 low price All 50 states including local taxes and multi state calculations Federal forms W 2 940 and 941 Use PaycheckCity s free paycheck calculators withholding calculators and tax calculators for all your paycheck and payroll

How to calculate annual income by hand The formula for the annual income is as follows annual income hourly wage hours per week weeks per year If you want to do it without the yearly salary income calculator substitute your numbers into this formula Salary Calculator Results If you are living in California and earning a gross annual salary of 72 020 or 6 002 per month the total amount of taxes and contributions that will be deducted from your salary is 16 442 This means that your net income or salary after tax will be 55 578 per year 4 632 per month or 1 069 per week

More picture related to What S My Net Income Calculator

Calculate Hourly Pay Based On Annual Salary ChurnjetShannan

https://i2.wp.com/www.excelstemplates.com/wp-content/uploads/2018/10/net-salary.png

How To Calculate Net Profit Haiper

https://cdn.educba.com/academy/wp-content/uploads/2019/01/Net-Income-Example-5-1.png

What Is Net Income After Tax Earnings Formula Calculator

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/09/17160238/Net-Income-Calculator-960x632.jpg

This calculator helps you determine the gross paycheck needed to provide a required net amount First enter the net paycheck you require Then enter your current payroll information and To calculate net income take the gross income the total amount of money earned then subtract expenses such as taxes and interest payments For the individual net income is the money you

Net Pay Definition Use our free Net Pay Calculator to calculate your net earnings quickly and efficiently in a matter of minutes Your net pay is the amount of money you receive on your paycheck after all the taxes are withheld When you use our Net Pay Calculator the first thing to enter is your annual gross income or the annual income How do you calculate disposable income Disposable income personal income mandatory deductions The amount of taxes that gets deducted from your pay depends on a few things how much you earn where you live because some states don t charge income tax some do and some cities do too and how you fill out paperwork when you start a job such as tax withholdings on Form W 4

Gross Annual Income Calculator Hourly JeremyAarya

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/07/11073323/Annual-Income-Calculator.jpg

Sauer Bildhauer nderungen Von Net Worth Formula Balance Sheet Emulsion

https://wsp-blog-images.s3.amazonaws.com/uploads/2021/12/16190411/Net-Income-Apple.jpg

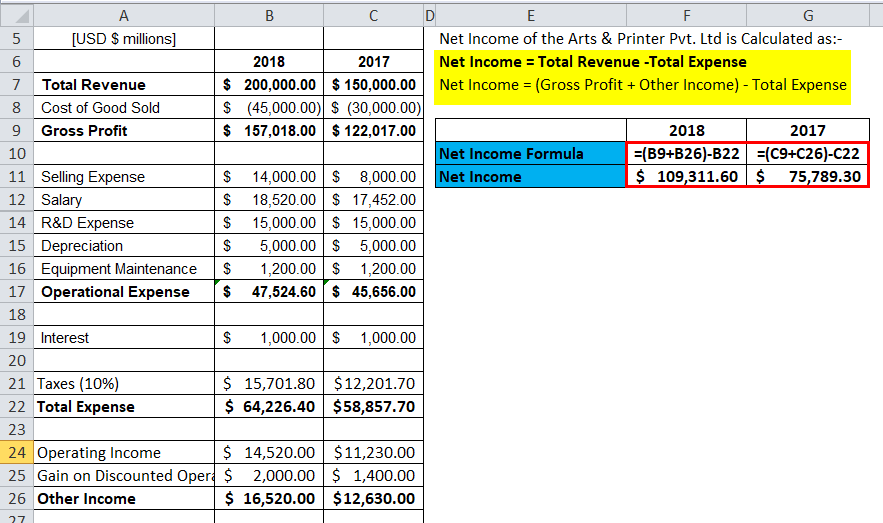

What S My Net Income Calculator - Advertising 1 000 Interest expense 1 000 First Wyatt could calculate his gross income by taking his total revenues and subtracting COGS Gross income 60 000 20 000 40 000 Next Wyatt adds up his expenses for the quarter Expenses 6 000 2 000 10 000 1 000 1 000 20 000 Now Wyatt can calculate his net income