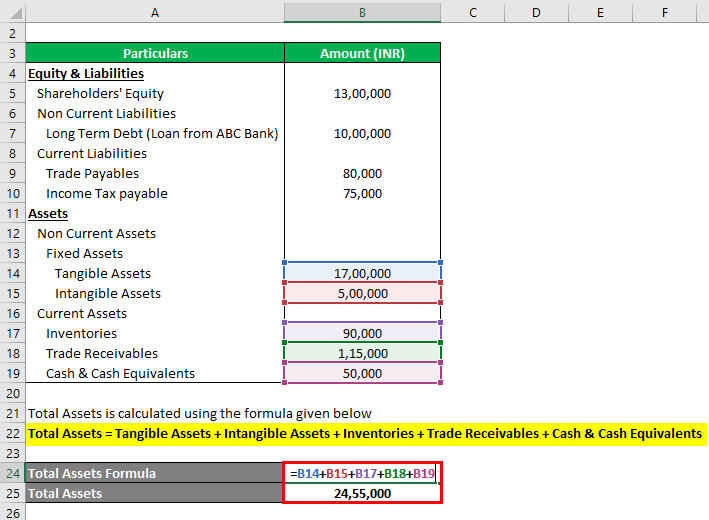

Net Asset Value Example Balance Sheet First we need to calculate total assets and then total liabilities Step 1 Calculation of Total liabilities Step 2 Calculation of Total assets Step 3 We can use the above equation to calculate net assets Net Assets 11 03 232 77 9 93 633 64 Net Assets will be Net Assets 1 09 599 13

Net asset value is the value of a fund s assets minus any liabilities and expenses The NAV on a per share basis represents the price at which investors can buy or sell units of the fund When the value of the securities in the fund increases the NAV increases When the value of the securities in the fund decreases the NAV decreases Net Asset Value NAV Net asset value NAV is value per share of a mutual fund or an exchange traded fund ETF on a specific date or time With both security types the per share dollar amount

Net Asset Value Example Balance Sheet

/dotdash_Final_Other_Current_Assets_OCA_Dec_2020-01-1ef8bd75eff345e7ac48ba70fb718619.jpg)

Net Asset Value Example Balance Sheet

https://www.investopedia.com/thmb/bgqqqjp_b3nnkk4XpliMIiXiZuo=/4755x3566/smart/filters:no_upscale()/dotdash_Final_Other_Current_Assets_OCA_Dec_2020-01-1ef8bd75eff345e7ac48ba70fb718619.jpg

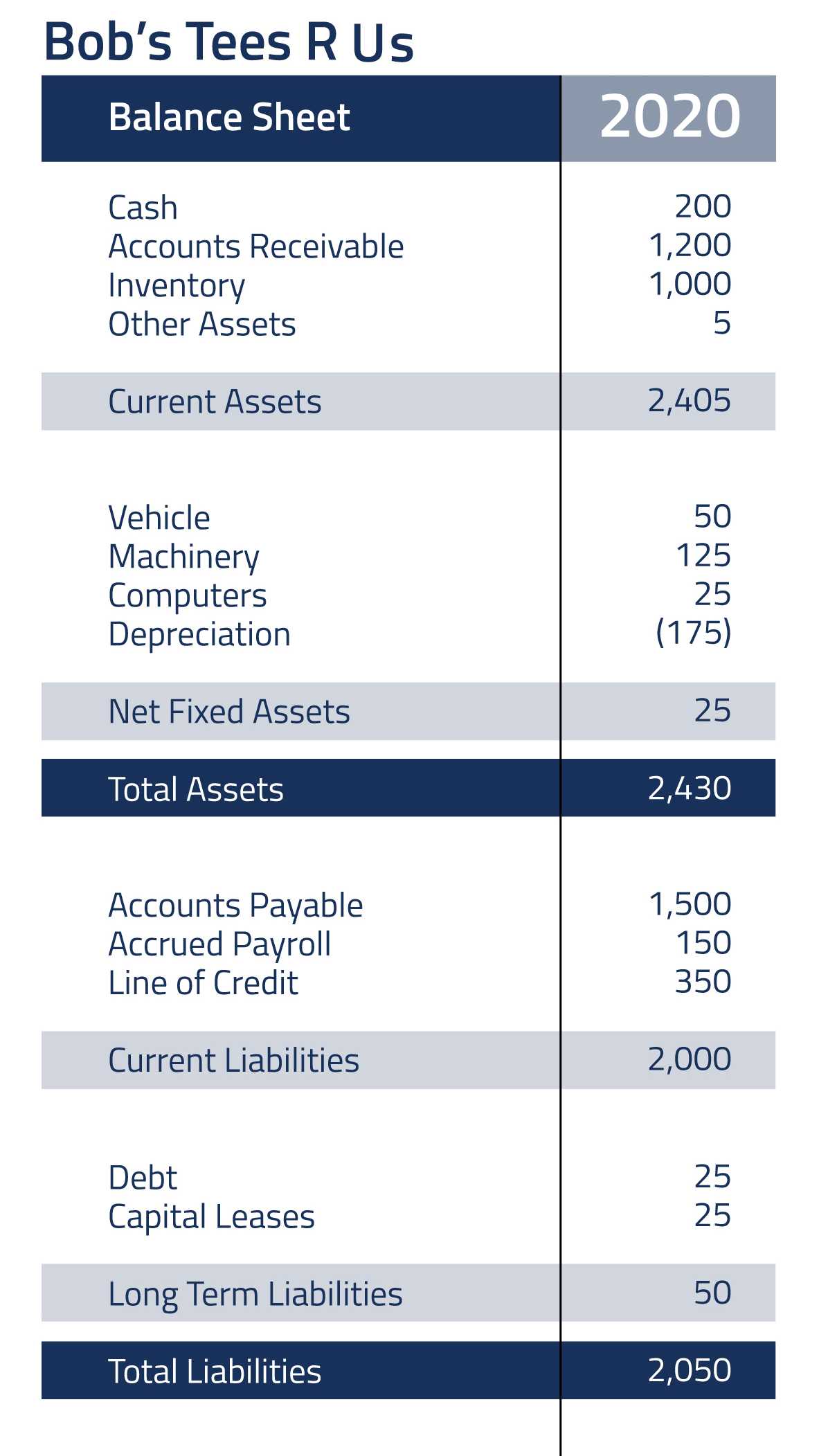

16 A Balance Sheet Is Something I Learned In Class Balance Sheet

https://i.pinimg.com/originals/11/41/54/114154f24840ed4e63b586f34f43f683.png

What Is Net Asset Value Definition Formula Examples Snov io

https://lh3.googleusercontent.com/ZqlBWoBZWW0BUt8CLW0lLknUTeG0lejkZ3Bi2qcMFdFxCda2oP247sSTdTZfJHKpjaAVkbv5zomPNEKOO-zw5LqWbbnYhwvhYwZUslNxLtTY-tzZt5q7bxm8z1xONHaSH2RoJGId

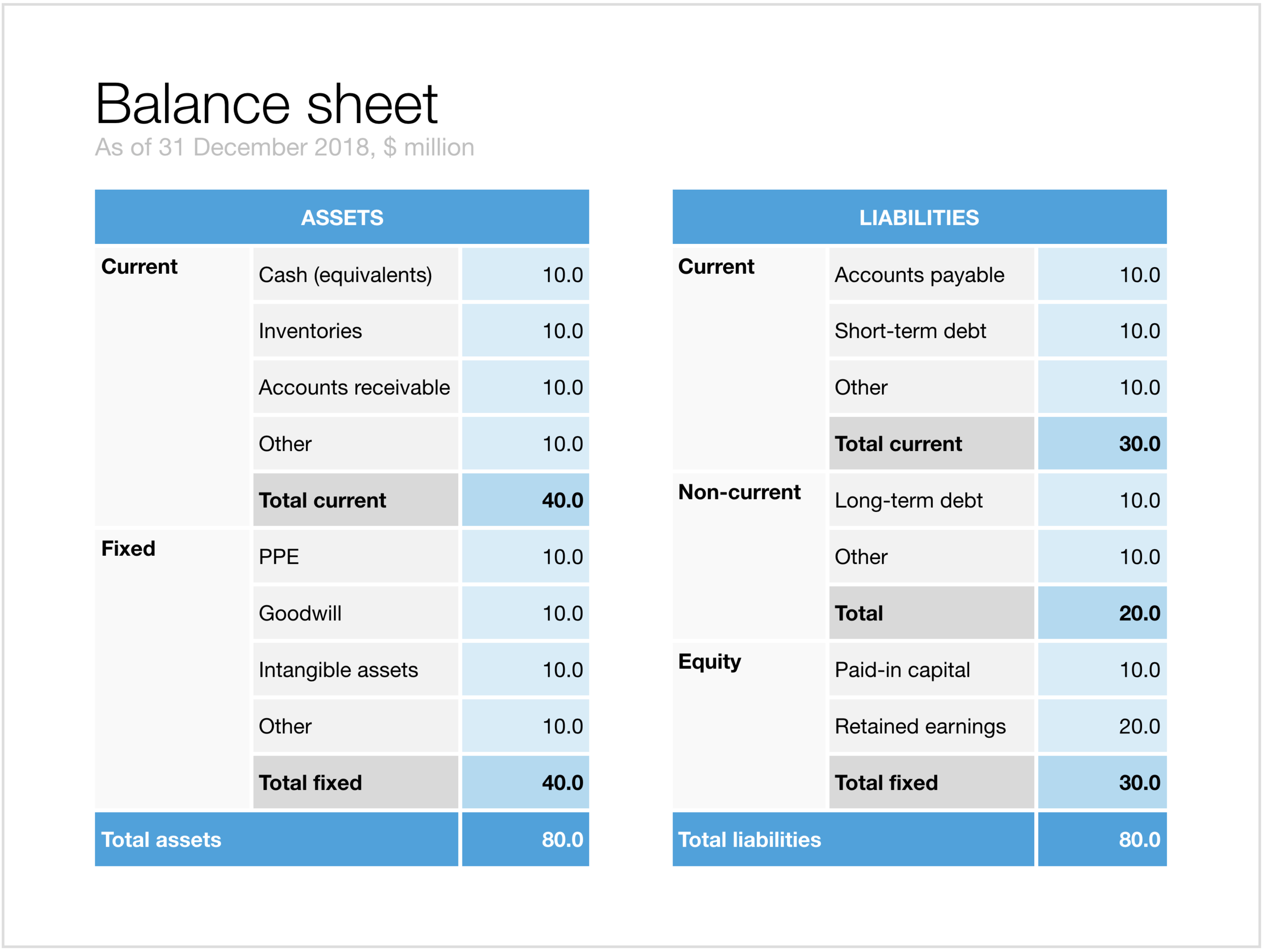

The formula for calculating net assets is total assets minus total liabilities as in the question the value of the total assets is already given now we have the calculate the total liabilities that can be calculated as Current plus Non Current Liabilities 1 000 plus 20 000 21 000 Net Assets 100 000 21 000 79 000 The shareholders equity section represents the residual value or net worth remaining upon deducting total liabilities from the total assets of a company The balance sheet offers practical insights into a company s current financial position and is used to perform ratio analysis to measure operating efficiency liquidity

The net asset on the balance sheet is defined as the amount your total assets exceed your total liabilities and is calculated by simply adding what you own assets and subtracting it from whatever you owe liabilities It is commonly known as net worth NW You are free to use this image on your website templates etc Please provide us A Net Asset Value is one of the organization s monetary stability indicators It s calculated as the total value of the company s assets minus the total value of its liabilities Net Asset Value Value of assets Value of liabilities If it s represented on a per share basis the difference is then divided by the number of shares

More picture related to Net Asset Value Example Balance Sheet

Net Asset Formula Examples With Excel Template And Calculator

https://cdn.educba.com/academy/wp-content/uploads/2021/07/Net-Asset-Formula-Example-1-2.png

Asset Based Valuations Benefits And Pitfalls

https://www.hadleycapital.com/static/db86366a9215b5978ee17f570be2ce5f/85367/net-book-value-calculation.jpg

Debt to asset Ratio Calculator BDC ca

https://www.bdc.ca/globalassets/digizuite/36759-debt-asset-ratio-960px-balance-sheet.png?v=4a4856

Net assets are an important part of your business balance sheet It is the sum total of everything your company owns gross assets minus the total cost of your debts liabilities The resulting figure is often referred to as your company s net asset value The calculation is the same as for an individual s net worth Net book value or net asset value is the value an asset is reported in a company s set of accounts Net book value is calculated as the asset s original cost less accumulated depreciation depletion and impairment The balance sheet is a financial statement that reports the financial position of a company at a point in time with all assets

It can also be referred to as a statement of net worth or a statement of financial position The balance sheet is based on the fundamental equation Assets Liabilities Equity Image CFI s Financial Analysis Course As such the balance sheet is divided into two sides or sections The left side of the balance sheet outlines all of a Net assets provide a rough guide for the value of company resources Typically the higher a company s net asset value the higher the value of a company Let s assume that Company Z s balance sheet reported 10 500 000 in assets and 5 000 000 in total liabilities The company s net assets would be 10 500 000 5 000 000 5 500 000

Asset Side Of The Balance Sheet Finance Train

https://financetrain.sgp1.cdn.digitaloceanspaces.com/asset-1-1024x612.png

Balance Sheet In PowerPoint Magical Presentations Fast Easy Beautiful

https://images.squarespace-cdn.com/content/v1/52de5460e4b036f86899408c/1520149371318-Y1DK2SSHA0NJW3NM9RBM/240K+-+Balance+sheet+in+Keynote.png

Net Asset Value Example Balance Sheet - The formula for calculating net assets is total assets minus total liabilities as in the question the value of the total assets is already given now we have the calculate the total liabilities that can be calculated as Current plus Non Current Liabilities 1 000 plus 20 000 21 000 Net Assets 100 000 21 000 79 000