Net Asset Value Example Net Asset Value NAV Net asset value NAV is value per share of a mutual fund or an exchange traded fund ETF on a specific date or time With both security types the per share dollar amount

Net asset value is the value of a fund s assets minus any liabilities and expenses The NAV on a per share basis represents the price at which investors can buy or sell units of the fund When the value of the securities in the fund increases the NAV increases When the value of the securities in the fund decreases the NAV decreases The net asset value formula is calculated by adding up what a fund owns and subtracting what it owes For example if a fund holds investments valued at 100 million and has liabilities of 10

Net Asset Value Example

Net Asset Value Example

https://www.wikihow.com/images/2/28/1394384-11.jpg

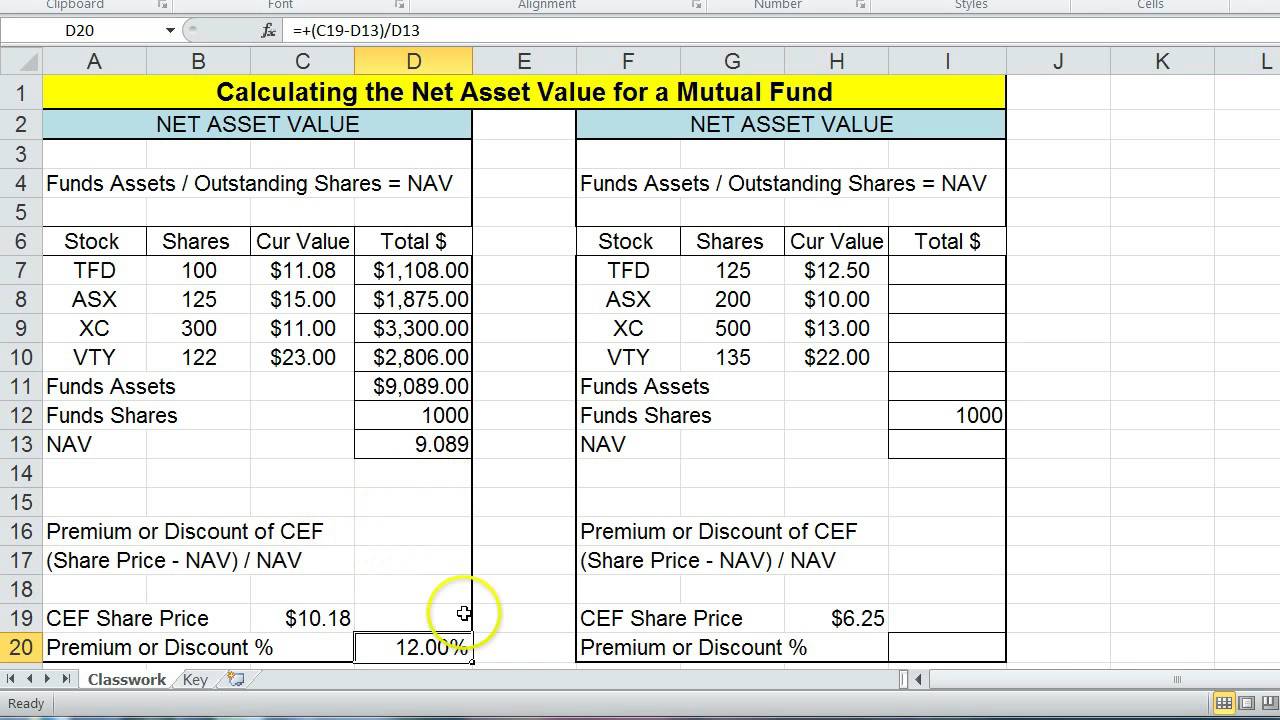

Calculating Mutual Fund Net Asset Value YouTube

https://i.ytimg.com/vi/apT3XPYFlAs/maxresdefault.jpg

Net Asset Value NAV And Its Importance Finvestfox

https://finvestfox.com/wp-content/uploads/2020/10/Net-Asset-Value.jpg

How to Calculate Net Asset Value NAV The net asset value NAV commonly appears in the context of mutual funds as the metric serves as the basis for setting the mutual fund share price NAV on a per unit basis represents the price at which units i e ownership shares in the mutual fund can be purchased or redeemed which is typically done at the end of each trading day Net asset value or NAV represents the value of an investment fund NAV most simply is calculated by adding up what a fund owns the assets and subtracting what it owes the liabilities NAV is typically used to represent the value of the fund per share however so the total above is usually divided by the number of outstanding shares

Net Asset Value Formula A fund s NAV fluctuates along with the value of its underlying investments The formula for NAV is NAV Market Value of All Securities Held by Fund Cash and Equivalent Holdings Fund Liabilities Total Fund Shares OutstandingLet s assume at the close of trading yesterday that a particular mutual fund held 10 500 000 worth of securities 2 000 000 of cash and Net Asset Value commonly referred to as NAV is a crucial term in the financial market particularly in the realm of mutual funds exchange traded funds ETFs and closed end funds

More picture related to Net Asset Value Example

Net Asset Value NAV Definition Formula Uses Seeking Alpha

https://static.seekingalpha.com/cdn/s3/uploads/getty_images/508546190/image_508546190.jpg?io=getty-c-w1280

What Is Net Asset Value Facts You Need To Know

https://investmentfirms.nyc3.digitaloceanspaces.com/wp-content/uploads/2021/03/20172616/net-asset-value.jpg

Net Asset Value NAV Meaning And Definition Capital

https://capital.com/files/imgs/glossary/1200x627x1/98-Net asset value.jpg

Net asset value NAV is the value of an entity s assets minus the value of its liabilities often in relation to open end mutual funds hedge funds and venture capital funds If the NAV in the above example had with the same assets been calculated as 160 million and the NAV per share as 160 the investor would have been given Formula to Calculate Net Asset Value NAV Net asset value formula is mainly used by the mutual funds order to know the unit price of specific fund at the specific time and according to the formula net asset value is calculated by subtracting the total value of the liabilities from the total value of assets of the entity and the resultant is divided by the total number of the outstanding shares

The net asset value formula is used to calculate a mutual fund s value per share A mutual fund is a pool of investments that are divided into shares to be purchased by investors Each share contains a weighted portion of each investment in the collective pool Example of Net Asset Value Formula A simple perhaps unrealistic example of A Net Asset Value is one of the organization s monetary stability indicators It s calculated as the total value of the company s assets minus the total value of its liabilities Net Asset Value Value of assets Value of liabilities If it s represented on a per share basis the difference is then divided by the number of shares

What Is The Net Asset Value Formula For Real Estate Investors

https://loanbase.com/wp-content/uploads/2023/02/shutterstock_1871826286.jpg

What Is Net Asset Value Definition Formula Examples Snov io

https://lh3.googleusercontent.com/ZqlBWoBZWW0BUt8CLW0lLknUTeG0lejkZ3Bi2qcMFdFxCda2oP247sSTdTZfJHKpjaAVkbv5zomPNEKOO-zw5LqWbbnYhwvhYwZUslNxLtTY-tzZt5q7bxm8z1xONHaSH2RoJGId

Net Asset Value Example - Net Asset Value commonly referred to as NAV is a crucial term in the financial market particularly in the realm of mutual funds exchange traded funds ETFs and closed end funds