Independent Contractor Salary Vs Employee Properly classifying workers as employees or independent contractors has always been a recurring tax issue for many business owners but it s likely even more important in our current environment

Employee vs independent contractor Differences you need to know What does it mean to be an independent contractor and how is that status different from being a full employee This article is for informational purposes Updated March 10 2023 Independent contractor jobs and full time positions each have their own benefits and challenges and people typically choose based on the type of employment that fits their needs When comparing a contract employee s salary and a full time employee s salary it s important to consider the factors that can affect your pay

Independent Contractor Salary Vs Employee

Independent Contractor Salary Vs Employee

https://assets-global.website-files.com/628bae62f5026725bd34beb0/628bae62f50267084e34ce04_common_law_employment.jpg

Hiring Independent Contractors vs. Full-Time Employees - Pilot Blog | Pilot Blog

https://assets-global.website-files.com/60a6b551be6130e4e5b19b98/616453e2e6f0d1a36c8a3ead_614dfcc5ff3ea8001a34e1dd_independent-contractor-vs-employee.png

Salaried Employees vs Independent Sales Reps: Which is best for your global enterprise? - Express Global Employment

https://expressglobalemployment.com/wp-content/uploads/2020/12/Salaried-Employees-vs-Independent-Sales-Reps-Which-is-best-for-your-global-enterprise-1-scaled-1.jpg

Independent contractors vs employees The differences Employers like to use independent contractors when they can because doing so allows them to avoid expenses associated with employees taxes training promotions overtime benefits unemployment insurance workers compensation insurance FMLA leave 401K matches and so on Tax Tip 2022 117 August 2 2022 A business might pay an independent contractor and an employee for the same or similar work but there are key legal differences between the two It is critical for business owners to correctly determine whether the people providing services are employees or independent contractors

This article will be limited to the IRS test for independent contractor classification Tax requirements An employee is generally considered an individual who works for wages and salary while an independent contractor signs a contract to provide specified services at an agreed upon price and time and during a specific time frame Often independent contractors and employees work side by side at the same company even doing the same or similar work But there are very important legal differences between being a contractor and an employee Receives net salary after the employer has withheld income tax

More picture related to Independent Contractor Salary Vs Employee

1099 Vs. W2 - Difference Between Independent Contractors & Employees

https://www.accuservepayroll.com/wp-content/uploads/2020/05/1099vsw2chart-1.png

Misclassification of Employees as Independent Contractors | U.S. Department of Labor

https://www.dol.gov/sites/dolgov/files/WHD/images/misclassification.png

What is a 1099 vs W-2 Employee? – Napkin Finance

https://napkinfinance.com/wp-content/uploads/2016/11/NapkinFinance-1099vsW2-01-07-19-v03-1.jpg

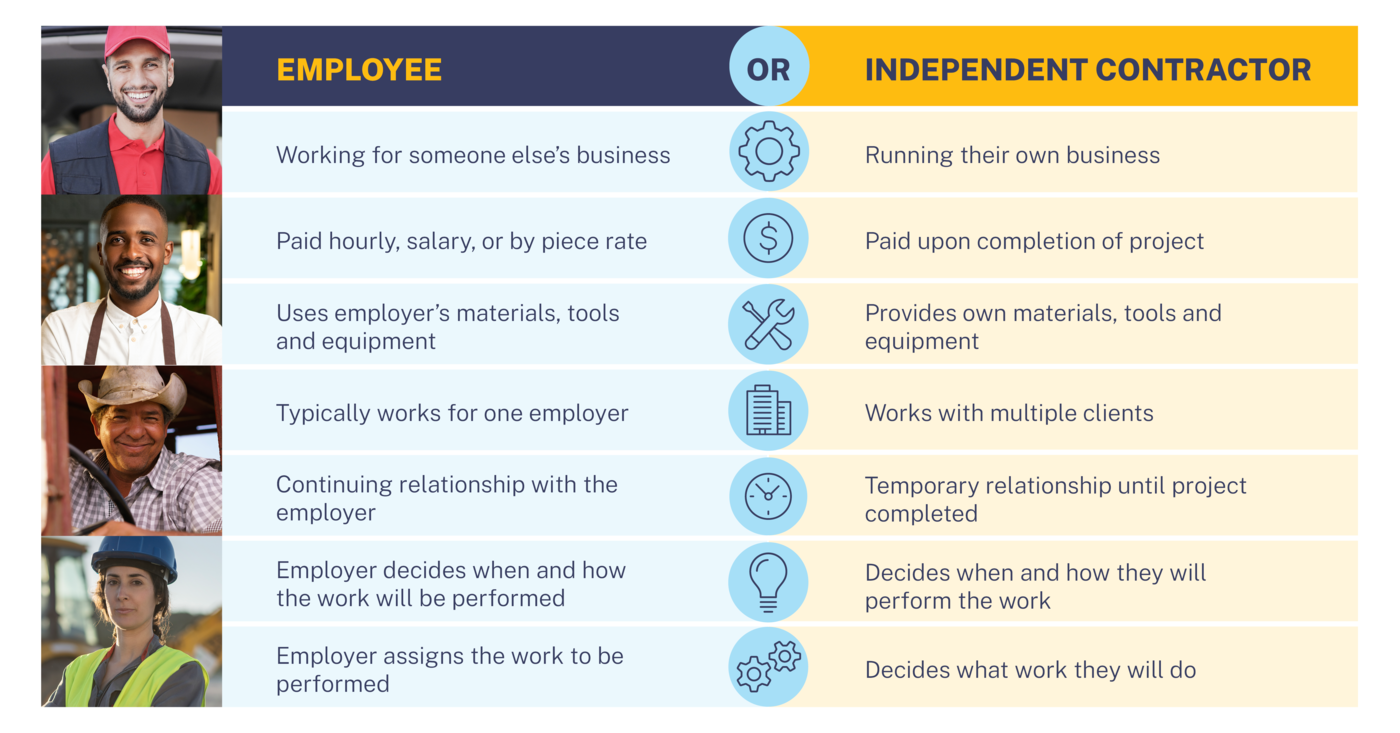

The difference between independent contractors and employees plus why it matters A detailed breakdown of the costs of hiring each Situational reasons to choose one over the other For a quick overview you can reference the independent contractor vs employee chart below Note Want to know how hiring contractors or employees affects your books Definition Of An Independent Contractor The IRS defines an independent contractor as a worker who individually contracts with an employer to provide specialized or requested services on an as

2 Financial control If the worker is paid a salary or guaranteed a regular company wage they re probably classified as an employee If the worker is paid a flat fee per job or project they re more likely to be classified as an independent contractor Independent contractors usually also have what the IRS calls a significant Topic No 762 Independent Contractor vs Employee For federal employment tax purposes the usual common law rules are applicable to determine if a worker is an independent contractor or an employee Under the common law you must examine the relationship between the worker and the business

Blog | Employee OR Independent Contractor: Know the Difference | Dynamic Office & Accounting Solutions

http://www.go2dynamic.com/uploads/documents/infographic_employee-vs-contractor_gotodynamic_v1.jpg

Independent Contractor vs. Regular Employee: What's the Difference? - Shegerian Law

https://i0.wp.com/shegerianlaw.com/wp-content/uploads/2022/06/Info14-Design-Independent-Contractor-vs-Regular-Employee.png?quality=100

Independent Contractor Salary Vs Employee - This article will be limited to the IRS test for independent contractor classification Tax requirements An employee is generally considered an individual who works for wages and salary while an independent contractor signs a contract to provide specified services at an agreed upon price and time and during a specific time frame