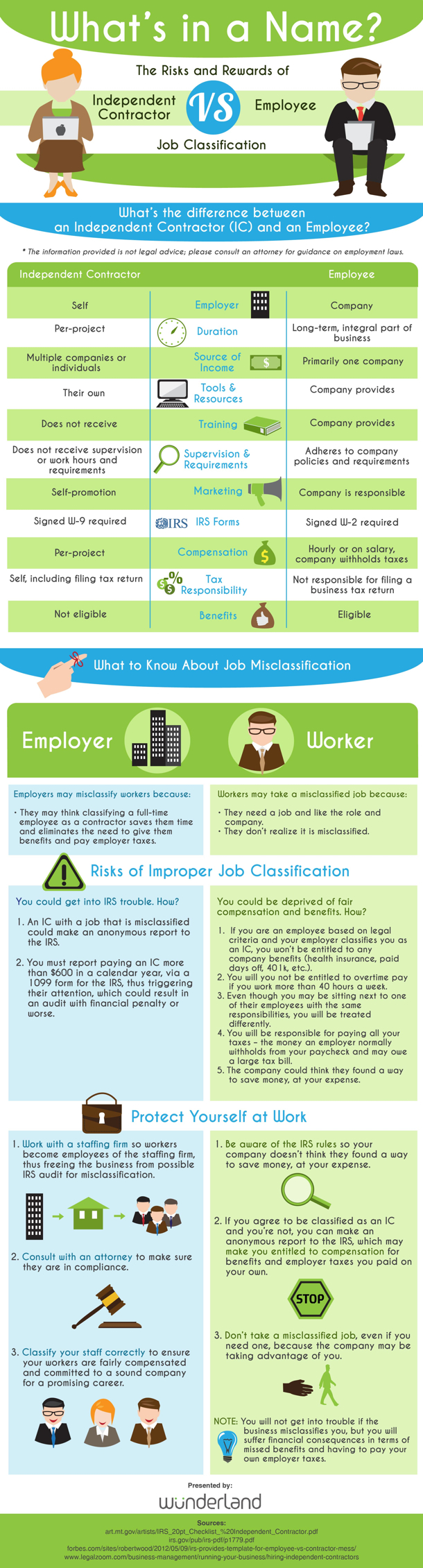

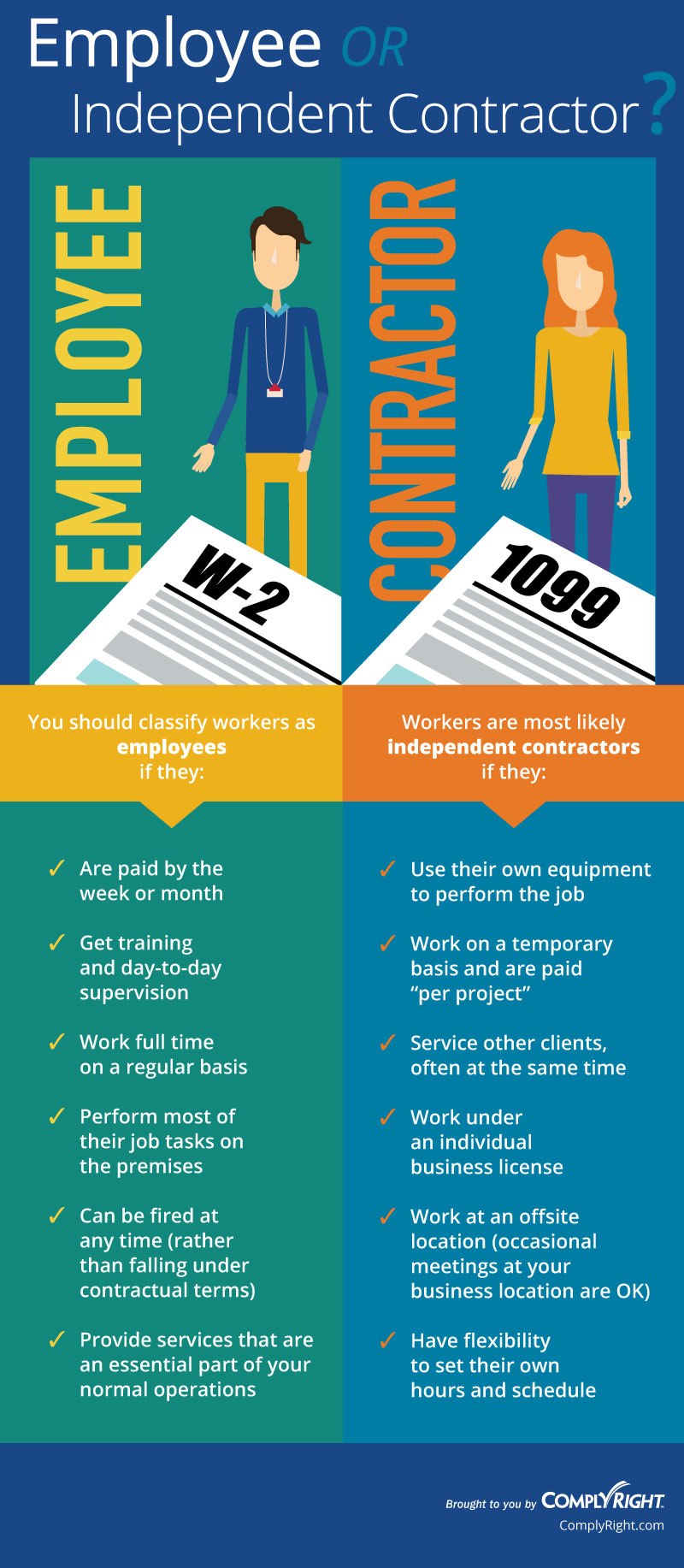

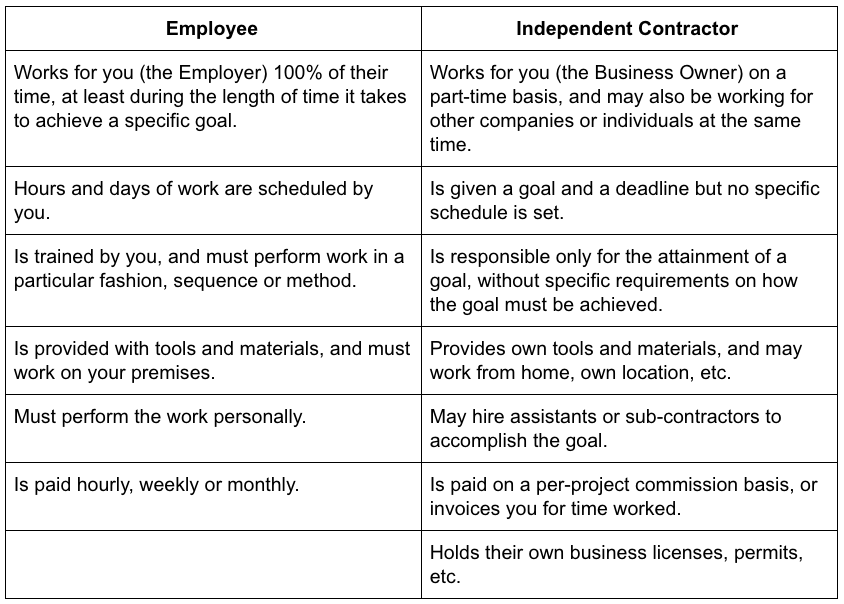

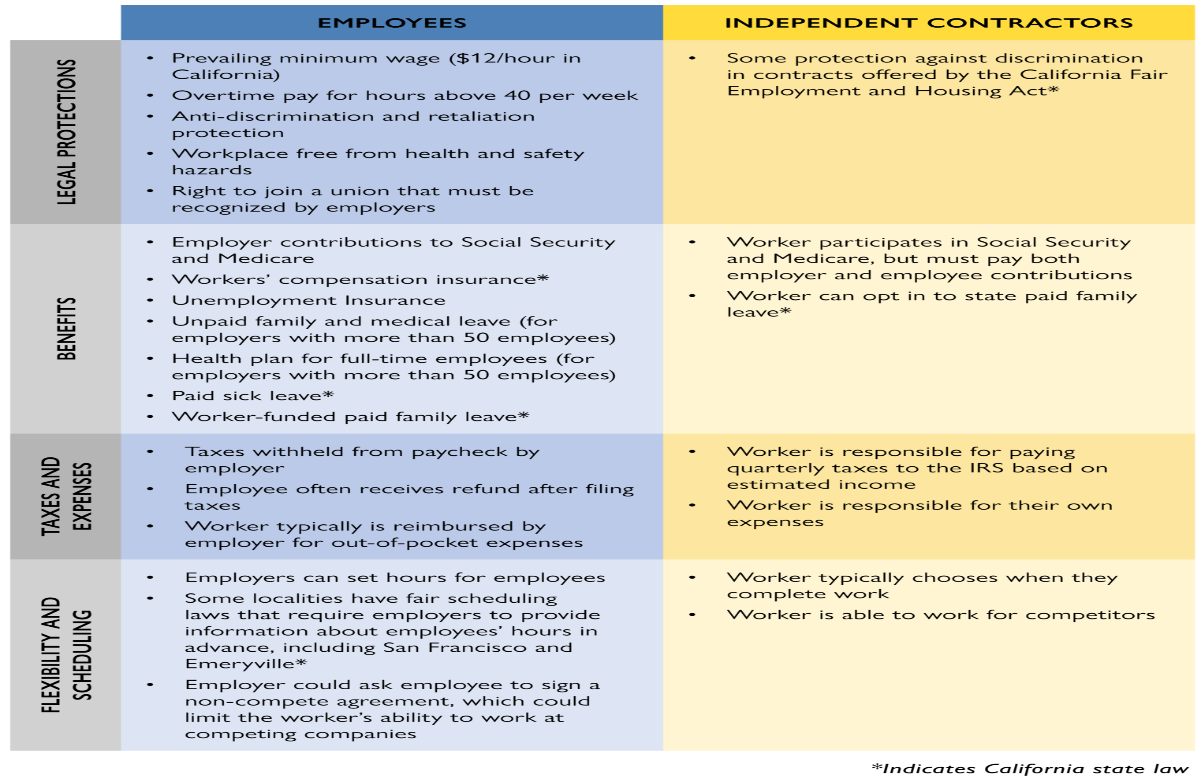

Independent Contractor Vs Employee Independent contractors vs employees The differences Employers like to use independent contractors when they can because doing so allows them to avoid expenses associated with employees taxes training promotions overtime benefits unemployment insurance workers compensation insurance FMLA leave 401K matches and so on

Independent contractors are normally people in an independent trade business or profession in which they offer their services to the public Independent contractor vs employee Whether a worker is an independent contractor or an employee depends on the relationship between the worker and the business On January 10 2024 the U S Department of Labor published a final rule Employee or Independent Contractor Classification Under the Fair Labor Standards Act effective March 11 2024 revising the Department s guidance on how to analyze who is an employee or independent contractor under the Fair Labor Standards Act FLSA This final rule rescinds the Independent Contractor Status Under the

Independent Contractor Vs Employee

Independent Contractor Vs Employee

http://workawesome.com/wp-content/uploads/2014/09/Contractor-vs-Employee-Risks-and-Rewards-Infographic-small.jpg

Employee Or Independent Contractor

https://i0.wp.com/getworkforce.com/wp-content/uploads/2017/10/employee-or-contractor.png?resize=799%2C802&ssl=1

Independent Contractor Versus Employee Worker Classification

http://cdn.complyright.com/Downloadables/Infographics/Independent-Contractor-Versus-Employee.jpg

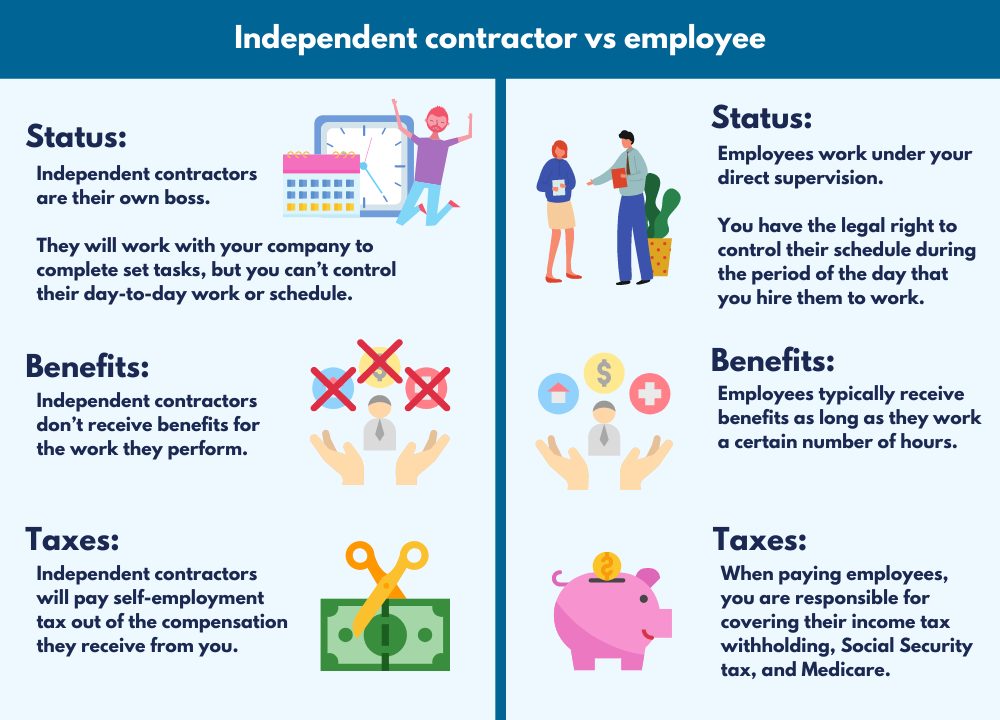

Today the Department of Labor published a final rule Employee or Independent Contractor Classification Under the Fair Labor Standards Act to provide guidance on whether a worker is an employee or independent contractor under the FLSA This rule will help to ensure that workers who are employees are paid the minimum wage and overtime due them While the independent contractor is his or her own boss work stays within the definitions of oral or written contract and adheres to certain requirements An employee on the other hand relies on the business for steady income gives up elements of control and independence is eligible for certain benefits and works within constraint of

Topic no 762 Independent contractor vs employee For federal employment tax purposes the usual common law rules are applicable to determine if a worker is an independent contractor or an employee Under the common law you must examine the relationship between the worker and the business You should consider all evidence of the degree of The following top 20 questions are what the IRS uses to determine if a worker is an independent contractor or employee While no single test nor even the combination of a majority of tests will necessarily be determinative a yes answer to any one of the questions except 16 may mean one of your workers is an employee and should be

More picture related to Independent Contractor Vs Employee

Employee Vs Independent Contractor which Is Better For Your Business

https://www.richdad.com/MediaLibrary/RichDad/Images/resources/blog-post-images/IRS_criteria.png

Most Independent Contractors Are Really Employees Employers

https://lubellrosen.com/storage/app/media/uploaded-files/1.png

Independent Contractor Vs Employee What s The Difference

https://legaltemplates.net/wp-content/uploads/independent-contractor-vs-employee-pros-and-cons.png

If you re found to have misclassified employees as independent contractors you may owe back pay if employees weren t paid minimum wage or overtime pay as well as penalties You also could end up liable for withheld employee benefits and find yourself subject to various federal and state employment laws that apply based on the number of WASHINGTON DC The U S Department of Labor today announced a final rule clarifying the standard for employee versus independent contractor status under the Fair Labor Standards Act FLSA This rule brings long needed clarity for American workers and employers said U S Secretary of Labor Eugene Scalia Sharpening the test to determine who is an independent contractor under the

Effective March 11 2024 a new administrative rule will modify how the Department of Labor DOL or Department classifies workers as either employees or independent contractors under the Fair The test used by the U S Department of Labor the DOL for determining whether a worker should be classified as an independent contractor or an employee for purposes of the federal Fair Labor Standards Act FLSA has been revised several times over the past decade Now the DOL is implementing a new final rule to replace the employer friendly test that was developed in 2021 the 2021

Hiring Cleaning Contractors Vs Employees

https://cleaninghq.maidily.com/wp-content/uploads/2022/04/independent-contractor-vs-employee-california-1600x1200-1.png

The Pros And Cons Of Hiring Independent Contractors

https://www.businessmanagementdaily.com/app/uploads/2020/09/independent-contractor-1000x720-1-1.jpg

Independent Contractor Vs Employee - The following top 20 questions are what the IRS uses to determine if a worker is an independent contractor or employee While no single test nor even the combination of a majority of tests will necessarily be determinative a yes answer to any one of the questions except 16 may mean one of your workers is an employee and should be