How To Work Out My Hourly Pay To work out your hourly rate your calculation would be 50000 40 52 24 04 per hour If you earn 50 000 per year your hourly wage works out as being 24 04 per hour In addition your monthly pre tax wage would be 4 166 67 and your weekly pay would be 961 54 All calculations are based upon a working schedule of 40 hours per

How do I calculate hourly rate First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52 Next divide this number from the annual salary For example if an employee has a salary of 50 000 and works 40 hours per week the hourly rate is 50 000 2 080 40 x 52 24 04 To calculate your hourly wage from your salary follow these steps Find out your annual salary Establish your weekly work hours Use the hourly wage to salary formula hourly wage annual salary weekly hours 52 For instance let s consider an example where your annual salary is 60 320 and you work 40 hours per week hourly wage 60 320 yr 40 h wk 52 wk yr

How To Work Out My Hourly Pay

How To Work Out My Hourly Pay

https://www.marketing91.com/wp-content/uploads/2019/04/How-To-Calculate-Hourly-Rate-Of-Work-1.jpg

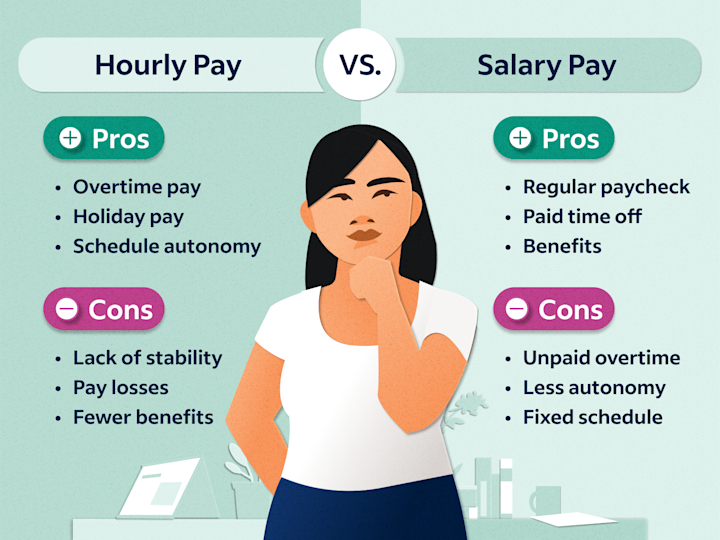

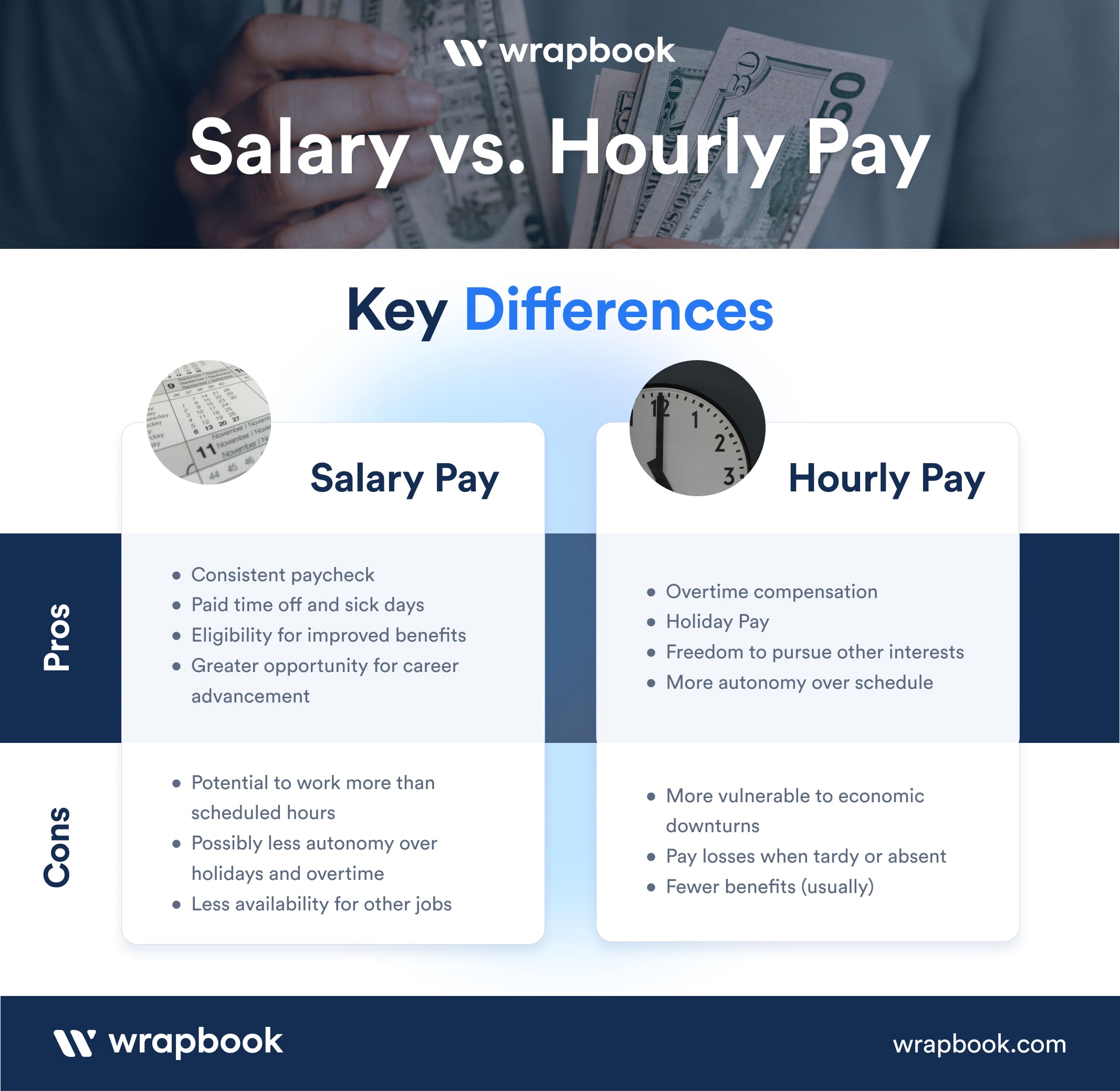

Differences Between Wages Vs Salaries Plus Pros And Cons Indeed

https://images.ctfassets.net/pdf29us7flmy/4pFOfwO8DKsTBzi6ny4dyg/5792c4141a3b12cccbf29e3310995b7f/hourly-vs-salary-new.png?w=720&q=100&fm=jpg

Pin On Fit

https://i.pinimg.com/originals/a3/a0/89/a3a08972a3e8eaa429b3e4fe8c977d81.gif

Step 3 enter an amount for dependents The old W4 used to ask for the number of dependents The new W4 asks for a dollar amount Here s how to calculate it If your total income will be 200k or less 400k if married multiply the number of children under 17 by 2 000 and other dependents by 500 Add up the total A salary is normally paid on a regular basis and the amount normally does not fluctuate based on the quality or quantity of work performed An employee s salary is commonly defined as an annual figure in an employment contract that is signed upon hiring Salary can sometimes be accompanied by additional compensation such as goods or services Wage

FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024 Hourly Rate Yearly Salary Hours per Week Days per Week x Work Days per Year The yearly salary is divided by the number of work hours during the year where the number of work hours is derived by first calculating the number of work hours per day by dividing the hours per week by the work days per week and then multiplying by the

More picture related to How To Work Out My Hourly Pay

Salary Vs Hourly The Difference How To Calculate Hourly Rate From

https://assets-global.website-files.com/6467d96400e84f307e2196ef/6467d96400e84f307e21a675_Salary vs Hourly - Pros and Cons - Infographic - Wrapbook.jpg

Pin On Fitness

https://i.pinimg.com/originals/11/22/44/112244a8df9498a82aa02577283b99a2.gif

Flat Rate Vs Hourly Pay Punchey Resources How to guides

http://resources.punchey.com/wp-content/uploads/2019/06/Screen-Shot-2019-06-14-at-12.45.14-PM-1024x1024.png

If you make 15 per hour and are paid for working 40 hours per week for 52 weeks per year your annual salary pre tax will be 15 40 52 31 200 Using this formula we can calculate the following annual incomes from basic hourly pay It s important to remember that these figures are pre tax and deductions The salary calculator converts your salary to equivalent pay frequencies including hourly daily weekly bi weekly monthly semi monthly quarterly and yearly Customize the salary calculator by including or excluding unpaid time such as vacation hours or holidays Time Worked Hours Per Day Days Per Week

If you worked out your hourly wages to 26 44 and your company pays you a 500 bonus that works out to around 19 hours of work 500 26 44 You may appreciate the bonus more when you realize you earned half a week of pay on top of your regular salary without having to work for it Hourly Wage Calculator This hourly wage calculator helps you find out your annual monthly daily or hourly paycheck having regard to how much you are working per day week and pay rate There is in depth information on how to estimate salary earnings per each period below the form Method 1 Method 2

How To Work Out Every Day POPSUGAR Fitness

https://media1.popsugar-assets.com/files/thumbor/8I_Buh3dACOGNCsLgEZGZTpiWNs/fit-in/2048xorig/filters:format_auto-!!-:strip_icc-!!-/2015/05/01/721/n/1922398/b08d6b12_20-ways.jpg

Pin On Workouts

https://i.pinimg.com/originals/6e/99/4e/6e994e750e5c596a38a6dc6d2bc01e19.jpg

How To Work Out My Hourly Pay - FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024