How To Work Out My Hourly Rate After Tax To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left hand table above In the Weekly hours field enter the number of hours you do each week excluding any overtime

First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52 Next divide this number from the annual salary For example if an employee has a salary of 50 000 and works 40 hours per week the hourly rate is 50 000 2 080 40 x 52 24 04 How do I calculate taxes from paycheck If you earn over 200 000 you can expect an extra tax of 9 of your wages known as the additional Medicare tax Your federal income tax withholdings are based on your income and filing status

How To Work Out My Hourly Rate After Tax

How To Work Out My Hourly Rate After Tax

https://i.pinimg.com/originals/11/22/44/112244a8df9498a82aa02577283b99a2.gif

Calculate Base Salary From Hourly Rate BobbieDerren

https://www.marketing91.com/wp-content/uploads/2019/04/How-To-Calculate-Hourly-Rate-Of-Work-1.jpg

How To Work Out Every Day POPSUGAR Fitness

https://media1.popsugar-assets.com/files/thumbor/8I_Buh3dACOGNCsLgEZGZTpiWNs/fit-in/2048xorig/filters:format_auto-!!-:strip_icc-!!-/2015/05/01/721/n/1922398/b08d6b12_20-ways.jpg

If you make 55 000 a year living in the region of New York USA you will be taxed 11 959 That means that your net pay will be 43 041 per year or 3 587 per month Your average tax rate is 21 7 and your marginal tax rate is 36 0 This marginal tax rate means that your immediate additional income will be taxed at this rate Step 3 enter an amount for dependents The old W4 used to ask for the number of dependents The new W4 asks for a dollar amount Here s how to calculate it If your total income will be 200k or less 400k if married multiply the number of children under 17 by 2 000 and other dependents by 500 Add up the total

How Tax Brackets Work The federal income tax bracket determines a taxpayer s tax rate There are seven tax rates for the 2024 tax season 10 12 22 24 32 35 and 37 Filing status First enter your current payroll information and deductions Then enter the hours you expect to work and how much you are paid You can enter regular overtime and one additional hourly rate

More picture related to How To Work Out My Hourly Rate After Tax

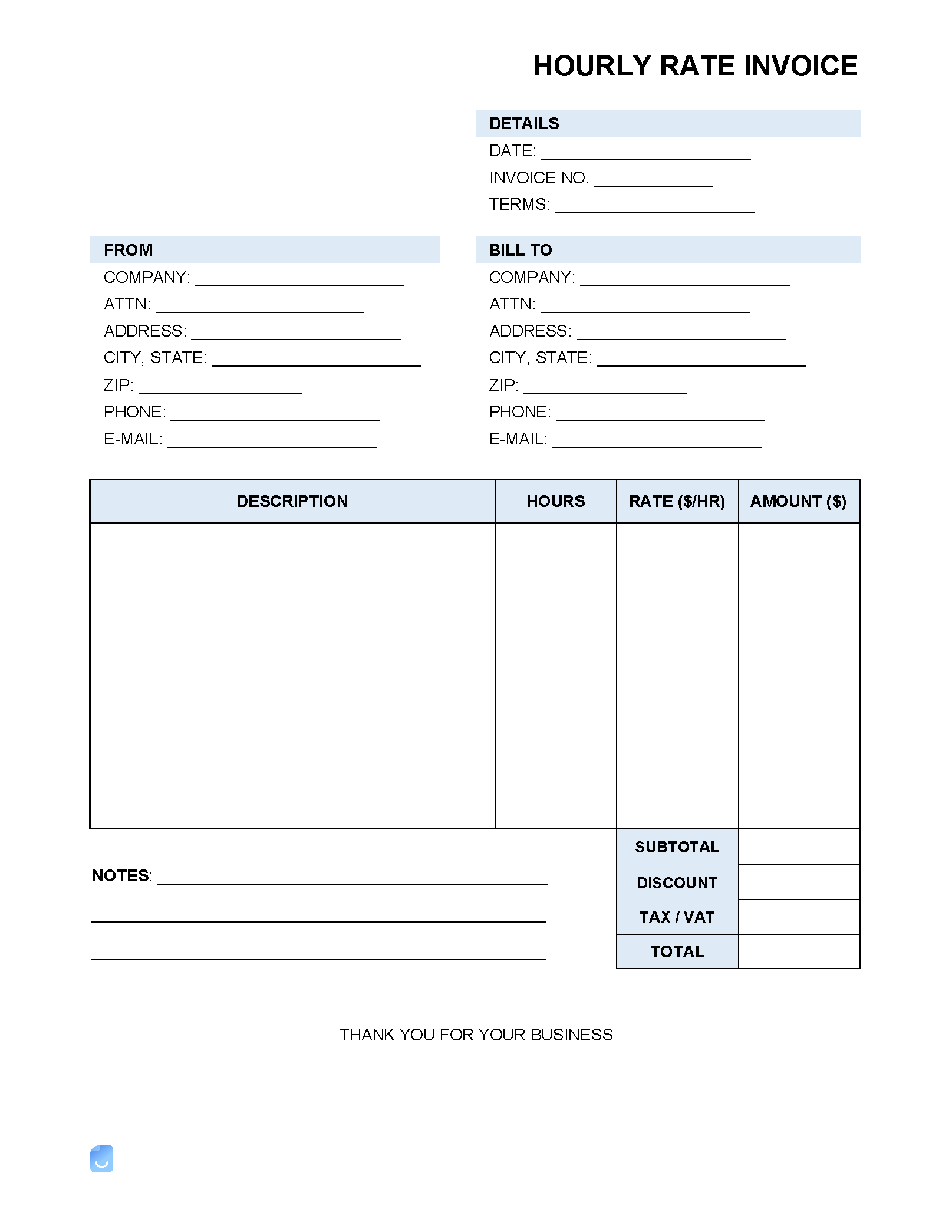

Hourly Rate hr Invoice Template Invoice Maker

https://im-next-wp-prod.s3.us-east-2.amazonaws.com/uploads/2022/11/Hourly-Rate-Invoice-Template.png

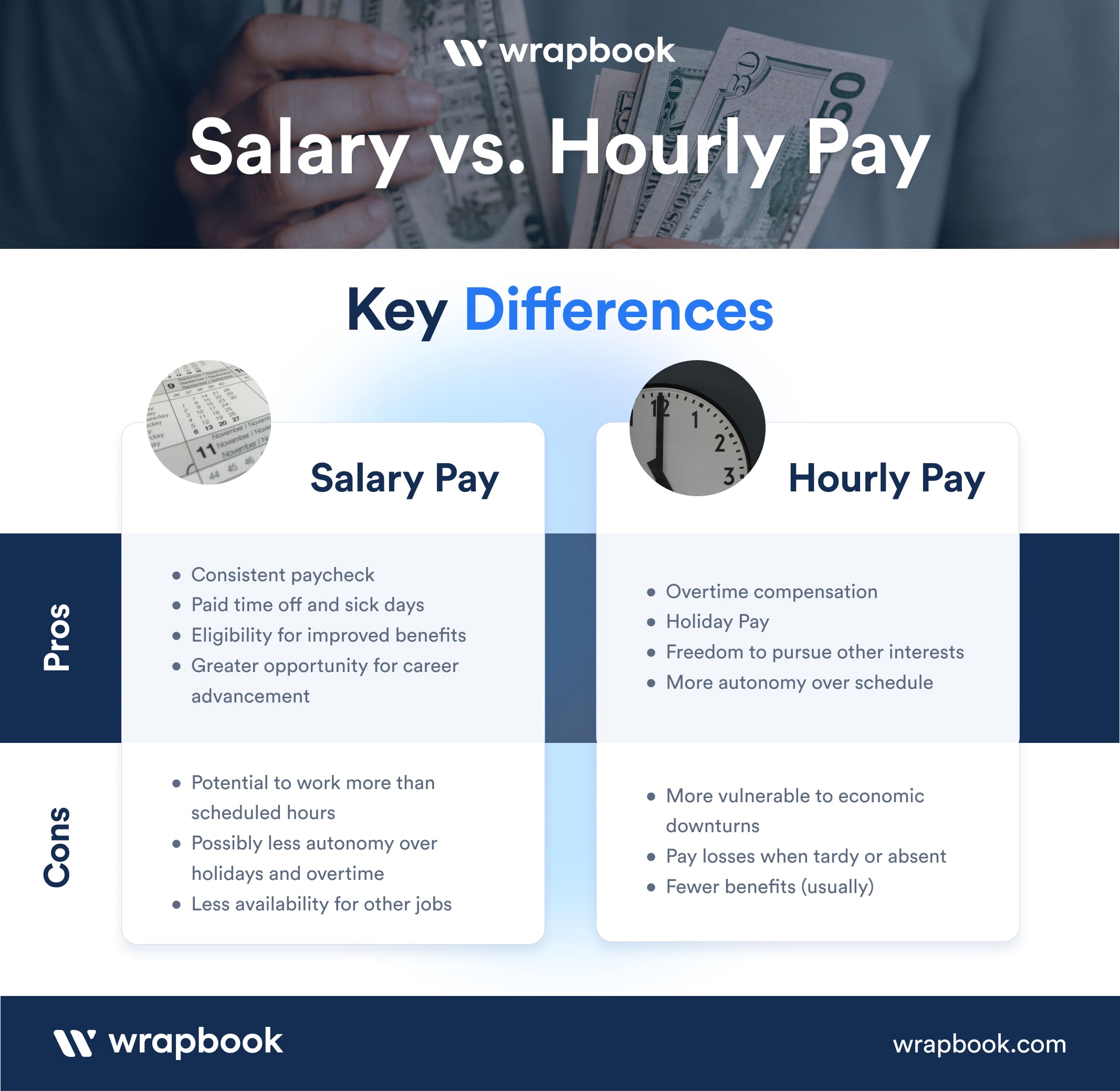

Salary Vs Hourly The Difference How To Calculate Hourly Rate From

https://assets-global.website-files.com/6467d96400e84f307e2196ef/6467d96400e84f307e21a675_Salary vs Hourly - Pros and Cons - Infographic - Wrapbook.jpg

5

https://www.wikihow.com/images/3/37/Calculate-Your-Hourly-Rate-Step-5Bullet2.jpg

Divide your total hours worked for the pay period by your gross wages to arrive at your hourly pay rate For instance weekly gross wages of 961 54 divided by 40 hours comes to 24 04 per hour 1 Check your tax code you may be owed 1 000s free tax code calculator 2 Transfer unused allowance to your spouse marriage tax allowance 3 Reduce tax if you wear wore a uniform uniform tax rebate 4 Up to 2 000 yr free per child to help with childcare costs tax free childcare 5 Take home over 500 mth

It is a flexible tool that allows you to convert your annual remuneration to an hourly paycheck recalculate monthly wage to hourly rate weekly rate to a yearly wage etc This salary converter does it all very quickly and easily saving you time and effort To calculate your hourly rate based upon your monthly salary multiply your monthly figure by 12 and then divide it by the number of hours you work per week and again by the number of paid weeks you work each year Hourly Monthly salary 12 Hours per week Weeks per year Example calculation

Antonio Receives A Portion Of His Income From His Holdings Of Interest

https://us-static.z-dn.net/files/dff/de0f82760ffa6f86ce0dc52d598e12ed.png

How To Work Out What A Rate Hike Can Do To Your Budget Simplsaver

https://www.simplsaver.com/wp-content/uploads/2023/01/mortgages-home-loans.png

How To Work Out My Hourly Rate After Tax - First enter your current payroll information and deductions Then enter the hours you expect to work and how much you are paid You can enter regular overtime and one additional hourly rate