How To Find Interest Paid On Car Loan For Taxes If certain conditions are met you can deduct some or all of the interest payments you make on your car loan from your federal taxes

Automobile loan interest Vehicle maintenance Insurance Tolls and parking fees Gasoline Oil Change To determine the amount of each actual vehicle expense that may qualify for a tax deduction you will need to calculate the percent of time that the vehicle is used for business Car loan interest can be tax deductible but only in specific situations If you re a business owner or self employed and use the vehicle for work you may be able to deduct some of all of the interest as a business expense Here s when car loan interest qualifies how to calculate your deduction and how to claim it at tax time

How To Find Interest Paid On Car Loan For Taxes

How To Find Interest Paid On Car Loan For Taxes

https://i.pinimg.com/originals/fd/7c/32/fd7c326e22beb980eba4b182ffa16f2b.jpg

Total Interest On A Loan YouTube

https://i.ytimg.com/vi/6sLvqJK_iSI/maxresdefault.jpg

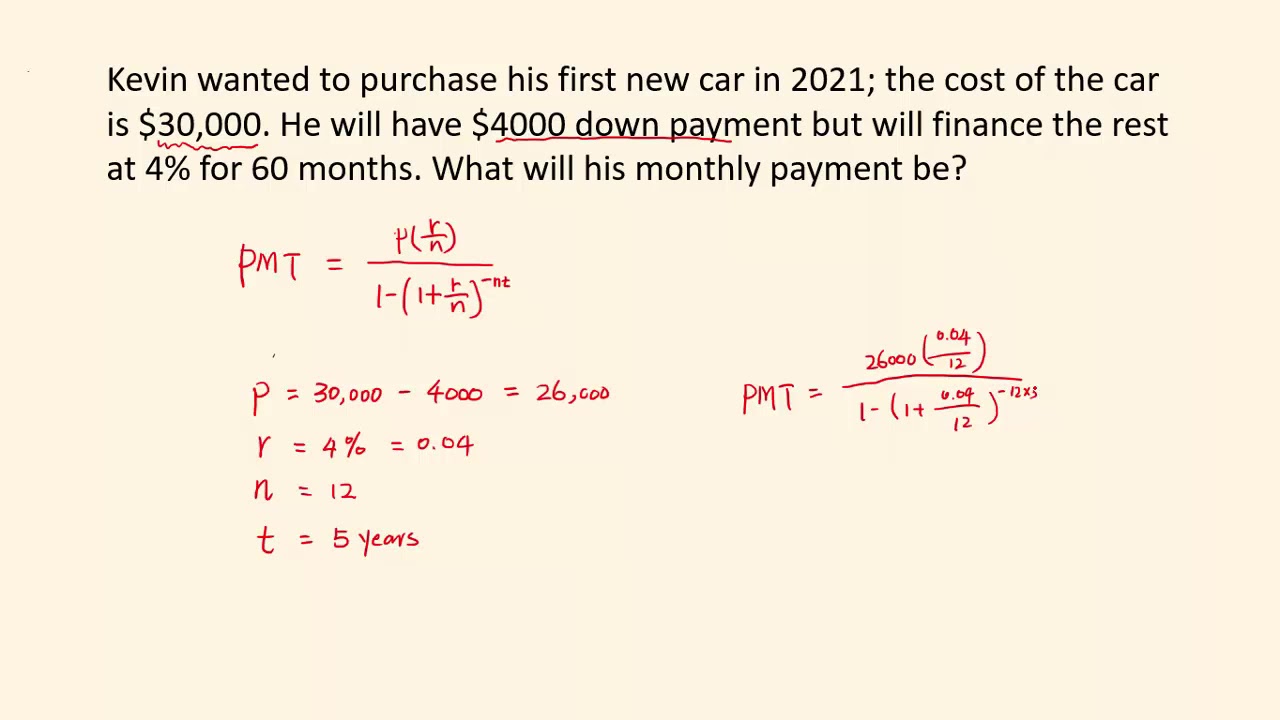

How To Calculate Your Car Loan Payment YouTube

https://i.ytimg.com/vi/p8f8XP2tmvE/maxresdefault.jpg

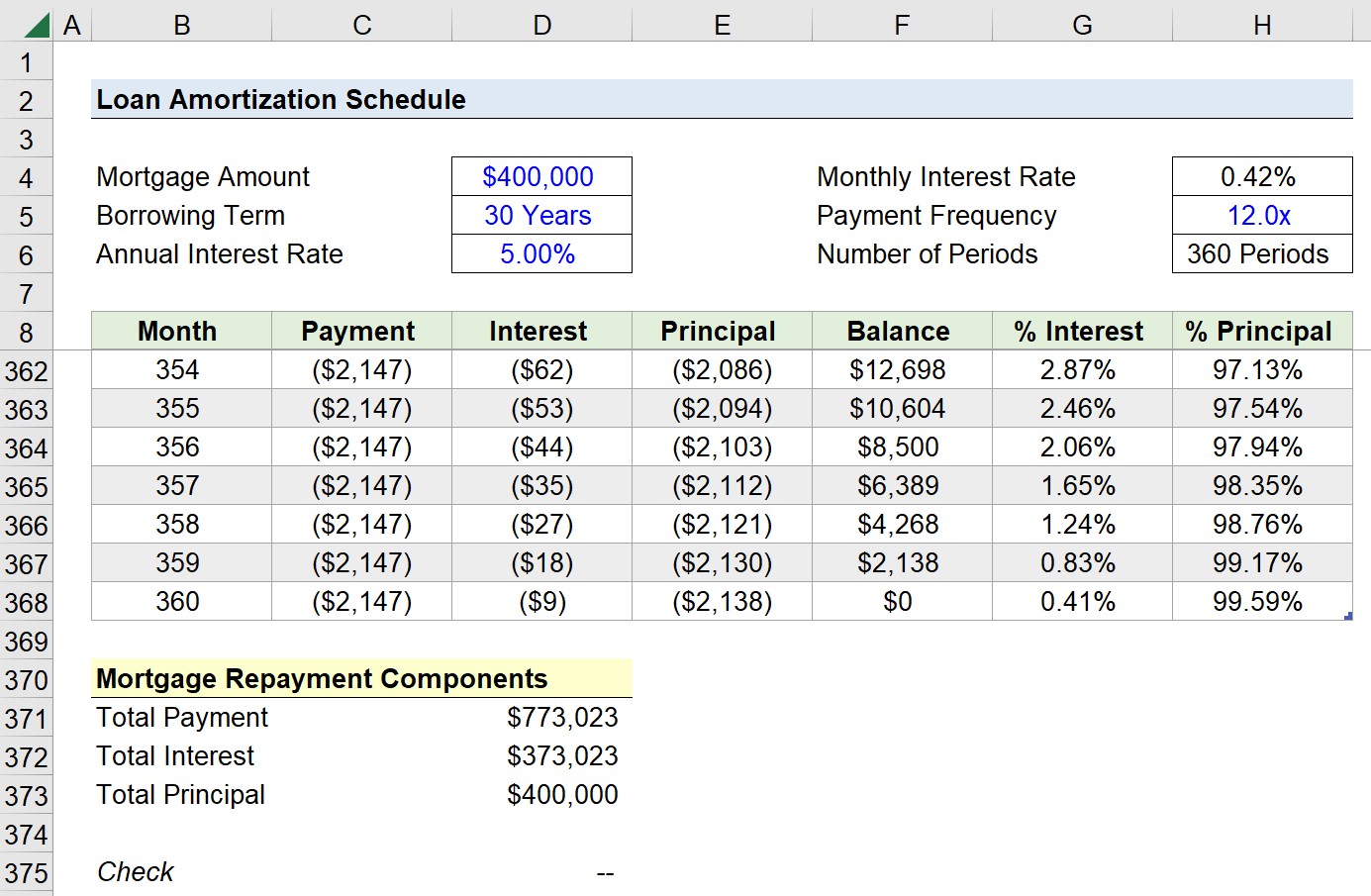

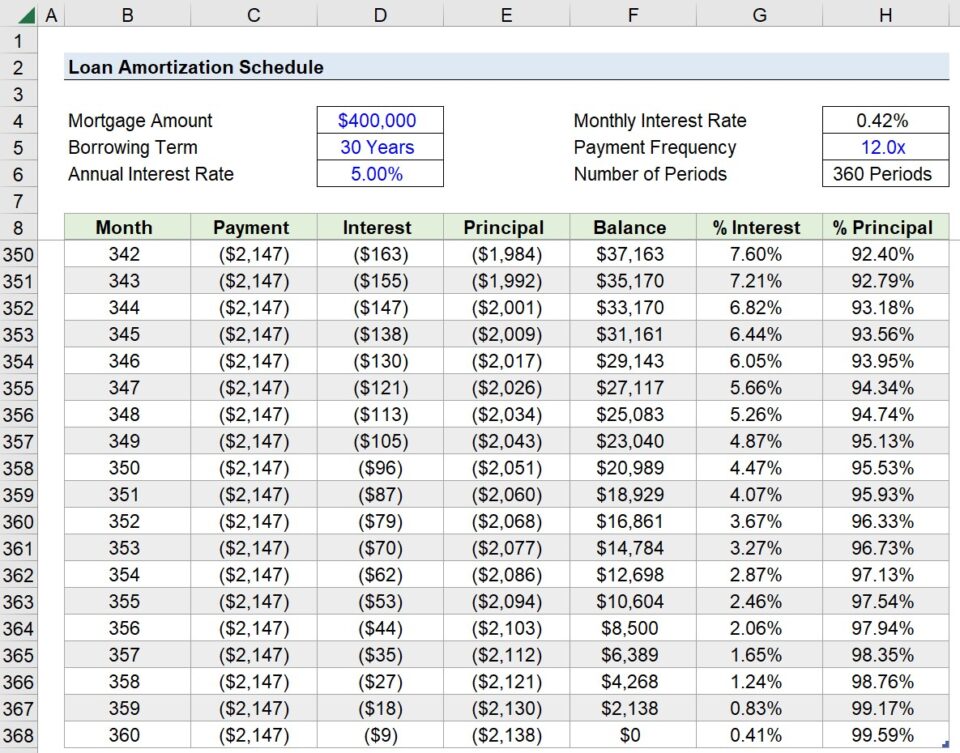

The vehicle must directly contribute to income generating activities Calculating the Deduction To calculate the deduction determine the total interest paid over the tax year which can be found on the annual statement from your loan servicer Apply the business use percentage to this amount Interest paid on personal loans car loans and credit cards is However you may be able to claim interest you ve paid when you file your taxes if you take out a loan or accrue credit card charges to finance business expenses

There are several components that are used to compute interest on your car loan You need to know the principal amount owed the term of the loan and the interest rate Most car loans use an amortization schedule to calculate interest If you paid loan interest for the year you might just qualify for a tax break from Uncle Sam According to the IRS you can deduct personal interest expenses paid on a student loan mortgage second mortgage line of credit or home equity loan If you re self employed and use your car for the business you might

More picture related to How To Find Interest Paid On Car Loan For Taxes

Cash Paid For Interest Statement Of Cash Flows YouTube

https://i.ytimg.com/vi/MARXkBZWO1s/maxresdefault.jpg

Calculate Monthly Payment And Total Interest For A Car Loan YouTube

https://i.ytimg.com/vi/lVIbAEipwik/maxresdefault.jpg

How To Calculate The Total Amount Of Interest Paid On A Mortgage Home

https://i.ytimg.com/vi/VQvyF9juUHA/maxresdefault.jpg

For your personal vehicle No There are vehicle expenses you can enter on a Schedule C if you are self employed But if you are not self employed there is nothing for you to enter on a tax return about the interest you are paying for a car loan Many people write off interest when paying their taxes You re already paying a lot of money on your car loan so why not get some extra

[desc-10] [desc-11]

Amortization Schedule Formula By Hand Ecosia Images

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/12/12004608/Mortgage-Loan-Amortization-Schedule-in-Excel.jpg

Interest Rates Estimates 2025 Joshua M Matter

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/12/12004614/Loan-Amortization-Schedule-Calculator-960x753.jpg

How To Find Interest Paid On Car Loan For Taxes - If you paid loan interest for the year you might just qualify for a tax break from Uncle Sam According to the IRS you can deduct personal interest expenses paid on a student loan mortgage second mortgage line of credit or home equity loan If you re self employed and use your car for the business you might