Can I Claim Interest On My Car Loan Understanding the nuances of tax deductions can significantly impact your financial planning particularly regarding car loans Many individuals wonder if they can claim interest on their car loan as a deduction on their taxes potentially reducing their taxable income Eligibility Criteria for Deducting Interest The IRS permits the deduction

For instance if you use the vehicle 50 percent of the time for business reasons you can only deduct 50 percent of the loan interest on your tax returns If you pay 1 000 in interest on your car loan annually you can only claim a 500 deduction Can I deduct loan interest on my tax return Interest incurred to produce rents or royalties this may be limited See Publication 527 Residential Rental Property Types of interest not deductible include personal interest such as Interest paid on a loan to purchase a car for personal use Credit card and installment interest incurred for personal expenses

Can I Claim Interest On My Car Loan

Can I Claim Interest On My Car Loan

https://imgv2-1-f.scribdassets.com/img/document/692222831/original/f8b5c59c17/1716353789?v=1

49 Free Claim Letter Esimerkkej Miten Kirjoittaa Korvauskirje Tech Blog

https://templatelab.com/wp-content/uploads/2019/01/claim-letter-12.jpg?w=395

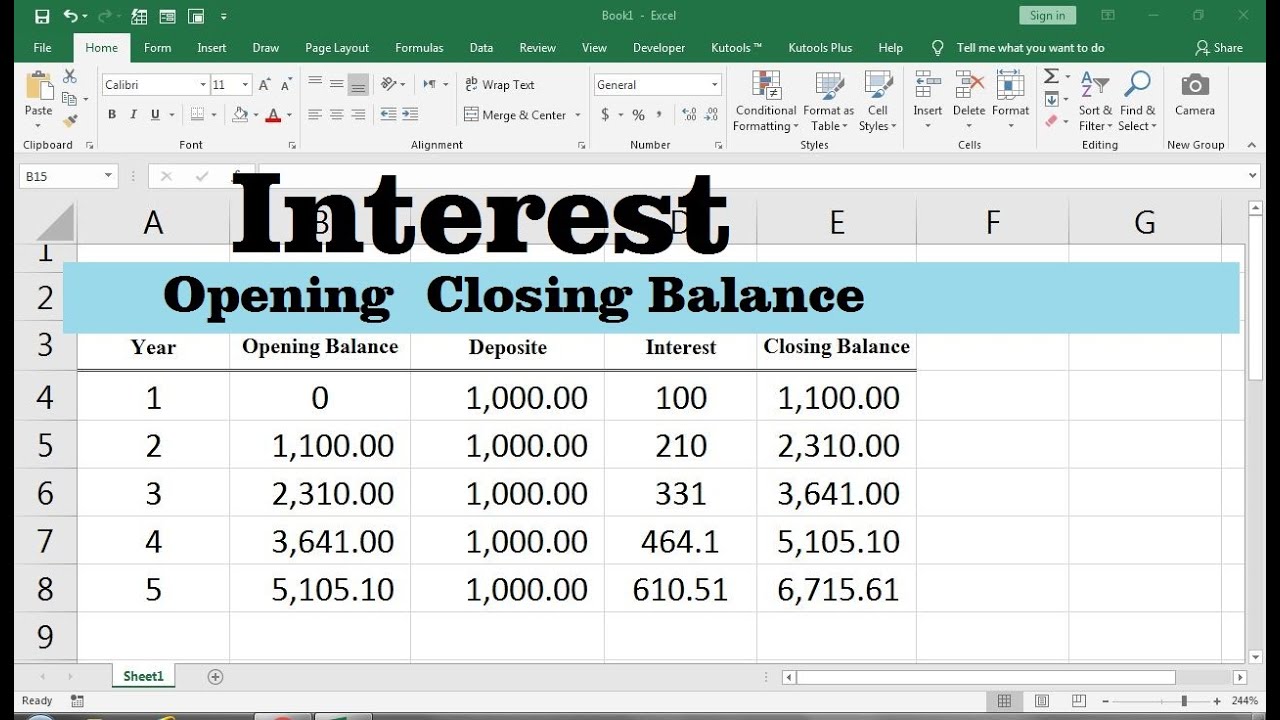

How To Calculate Simple Interest In Excel YouTube

https://i.ytimg.com/vi/aWveNlUZyP8/maxresdefault.jpg

You cannot deduct a personal car loan or it s interest While typically deducting car loan interest is not allowed there is one exception to this rule If you use your car for business purposes you may be allowed to partially deduct car loan interest as a business expense If you use your car for business purposes you may be able to deduct Can I claim car loan interest on my tax return Only those who are self employed or own a business and use a vehicle for business purposes may claim a tax deduction for car loan interest If you are an employee of someone else s business you cannot claim this deduction In addition interest paid on a loan used to purchase a car solely for

This is an optional tax refund related loan from Pathward N A it is not your tax refund Loans are offered in amounts of 250 500 750 1 250 or 3 500 Approval and loan amount based on expected refund amount eligibility criteria and underwriting If you pay 1 000 in interest on your car loan annually you can only claim a 500 deduction Can you write off car loan interest as a business expense You can deduct the interest paid on an auto loan as a business expense using one of two methods the expense method or the standard mileage deduction when you file your taxes

More picture related to Can I Claim Interest On My Car Loan

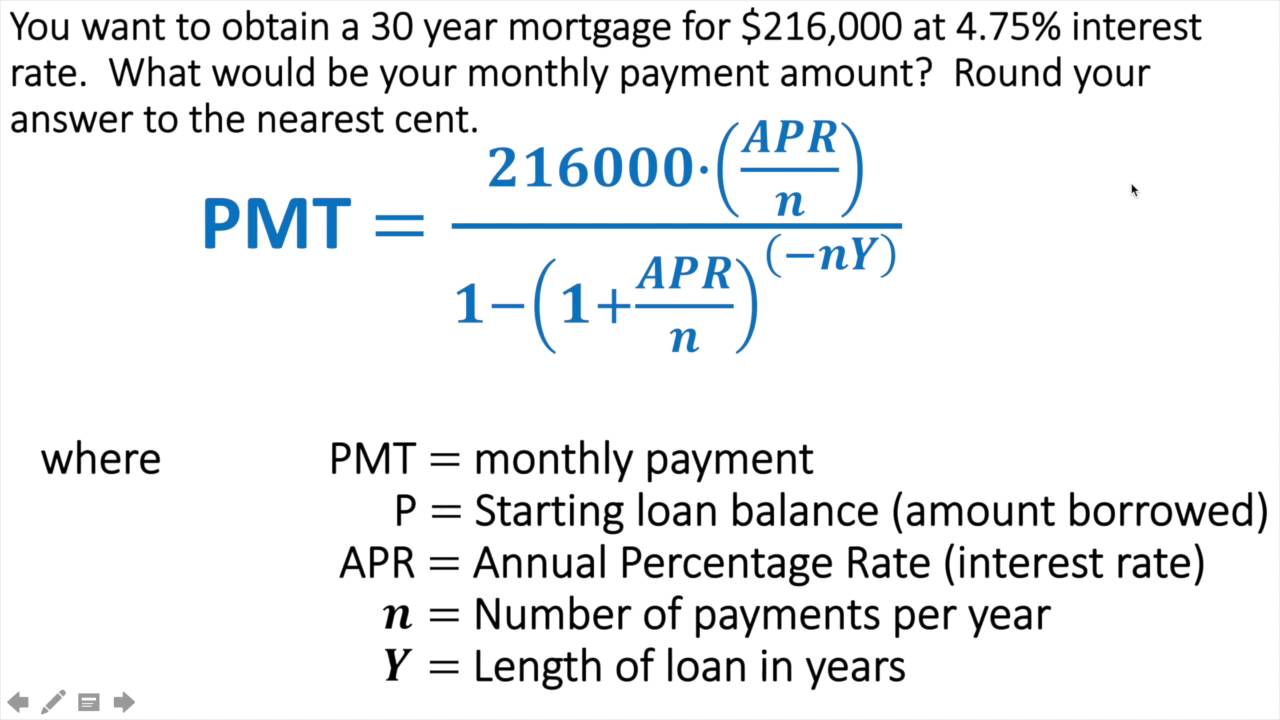

How To Calculate Your Car Loan Payment YouTube

https://i.ytimg.com/vi/p8f8XP2tmvE/maxresdefault.jpg

Calculating Loan Payments For A Mortgage YouTube

https://i.ytimg.com/vi/Ryfn1L1mjXw/maxresdefault.jpg

Loan Request Letter To Bank Manager Infoupdate

https://i.ytimg.com/vi/j_cN_gWoZOc/maxresdefault.jpg

Car loan interest can be tax deductible but only in specific situations If you re a business owner or self employed and use the vehicle for work you may be able to deduct some of all of the interest as a business expense How To Claim the Car Loan Interest Deduction Follow this step by step guide to claim the deduction on your tax If 60 of your driving time is used for pie delivery and 40 is for personal tasks you can deduct 60 of your auto loan interest The costs you can deduct with the actual expenses method include gas repairs insurance if I use my car for business 60 of the time and my lease payment is 500 I can claim 300 per month as a write off

[desc-10] [desc-11]

Settlement Demand Letter Exle Infoupdate

https://www.typecalendar.com/wp-content/uploads/2023/03/Claim-Letter.jpg

Auction Kent County MI

https://www.kentcountymi.gov/ImageRepository/Document?documentID=73

Can I Claim Interest On My Car Loan - [desc-12]