How To Calculate Total Gross Income Yearly A company s gross income found on the income statement is the revenue from all sources minus the firm s cost of goods sold COGS Key Takeaways Gross income for an individual consists of

The result is net income How to calculate annual income To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 How to calculate taxes taken out of a paycheck Gross Pay Calculator Gross Pay Calculator Straight Time ST Hours Rate Hr hourly rate of pay Overtime OT OT Hours OT Rate OT rate multiplier 1 5 is time and a half ST Double Time DT DT Hours DT Rate DT rate multiplier 2 is double time ST Round hours to Answer Gross Pay Rate Hr Hours Amount ST OT DT Total

How To Calculate Total Gross Income Yearly

How To Calculate Total Gross Income Yearly

https://www.patriotsoftware.com/wp-content/uploads/2018/09/gross-vs.-net-pay-part-2-1-768x552.png

How To Calculate Net Take Home Salary Haiper

https://www.patriotsoftware.com/wp-content/uploads/2019/12/gross-vs.-net-pay-visual.jpg

Dec t Detaliat Venituri How To Calculate Gross Annual Income nvins

https://m.foolcdn.com/media/dubs/images/gross-monthly-income-infographic_cOZTYId.width-880.png

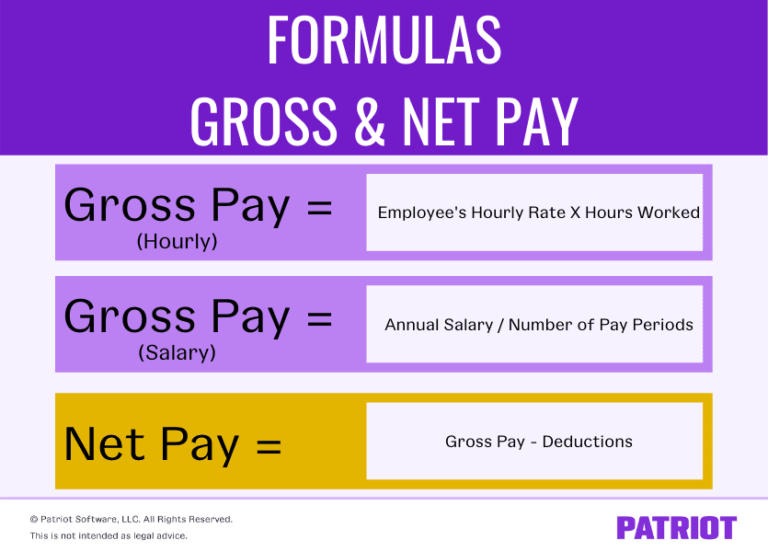

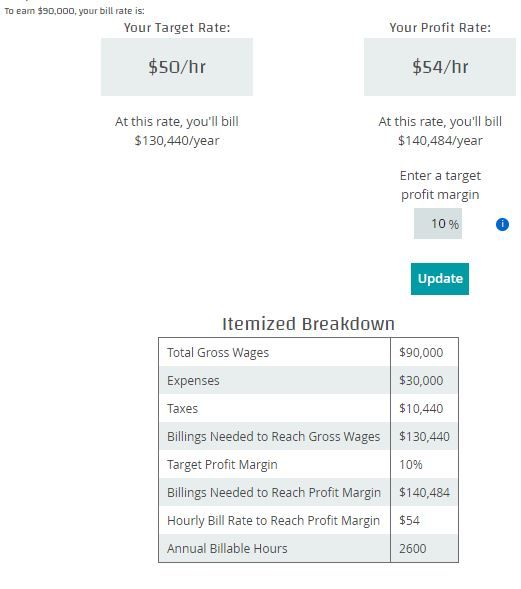

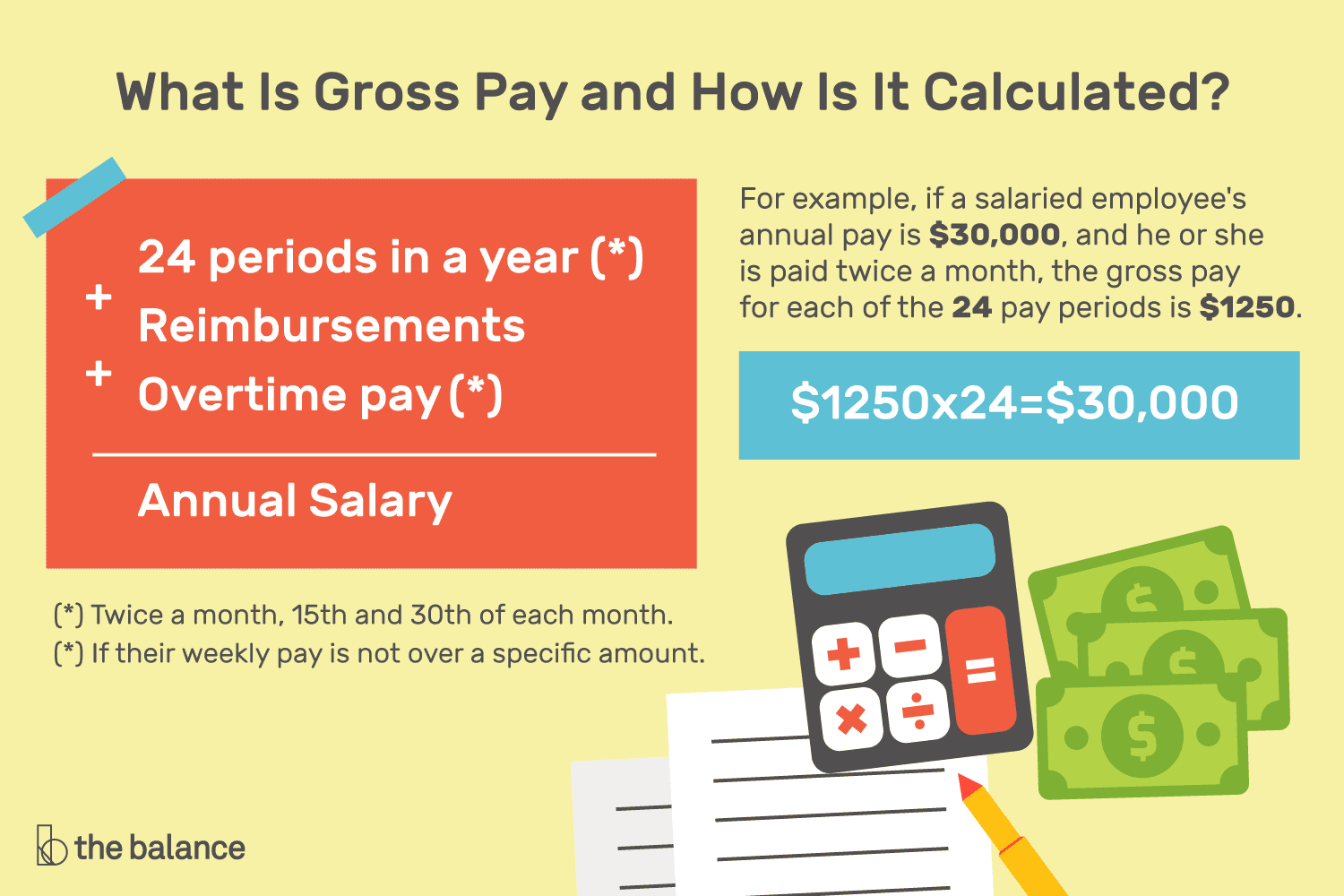

The formula for calculating the gross income or gross profit of a business is as follows Gross Income Gross Revenue Cost of Goods Sold Example Assume that the gross revenue of ABC a paint manufacturing company totaled 1 300 000 and the expenses were as follows Cost of raw materials 150 000 Calculating gross payroll vs net payroll The method for calculating gross payroll varies for salaried vs hourly employees For salaried employees Gross payroll equals the annual salary divided by the number of pay periods each year The number of pay periods will vary based on whether the pay schedule is weekly biweekly or monthly

To calculate your gross annual income multiply your monthly or weekly gross pay by the number of times you get paid per year There are 12 pay periods if you get paid once a month or How to calculate gross income by year Here is a step by step guide to calculate gross income by year for those with primarily W 2 income Please note there are a few gross income formulas 1 Calculate total W 2 income Gather every paycheck from the year It should be around 26 total if you have a bi monthly pay period

More picture related to How To Calculate Total Gross Income Yearly

Atticus Ly ice D b n Net Income Calculator Ireland Beha Vietor Je

https://s29814.pcdn.co/wp-content/uploads/2020/06/gross-income-vs-net-income.jpg.optimal.jpg

The Gross Profit Formula Lower Costs Raise Revenue QuickBooks Australia

https://quickbooks.intuit.com/oidam/intuit/sbseg/en_au/blog/images/image/gross-profit-outdoor-manufacturing-statement-inforgraphic-au.png

Juno What Is Gross Monthly Income And How Can You Calculate It

https://nuo-cms.s3.ap-southeast-1.amazonaws.com/Gross_Monthly_Income_cbe794c026.png

Enter the total qualifying mortgage interest you paid during the year Include deductible points you paid You can deduct mortgage interest expense on the first 750 000 375 000 if married Gross income is defined as the total amount of income earned by an individual before taxes or any applicable deductions Therefore the gross income is equal to the sum of an individual s total earned income less any tax exempt sources of income The gross income is inclusive of sources such as the following Employee Wages i e Annual Salary

For someone with an income of 30 per hour the annual salary is 62 400 assuming 40 weekly working hours We can use the following formula for the total yearly pay to calculate it Annual salary Hours per week Weeks per year Hourly wage Annual salary 40 hrs week 52 weeks yr 30 hr Annual salary 62 400 yr What is annual gross income Annual gross income is the amount of money you earn in one fiscal year before any deductions Your annual gross income is the amount of money you receive not just money from your job For example annual gross income can include any of the following Wages Salary Commission Overtime pay Retirement funds Pensions

What Is Gross Pay And How Is It Calculated Db excel

https://db-excel.com/wp-content/uploads/2019/09/what-is-gross-pay-and-how-is-it-calculated.png

How To Calculate Gross Profit Percentage In Excel Haiper

https://lh6.googleusercontent.com/proxy/mOGRckDxza9Medovwlk_Cqx1W6LMVrJIOCKjIzlUmCa6-sgNs0cK_blXfJDyJBrybxAeyzUzcPaTCLlCTZkJVBKcy7qf8AXcxcw0aR6WsGIJYobPnbJhQ2E_YBvgktrZIaVt-IDfbXESwBDizK1s0grM=w1200-h630-p-k-no-nu

How To Calculate Total Gross Income Yearly - Enter the number of weeks you work per year Click the Calculate button The result will be displayed below the button showing your estimated yearly gross income Example If your hourly rate is 20 you work 40 hours per week and you work 50 weeks in a year clicking Calculate will display the result Your yearly gross income