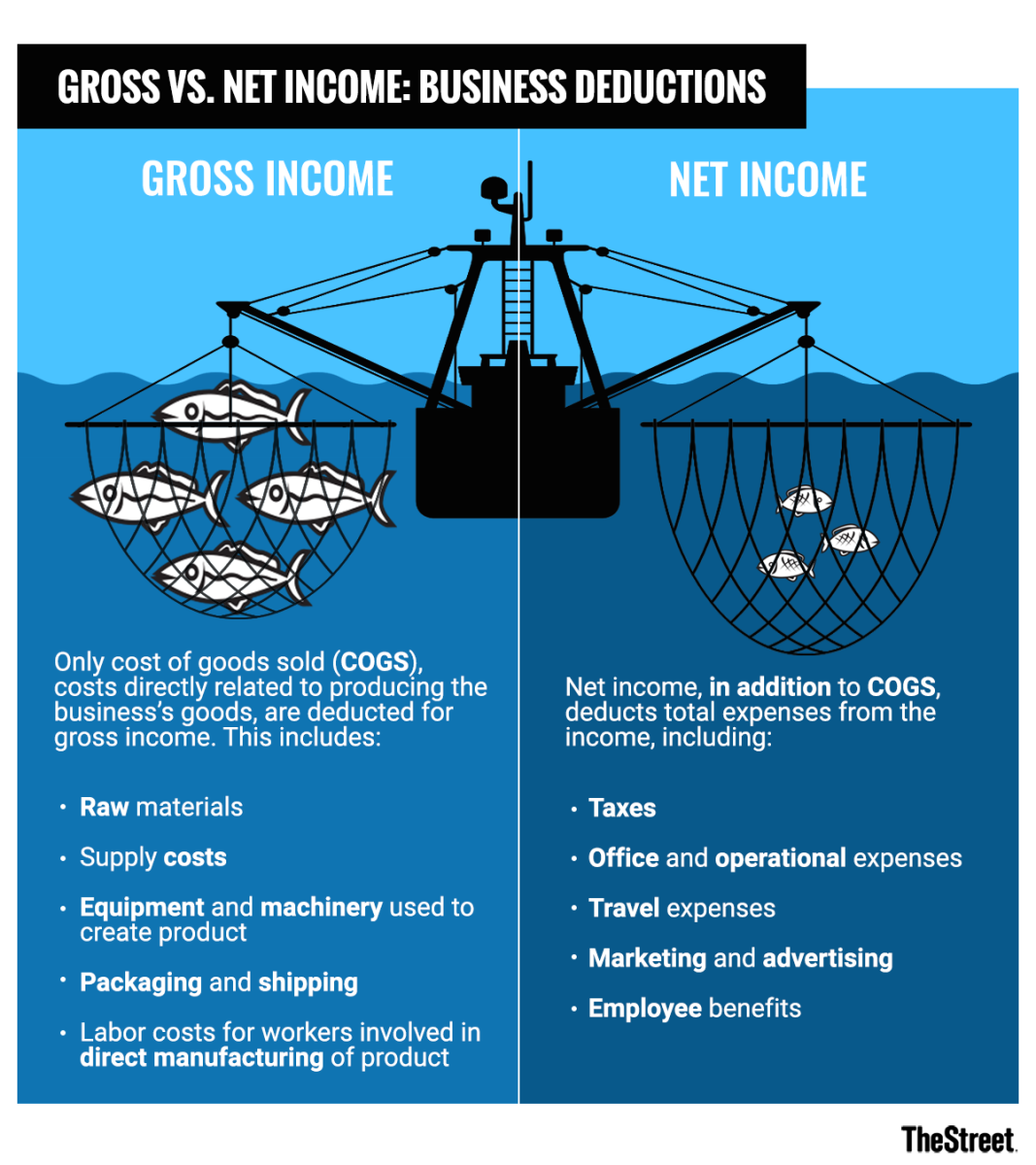

How To Get The Gross Annual Income AGI is the gross income of your business for the year minus adjustments It s the amount of money the IRS determines as your income tax liability for the year which just means how much you may owe AGI is important for small business owners to understand what adjustments or deductions need to be accounted for during tax time

What is Annual Gross Income Annual Gross Income AGI represents the total earnings someone receives over a year before any deductions or taxes are taken out It s a comprehensive figure including wages bonuses and additional income sources Annual gross income is the amount of money you earn in one fiscal year before any deductions Your annual gross income is the amount of money you receive not just money from your job For example annual gross income can include any of the following Wages Salary Commission Overtime pay Retirement funds Pensions Welfare benefits

How To Get The Gross Annual Income

How To Get The Gross Annual Income

https://i.ytimg.com/vi/ev3JQIvAaPY/maxresdefault.jpg

How To Calculate Gross Annual Income From W2 Gambaran

https://decoalert.com/wp-content/uploads/2021/06/Is-base-salary-the-same-as-gross-pay-1024x576.jpg

How To Calculate Gross Monthly Income From Hourly Wage Haiper

https://www.patriotsoftware.com/wp-content/uploads/2018/09/gross-vs.-net-pay-part-2-1-768x552.png

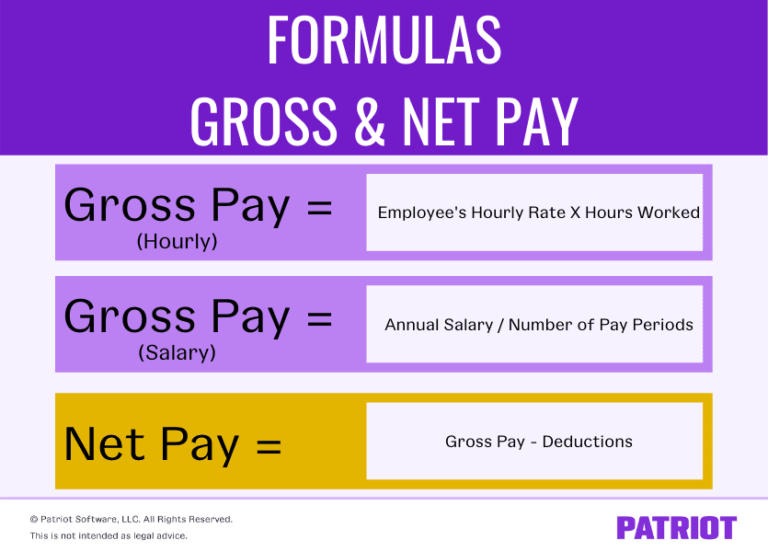

The credit is nonrefundable and subject to income limits in 2023 your AGI may not exceed 300 000 for married couples filing jointly 225 000 for heads of household and 150 000 for all other To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 How to calculate taxes taken out of a paycheck

Step by Step Guide Navigating the calculation process involves meticulous steps Begin by summing up your primary income sources including employment investments and side hustles Factor in bonuses dividends and any additional income streams The resultant total is your gross annual income Incorporating LSI Keywords Last quarterly payment for 2023 is due on Jan 16 2024 Taxpayers may need to consider estimated or additional tax payments due to non wage income from unemployment self employment annuity income or even digital assets The Tax Withholding Estimator on IRS gov can help wage earners determine if there s a need to consider an additional tax

More picture related to How To Get The Gross Annual Income

How To Calculate Net Take Home Salary Haiper

https://www.patriotsoftware.com/wp-content/uploads/2019/12/gross-vs.-net-pay-visual.jpg

Gross Annual Income Calculator Hourly JeremyAarya

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/07/11073323/Annual-Income-Calculator.jpg

What s The Difference Between Gross Vs Net Income TheStreet

https://www.thestreet.com/.image/t_share/MTY3NTQxMjkzMTYwNDc0NTEw/image-placeholder-title.png

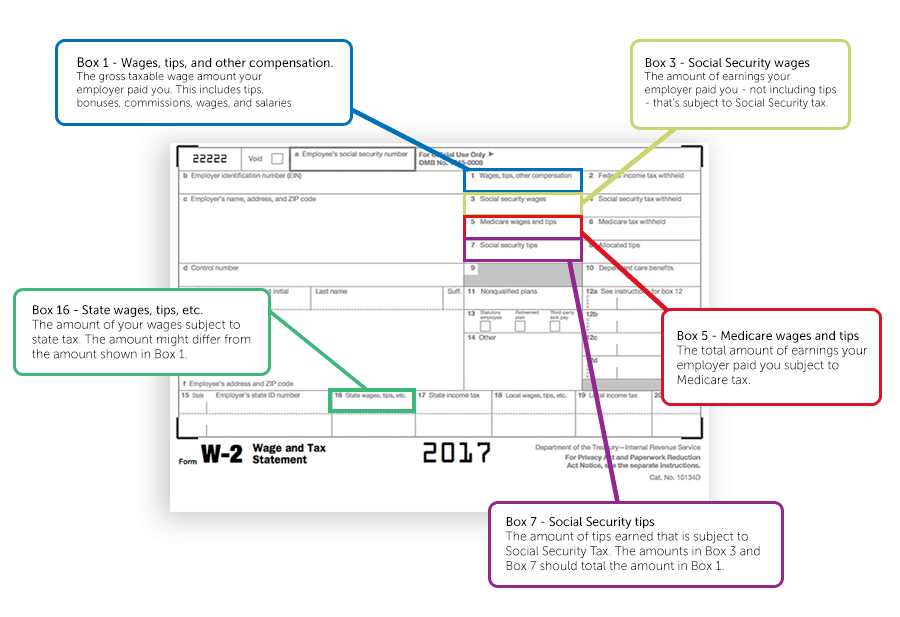

Annual income is the amount of income you earn in one fiscal year Your annual income includes everything from your yearly salary to bonuses commissions overtime and tips You may hear it referred to in two different ways gross income and net income Gross annual income is your earnings before tax while net annual income is the amount you Follow these steps to determine gross pay 1 Add up W 2 wages for the month Tally up the gross pay or income listed on each of your paystubs for a given month 2 Sum additional sources of income Add in additional sources of income in your gross monthly income calculation factor in additional payments

Here are the simple formulas for calculating your gross annual income Gross annual income gross monthly pay x 12 Gross annual income gross weekly pay x 52 Adjust the Multiply your monthly income by 12 because a year has 12 months Your monthly earnings would be 2 500 if your rental income was 2 000 and your self employment income was 500 Divide your 2 500 monthly earnings by 12 months to get the total This equates to a yearly salary of 30 000 for you 3

Income Understanding The Force Of Life Hitchhikers Guide To Personal

https://financehitchhiker.files.wordpress.com/2018/10/income.jpg?w=2000

W 2 Vs Last Pay Stub What s The Difference 2023

https://apspayroll.com/wp-content/uploads/2022/11/w2-last-pay-stub-difference.png

How To Get The Gross Annual Income - To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 How to calculate taxes taken out of a paycheck