How To Calculate Tax On Total Income From Salary The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return It is mainly intended for residents of the U S and is based on the tax brackets of 2024 and 2025 The 2025 tax values can be used for 1040 ES estimation planning ahead or comparison

Annual gross income Think of this as your salary or the sum of your wages and tips plus any income from interest dividends alimony retirement distributions unemployment compensation and Starting with your salary of 40 000 your standard deduction of 14 600 is deducted the personal exemption of 4 050 is eliminated for 2018 2025 This makes your total taxable income amount 25 400 Given that the first tax bracket is 10 you will pay 10 tax on 11 600 of your income This comes to 1 160

How To Calculate Tax On Total Income From Salary

How To Calculate Tax On Total Income From Salary

https://g.foolcdn.com/editorial/images/452002/taxesgeneric-with-calculator.jpeg

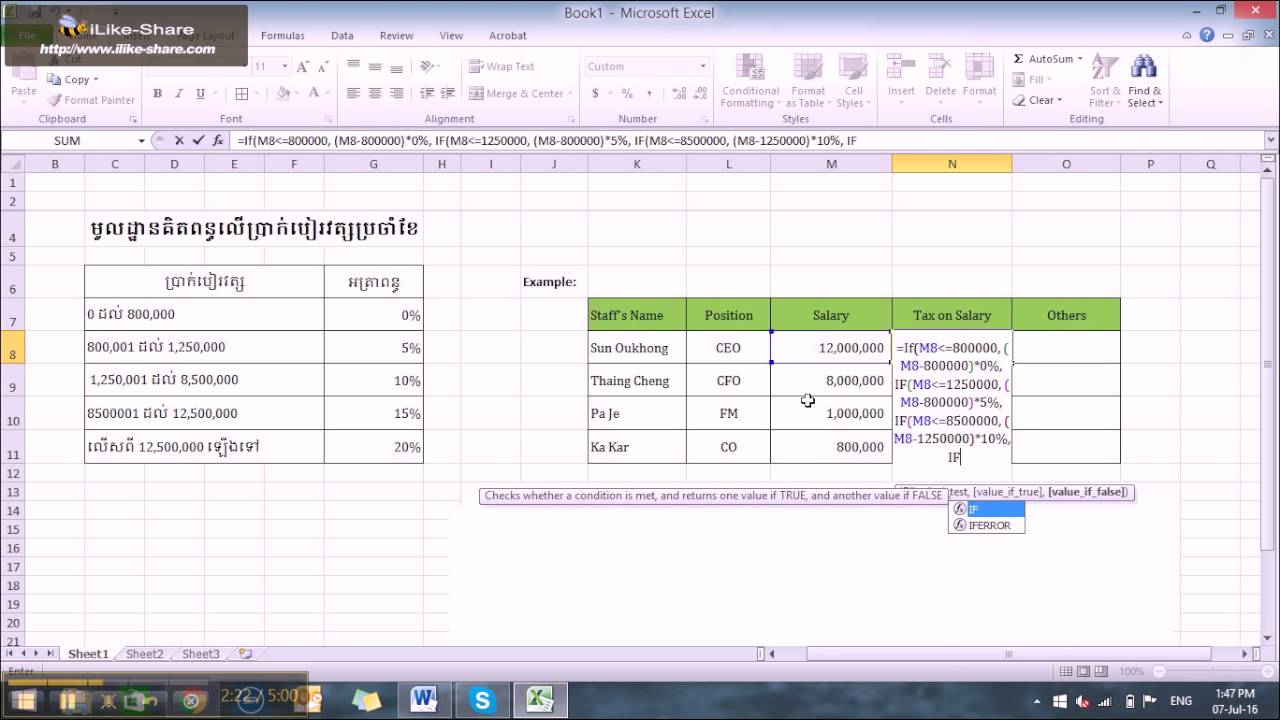

How To Calculate Tax On Total Income YouTube

https://i.ytimg.com/vi/2RkGeLG29Ck/maxresdefault.jpg

How To Calculate Income Tax On Salary With Example

https://razorpay.com/learn-content/uploads/2022/02/Facebook-post-16-1024x538.png

This calculator computes federal income taxes state income taxes social security taxes medicare taxes self employment tax capital gains tax and the net investment tax The provided information does not constitute financial tax or legal advice We strive to make the calculator perfectly accurate Estimate Federal Income Tax for 2020 2019 2018 2017 2016 2015 and 2014 from IRS tax rate schedules Find your total tax as a percentage of your taxable income Calculate net income after taxes

The money also grows tax free so that you only pay income tax when you withdraw it at which point it has hopefully grown substantially Some deductions from your paycheck are made post tax These include Roth 401 k contributions The money for these accounts comes out of your wages after income tax has already been applied Federal Income Tax The federal income tax is a progressive tax meaning it increases in accordance with the taxable amount The more someone makes the more their income will be taxed as a percentage In 2025 the federal income tax rate tops out at 37 Only the highest earners are subject to this percentage

More picture related to How To Calculate Tax On Total Income From Salary

How To Calculate Income Tax On Salary With Example

https://razorpay.com/learn-content/uploads/2022/02/Facebook-post-15-1-1024x538.png

2024

https://img.cs-finance.com/img/the-basics/how-to-calculate-income-tax-expense.jpg

Gross Income Formula And Calculation

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/09/17235937/Gross-Income-Calculator.jpg

Salary Income Tax Calculators Mortgage Calculators Retirement Calculators there are a total of seven tax brackets The tax brackets consist of the following marginal rates 10 15 25 28 33 35 and 39 6 12 22 24 32 35 and 37 Use our Salary Tax Calculator to get a full breakdown of your federal and state tax Remember that a tax deduction reduces your taxable income cutting your tax bill indirectly by reducing the income that s subject to a marginal tax rate A tax credit is a dollar for dollar discount on your tax bill So if you owe 1 000 but qualify for a 500 tax credit your tax bill goes down to 500

[desc-10] [desc-11]

How To Calculate Tax On Salary YouTube

https://i.ytimg.com/vi/hVNRJEljsxI/maxresdefault.jpg

How To Calculate Income Tax Calculator Ay 2019 2020 Carfare me 2019 2020

https://www.bankbazaar.com/images/india/infographic/how-calculate-income-tax-on-salary-with-example.png

How To Calculate Tax On Total Income From Salary - [desc-14]