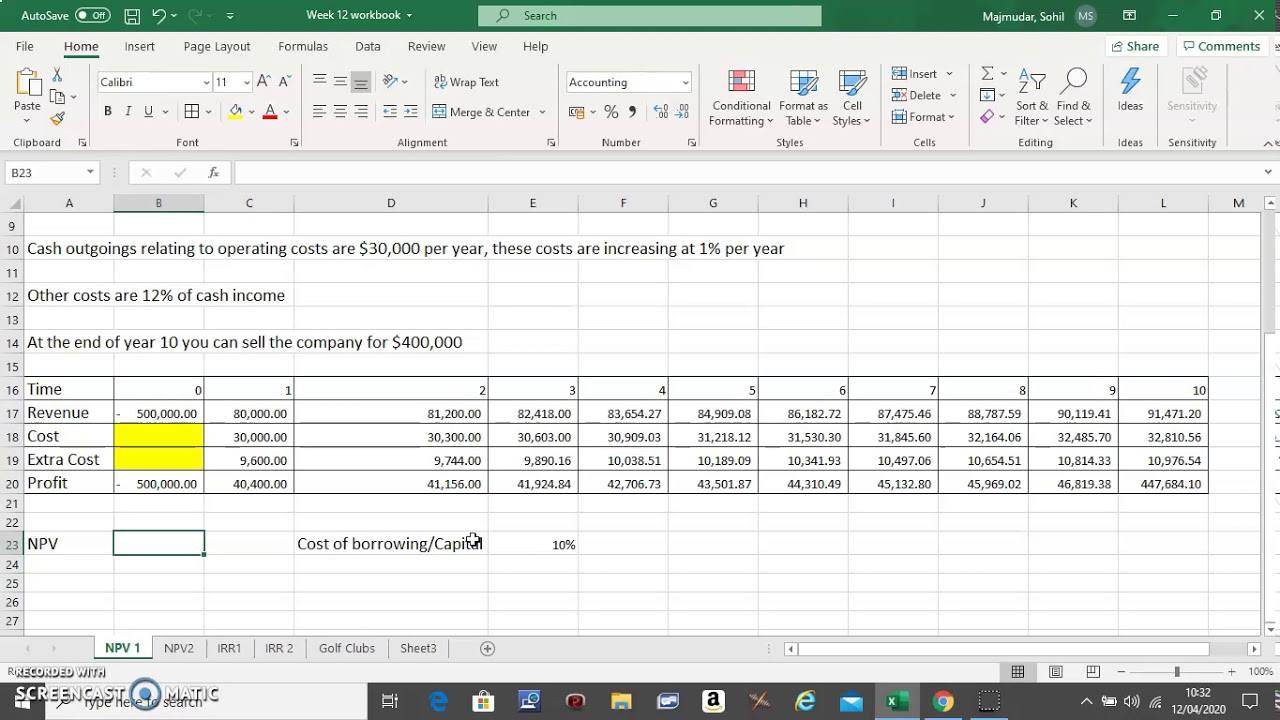

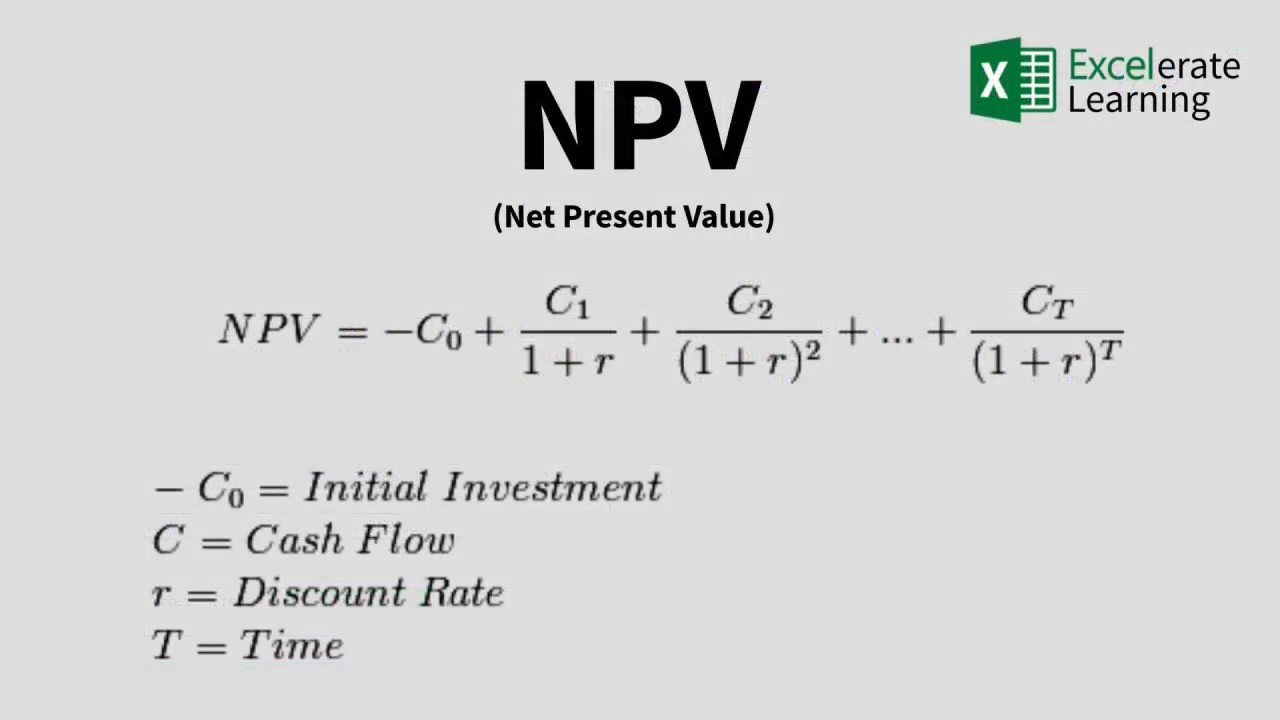

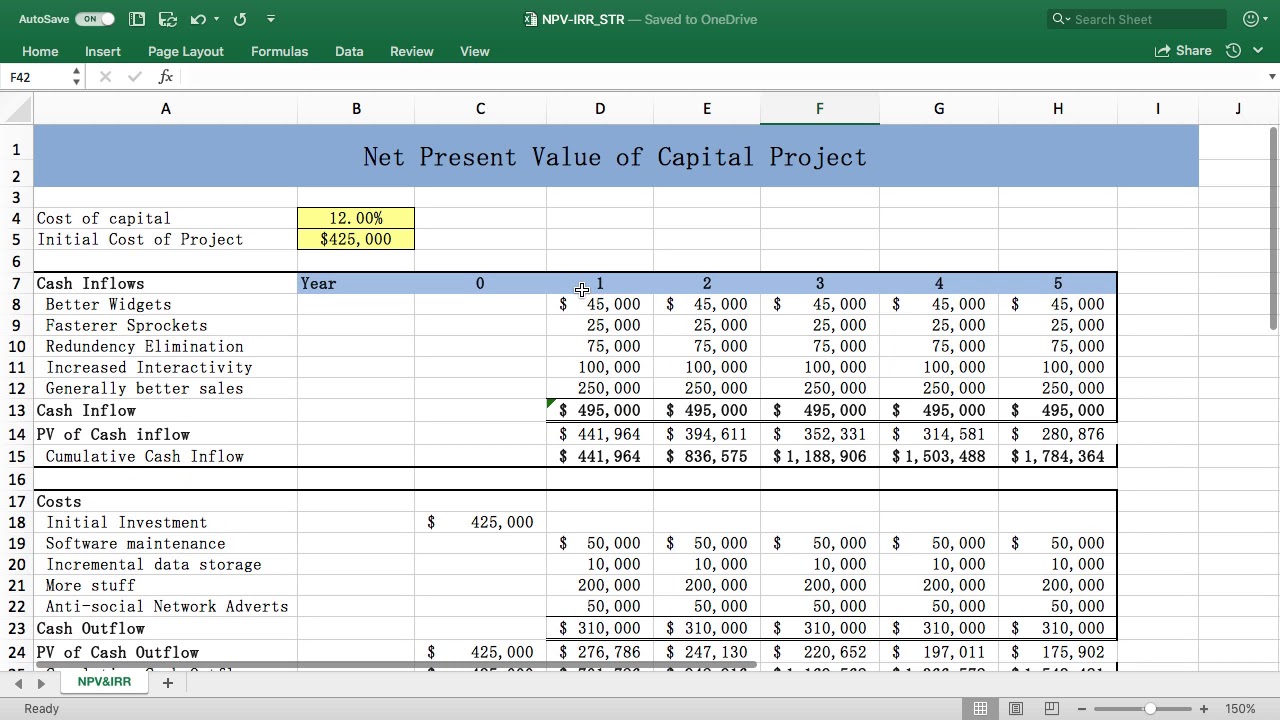

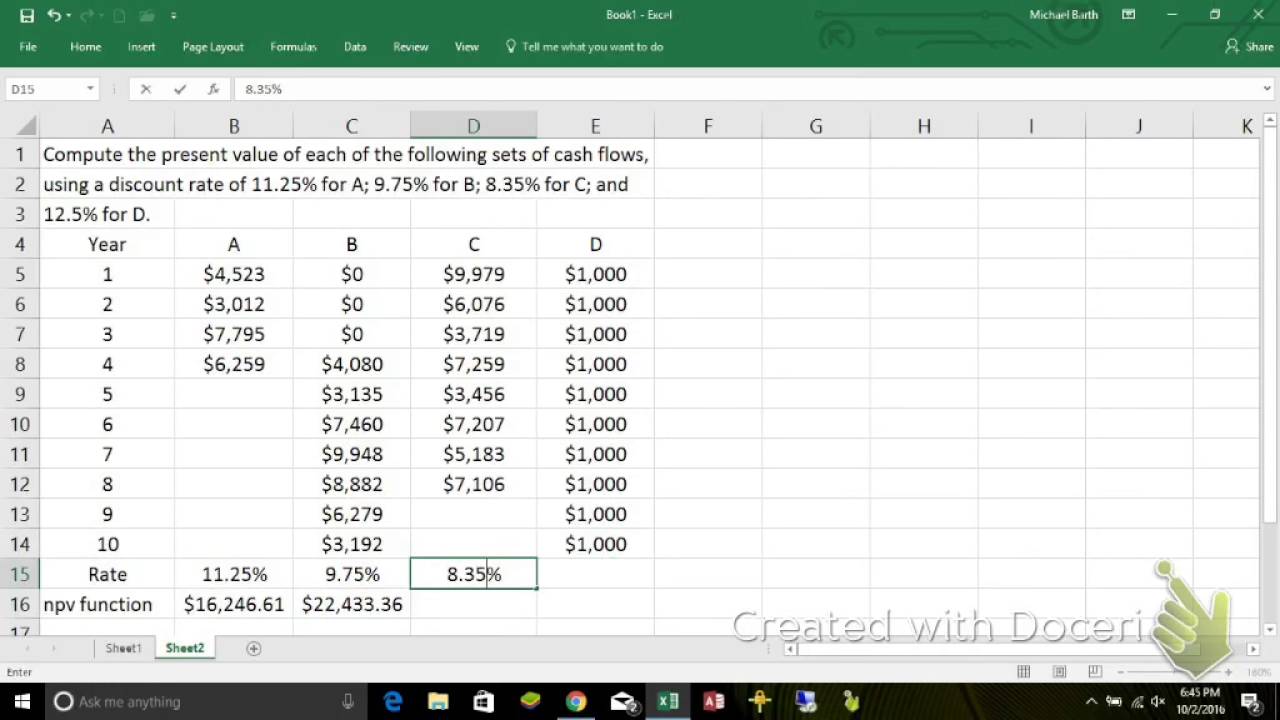

How To Calculate Monthly Npv In Excel Step 1 To manually calculate NPV in Excel write the following formula Click to copy Syntax Highlighter Our discount rate sits in Cell B10 so I am creating an absolute reference to it IRR is the discount rate that makes the net present value of a project zero Kasper Langmann co founder of Spreadsheeto

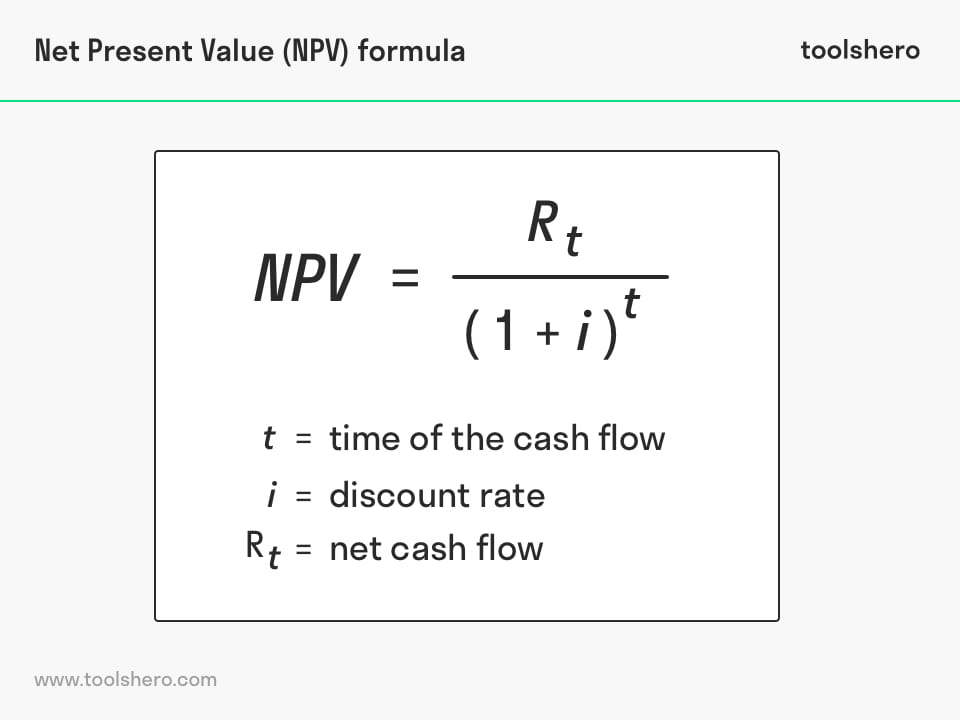

But to get the returns based on a monthly cash flow we have to set the rate to reflect the monthly status General syntax of the annual NPV To get the annual net present value we need to use the following formula NPV rate range of projected value Initial investment General syntax of the monthly NPV NPV rate 12 range of projected This concept is the basis of the Net Present Value Rule which says that you should only engage in projects with a positive net present value Excel NPV function The NPV function in Excel returns the net present value of an investment based on a discount or interest rate and a series of future cash flows

How To Calculate Monthly Npv In Excel

How To Calculate Monthly Npv In Excel

https://i.ytimg.com/vi/gYNOgw2Uwhg/maxresdefault.jpg

NPV IRR Calculator Excel Template Calculate NPV IRR In Excel YouTube

https://i.ytimg.com/vi/muwYplI6_ws/maxresdefault.jpg

How To Calculate Net Present Value In Excel Template YouTube

https://i.ytimg.com/vi/inDOlGmyqxI/maxresdefault.jpg

This is the NPV you have been looking for It s 0 because you ve used IRR to calculate NPV Internal rate of return or IRR is the discount rate that makes the NPV of the investment plan 0 Calculate NPV in Excel Using Excel VBA If you wish to fully automate the net present value calculation process you can use Excel VBA The reason for writing E6 instead of E6 E17 is Excel NPV discounts the first value So with E6 E17 NPV effectively makes the present value date the month before 4 1 2018 Nevertheless you might note that NPV and XNPV return very different values about 647 22 for NPV and about 0 11 for XNPV

The correct NPV formula in Excel uses the NPV function to calculate the present value of a series of future cash flows and subtracts the initial investment Net Present Value For example project X requires an initial investment of 100 cell B5 1 We expect a profit of 0 at the end of the first period a profit of 50 at the end of the second period and a profit of 150 at the end of the Now that you have a decent understanding of what NPV is let s see a couple of examples on how to calculate in Excel Excel NPV Function Excel has an in built NPV function with the following syntax NPV rate value1 value2 The above formula takes the following arguments rate this is the discount rate for one time period For

More picture related to How To Calculate Monthly Npv In Excel

How To Calculate Accounting Payback Period Or Capital Budgeting Break

https://i.ytimg.com/vi/b4eV7vo1vJM/maxresdefault.jpg

Excel s Npv Function For PV Of Uneven Cash Flows YouTube

https://i.ytimg.com/vi/LKltww9sFM0/maxresdefault.jpg

Net Present Value NPV Definition And How To Use It In 54 OFF

https://www.toolshero.com/wp-content/uploads/2018/05/net-present-value-npv-formula-toolshero-1.jpg

Step by Step Tutorial How to Calculate NPV in Excel Before we dive into the steps it s important to understand that calculating NPV in Excel will give you a clear idea of whether your investment or project is financially viable If the NPV is positive it s generally considered a good investment Let s get started How to Calculate NPV in Excel This section will walk you through calculating Net Present Value NPV using Excel Each step is designed to help you understand and apply the NPV formula to your financial data Step 1 Open Excel First open a new or existing Excel spreadsheet Having Excel open and ready is the first step to calculating NPV

[desc-10] [desc-11]

Net Present Value NPV Definition And How To Use It In 56 OFF

https://i.insider.com/6166ffd138c19600182fa49e?width=1000&format=jpeg&auto=webp

How To Calculate Net Present Value Npv In Excel YouTube

http://i.ytimg.com/vi/hG68UMupJzs/maxresdefault.jpg

How To Calculate Monthly Npv In Excel - The correct NPV formula in Excel uses the NPV function to calculate the present value of a series of future cash flows and subtracts the initial investment Net Present Value For example project X requires an initial investment of 100 cell B5 1 We expect a profit of 0 at the end of the first period a profit of 50 at the end of the second period and a profit of 150 at the end of the