How To Calculate Net Present Value Of Monthly Payments In Excel Excel NPV Function The NPV function in Excel has the following parameters NPV rate values rate a discount rate for a period values an array of cells containing future payments negative value or incomes positive value Here are some important prerequisites for using the function

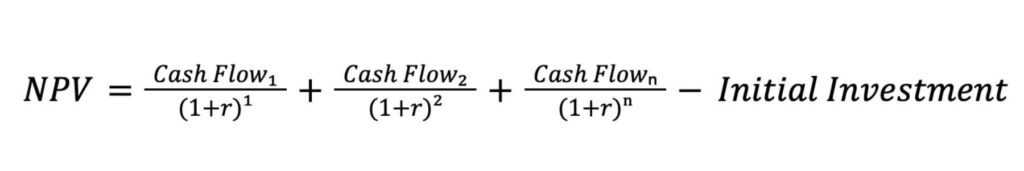

For a single cash flow present value PV is calculated with this formula Where r discount or interest rate i the cash flow period For example to get 110 future value after 1 year i how much should you invest today in your bank account which is offering 10 annual interest rate r The above formula gives this answer Calculates the net present value of an investment by using a discount rate and a series of future payments negative values and income positive values Syntax NPV rate value1 value2 The NPV function syntax has the following arguments Rate Required The rate of discount over the length of one period Value1 value2

How To Calculate Net Present Value Of Monthly Payments In Excel

How To Calculate Net Present Value Of Monthly Payments In Excel

https://jexo.io/content/images/2021/04/net-present-value-formula--1-.png

How To Calculate Net Present Value NPV Formula Global Online Money

https://www.investopedia.com/thmb/yPyA50WVPv_Gc_qgsv6xils7ntc=/1200x800/net-present-value-785bef0bd7e840438ada6e8abadadb97.jpg

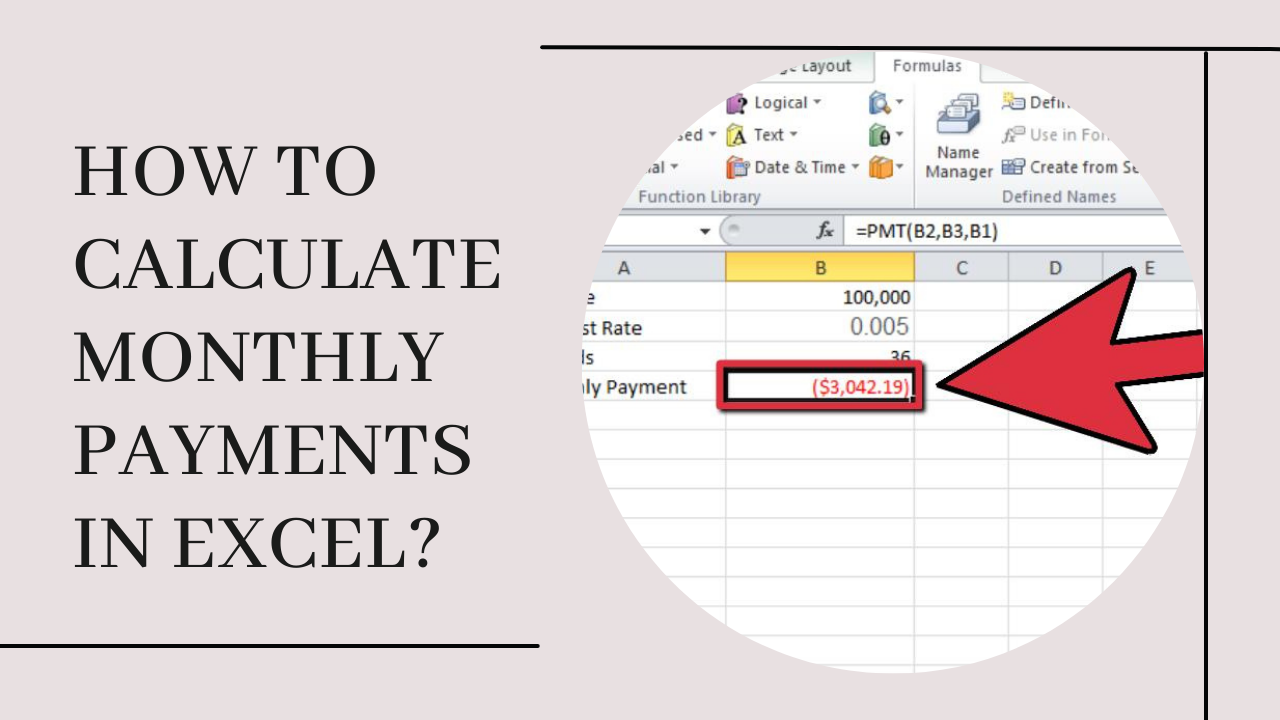

How To Calculate Monthly Payments In Excel Earn Excel

https://earnandexcel.com/wp-content/uploads/Beige-Minimal-and-Simple-Draw-Tutorial-Youtube-Thumbnail.png

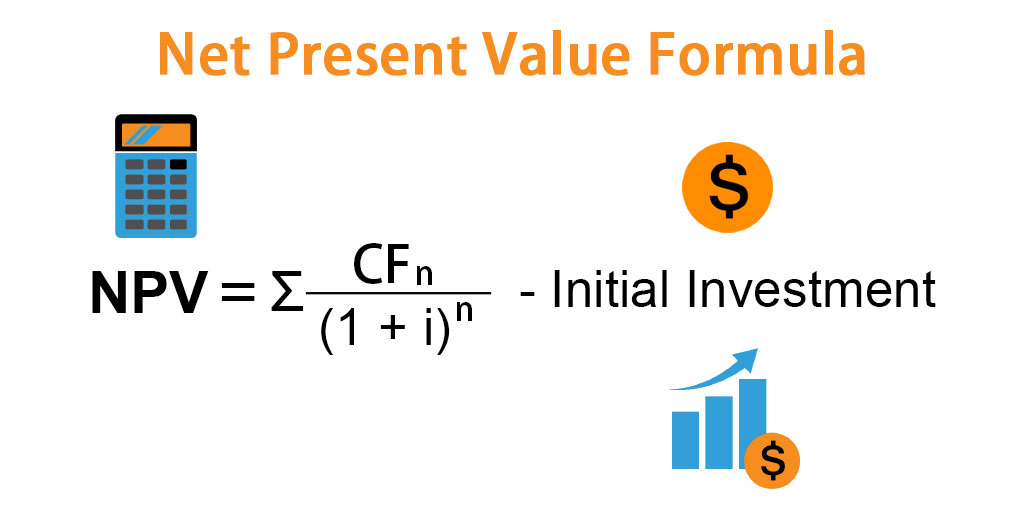

NPV short for Net Present Value as the name suggests is the net value of all your future cashflows which could be positive or negative For example suppose there s an investment opportunity where you need to pay 10 000 now and you will be paid 1000 per year for the next 20 years Net present value NPV is used to calculate the current value of a future stream of payments from a company project or investment To calculate NPV you need to estimate the timing and

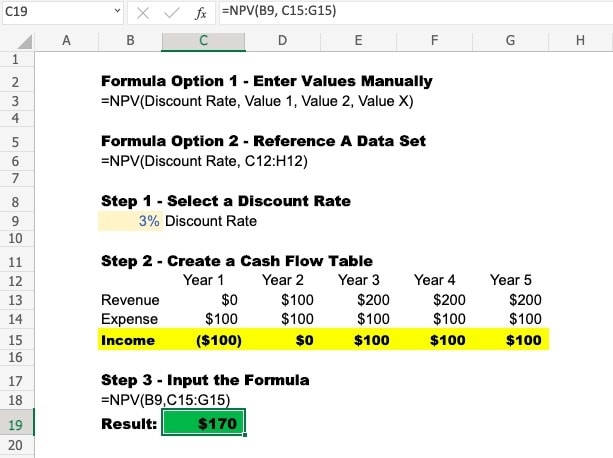

NPV calculates the net present value NPV of an investment using a discount rate and a series of future cash flows The discount rate is the rate for one period assumed to be annual NPV in Excel is a bit tricky because of how the function is implemented Although NPV carries the idea of net as in the present value of future cash flows Example Using the Function Suppose we are given the following data on cash inflows and outflows The required rate of return is 10 To calculate the NPV we will use the formula below The NPV formula is based on future cash flows If the first cash flow occurs at the start of the first period the first value must be added to the NPV

More picture related to How To Calculate Net Present Value Of Monthly Payments In Excel

How To Calculate Net Present Value In Excel F9 Finance

https://www.f9finance.com/wp-content/uploads/2021/03/Excel_Formula_NPV_1.jpg

How To Calculate Net Present Value NPV Forage

https://www.theforage.com/blog/wp-content/uploads/2022/12/npv-formula-1-1024x171.jpg

Net Present Value Pengertian Manfaat Rumus Dan Perbedaannya Dengan

https://kledo.com/blog/wp-content/uploads/2021/12/Net-Present-Value.jpg

IRR is based on NPV You can think of it as a special case of NPV where the rate of return that is calculated is the interest rate corresponding to a 0 zero net present value NPV IRR values values 0 When all negative cash flows occur earlier in the sequence than all positive cash flows or when a project s sequence of cash flows In this tutorial you will learn to calculate Net Present Value or NPV in Excel In this tutorial you will learn to calculate Net Present Value or NPV in

To get the annual net present value we need to use the following formula NPV rate range of projected value Initial investment General syntax of the monthly NPV NPV rate 12 range of projected value Initial investment Note that the only difference comes in where we have the rate NPV Formula The Excel formula for XNPV is as follows XNPV Rate Values Dates Where Rate The appropriate discount rate based on the riskiness and potential returns of the cash flows Values The array of cash flows with all cash outflows and inflows accounted for Dates The corresponding dates for the series of cash flows that

How To Calculate Net Present Value In Excel NPV YouTube

https://i.ytimg.com/vi/C3zjfKTCqWw/maxresdefault.jpg

How To Calculate Net Present Value NPV Forage

https://www.theforage.com/blog/wp-content/uploads/2022/12/net-present-value-npv-1.jpg

How To Calculate Net Present Value Of Monthly Payments In Excel - By definition net present value is the difference between the present value of cash inflows and the present value of cash outflows for a given project To understand this definition you first need to know what is the present value Imagine that you want to have 2200 in your account next year