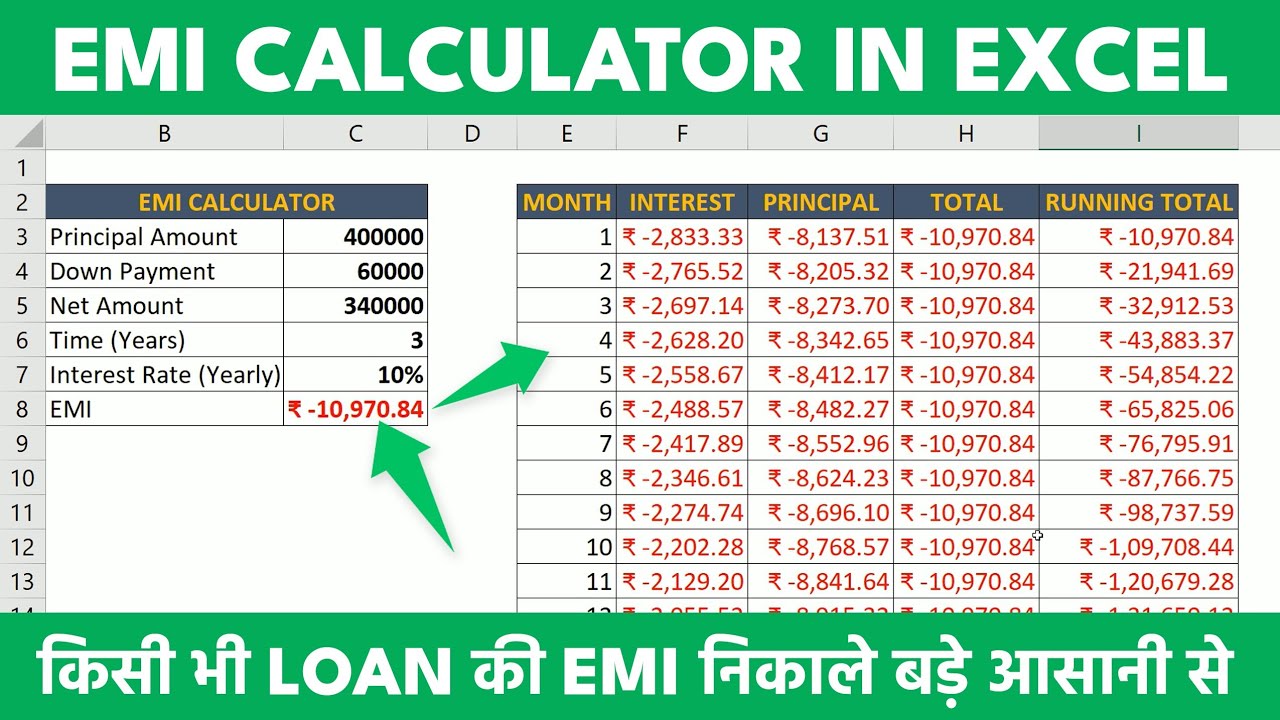

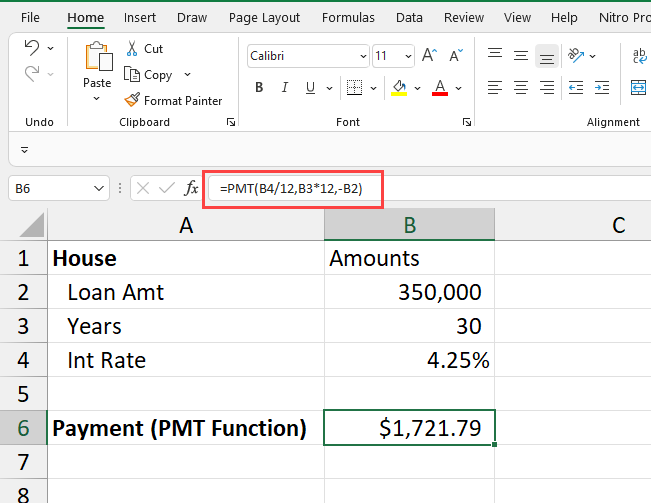

How To Calculate Loan Payment Amount In Excel The only required arguments are the first three for interest rate number of payments and loan amount To get the monthly payment amount for a loan with four percent interest 48 payments and an amount of 20 000 you would use this formula PMT B2 12 B3 B4 As you see here the interest rate is in cell B2 and we divide that by 12 to obtain

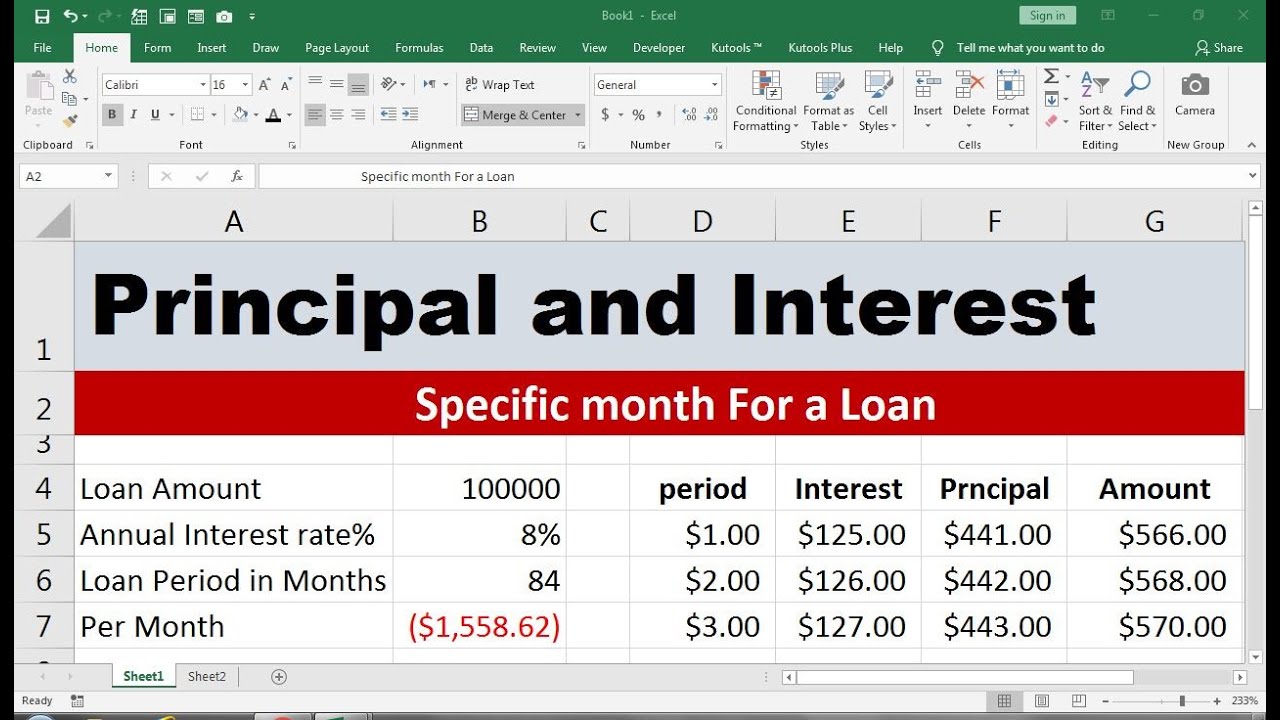

To create an annual loan payment calculator in Excel we have shown three different and effective ways to do the work Free Excel Courses Create Basic Excel Pivot Tables To calculate it you need to have the loan amount interest rate and periods The formula to calculate the annual loan payment is R Interest Rate P Principal To find the outstanding loan balance slight modifications were made to the dataset the loan amount was decreased and the duration of the loan increased Calculate the outstanding loan amount with one intermediate period STEPS Select a cell to see the result Here C13 The generic formula for a fixed periodic payment is

How To Calculate Loan Payment Amount In Excel

How To Calculate Loan Payment Amount In Excel

https://i.ytimg.com/vi/QA4OidnxJL4/maxresdefault.jpg

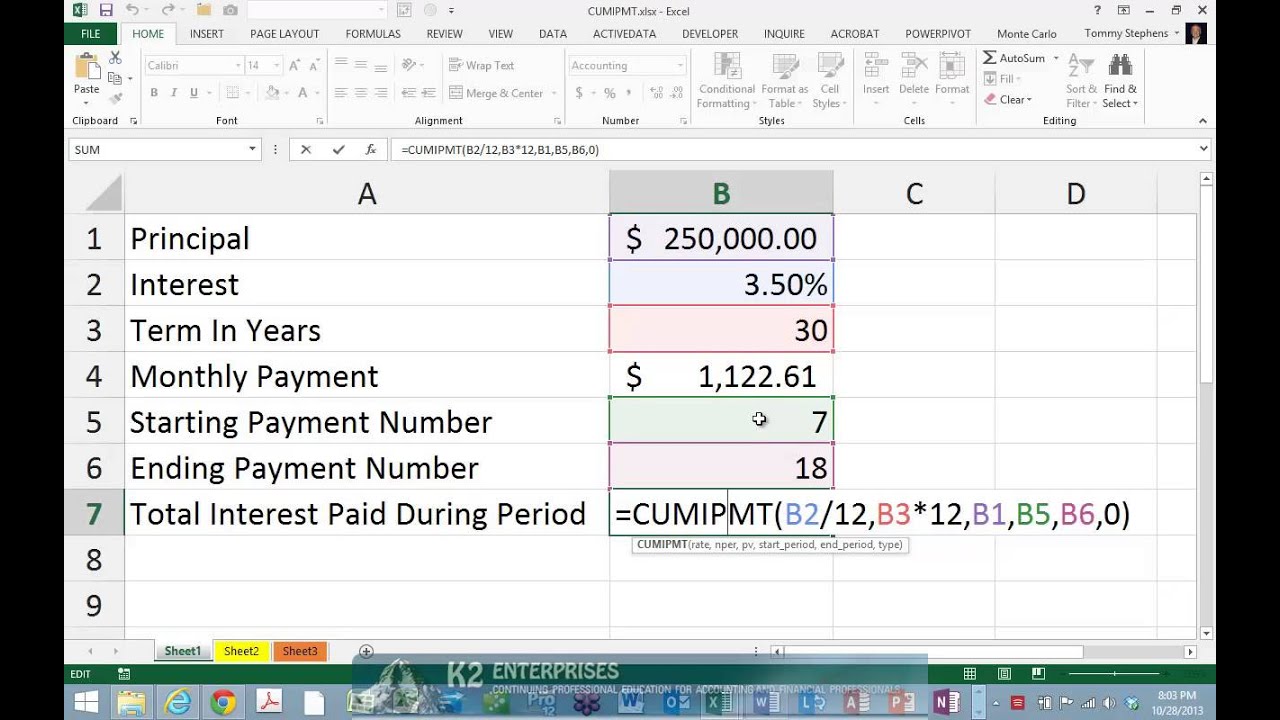

Using Excel s CUMIPMT Function To Determine Interest Paid Over Multiple

https://i.ytimg.com/vi/JfXVBDQbA5k/maxresdefault.jpg

How To Calculate Principal And Interest On A Loan In Excel YouTube

https://i.ytimg.com/vi/NyZE0vNllc0/maxresdefault.jpg

All you need is your loan term payment amount principal and Excel s RATE function The syntax for the formula is RATE term pmt principal future value type guess rate with the first three arguments required Term The term in years multiplied by 12 in the formula or the total number of payments PMT calculates the payment for a loan based on constant payments and a constant interest rate NPER calculates the number of payment periods for an investment based on regular constant payments and a constant interest rate PV returns the present value of an investment The present value is the total amount that a series of future payments is

Calculate the monthly payment Conclusion Calculating a loan amount in Excel can significantly streamline managing your finances With just a few steps you can determine how different loan amounts interest rates and terms affect your monthly payments Loans have four primary components the amount the interest rate the number of periodic payments the loan term and the payment amount per period One use of the PV function is to calculate the original loan amount when given the other 3 components For this example we want to find the

More picture related to How To Calculate Loan Payment Amount In Excel

Excel PMT Function Exceljet

https://exceljet.net/sites/default/files/styles/og_image/public/images/functions/main/exceljet_pmt.png

Download Microsoft Excel Mortgage Calculator Spreadsheet XLSX Excel

https://www.mortgagecalculator.org/images/enable-editing-protect-mode.png

PMT Function In Excel How To Use It To Calculate Loan Payment Chris

https://chrismenardtraining.com/_CMT/images/photos/Original/218.jpg

Excel PMT function is one of the many financial functions available in Excel It helps you calculate the payment you need to make for a loan when you know the total loan amount interest rate and the number of constant payments For example suppose you buy a house for USD 200 000 Using Excel functions to calculate total amount paid When it comes to calculating the total amount paid on a loan in Excel there are several functions that can help streamline the process These functions allow you to calculate the monthly payment on the loan as well as break down the payments into interest and principal portions

[desc-10] [desc-11]

Worksheet calculate

http://www.wikihow.com/images/2/28/Calculate-a-Monthly-Payment-in-Excel-Step-12-Version-2.jpg

Interest Rates Estimates 2025 Joshua M Matter

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/12/12004614/Loan-Amortization-Schedule-Calculator-960x753.jpg

How To Calculate Loan Payment Amount In Excel - [desc-14]