How To Calculate Loan Amount In Excel To calculate the original loan amount given the loan term the interest rate and a periodic payment amount you can use the PV function In the example shown the formula in C10 is PV C5 12 C7 C6 The Excel PV function is a financial function that returns the present value of an investment You can use the PV function to get the value

Gather the annual interest rate monthly payment and loan amount and place them in your sheet Select the cell where you want to see the term and then use the NPER function to find the payment period The syntax for the function is NPER rate payment loan amount future value type where the first three arguments are required for rate Method 3 Computing Capital Payment for a Certain Interest Rate on a Loan Let s dive into the PPMT function in Excel The PPMT function helps you determine the principal payment for a given period based on periodic constant payments and a fixed interest rate Here s how it works Syntax rate The interest rate per period per Specifies the payment period must be in the range 1

How To Calculate Loan Amount In Excel

How To Calculate Loan Amount In Excel

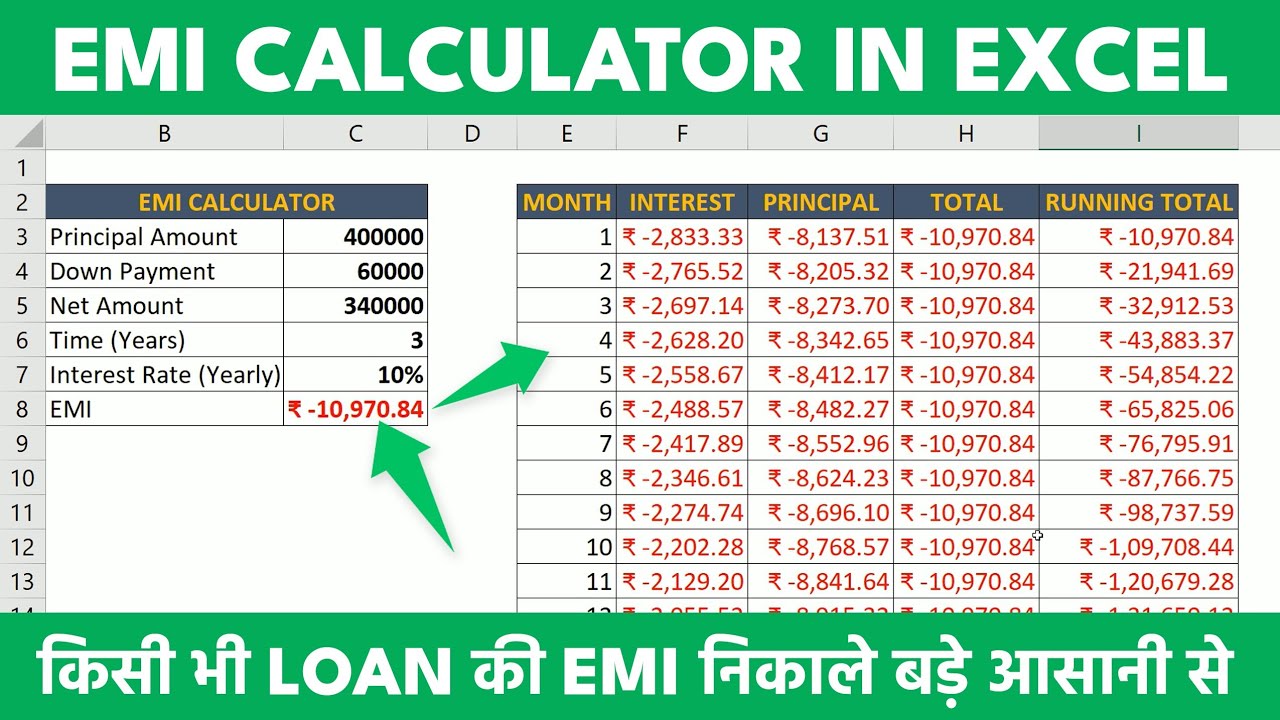

https://i.ytimg.com/vi/QA4OidnxJL4/maxresdefault.jpg

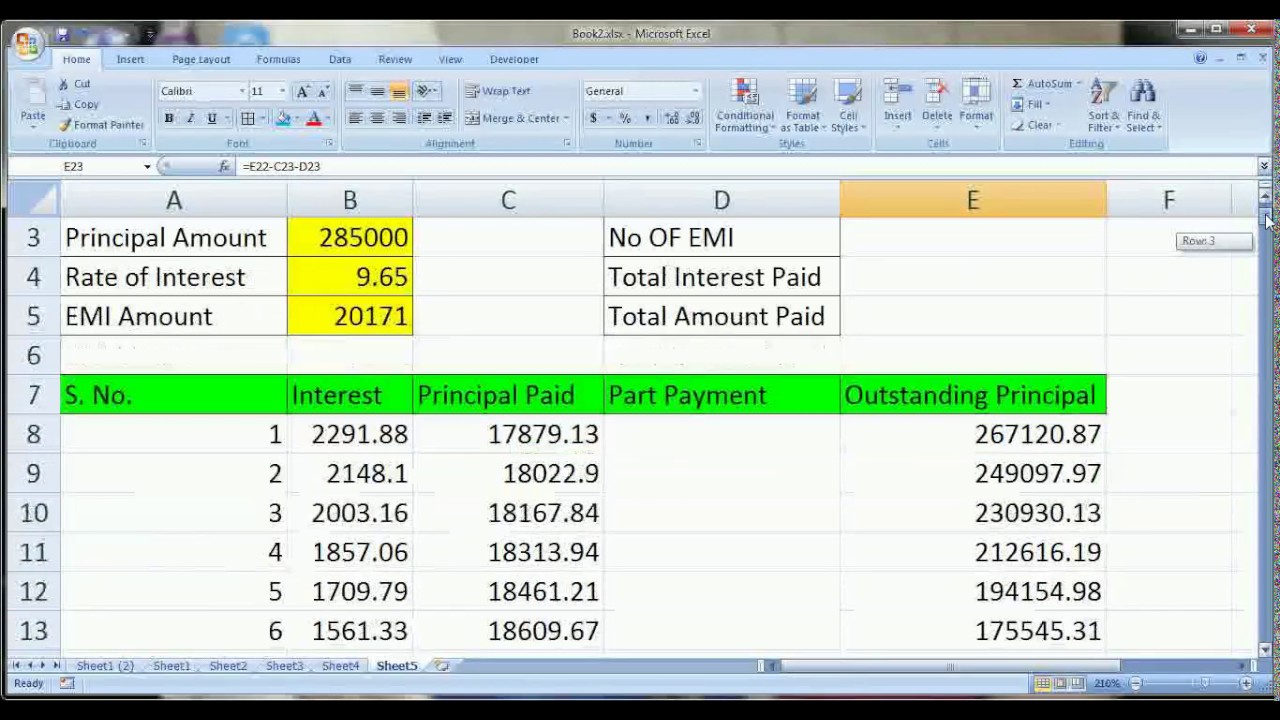

How To Create A Reducing Balance EMI Calculator In Excel Free

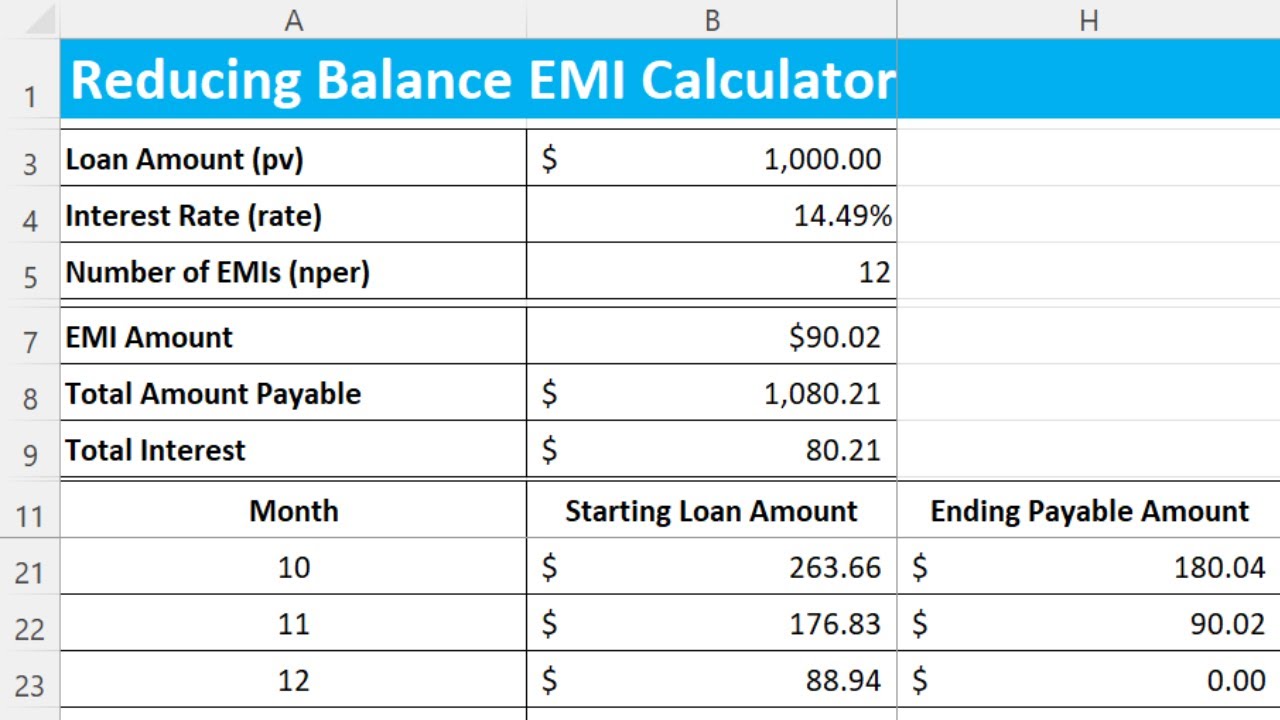

https://i.ytimg.com/vi/gZJaAnZeVLo/maxresdefault.jpg

How To Calculate The Total Interest On A Loan In Excel YouTube

https://i.ytimg.com/vi/2Pr6xAJV0-0/maxresdefault.jpg

Enter your loan details in the corresponding cells For example the loan amount goes under Loan Amount the interest rate under Interest Rate and so on Ensure accuracy while entering your details Incorrect entries may lead to inaccurate calculations making your entire effort futile Step 3 Use the PMT Function Principal The total loan amount For an annuity you can use the future value and type arguments as described earlier Here we have the annual interest rate in cell B2 monthly payment in cell B3 entered as a negative number and loan amount in cell B4 You would enter the following formula in cell B5 to calculate your loan term NPER B2 12

To calculate the original loan amount you can use the PV function if you have the loan term interest rate and periodic payment amount How to calculate original loan amount in Excel Select cell C9 Type the formula PV C3 12 C5 C4 0 Here C3 interest rate C5 no of total payments C4 monthly payment Press Enter Summing up the total amount paid When managing a loan in Excel it s important to accurately calculate the total amount paid over the loan term Using the SUM function and organizing the data in a clear manner can help you keep track of the overall cost A Use the SUM function to calculate the total amount paid over the loan term

More picture related to How To Calculate Loan Amount In Excel

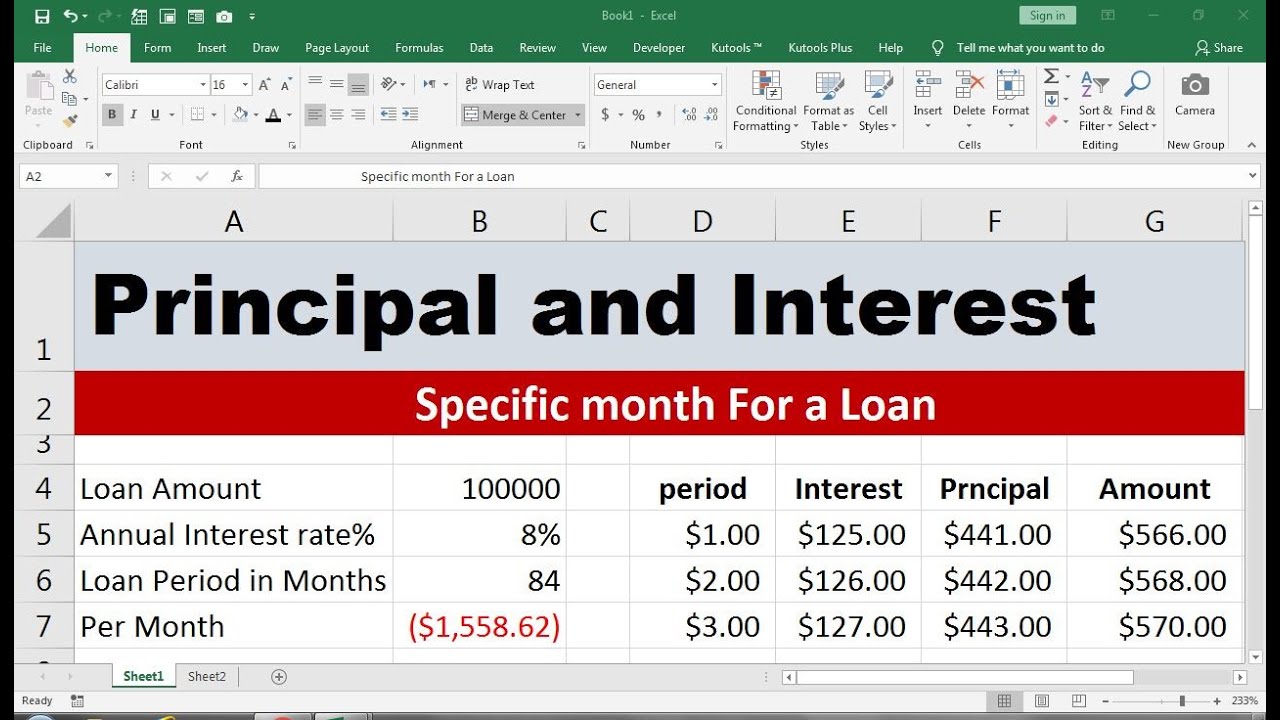

How To Calculate Principal And Interest On A Loan In Excel YouTube

https://i.ytimg.com/vi/NyZE0vNllc0/maxresdefault.jpg

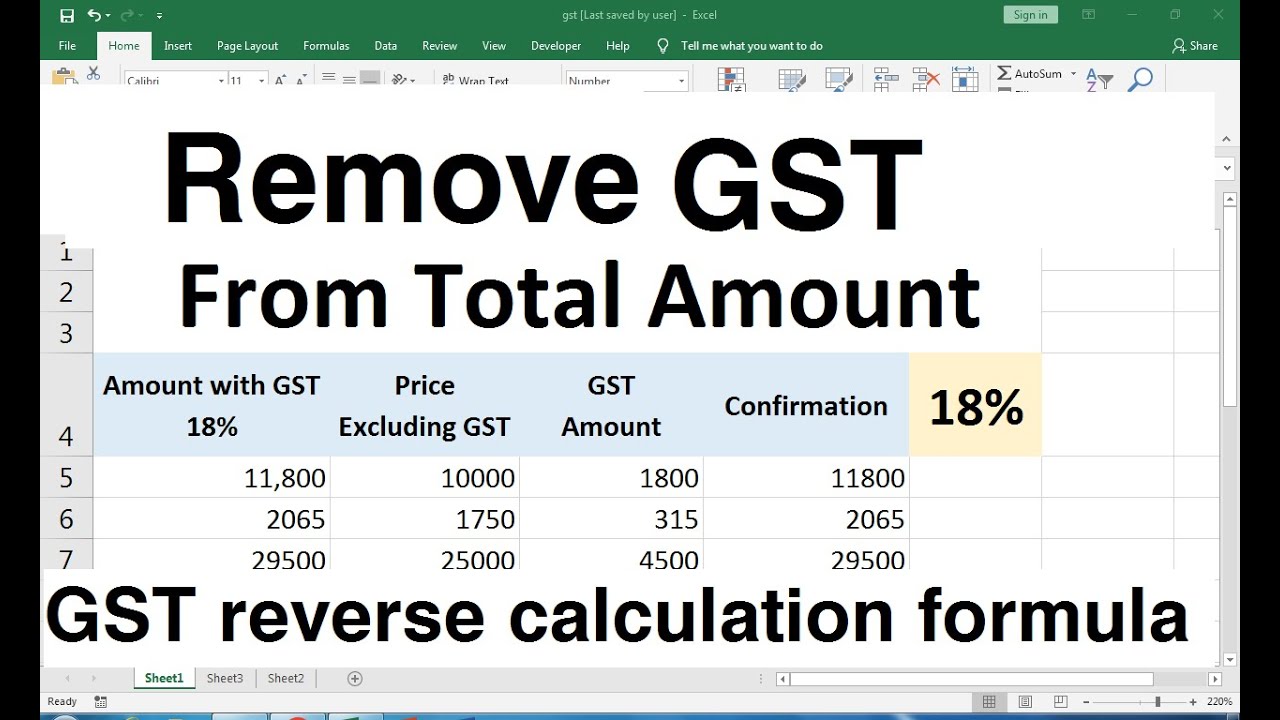

How To Calculate Gst Amount From Total Amount In Excel YouTube

https://i.ytimg.com/vi/ptTea5xLrXY/maxresdefault.jpg

How To Calculate Home Loan EMI In Excel YouTube

https://i.ytimg.com/vi/qzW5XaLnrJM/maxresdefault.jpg

It plays a significant role in determining the loan amount as longer loan terms typically result in higher total repayment amounts due to accrued interest Setting Up Excel for Loan Amount Calculation When calculating a loan amount in Excel it s important to set up your spreadsheet correctly to ensure accurate results Here s how to do it A This article will provide you with step by step instructions on how to calculate the loan amount in Excel Step 1 Open Microsoft Excel Launch Microsoft Excel on your device and open a new blank workbook to begin your calculations Step 2 Label Columns Create four columns and label them as follows A Loan Amount

[desc-10] [desc-11]

Loan Calculator Find Interest And Principal Payments On A Loan In

https://i.ytimg.com/vi/MzMQcHoO73k/maxresdefault.jpg

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

https://i.pinimg.com/originals/d8/14/65/d8146502cbf3d9112df6195c9de178d5.png

How To Calculate Loan Amount In Excel - [desc-12]