How To Calculate Interest On Loan In Excel Sheet Formula to Calculate an Interest Rate in Excel Maybe you have an existing loan and want to quickly see the annual interest rate you re paying As simple as calculating a payment with basic loan details you can do the same to determine the interest rate Get the loan term monthly payment and loan amount and enter them in your sheet

Loan Amount 5 000 000 00 The loan amount It must be entered as a negative value Yearly Rate 10 10 interest rate should be paid annually Period per Year 12 There are 12 months in a year Period 1 To get the result for the first month the input is 1 This value is variable Total Period year 25 The number of years allowed to pay off the total loan amount Creating a Daily Loan Interest Calculator in Excel Allocate two cells in your Excel sheet for the annual loan balance and annual interest rate Choose a cell where you want to display the daily loan interest Let s use cell D7 In cell D7 insert the following formula to calculate daily loan interest

How To Calculate Interest On Loan In Excel Sheet

How To Calculate Interest On Loan In Excel Sheet

https://i.ytimg.com/vi/FxW5zy4O58E/maxresdefault.jpg

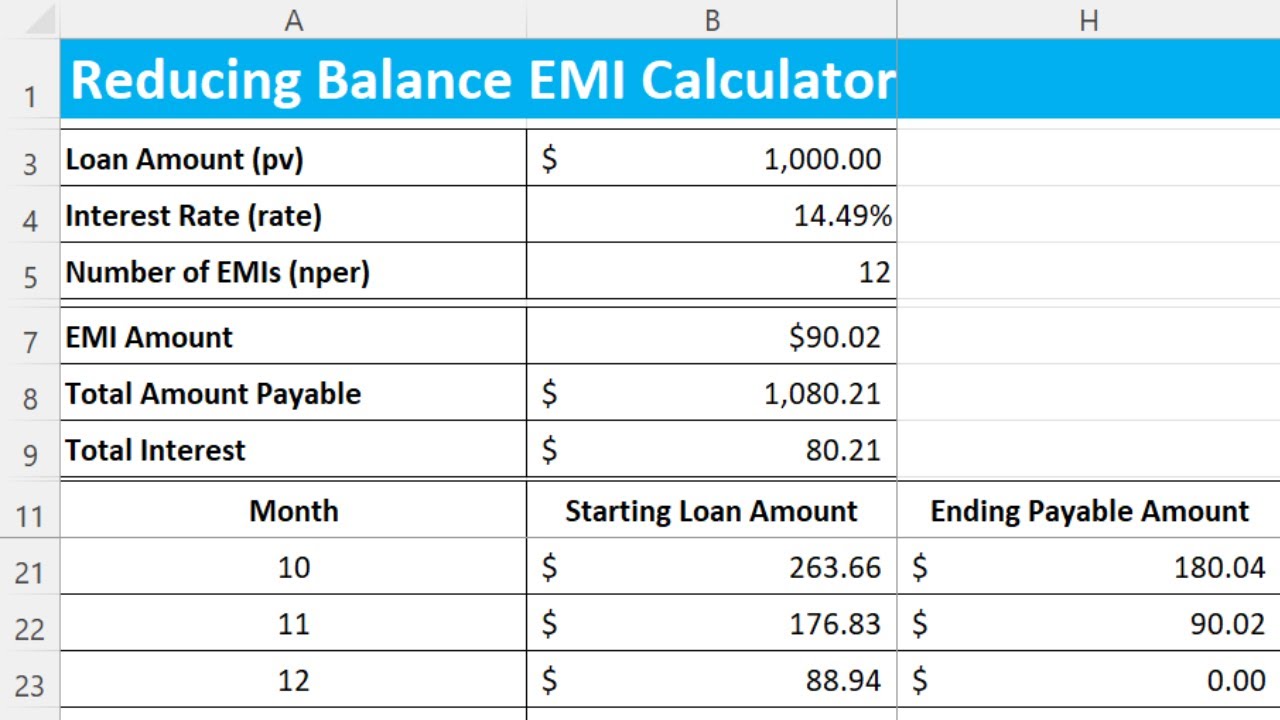

How To Create A Reducing Balance EMI Calculator In Excel Free

https://i.ytimg.com/vi/gZJaAnZeVLo/maxresdefault.jpg

How To Calculate The Total Interest On A Loan In Excel YouTube

https://i.ytimg.com/vi/2Pr6xAJV0-0/maxresdefault.jpg

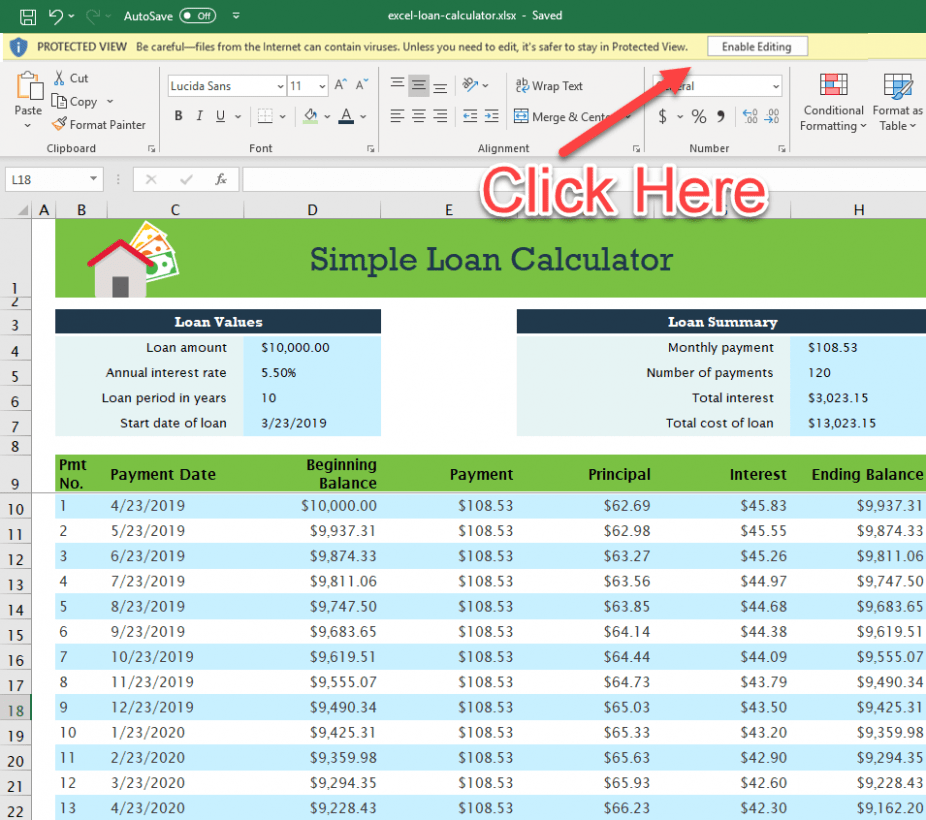

To calculate payments you ll just need the principal amount interest rate and number of payments remaining You can then use the IPMT function to determine how much you ll have to pay in interest in each period You can calculate interest payments in Excel on a Windows PC or a Mac This loan calculator uses the PMT PV RATE and NPER formulas to calculate the Payment Loan Amount Annual Interest or Term Length for a fixed rate loan Useful for both auto and mortgage loans See below for more information How to Use the Loan Calculator Spreadsheet This calculator demonstrates 4 different types of loan calculations

We have offered a downloadable Windows application for calculating mortgages for many years but we have recently had a number of people request an Excel spreadsheet which shows loan amortization tables Our Simple Excel loan calculator spreadsheet offers the following features works offline easily savable allows extra payments to be added Calculate Loan Payments If you ve been approved for a specific loan amount and interest rate you can figure out your payments easily You can then see if you should shop around for a better rate need to reduce your loan amount or should increase the number of payments For this you ll use the PMT function in Excel

More picture related to How To Calculate Interest On Loan In Excel Sheet

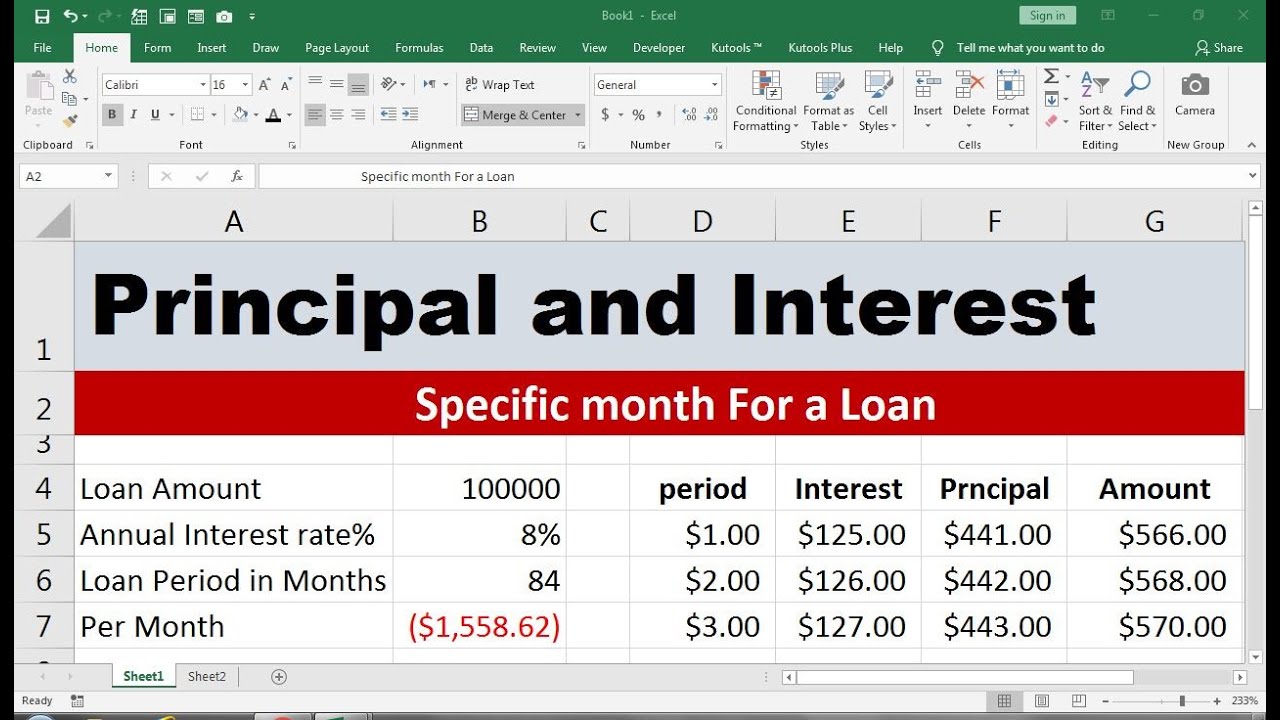

How To Calculate Principal And Interest On A Loan In Excel YouTube

https://i.ytimg.com/vi/NyZE0vNllc0/maxresdefault.jpg

How To Calculate The Monthly Interest And Principal On A Mortgage Loan

https://i.ytimg.com/vi/FN9poyqaIBw/maxresdefault.jpg

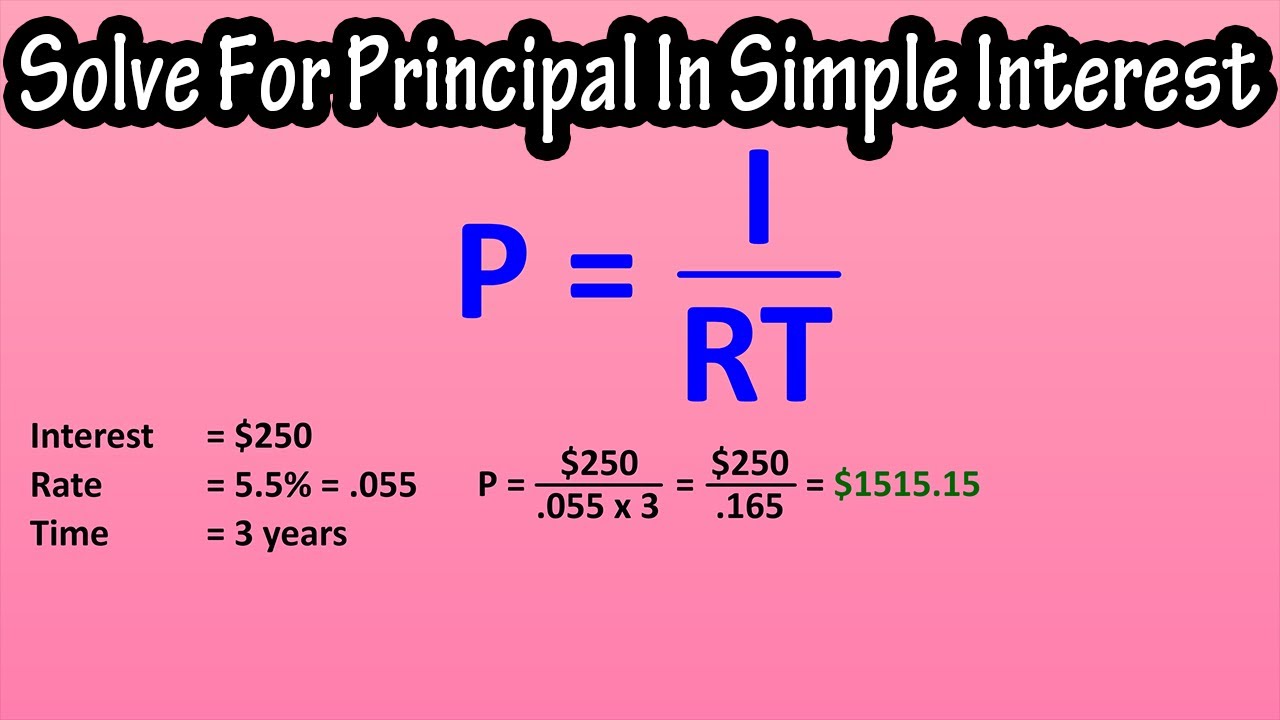

Calculate Principal Amount From Emi Ecosia Images

https://i.ytimg.com/vi/AdF-8ydl0mk/maxresdefault.jpg

Input your loan details into the worksheet Include columns for Loan Amount Interest Rate Loan Term and Monthly Payment For example you might have A1 Loan Amount B1 Interest Rate C1 Loan Term in years D1 Monthly Payment Step 4 Calculate Monthly Interest Rate Find out how long it will take to pay off a personal loan Imagine that you have a 2 500 personal loan and have agreed to pay 150 a month at 3 annual interest Using the function NPER rate PMT PV NPER 3 12 150 2500 it would take 17 months and some days to pay off the loan The rate argument is 3 12 monthly payments per year

[desc-10] [desc-11]

Car Payment Schedule Template

http://www.emmanuelbaccelli.org/wp-content/uploads/2022/10/sample-car-payment-schedule-template-doc.png

Commercial Real Estate Loan New Arrivals Calculator

https://www.mortgagecalculator.org/images/enable-editing-protect-mode.png

How To Calculate Interest On Loan In Excel Sheet - Calculate Loan Payments If you ve been approved for a specific loan amount and interest rate you can figure out your payments easily You can then see if you should shop around for a better rate need to reduce your loan amount or should increase the number of payments For this you ll use the PMT function in Excel