How Do I Calculate Interest Payments On A Loan In Excel Get the loan term monthly payment and loan amount and enter them in your sheet Select the cell where you want to see the interest rate You ll then enter the formula for the RATE function The syntax for the function is RATE term payment loan balance future value type where the first three arguments are required for the term in months

Loan Amount 5 000 000 00 The loan amount It must be entered as a negative value Yearly Rate 10 10 interest rate should be paid annually Period per Year 12 There are 12 months in a year Period 1 To get the result for the first month the input is 1 This value is variable Total Period year 25 The number of years allowed to pay off the total loan amount Formula Breakdown The RATE function will return the monthly rate in percentage of Loan Payment C7 denotes the NPER as the total payment period in years which is 5 We have multiplied it by 12 for the monthly payment system C6 denotes the payment made in each period as PMT The Minus sign denotes the monthly payment as debit C5 denotes the Loan as present value PV

How Do I Calculate Interest Payments On A Loan In Excel

How Do I Calculate Interest Payments On A Loan In Excel

https://i.pinimg.com/originals/6d/81/2a/6d812add1a01581d4bbd053e394f856f.jpg

How To Calculate Your Monthly Mortgage Payment Given The Principal

https://i.ytimg.com/vi/6bLg_Ex0A-4/maxresdefault.jpg

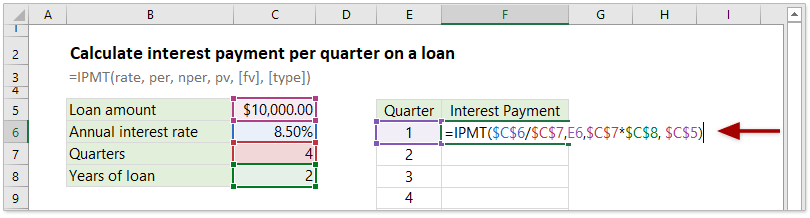

How To Calculate Interest Payments Per Period Or Total With Excel Formulas

https://cdn.extendoffice.com/images/stories/excel-formulas/calculate-interest-payments/doc-ipmt-function-quarter-2.png

PMT calculates the payment for a loan based on constant payments and a constant interest rate NPER calculates the number of payment periods for an investment based on regular constant payments and a constant interest rate PV returns the present value of an investment The present value is the total amount that a series of future payments is Where Rate required the constant interest rate per period You can supply it as a percentage or decimal number For example if you make annual payments on a loan with an annual interest rate of 6 percent use 6 or 0 06 for rate If you make weekly monthly or quarterly payments divide the annual rate by the number of payment periods per year as shown in this example

Follow the below steps to calculate loan interest Calculate the periodic rate i by dividing the annual interest rate by the number of payments in a year n Calculate the total payment P by multiplying the periodic rate i with the loan amount A and the number of payment n and then divide it by the factor of 1 1 i n Calculating loan payments is easy whether it s for mortgages cars students or credit cards First you need to know the type of loan before you can calculate the payments Interest Only Loan Payment An interest only loan is the one in which the borrower pays only the interest for a certain period of time These types of loan s monthly

More picture related to How Do I Calculate Interest Payments On A Loan In Excel

Spot Loan Apply Online Payday Loans Online With Monthly Payments

http://www.wikihow.com/images/2/28/Calculate-a-Monthly-Payment-in-Excel-Step-12-Version-2.jpg

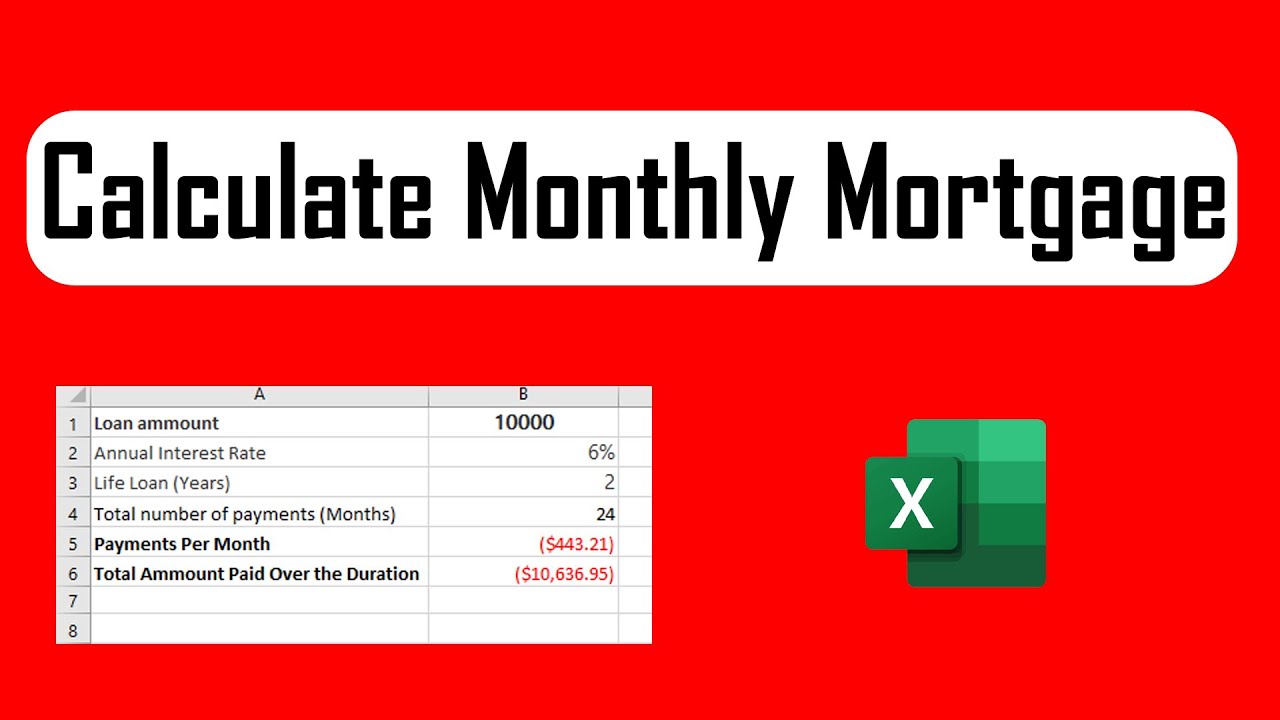

How To Calculate Monthly Mortgage Payment In Excel Using Function YouTube

https://i.ytimg.com/vi/0XDu2sKZXYQ/maxresdefault.jpg

3 Ways To Calculate Mortgage Interest WikiHow

https://www.wikihow.com/images/6/6d/Calculate-Mortgage-Interest-Step-14.jpg

Fill separate boxes with the amount of the loan the length you have to pay and the interest and Excel can calculate your monthly payments for you For the remainder of the section you can use the following example loan You take out a 100 000 home loan You have 30 years to pay it off at 4 5 annual interest rate Sometimes you may want to calculate the total interest paid on a loan For periodic constant payments and constant interest rate you can apply the IPMT function to figure out the interest payment for every period and then apply the Sum function to sum up these interest payments or apply the CUMIPMT function to get the total interest paid on a loan directly in Excel

[desc-10] [desc-11]

How To Calculate Mortgage Payments BeatTheBush YouTube

https://i.ytimg.com/vi/nsUSKz1a7tI/maxresdefault.jpg

How To Find Interest Rate On Loan Calculator

https://lh5.googleusercontent.com/proxy/D37vhAQY8dKmWDB2DapW9FSyTw8sJb7P5ljCDlLjzPORcETwGt0aGh8rDQb3QP4GFap4sKpRZMk_SVt5A7MBtyn3QYmj3a-zTeTJXx95OpES_sFqY7vXi0hy=w1200-h630-p-k-no-nu

How Do I Calculate Interest Payments On A Loan In Excel - PMT calculates the payment for a loan based on constant payments and a constant interest rate NPER calculates the number of payment periods for an investment based on regular constant payments and a constant interest rate PV returns the present value of an investment The present value is the total amount that a series of future payments is