How Much Will I Take Home After Taxes 50000 FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024

Step 6 Your paycheck For the final step divide your net pay by your pay frequency The following is the formula for each pay frequency Daily Your net pay Days worked per week Weeks worked per year Your daily paycheck Weekly Your net pay 52 Your weekly paycheck The average annual salary in the United States is 69 368 which is around 4 537 a month after taxes and contributions depending on where you live However extremely high earners tend to bias averages Likewise average salaries vary state by state such as California s salaries averaging 83 876 a year compared to Florida s at 63 336

How Much Will I Take Home After Taxes 50000

How Much Will I Take Home After Taxes 50000

https://i2.wp.com/financialsamurai.com/wp-content/uploads/2022/11/financial-freedom-saving-rate-retire-early-chart.png?fit=1456,9999

Donation Dots All Occasion fundraisers Catalog Fundraiser Dots

https://i.pinimg.com/originals/ea/d8/ea/ead8ea4c54d9d6aa19ee8f85288a920b.jpg

How Much Will I Take Home If I Earn 55000 YouTube

https://i.ytimg.com/vi/6khlBdTaVQ0/maxresdefault.jpg

The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator Every pay period your employer withholds 6 2 of your earnings for Social Security taxes and 1 45 of your earnings for Medicare taxes Your employer then matches that contribution If your filing status is single head of household of qualifying widow er your earnings in excess of 200 000 are subject to a 0 9 Medicare surtax not matched

Whether your pay is weekly bi weekly monthly or yearly this calculator can help you figure out your after tax income once you enter your gross pay and additional details Use our take home pay In 2022 your employer will withhold 6 2 of your wages up to 147 000 for Social Security Additionally you must pay 1 45 of all of your wages for Medicare without any limitations If you

More picture related to How Much Will I Take Home After Taxes 50000

How Much Did Jane Earn Before Taxes New Countrymusicstop

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

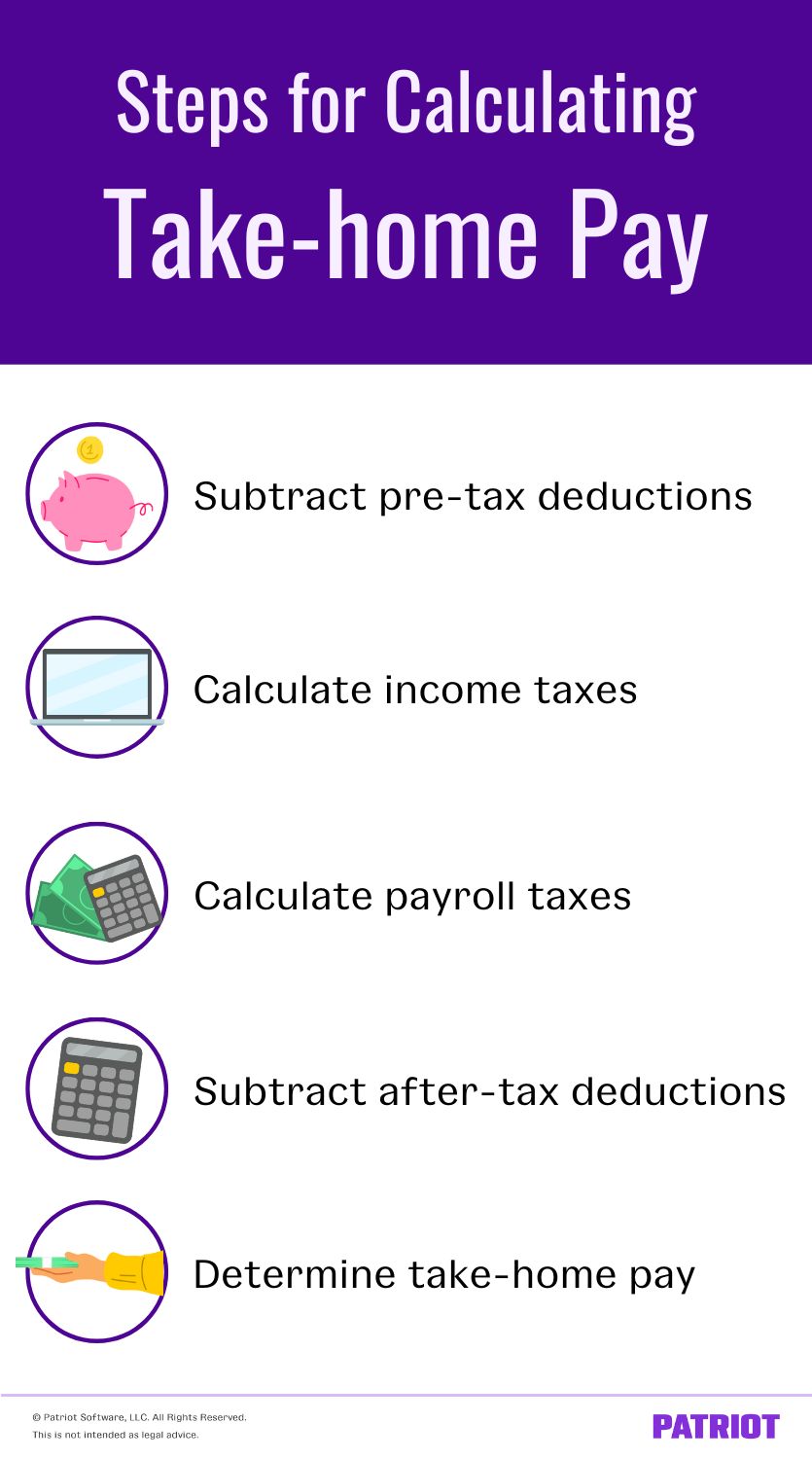

Take home Pay Definition Steps To Calculate Extra Partner For

https://www.patriotsoftware.com/wp-content/uploads/2022/09/take-home-pay.jpg

Here s How Much The 1 Billion Mega Millions Winner Will Actually Take

https://imageio.forbes.com/specials-images/imageserve/62e1567bd2f964d96f133856/0x0.jpg?format=jpg&crop=2220,1249,x0,y74,safe&width=1200

2013 46 337 2012 41 553 Every taxpayer in North Carolina will pay 4 75 of their taxable income in state taxes North Carolina has not always had a flat income tax rate though In 2013 the North Carolina Tax Simplification and Reduction Act radically changed the way the state collected taxes Calculate your take home pay after various taxes For United States residents Constantly updated to keep up with the tax year

After Tax If your salary is 50 000 then after tax and national insurance you will be left with 38 022 This means that after tax you will take home 3 169 every month or 731 per week 146 20 per day and your hourly rate will be 24 05 if you re working 40 hours week Scroll down to see more details about your 50 000 salary How to use the Take Home Calculator To use the tax calculator enter your annual salary or the one you would like in the salary box above If you are earning a bonus payment one month enter the value of the bonus into the bonus box for a side by side comparison of a normal month and a bonus month Find out the benefit of that overtime

How Much Do Bitcoin Miners Make How Do Earn Money From Bitcoin

https://usercontent2.hubstatic.com/8091971_f520.jpg

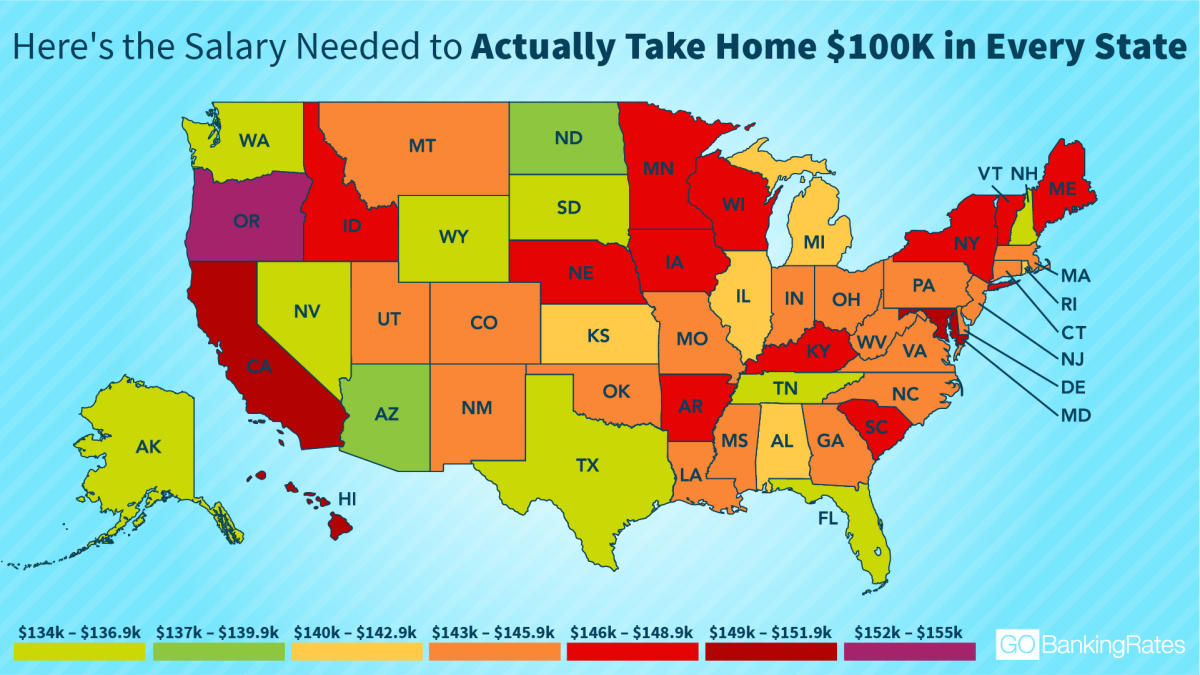

This Is The Ideal Salary You Need To Take Home 100K In Your State

https://s.yimg.com/ny/api/res/1.2/U7NjUVhG7xWBJwUW_nBP3A--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD02NzU-/https://media.zenfs.com/en-US/gobankingrates_644/b1c67f0ee5e533346e14defceab29095

How Much Will I Take Home After Taxes 50000 - The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator