What Would I Take Home After Tax 50000 Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major

In 2022 your employer will withhold 6 2 of your wages up to 147 000 for Social Security Additionally you must pay 1 45 of all of your wages for Medicare without any limitations If you The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator

What Would I Take Home After Tax 50000

What Would I Take Home After Tax 50000

https://www.income-tax.co.uk/images/37700-after-tax-salary-uk-2020.png

What Will My Take home Pay Be After Tax And NI In 22 23

http://static1.squarespace.com/static/5d8c6cef28ac7b58bd17ab1e/5d8c6cef28ac7b58bd17ab6e/6278d296671629771cda751e/1652598045612/unsplash-image-utWyPB8_FU8.jpg?format=1500w

What Is Adjusted Net Income UK Salary Tax Calculator

https://www.income-tax.co.uk/wp-content/uploads/2021/07/Adjusted-Net-Income-scaled.jpeg

Step 6 Your paycheck For the final step divide your net pay by your pay frequency The following is the formula for each pay frequency Daily Your net pay Days worked per week Weeks worked per year Your daily paycheck Weekly Your net pay 52 Your weekly paycheck The average annual salary in the United States is 69 368 which is around 4 537 a month after taxes and contributions depending on where you live However extremely high earners tend to bias averages Likewise average salaries vary state by state such as California s salaries averaging 83 876 a year compared to Florida s at 63 336

Use SmartAsset s paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes Overview of Arizona Taxes Arizona imposes a flat income tax rate of 2 50 and has no local income tax 2014 52 005 2013 56 567 2012 50 015 Michigan collects a state income tax and in some cities there is a local income tax too As with federal taxes your employer withholds money from each of your paychecks to put toward your Michigan income taxes

More picture related to What Would I Take Home After Tax 50000

Income Tax Calculator How Much Money Will YOU Take Home After Tax

https://cdn.images.express.co.uk/img/dynamic/23/590x/income-tax-calculator-1474933.jpg?r=1628605248648

EDA Professional Services Blog UK Tax Return Filing Deadline

http://1.bp.blogspot.com/-_8TmqQph10s/VHG1lTOQJjI/AAAAAAAAAFI/SFVHTRPkM34/s1600/HMRC_Self_Assessment_tax_return.jpg

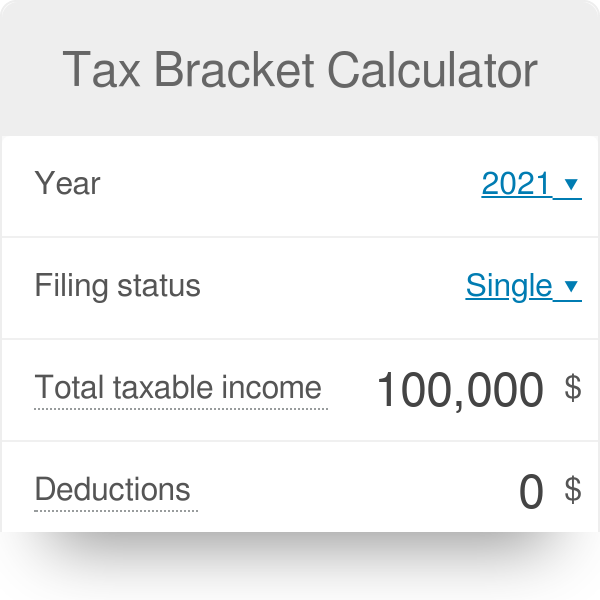

2022 Tax Brackets Married Filing Jointly Calculator

https://scrn-cdn.omnicalculator.com/finance/[email protected]

After Tax If your salary is 50 000 then after tax and national insurance you will be left with 38 022 This means that after tax you will take home 3 169 every month or 731 per week 146 20 per day and your hourly rate will be 24 05 if you re working 40 hours week Scroll down to see more details about your 50 000 salary How to use the Take Home Calculator To use the tax calculator enter your annual salary or the one you would like in the salary box above If you are earning a bonus payment one month enter the value of the bonus into the bonus box for a side by side comparison of a normal month and a bonus month Find out the benefit of that overtime

Calculate your take home pay after various taxes For United States residents Constantly updated to keep up with the tax year On a 50 000 salary your take home pay will be 38 771 after tax and National Insurance This equates to 3 230 92 per month and 745 60 per week If you work 5 days per week this is 149 12 per day or 18 64 per hour at 40 hours per week To calculate the take home pay we assumed the following You are not a company director

Can I Get Dental Insurance From Work UK Salary Tax Calculator

https://www.income-tax.co.uk/wp-content/uploads/2022/10/can-i-get-dental-insurance-through-work-scaled.jpg

2022 2023 NHS Pay Scales

https://nhs-payscales.com/wp-content/uploads/2022/01/Band-1.png

What Would I Take Home After Tax 50000 - Step 6 Your paycheck For the final step divide your net pay by your pay frequency The following is the formula for each pay frequency Daily Your net pay Days worked per week Weeks worked per year Your daily paycheck Weekly Your net pay 52 Your weekly paycheck