What Is The Take Home Pay For 80000 In California Summary If you make 80 000 a year living in the region of California USA you will be taxed 21 763 That means that your net pay will be 58 237 per year or 4 853 per month Your average tax rate is 27 2 and your marginal tax rate is 41 0 This marginal tax rate means that your immediate additional income will be taxed at this rate

State income tax 1 to 13 3 Social Security 6 2 Medicare 1 45 to 2 35 state disability insurance 1 2 The total tax varies depending on your earnings number of dependents and other factors The combined tax percentage usually ranges from 20 to 35 Updated on Jul 06 2024 The California Paycheck Calculator is a powerful tool designed to help employees and employers in California accurately calculate the net take home pay after deductions such as federal and state taxes Social Security Medicare and other withholdings This guide provides an in depth understanding of the calculator s utility its audience and

What Is The Take Home Pay For 80000 In California

What Is The Take Home Pay For 80000 In California

https://www.getmakedigital.com/assets/nhs/monthly_take_home_pay_band_5.jpg

Take Two Quits From The Rivalry To Acquire Codemasters After EA s Offer

https://www.dualshockers.com/static/uploads/2020/12/Take-Two.jpg

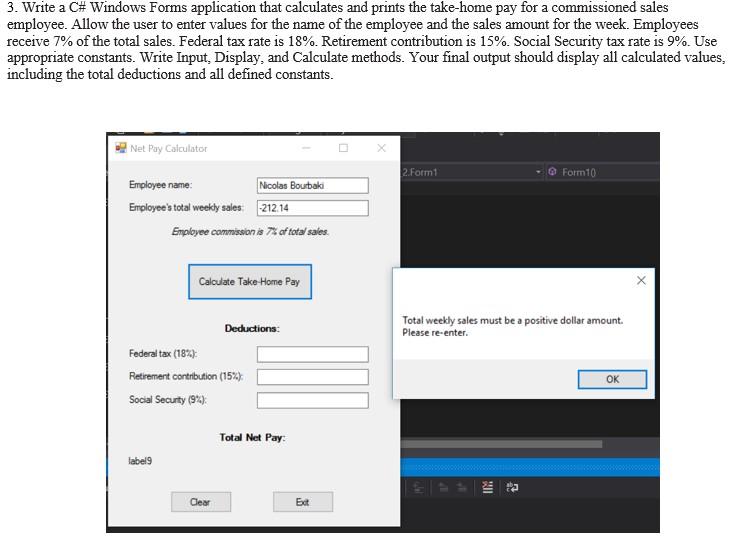

Solved 3 Write A C Windows Forms Application That Chegg

https://media.cheggcdn.com/media/171/17130fe6-1b12-4af6-af5f-2e96e02d4fe3/phpPLLm9L

As you can confirm in the California state tax calculator the result becomes 3 130 Regarding the local income tax we have to consider ETT and SDI 0 1 and 1 1 respectively Both makes 1 177 118 1 284 Finally to get your take home pay subtract all the taxes stated above from your AGI Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major

For Social Security the tax is 6 2 of your earnings up to a certain limit 160 200 in 2023 and for Medicare the tax is 1 45 of your earnings with no limit Some high income earners may also have to pay an additional 0 9 Medicare surtax Filing 80 000 00 of earnings will result in 3 580 70 of your earnings being taxed as state tax calculation based on 2024 California State Tax Tables This results in roughly 19 142 of your earnings being taxed in total although depending on your situation there may be some other smaller taxes added on Although this is the case keep in

More picture related to What Is The Take Home Pay For 80000 In California

Homemyexm This Is The Take Home Exam Of HFL1501 2022 It Will Grant

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/a729efc520ca3e66146b680e50b791da/thumb_1200_1697.png

Image

https://i.etsystatic.com/5672036/r/il/e615c4/1574796809/il_794xN.1574796809_os3v.jpg

Leave A Reply Cancel Reply

https://depedlps.club/wp-content/uploads/2018/02/Implementation-of-P-5000-take-home-pay-deped-personnel.png

The 80 000 00 California tax example uses standard assumptions for the tax calculation This tax example is therefore a flat example of your tax bill in California for the 2024 tax year Take Home Pay for 2024 factoring State and local Taxes see below 60 242 54 What Amount Minus Total Gross Annual Salary 80 000 00 Federal Income California requires most employers to pay unemployment insurance tax to help compensate workers who are out of work through no fault of their own Employers pay California unemployment tax on the first 7 000 SUI ETT and 153 164 SDI of an employee s wages For 2023 the SDI tax is 0 9 and the maximum tax for an employee is 1 378 48

FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024 For example let s look at a salaried employee who is paid 52 000 per year If this employee s pay frequency is weekly the calculation is 52 000 52 payrolls 1 000 gross pay If this employee s pay frequency is semi monthly the calculation is 52 000 24 payrolls 2 166 67 gross pay

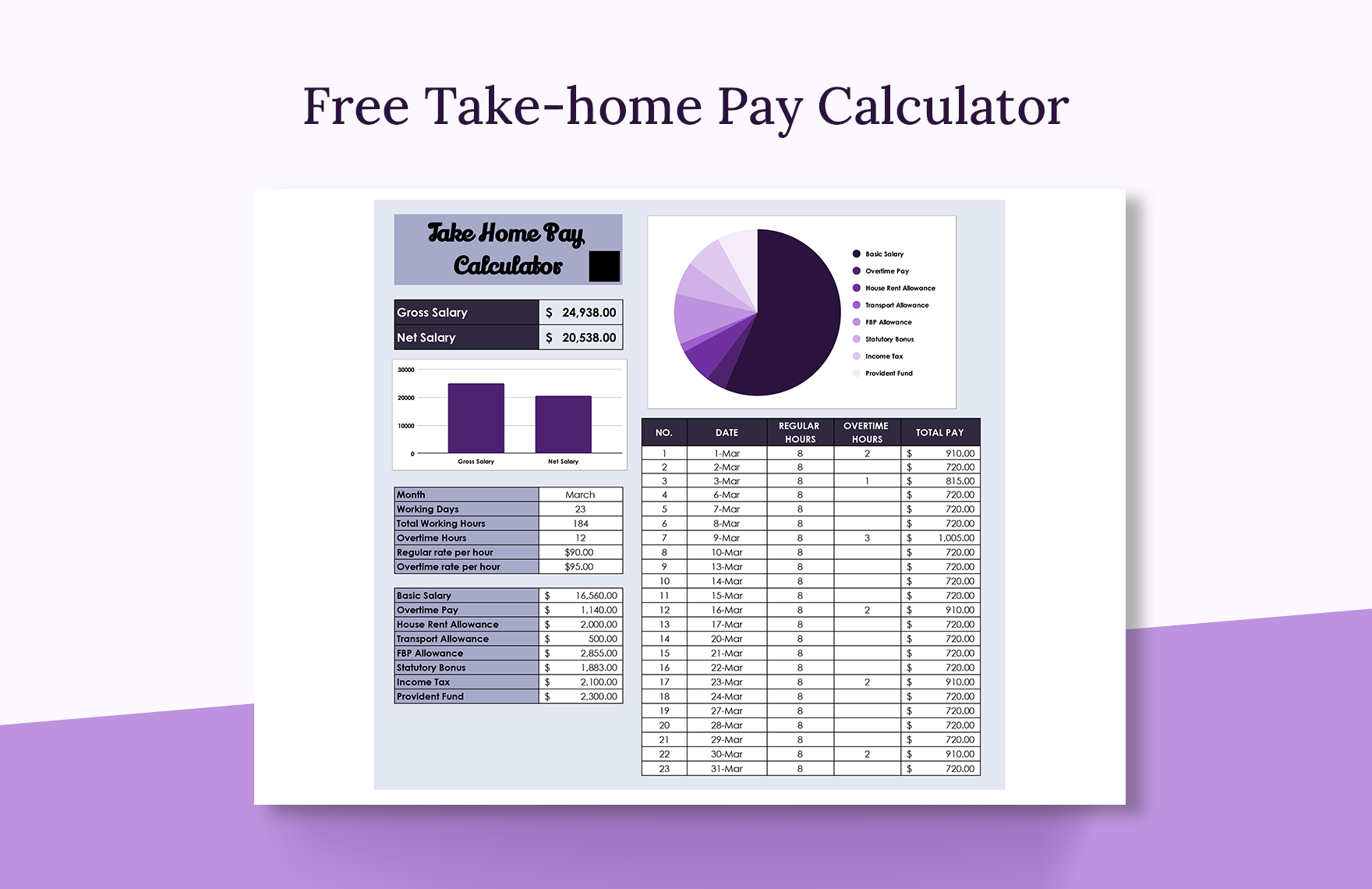

Free Take home Pay Calculator Google Sheets Excel Template

https://images.template.net/130562/take-home-pay-calculator-9l0y3.png

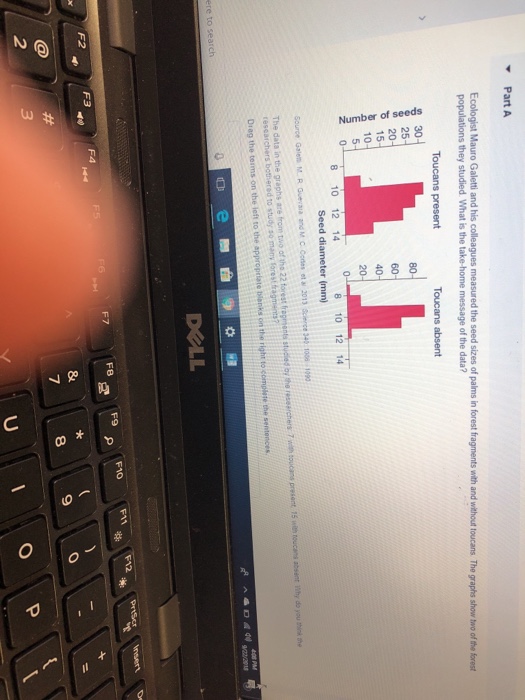

Solved Part A Ecologist Mauro Galetti And His Colleagues Chegg

https://media.cheggcdn.com/media/173/1733f9a7-bc62-41fc-a61f-c42d32c850a9/image

What Is The Take Home Pay For 80000 In California - Filing 80 000 00 of earnings will result in 3 580 70 of your earnings being taxed as state tax calculation based on 2024 California State Tax Tables This results in roughly 19 142 of your earnings being taxed in total although depending on your situation there may be some other smaller taxes added on Although this is the case keep in