How Much Is 75k A Year After Taxes In Missouri Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major

In the year 2024 in the United States 75 000 a year gross salary after tax is 59 995 annual 4 521 monthly 1 040 weekly 207 97 daily and 26 hourly gross based on the information provided in the calculator above Check the table below for a breakdown of 75 000 a year after tax in the United States Yearly What is a 75k after tax 75000 Federal and State Tax Calculation by the US Salary Calculator which can be used to calculate your 2024 tax return and tax refund calculations 60 921 50 net salary is 75 000 00 gross salary

How Much Is 75k A Year After Taxes In Missouri

How Much Is 75k A Year After Taxes In Missouri

https://i.ytimg.com/vi/-7S5AdqpS1k/maxresdefault.jpg

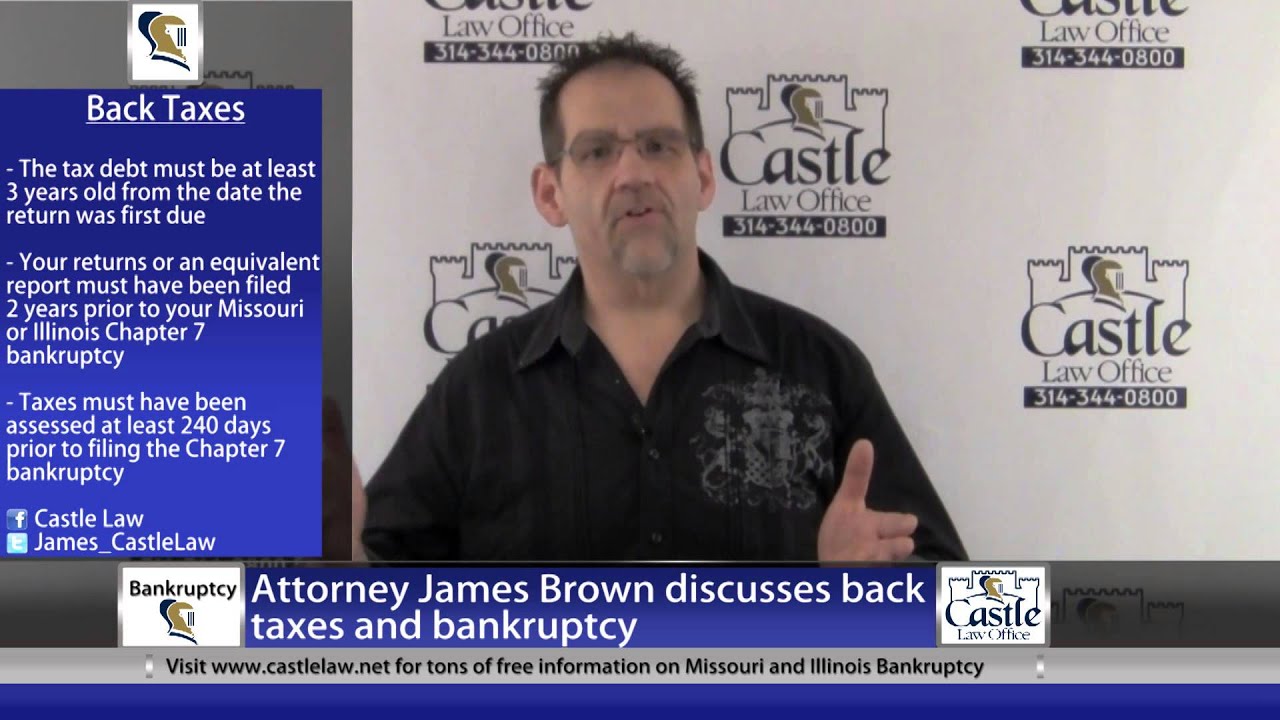

Bankruptcy And Back Taxes In Missouri YouTube

https://i.ytimg.com/vi/QrdPIaGOTeM/maxresdefault.jpg

75 000 A Year Is How Much An Hour And Best Jobs To Give You 75K

https://radicalfire.com/wp-content/uploads/2022/09/75000-A-Year-Is-How-Much-An-Hour-and-Best-Jobs-To-Give-You-75K.jpg

The average annual salary in the United States is 69 368 which is around 4 537 a month after taxes and contributions depending on where you live However extremely high earners tend to bias averages Likewise average salaries vary state by state such as California s salaries averaging 83 876 a year compared to Florida s at 63 336 Missouri tax brackets remain the same for all taxpayers regardless of filing status There are eight tax brackets in the Show Me State ranging from 0 to 4 95 Beginning in calendar year 2024 Missouri s top income tax rate falls to 4 8 A financial advisor in Missouri can help you understand how taxes fit into your overall financial goals

Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly They are used to fund social Security and Medicare For example in the 2020 tax year the Social Security tax is 6 2 for employees and 1 45 for the Medicare tax 37 609 351 or more 731 201 or more 365 601 or more 690 351 or more Use our United States Salary Tax calculator to determine how much tax will be paid on your annual Salary Federal tax state tax Medicare as well as Social Security tax allowances are all taken into account and are kept up to date with 2024 25 rates

More picture related to How Much Is 75k A Year After Taxes In Missouri

Jobs That Pay 75K A Year Or More With No Experience Required

https://gigsdoneright.com/wp-content/uploads/2023/01/jobs-that-pay-75k-a-year.jpg

How Much Tax Is Taken Out Of Paycheck In Texas TaxesTalk

https://www.taxestalk.net/wp-content/uploads/see-what-a-100k-salary-looks-like-after-taxes-in-your-state.jpeg

44 000 A Year Is How Much An Hour

https://savvybudgetboss.com/wp-content/uploads/2022/04/40000-a-year-after-taxes.png

The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator Launch ADP s Missouri Paycheck Calculator to estimate your or your employees net pay Free and simple Fast easy accurate payroll and tax so you can save time and money Payroll Overview Overview Small Business Payroll 1 49 Employees For over 70 years ADP has helped enterprise organizations with 1 000 employees make the

Summary If you make 75 000 a year living in the region of Missouri USA you will be taxed 18 110 That means that your net pay will be 56 891 per year or 4 741 per month Your average tax rate is 24 2 and your marginal tax rate is 35 0 This marginal tax rate means that your immediate additional income will be taxed at this rate To effectively use the Missouri Paycheck Calculator follow these steps Enter your gross pay for the pay period Choose your pay frequency e g weekly bi weekly monthly Input your filing status and the number of allowances you claim Add any additional withholdings or deductions such as retirement contributions or health insurance premiums

Gas Taxes In Your State Associated Industries Of Missouri

https://a4gb.files.wordpress.com/2019/07/unnamed.png?w=660

18 Jobs That Pay 75k A Year Without A Degree You Can Do These

https://lifeandmyfinances.com/wp-content/uploads/2021/11/18-Jobs-That-Pay-75k-a-Year-Without-a-Degree-pin.jpg

How Much Is 75k A Year After Taxes In Missouri - 75k Salary After Tax in Missouri 2024 This Missouri salary after tax example is based on a 75 000 00 annual salary for the 2024 tax year in Missouri using the State and Federal income tax rates published in the Missouri tax tables The 75k salary example provides a breakdown of the amounts earned and illustrates the typical amounts paid each month week day and hour