How Much Is 71000 A Year After Taxes Before reviewing the exact calculations in the 71 000 00 after tax salary example it is important to first understand the setting we used in the US Tax calculator to produce this salary example Answer is 36 65 assuming you work roughly 40 hours per week or you may want to know how much 71k a year is per month after taxes Answer

In the year 2024 in the United States 71 000 a year gross salary after tax is 57 181 annual 4 312 monthly 991 79 weekly 198 36 daily and 24 79 hourly gross based on the information provided in the calculator above Check the table below for a breakdown of 71 000 a year after tax in the United States Yearly FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024

How Much Is 71000 A Year After Taxes

How Much Is 71000 A Year After Taxes

https://savoteur.com/wp-content/uploads/2022/07/37000-a-year-is-how-much-an-hour-2.jpg

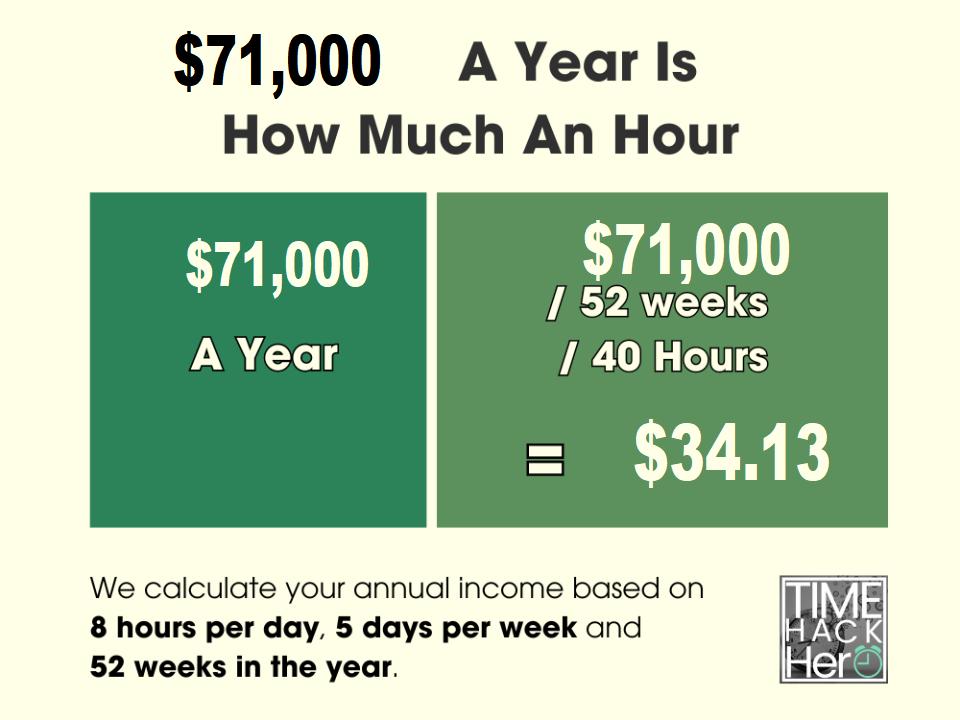

71 000 A Year Is How Much An Hour Before And After Taxes The Next

https://thenextgenbusiness.com/wp-content/uploads/2021/07/71000dollarsayear-1024x616.webp

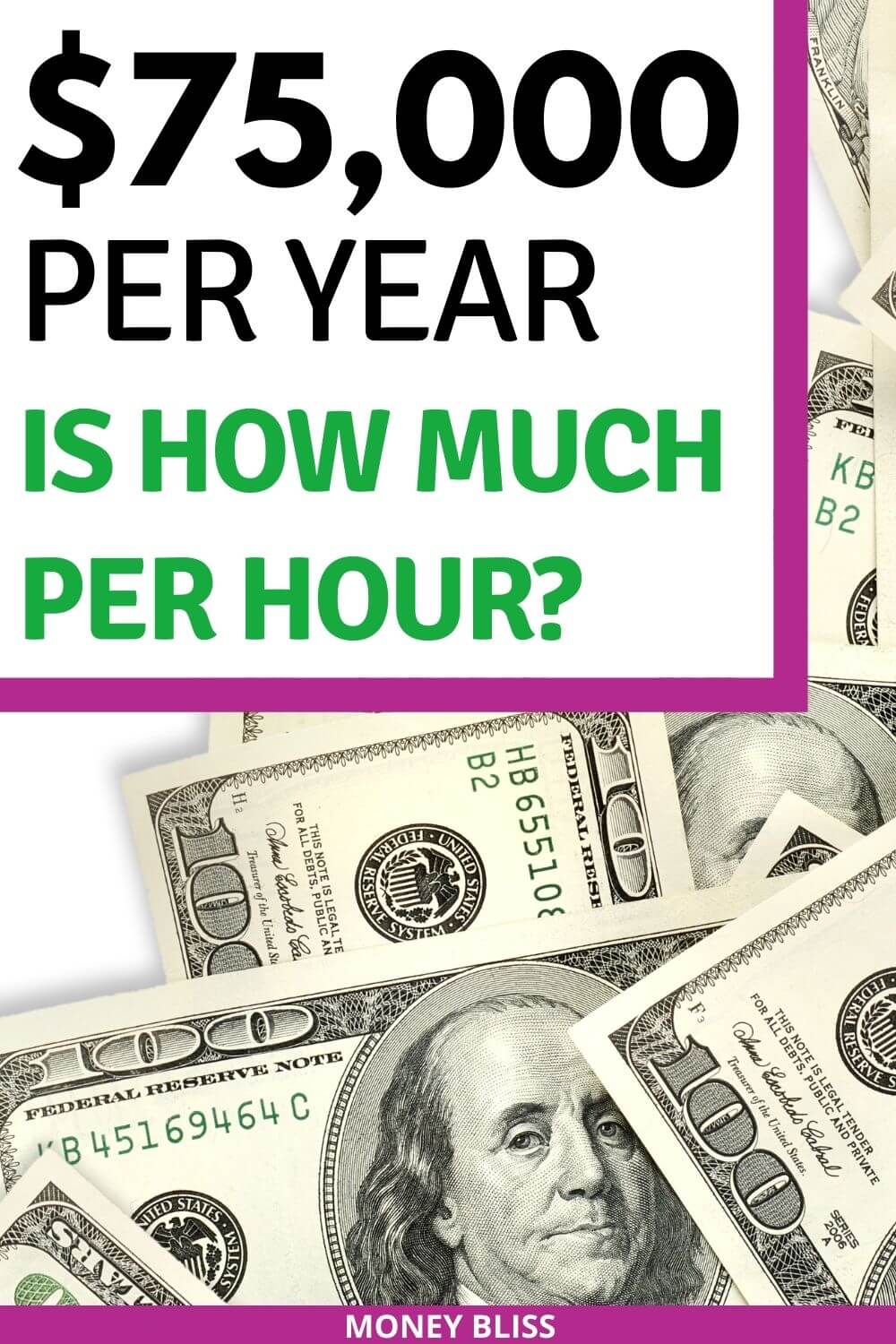

75000 A Year Is How Much An Hour Good Salary Money Bliss

https://moneybliss.org/wp-content/uploads/2021/11/75000-a-year.jpg

The average annual salary in the United States is 69 368 which is around 4 537 a month after taxes and contributions depending on where you live However extremely high earners tend to bias averages Likewise average salaries vary state by state such as California s salaries averaging 83 876 a year compared to Florida s at 63 336 71 000 00 After Tax This income tax calculation for an individual earning a 71 000 00 salary per year The calculations illustrate the standard Federal Tax State Tax Social Security and Medicare paid during the year assuming no changes to salary or circumstance

Roughly if you make a yearly salary of 71 000 you will need to pay between 11 36k to 17 04k in taxes Let s be conservative and estimate based on the higher taxes of 17 04k We are also going to assume that you get two weeks of paid vacation per year 71 000 17040 2080 25 an hour That means that after taxes you will have an Summary If you make 71 000 a year living in the region of Texas USA you will be taxed 13 820 That means that your net pay will be 57 181 per year or 4 765 per month Your average tax rate is 19 5 and your marginal tax rate is 29 7 This marginal tax rate means that your immediate additional income will be taxed at this rate

More picture related to How Much Is 71000 A Year After Taxes

How Much Is 250 000 A Year After Taxes filing Single Smart

https://smartpersonalfinance.info/wp-content/uploads/2022/04/after-tax-income-on-250000-dollars.png

How Much Did Jane Earn Before Taxes New Countrymusicstop

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

71000 A Year Is How Much An Hour Before And After Taxes

https://timehackhero.com/wp-content/uploads/2023/10/71000-a-Year-is-How-Much-an-Hour.jpg

So after taxes you would have approximately 55 380 left as your annual income To calculate your monthly income after taxes you can divide 55 380 by 12 since there are 12 months in a year 55 380 annual income after tax 12 months 4 615 So at a yearly salary of 71 000 your monthly income after taxes would be approximately The first 9 950 are taxed with 10 the next 30 575 with 12 There are further tax brackets with rates of 22 24 32 35 and 37 You will have to pay 7 880 in federal income tax as a single filer on earned income of 71 000 a year

Summary If you make 71 000 a year living in the region of California USA you will be taxed 18 075 That means that your net pay will be 52 925 per year or 4 410 per month Your average tax rate is 25 5 and your marginal tax rate is 41 0 This marginal tax rate means that your immediate additional income will be taxed at this rate 71 000 a year is 2 730 77 biweekly before taxes and approximately 2 048 08 after taxes Paying a tax rate of 25 and working full time at 40 hours a week you would earn 2 048 08 after taxes To calculate how much you make biweekly before taxes you would multiply the hourly wage for 71 000 a year 34 13 by 80 hours to get 2 730 77

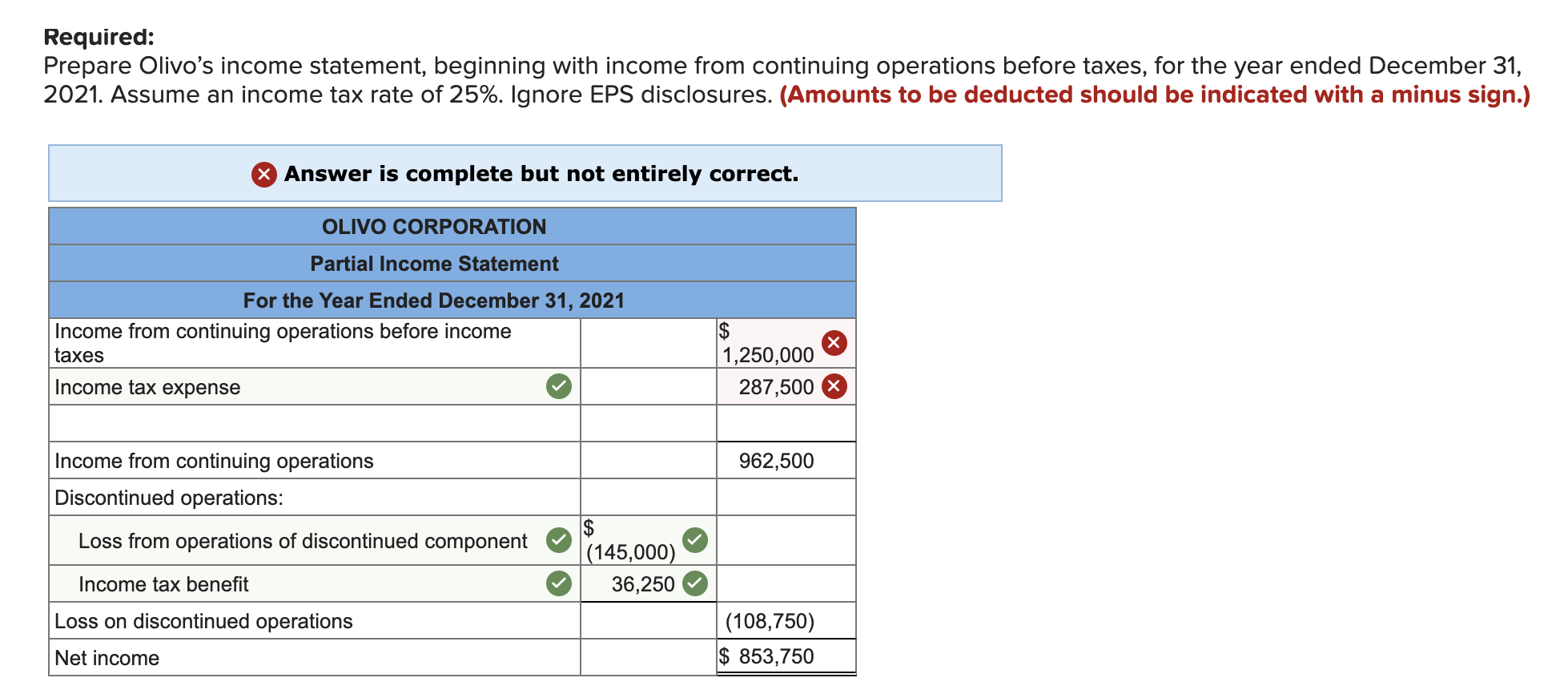

Solved For The Year Ending December 31 2021 Olivo Chegg

https://media.cheggcdn.com/media/ed2/ed21eb87-6154-4d25-b186-c81041f58e83/phpPre585

How Much Is Your Time Worth ShimSpine

https://www.shimspine.com/wp-content/uploads/2016/11/FamilyFunStandUpPaddling.jpg

How Much Is 71000 A Year After Taxes - 2014 46 784 2013 46 337 2012 41 553 Every taxpayer in North Carolina will pay 4 75 of their taxable income in state taxes North Carolina has not always had a flat income tax rate though In 2013 the North Carolina Tax Simplification and Reduction Act radically changed the way the state collected taxes