How Much Is 71000 After Taxes In California Summary If you make 71 000 a year living in the region of California USA you will be taxed 18 075 That means that your net pay will be 52 925 per year or 4 410 per month Your average tax rate is 25 5 and your marginal tax rate is 41 0 This marginal tax rate means that your immediate additional income will be taxed at this rate

The average annual salary in the United States is 69 368 which is around 4 537 a month after taxes and contributions depending on where you live However extremely high earners tend to bias averages Likewise average salaries vary state by state such as California s salaries averaging 83 876 a year compared to Florida s at 63 336 In the year 2024 in the United States 71 000 a year gross salary after tax is 57 181 annual 4 312 monthly 991 79 weekly 198 36 daily and 24 79 hourly gross based on the information provided in the calculator above Check the table below for a breakdown of 71 000 a year after tax in the United States Yearly

How Much Is 71000 After Taxes In California

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

How Much Is 71000 After Taxes In California

https://www.investopedia.com/thmb/9xFmEb6FVlX0hIqe4MC_vVtlHLk=/1355x1142/filters:no_upscale():max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg

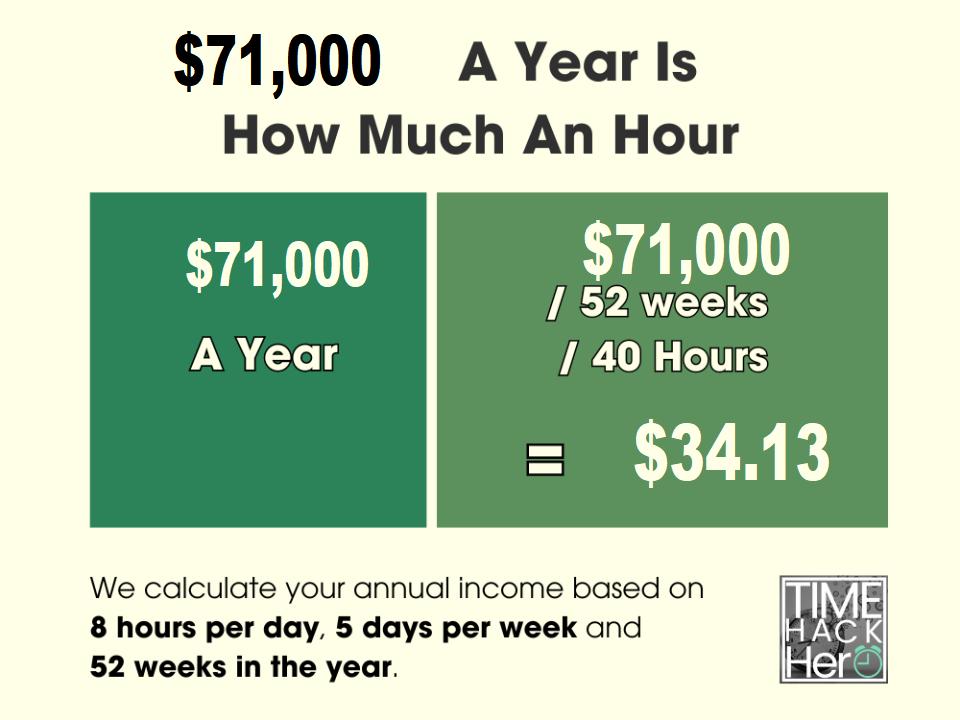

71 000 A Year Is How Much An Hour Before And After Taxes The Next

https://thenextgenbusiness.com/wp-content/uploads/2021/07/71000dollarsayear-1024x616.webp

/GettyImages-1190995919-bce27cedc8fa4274b70ffcd0062e6098.jpg)

A Brief History Of Taxes In The U S

https://www.investopedia.com/thmb/cHigOcnY9JPQ4CjU4oshzsrEVm4=/2152x1393/filters:fill(auto,1)/GettyImages-1190995919-bce27cedc8fa4274b70ffcd0062e6098.jpg

FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024 71 000 00 After Tax This income tax calculation for an individual earning a 71 000 00 salary per year The calculations illustrate the standard Federal Tax State Tax Social Security and Medicare paid during the year assuming no changes to salary or circumstance State for Tax Purposes California Base Salary 71 000 00 Payment

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major Your employer withholds a 6 2 Social Security tax and a 1 45 Medicare tax from your earnings after each pay period Take note Individuals earning over 200 000 as well as joint filers over 250 000 and those married but filing separately with incomes above 125 000 also pay a 0 9 Medicare surtax

More picture related to How Much Is 71000 After Taxes In California

See What A 100K Salary Looks Like After Taxes In Your State

https://cdn.gobankingrates.com/wp-content/uploads/2019/07/Bentonville-Arkansas-shutterstock_1366857071.jpg?quality=80

How Much Did Jane Earn Before Taxes New Countrymusicstop

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

See What A 100K Salary Looks Like After Taxes In Your State

https://cdn.gobankingrates.com/wp-content/uploads/2018/03/50-Wyoming-shutterstock_723587425.jpg?quality=80

The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator If you make 73 000 a year living in the region of California USA you will be taxed 18 895 That means that your net pay will be 54 105 per year or 4 509 per month Your average tax rate is 25 9 and your marginal tax rate is 41 0 This marginal tax rate means that your immediate additional income will be taxed at this rate

Age Enter the age you were on Jan 1 2024 Your age can have an effect on certain tax rules or deductions For example people aged 65 or older get a higher standard deduction 401 k Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly They are used to fund social Security and Medicare For example in the 2020 tax year the Social Security tax is 6 2 for employees and 1 45 for the Medicare tax

How High Will California s Taxes Go Before There s No One Left To Tax

https://d2eehagpk5cl65.cloudfront.net/img/q60/uploads/2022/01/Thumbnail-2-2.jpg

71000 A Year Is How Much An Hour Before And After Taxes

https://timehackhero.com/wp-content/uploads/2023/10/71000-a-Year-is-How-Much-an-Hour.jpg

How Much Is 71000 After Taxes In California - Summary If you make 76 000 a year living in the region of California USA you will be taxed 20 124 That means that your net pay will be 55 876 per year or 4 656 per month Your average tax rate is 26 5 and your marginal tax rate is 41 0 This marginal tax rate means that your immediate additional income will be taxed at this rate