How Much Is 42000 After Taxes FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024

An individual who receives 34 958 25 net salary after taxes is paid 42 000 00 salary per year after deducting State Tax Federal Tax Medicare and Social Security Let s look at how to calculate the payroll deductions in the US How to calculate Tax Medicare and Social Security on a 42 000 00 salary How much is 42 000 a Year After Tax in the United States In the year 2024 in the United States 42 000 a year gross salary after tax is 35 507 annual 2 691 monthly 618 92 weekly 123 78 daily and 15 47 hourly gross based on the information provided in the calculator above Check the table below for a breakdown of 42 000 a year

How Much Is 42000 After Taxes

How Much Is 42000 After Taxes

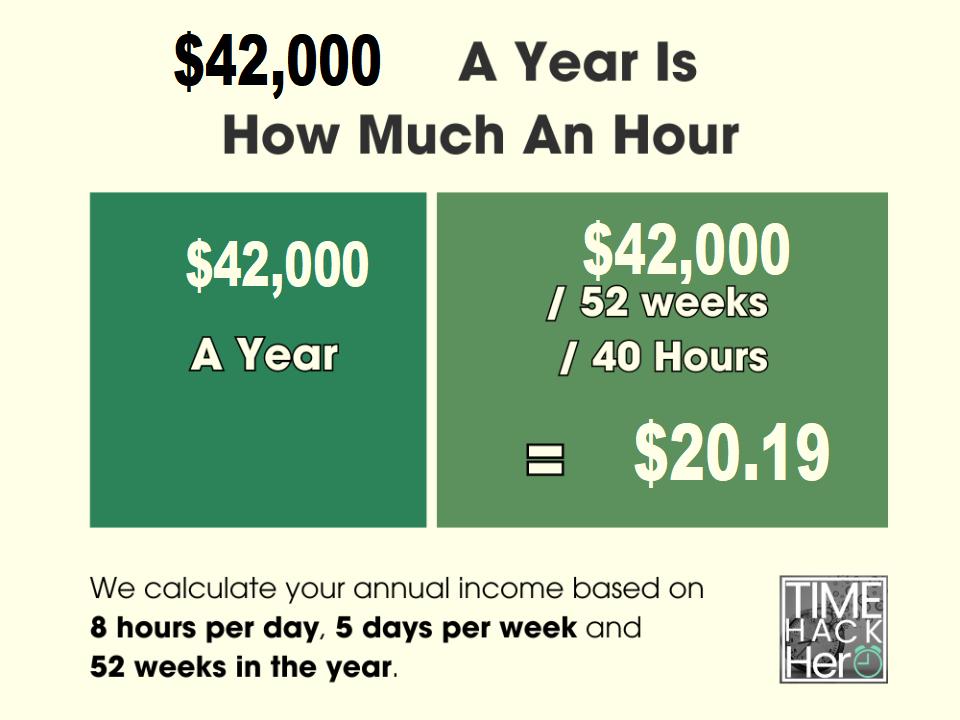

https://timehackhero.com/wp-content/uploads/2023/10/42000-a-Year-is-How-Much-an-Hour.jpg

How Much Is 42000 A Year Per Hour Aimingthedreams

https://aimingthedreams.com/wp-content/uploads/2022/08/42000-768x1152.jpg

How Much Is Itel P35 Pro In Nigeria Solaroid Energy

https://solaroidenergy.com/wp-content/uploads/2023/03/how-much-is-itel-p35-pro-in-nigeria.jpg

42 000 00 After Tax This income tax calculation for an individual earning a 42 000 00 salary per year The calculations illustrate the standard Federal Tax State Tax Social Security and Medicare paid during the year assuming no changes to salary or circumstance Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly They are used to fund social Security and Medicare For example in the 2020 tax year the Social Security tax is 6 2 for employees and 1 45 for the Medicare tax

Age Enter the age you were on Jan 1 2024 Your age can have an effect on certain tax rules or deductions For example people aged 65 or older get a higher standard deduction 401 k 37 609 351 or more 731 201 or more 365 601 or more 690 351 or more Use our United States Salary Tax calculator to determine how much tax will be paid on your annual Salary Federal tax state tax Medicare as well as Social Security tax allowances are all taken into account and are kept up to date with 2024 25 rates

More picture related to How Much Is 42000 After Taxes

How Much Is 42 000 A Year After Taxes filing Single 2023 Smart

https://smartpersonalfinance.info/wp-content/uploads/2022/08/after-tax-income-on-42000-dollars-sm-2-1024x768.png

Top 10 How Much Is 42000 A Year After Taxes That Will Change Your Life

https://blueworlddreams.com/wp-content/uploads/2022/01/42000-a-year-is-how-much-an-hour.jpg

How Much Does An Engagement Ring Setting Cost Cheapest Buying Save 62

https://i.shgcdn.com/afc56d34-755b-492c-bb95-9070617915bb/-/format/auto/-/preview/3000x3000/-/quality/lighter/

Estimate your US federal income tax for 2023 2022 2021 2020 2019 2018 2017 2016 or 2015 using IRS formulas The calculator will calculate tax on your taxable income only Does not include income credits or additional taxes Does not include self employment tax for the self employed After you use the estimator Use your estimate to change your tax withholding amount on Form W 4 Or keep the same amount To change your tax withholding amount Enter your new tax withholding amount on Form W 4 Employee s Withholding Certificate Ask your employer if they use an automated system to submit Form W 4 Submit or give Form W 4 to

How to calculate annual income To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000 In the year 2023 in the United States 42 000 a month gross salary after tax is 335 881 annual 26 394 monthly 6 070 weekly 1 214 daily and 151 75 hourly gross based on the information provided in the calculator above Check the table below for a breakdown of 42 000 a month after tax in the United States Yearly

10 What Is 10 Of 42000 HiedieCayne

https://static.seekingalpha.com/uploads/2021/10/9/saupload_OOpAI9nOoD_wBAmUpOlLnD5Bg3gxwU9kQbV0uEov1sTACUXvoD_1TXpyzMJ4CH-cFpvVQG_hTXg2VAE4KErHUgo0lwNcpBc3-KfofE10pMmvayoRLvBgv5LEf7j16f6FWpUSBekA_s0.png

How Much Did Jane Earn Before Taxes New Countrymusicstop

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

How Much Is 42000 After Taxes - Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly They are used to fund social Security and Medicare For example in the 2020 tax year the Social Security tax is 6 2 for employees and 1 45 for the Medicare tax