How Much Is 42000 After Taxes In Ny Summary If you make 42 000 a year living in the region of New York USA you will be taxed 8 550 That means that your net pay will be 33 450 per year or 2 787 per month Your average tax rate is 20 4 and your marginal tax rate is 26 0 This marginal tax rate means that your immediate additional income will be taxed at this rate

State income tax 4 to 10 9 local income tax Social Security 6 2 Medicare 1 45 to 2 35 State Disability Insurance 0 5 Paid Family and Medical Leave 0 455 Updated on Jul 06 2024 Free tool to calculate your hourly and salary income after federal state and local taxes in New York New York paycheck calculator Use ADP s New York Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees Just enter the wages tax withholdings and other information required below and our tool will take care of the rest

How Much Is 42000 After Taxes In Ny

How Much Is 42000 After Taxes In Ny

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

42000 A Year Is How Much An Hour Good Salary To Live On Money Bliss

https://moneybliss.org/wp-content/uploads/2022/12/42000-a-year.jpg

42 000 A Year Is How Much An Hour Can You Live Off It

https://logicaldollar.com/wp-content/uploads/2022/11/42000-a-year-how-much-an-hour.jpg

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major New York State Tax Quick Facts State income tax 4 10 9 NYC income tax 3 078 3 876 in addition to state tax Sales tax 4 local tax 3 4 875 Property tax 1 73 average effective rate Gas tax 25 35 cents per gallon of regular gasoline 23 7 to 25 3 cents per gallon of diesel For taxpayers in the state of New York there s

To use our New York Salary Tax Calculator all you need to do is enter the necessary details and click on the Calculate button After a few seconds you will be provided with a full breakdown of the tax you are paying This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024

More picture related to How Much Is 42000 After Taxes In Ny

What Happens If You Don t Pay Your Taxes A Complete Guide All

https://www.allthingsfinance.net/wp-content/uploads/2020/04/image1-56-1536x1086.jpg

What Is BBVA Immediate Cash And How Much Is The Commission American Post

https://www.americanpost.news/wp-content/uploads/2022/02/What-is-BBVA-Immediate-Cash-and-how-much-is-the.jpg

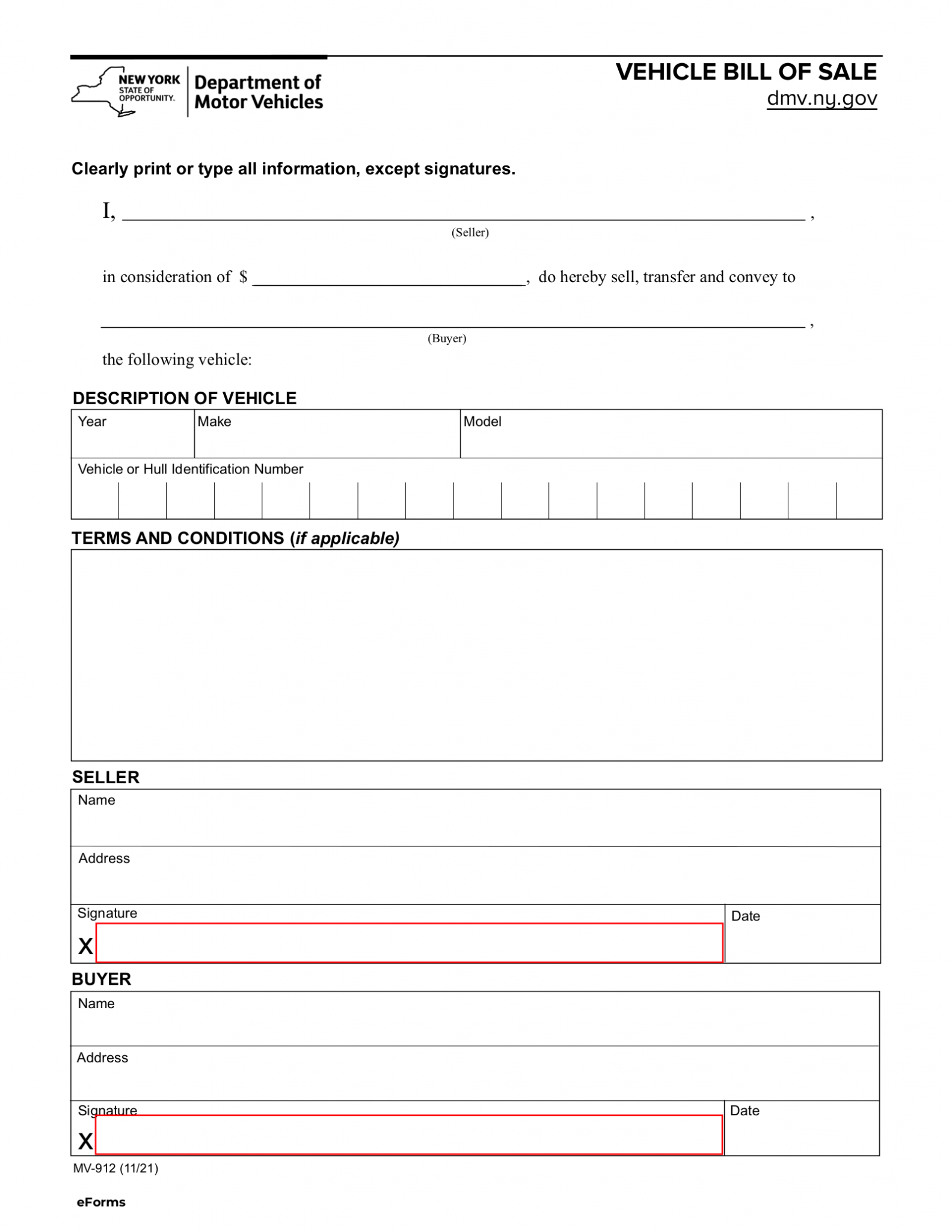

Formularios Gratuitos De Factura De Venta De Nueva York PDF formularios

https://eforms.com/images/2015/12/New-York-DMV-Bill-of-Sale-Form-mv-912-1583x2048.png

Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly They are used to fund social Security and Medicare For example in the 2020 tax year the Social Security tax is 6 2 for employees and 1 45 for the Medicare tax New York Income Tax Calculator 2023 2024 Learn More On TurboTax s Website If you make 70 000 a year living in New York you will be taxed 11 074 Your average tax rate is 10 94 and your

What is 35 731 00 as a gross salary An individual who receives 35 731 00 net salary after taxes is paid 42 000 00 salary per year after deducting State Tax Federal Tax Medicare and Social Security Let s look at how to calculate the payroll deductions in the US How to calculate Tax Medicare and Social Security on a 42 000 00 salary How much is 42 000 a Year After Tax in the United States In the year 2024 in the United States 42 000 a year gross salary after tax is 35 507 annual 2 691 monthly 618 92 weekly 123 78 daily and 15 47 hourly gross based on the information provided in the calculator above Check the table below for a breakdown of 42 000 a year

42000 After Tax Calculator How Much Is Salary After Tax 42k In UK

https://www.londonbusinessblog.co.uk/wp-content/uploads/2023/03/tax-after-42k-in-uk.png

How Much Is The Down Payment For A 575 000 Home Moreira Team Mortgage

https://moreirateam.com/wp-content/uploads/down-payment-for-a-575000-dollar-house.jpg

How Much Is 42000 After Taxes In Ny - To use our New York Salary Tax Calculator all you need to do is enter the necessary details and click on the Calculate button After a few seconds you will be provided with a full breakdown of the tax you are paying This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs