How Much Is 38000 Monthly After Tax FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024

The 12 month period for income taxes begins on January 1st and ends on December 31st of the same calendar year The federal income tax rates differ from state income tax rates Federal taxes are progressive higher rates on higher income levels At the same time states have an advanced tax system or a flat tax rate on all income Before reviewing the exact calculations in the 38 000 00 after tax salary example it is important to first understand the setting we used in the US Tax calculator to produce this salary example Answer is 19 62 assuming you work roughly 40 hours per week or you may want to know how much 38k a year is per month after taxes Answer

How Much Is 38000 Monthly After Tax

How Much Is 38000 Monthly After Tax

https://moneybliss.org/wp-content/uploads/2022/04/38000-a-year-1.jpg

NBN Scams Conning Australians Out Of 110 000 Every Month

https://securitybrief.com.au/uploads/story/2019/06/18/compatible_GettyImages-917611508.jpg

How Much Money Do Sushi Chefs Typically Make

https://www.mashed.com/img/gallery/how-much-money-do-sushi-chefs-typically-make/the-average-sushi-chef-makes-38000-per-year-1647297030.jpg

The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator Whether your pay is weekly bi weekly monthly or yearly this calculator can help you figure out your after tax income once you enter your gross pay and additional details Use our take home pay

The average annual salary in the United States is 69 368 which is around 4 537 a month after taxes and contributions depending on where you live However extremely high earners tend to bias averages Likewise average salaries vary state by state such as California s salaries averaging 83 876 a year compared to Florida s at 63 336 In 2022 your employer will withhold 6 2 of your wages up to 147 000 for Social Security Additionally you must pay 1 45 of all of your wages for Medicare without any limitations If you

More picture related to How Much Is 38000 Monthly After Tax

Of The Payment And b The Amount Of Interest What Was The Amount Of

https://img.homeworklib.com/questions/ae9fdfe0-6f2d-11ea-93be-f35681c5df9e.png?x-oss-process=image/resize,w_560

60 30 10 Rule Budget What Is It How Does It Work

https://wealthywomanfinance.com/wp-content/uploads/2022/10/60-30-10-budget-template-1000-×-1000-px.jpg

38000 A Year Is How Much A Month HOWMUCHSE

https://i2.wp.com/moneybliss.org/wp-content/uploads/2022/04/38000-a-year-768x1152.jpg

Estimate your US federal income tax for 2023 2022 2021 2020 2019 2018 2017 2016 or 2015 using IRS formulas The calculator will calculate tax on your taxable income only Does not include income credits or additional taxes Does not include self employment tax for the self employed 37 609 351 or more 731 201 or more 365 601 or more 690 351 or more Use our United States Salary Tax calculator to determine how much tax will be paid on your annual Salary Federal tax state tax Medicare as well as Social Security tax allowances are all taken into account and are kept up to date with 2024 25 rates

After Tax If your salary is 38 000 then after tax and national insurance you will be left with 29 862 This means that after tax you will take home 2 489 every month or 574 per week 114 80 per day and your hourly rate will be 18 28 if you re working 40 hours week Scroll down to see more details about your 38 000 salary How to calculate annual income To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year For example if an employee earns 1 500 per week the individual s annual income would be 1 500 x 52 78 000

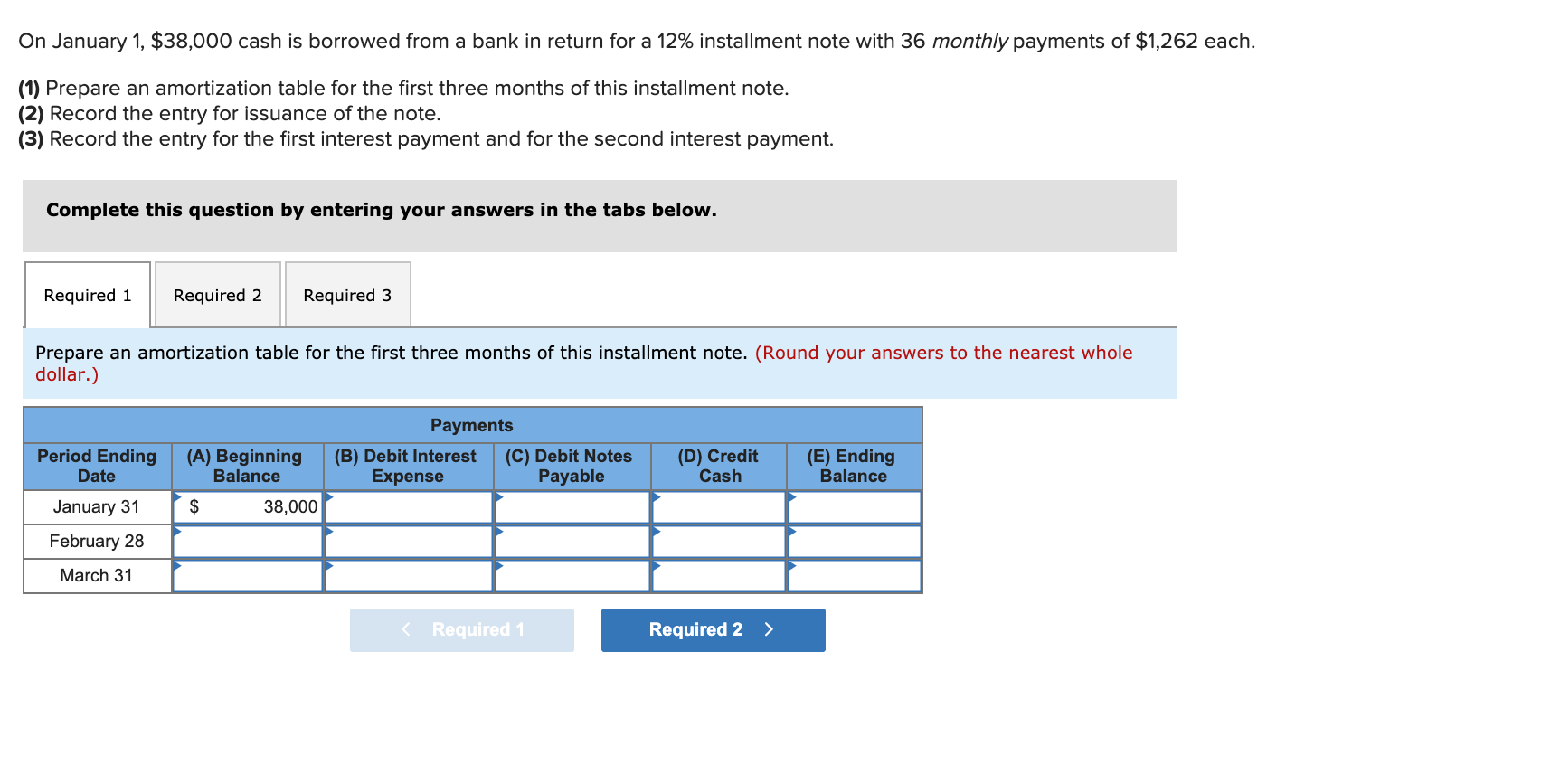

Solved On January 1 38 000 Cash Is Borrowed From A Bank In Chegg

https://media.cheggcdn.com/media/583/583c5b30-fdae-4cfa-ad78-84228bcc4aa1/php07N2nF

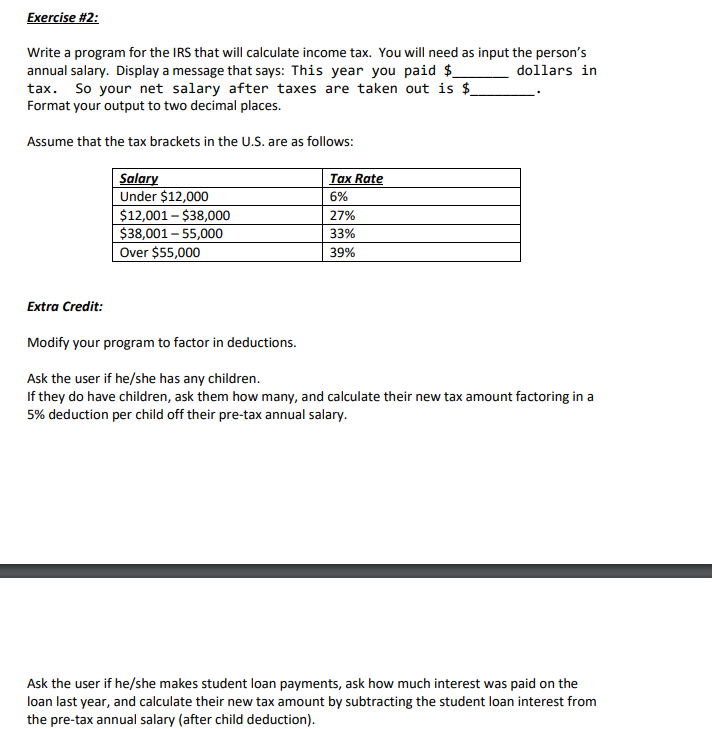

Solved Exercise 2 Write A Program For The IRS That Will Chegg

https://media.cheggcdn.com/media/ebc/ebc3a565-f47c-44c6-ab66-bd93d04d179c/phpJMBzy3.png

How Much Is 38000 Monthly After Tax - The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator