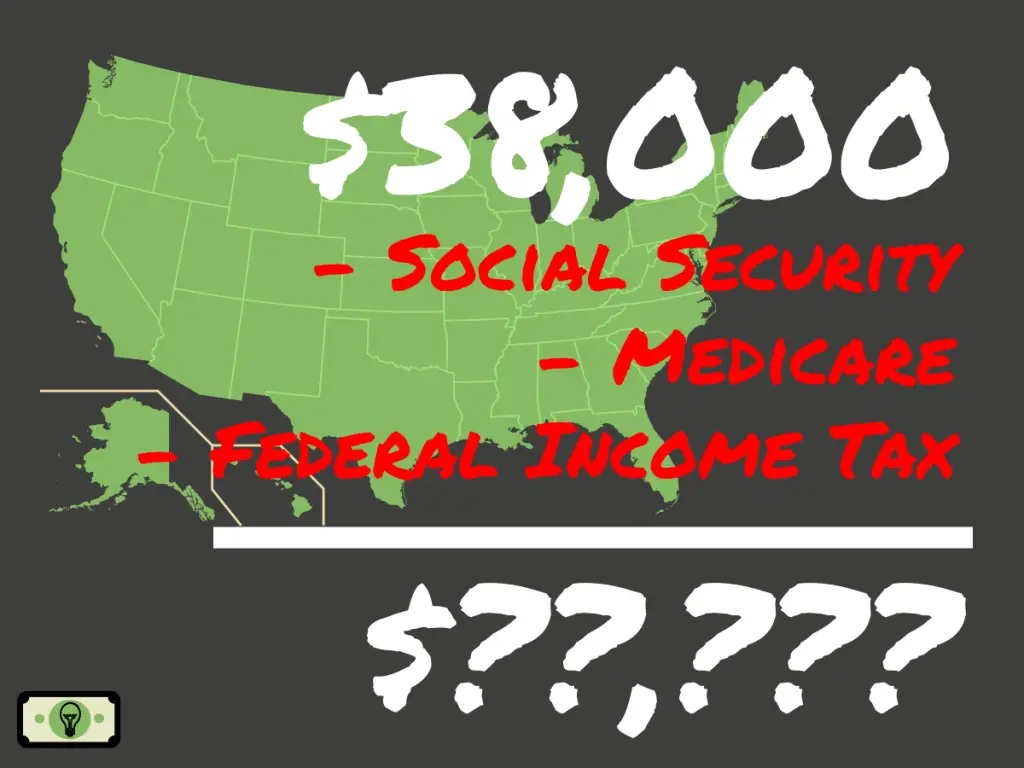

How Much Is 38000 After Tax In the year 2024 in the United States 38 000 a year gross salary after tax is 32 293 annual 2 449 monthly 563 19 weekly 112 64 daily and 14 08 hourly gross based on the information provided in the calculator above Check the table below for a breakdown of 38 000 a year after tax in the United States Yearly

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major An individual who receives 30 695 40 net salary after taxes is paid 38 000 00 salary per year after deducting State Tax Federal Tax Medicare and Social Security Let s look at how to calculate the payroll deductions in the US How to calculate Tax Medicare and Social Security on a 38 000 00 salary

How Much Is 38000 After Tax

How Much Is 38000 After Tax

https://smartpersonalfinance.info/wp-content/uploads/2022/08/after-tax-income-on-38000-dollars-sm-2-1024x768.png

How Much Is A Perm And Other Common Perm FAQs Answered 2021 Sleek

https://i.pinimg.com/originals/3a/7c/5c/3a7c5c7285806de9839c6c942a098cb2.jpg

38000 A Year Is How Much An Hour Good Salary Or No Money Bliss

https://moneybliss.org/wp-content/uploads/2022/04/38000-a-year-1.jpg

38 000 00 After Tax This income tax calculation for an individual earning a 38 000 00 salary per year The calculations illustrate the standard Federal Tax State Tax Social Security and Medicare paid during the year assuming no changes to salary or circumstance For example in the 2020 tax year the Social Security tax is 6 2 for employees and 1 45 for the Medicare tax If your monthly paycheck is 6000 372 goes to Social Security and 87 goes to Medicare leaving you with 6000 372 87 5541

Estimate your US federal income tax for 2023 2022 2021 2020 2019 2018 2017 2016 or 2015 using IRS formulas The calculator will calculate tax on your taxable income only Does not include income credits or additional taxes Does not include self employment tax for the self employed Whether your pay is weekly bi weekly monthly or yearly this calculator can help you figure out your after tax income once you enter your gross pay and additional details Use our take home pay

More picture related to How Much Is 38000 After Tax

How Much Does An Engagement Ring Setting Cost Cheapest Buying Save 62

https://i.shgcdn.com/afc56d34-755b-492c-bb95-9070617915bb/-/format/auto/-/preview/3000x3000/-/quality/lighter/

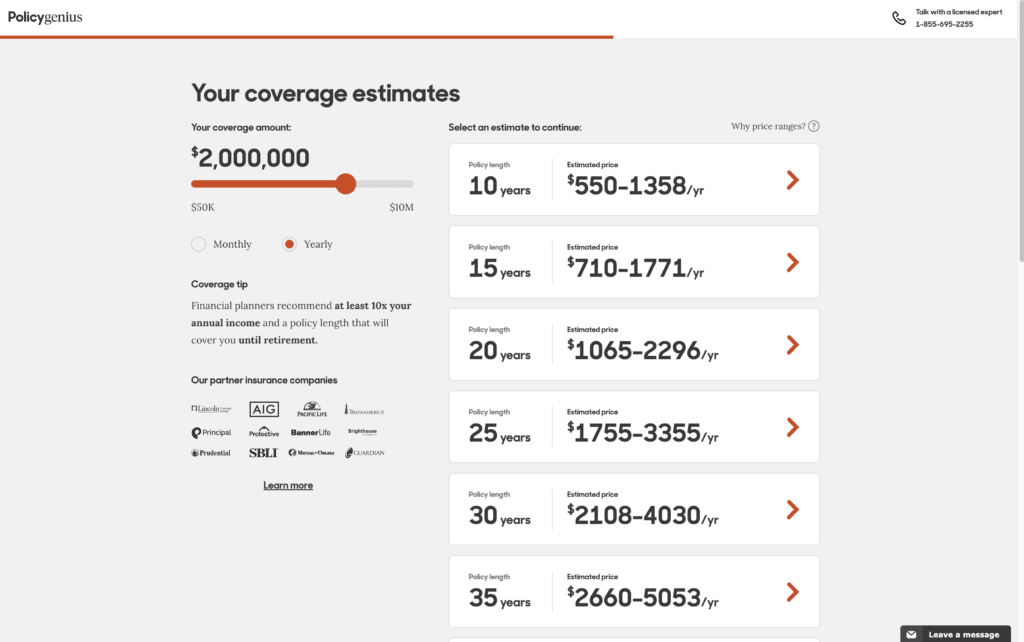

How Much Is 2 Million Life Insurance

https://www.goodfinancialcents.com/wp-content/uploads/2022/04/Cost-of-2-Million-Life-Insurane-with-Policy-Genius-Annual-pay-1024x642.png

If X 3 2 3 2y 3 2 3 2 Then Find X 2 y 2 Brainly in

https://hi-static.z-dn.net/files/d8f/aeb8abeb5eacff35d988066674c764e1.jpg

In 2022 your employer will withhold 6 2 of your wages up to 147 000 for Social Security Additionally you must pay 1 45 of all of your wages for Medicare without any limitations If you The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator

The average annual salary in the United States is 69 368 which is around 4 537 a month after taxes and contributions depending on where you live However extremely high earners tend to bias averages Likewise average salaries vary state by state such as California s salaries averaging 83 876 a year compared to Florida s at 63 336 37 609 351 or more 731 201 or more 365 601 or more 690 351 or more Use our United States Salary Tax calculator to determine how much tax will be paid on your annual Salary Federal tax state tax Medicare as well as Social Security tax allowances are all taken into account and are kept up to date with 2024 25 rates

How Much Tax Will I Pay On 41000 Update New Countrymusicstop

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

What Is BBVA Immediate Cash And How Much Is The Commission American Post

https://www.americanpost.news/wp-content/uploads/2022/02/What-is-BBVA-Immediate-Cash-and-how-much-is-the.jpg

How Much Is 38000 After Tax - Estimate your US federal income tax for 2023 2022 2021 2020 2019 2018 2017 2016 or 2015 using IRS formulas The calculator will calculate tax on your taxable income only Does not include income credits or additional taxes Does not include self employment tax for the self employed