How Much Is 38000 After Taxes In Md The tax calculation below shows exactly how much Maryland State Tax Federal Tax and Medicare you will pay when earning 38 000 00 per annum when living and paying your taxes in Maryland

Income Tax Calculator The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return It is mainly intended for residents of the U S and is based on the tax brackets of 2024 and 2025 The 2025 tax values can be used for 1040 ES estimation planning ahead or comparison Take Home Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2025 tax brackets and the new W 4 which in 2020 has had its first major change since 1987

How Much Is 38000 After Taxes In Md

How Much Is 38000 After Taxes In Md

https://www.gannett-cdn.com/-mm-/3eb9009c1a9366e33a28c376eca11ea26824544a/c=0-44-580-370/local/-/media/2018/04/22/USATODAY/usatsports/MotleyFool-TMOT-33d5f547-taxes_large.jpg?width=3200&height=1680&fit=crop

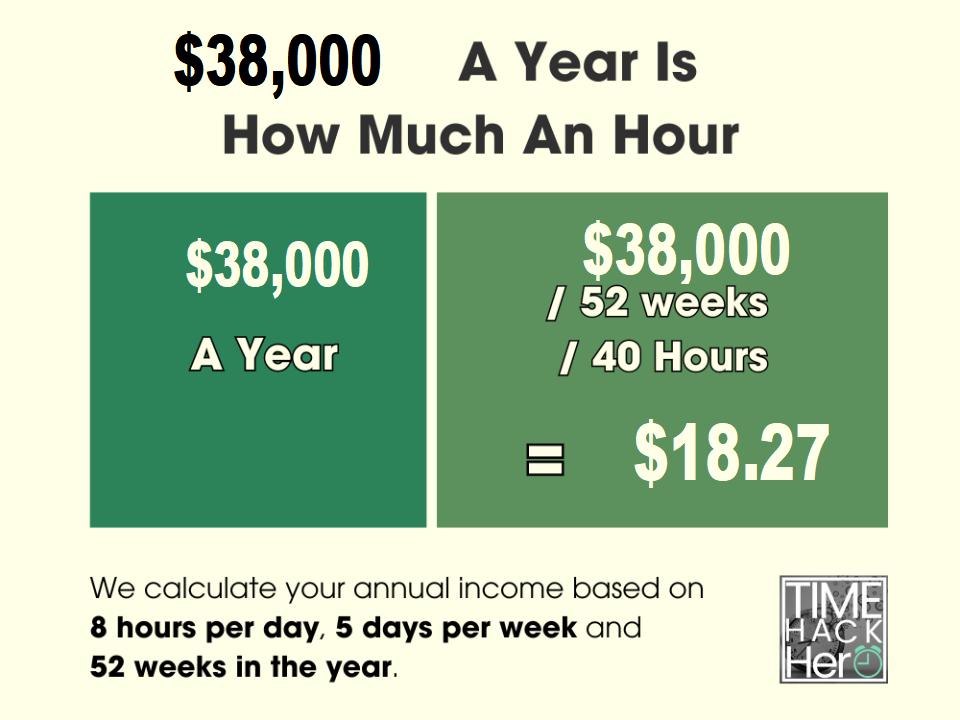

38000 A Year Is How Much An Hour Before And After Taxes

https://timehackhero.com/wp-content/uploads/2023/10/38000-a-Year-is-How-Much-an-Hour.jpg

8 Reasons To Hire Someone To Help With Your Income Tax Planning Black

https://blackdiamondfs.com/wp-content/uploads/2021/08/taxfilingstatus.jpeg

SmartAsset s hourly and salary paycheck calculator shows your income after federal state and local taxes Enter your info to see your take home pay 38 000 00 After Tax This income tax calculation for an individual earning a 38 000 00 salary per year The calculations illustrate the standard Federal Tax State Tax Social Security and Medicare paid during the year assuming no changes to salary or circumstance California Salary and Tax Illustration

What is a 38k after tax 38000 Federal and State Tax Calculation by the US Salary Calculator which can be used to calculate your 2025 tax return and tax refund calculations 31 165 79 net salary is 38 000 00 gross salary Use our US salary calculator to find out your net pay and how much tax you owe based on your gross income

More picture related to How Much Is 38000 After Taxes In Md

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

State Income Tax Vs Federal Income Tax What s The Difference

https://www.investopedia.com/thmb/9xFmEb6FVlX0hIqe4MC_vVtlHLk=/1355x1142/filters:no_upscale():max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg

38000 A Year Is How Much An Hour Good Salary Or No Money Bliss

https://moneybliss.org/wp-content/uploads/2022/04/38000-a-year-1.jpg

How Much Does An Engagement Ring Setting Cost Cheapest Buying Save 62

https://i.shgcdn.com/afc56d34-755b-492c-bb95-9070617915bb/-/format/auto/-/preview/3000x3000/-/quality/lighter/

Calculate your federal state and local taxes for the current filing year with our free income tax calculator Enter your income and location to estimate your tax burden Updated on Feb 14 2025 Free paycheck calculator to calculate your hourly and salary income after taxes deductions and exemptions

[desc-10] [desc-11]

/GettyImages-1190995919-bce27cedc8fa4274b70ffcd0062e6098.jpg)

A Brief History Of Taxes In The U S

https://www.investopedia.com/thmb/cHigOcnY9JPQ4CjU4oshzsrEVm4=/2152x1393/filters:fill(auto,1)/GettyImages-1190995919-bce27cedc8fa4274b70ffcd0062e6098.jpg

How Much Is 38 000 A Year After Taxes filing Single 2023 Smart

https://smartpersonalfinance.info/wp-content/uploads/2022/08/after-tax-income-on-38000-dollars-sm-2-1024x768.png

How Much Is 38000 After Taxes In Md - 38 000 00 After Tax This income tax calculation for an individual earning a 38 000 00 salary per year The calculations illustrate the standard Federal Tax State Tax Social Security and Medicare paid during the year assuming no changes to salary or circumstance California Salary and Tax Illustration