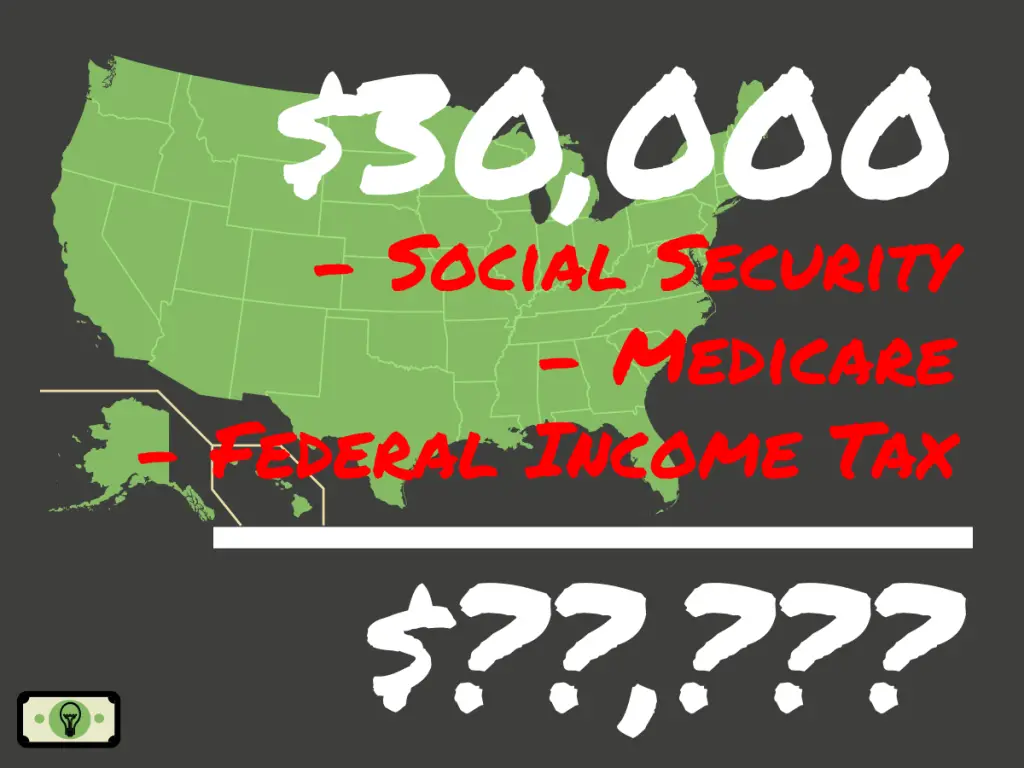

How Much Is 30000 After Tax In California SmartAsset s California paycheck calculator shows your hourly and salary income after federal state and local taxes Enter your info to see your take home pay

Filing 30 000 00 of earnings will result in 385 74 of your earnings being taxed as state tax calculation based on 2024 California State Tax Tables This results in roughly 4 297 of your earnings being taxed in total although depending on your situation there may be some other smaller taxes added on Although this is the case keep in mind Use our income tax calculator to find out what your take home pay will be in California for the tax year Enter your details to estimate your salary after tax

How Much Is 30000 After Tax In California

How Much Is 30000 After Tax In California

https://budgetandbillz.com/wp-content/uploads/2022/03/30000-a-Year-is-How-Much-an-Hour-1024x576.jpg

How Much Is 30000 Dollars GYD To TTD According To The Foreign

https://ex-rate.com/wa-data/public/crcy/images/GYD/TTD.jpg

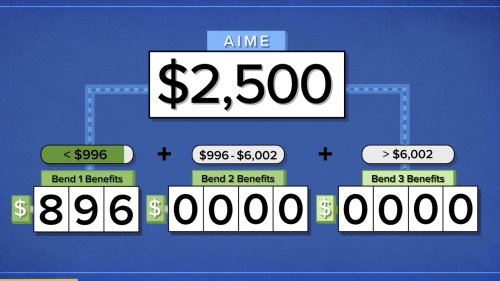

How Much Your Social Security Benefits Will Be If You Make 30 000

https://i.ytimg.com/vi/nwSXV3Rlcrw/maxresdefault.jpg

Take Home Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major change since 1987 Discover Talent s income tax calculator tool and find out what your paycheck tax deductions will be in California for the 2024 tax year

SmartAsset s hourly and salary paycheck calculator shows your income after federal state and local taxes Enter your info to see your take home pay Updated on Jul 06 2024 Free tool to calculate your hourly and salary income after federal state and local taxes in California

More picture related to How Much Is 30000 After Tax In California

How Much Are Payments On A 30 000 Car Loan

https://autobypayment.com/images/og/what-are-payments/30000-car.jpg

How Much Is 30000 Pesos CLP To USD According To The Foreign

https://ex-rate.com/wa-data/public/crcy/images/CLP/USD.jpg

How Much Is 30 000 A Year After Taxes filing Single 2023 Smart

https://smartpersonalfinance.info/wp-content/uploads/2022/08/after-tax-income-on-30000-dollars-sm-2-1024x768.png

The tax calculation below shows exactly how much California State Tax Federal Tax and Medicare you will pay when earning 30 000 00 per annum when living and paying your taxes in California Updated on Jul 06 2024 Free paycheck calculator to calculate your hourly and salary income after taxes deductions and exemptions

Find out how much you ll pay in California state income taxes given your annual income Customize using your filing status deductions exemptions and more The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes

How Much Is 30000 Pounds GBP To THB According To The Foreign

https://ex-rate.com/wa-data/public/crcy/images/GBP/THB.jpg

How Much You Can Expect To Get From Social Security If You Make 30 000

https://ic-cdn.flipboard.com/cnbcfm.com/eccf30e66ff60fb1749194ab48ccdfcde7ab2ae1/_medium.jpeg

How Much Is 30000 After Tax In California - Discover Talent s income tax calculator tool and find out what your paycheck tax deductions will be in California for the 2024 tax year