How Much Is 250k After Taxes In California Income tax calculator California Find out how much your salary is after tax Enter your gross income Per Where do you work Salary rate Annual Month Weekly Day Hour Withholding Salary 250 000 Federal Income Tax 57 154 State Income Tax 21 786 Social Security 9 114 Medicare 4 075 SDI State Disability Insurance 1 602 Total tax

What is a 250k after tax 250000 Federal and State Tax Calculation by the US Salary Calculator which can be used to calculate your 2023 tax return and tax refund calculations 181 446 00 net salary is 250 000 00 gross salary California income tax rate 1 00 13 30 Median household income in California 91 905 U S Census Bureau Number of cities that have local income taxes How Your California Paycheck Works Your job probably pays you either an hourly wage or an annual salary

How Much Is 250k After Taxes In California

How Much Is 250k After Taxes In California

https://i.ytimg.com/vi/MVbqmY3Pys4/maxresdefault.jpg

22 7 Yield Retire With Less Series Aug 22 How Much Do You Need To

https://i.ytimg.com/vi/UFMOPY32Kuw/maxresdefault.jpg

How Much Tax Is Taken Out Of Paycheck In Texas TaxesTalk

https://www.taxestalk.net/wp-content/uploads/see-what-a-100k-salary-looks-like-after-taxes-in-your-state.jpeg

This California salary after tax example is based on a 250 000 00 annual salary for the 2024 tax year in California using the State and Federal income tax rates published in the California tax tables The 250k salary example provides a breakdown of the amounts earned and illustrates the typical amounts paid each month week day and hour Federal Paycheck Quick Facts Federal income tax rates range from 10 up to a top marginal rate of 37 The U S real median household income adjusted for inflation in 2022 was 74 580 9 U S states don t impose their own income tax for tax year 2023 How Your Paycheck Works Income Tax Withholding

250 000 00 After Tax This income tax calculation for an individual earning a 250 000 00 salary per year The calculations illustrate the standard Federal Tax State Tax Social Security and Medicare paid during the year assuming no changes to salary or circumstance California Salary and Tax Illustration Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major

More picture related to How Much Is 250k After Taxes In California

How I Made 250k 9 Lessons From 4 Years On YouTube YouTube

https://i.ytimg.com/vi/UGzNMRWEXjU/maxresdefault.jpg

What A 250K Budget Actually Translates To In Square Footage

https://www.domino.com/uploads/2020/07/16/Design-by-Emily-Henderson-Design-Photographer-by-Tessa-Neustadt_332.jpg?width=1000&crop=1.9:1,smart

Which 250k Option Is Best Afkarena

https://preview.redd.it/kyjubrnl55471.jpg?auto=webp&s=447bfe5c009543d6747c99ac2027f90ab9aac9e6

All features services support prices offers terms and conditions are subject to change without notice Use our Tax Bracket Calculator to understand what tax bracket you re in for your 2023 2024 federal income taxes Based on your annual taxable income and filing status your tax bracket determines your federal tax rate Our California State Tax Calculator will display a detailed graphical breakdown of the percentage and amounts which will be taken from your 250 000 00 and go towards tax While this calculator can be used for California tax calculations by using the drop down menu provided you are able to change it to a different State

Federal Income Tax Calculator 2023 2024 Both employers and employees split the Federal Insurance Contribution Act FICA taxes that pay for Social Security and Medicare programs The FICA rate due every pay period is 15 3 of an employee s wages However this tax payment is divided in half between the employer and the employee Salary Calculator Results If you are living in California and earning a gross annual salary of 72 020 or 6 002 per month the total amount of taxes and contributions that will be deducted from your salary is 16 442 This means that your net income or salary after tax will be 55 578 per year 4 632 per month or 1 069 per week

Michigan Paid Former OC Tim Drevno 250K After Resignation Mlive

https://www.mlive.com/resizer/Q2HCIdYG4ZR4BBiaIm7Q-xi_o9o=/1280x0/smart/advancelocal-adapter-image-uploads.s3.amazonaws.com/image.mlive.com/home/mlive-media/width2048/img/wolverines_impact/photo/110417-news-umvsminn-54jpg-3023a9e08cd98309.jpg

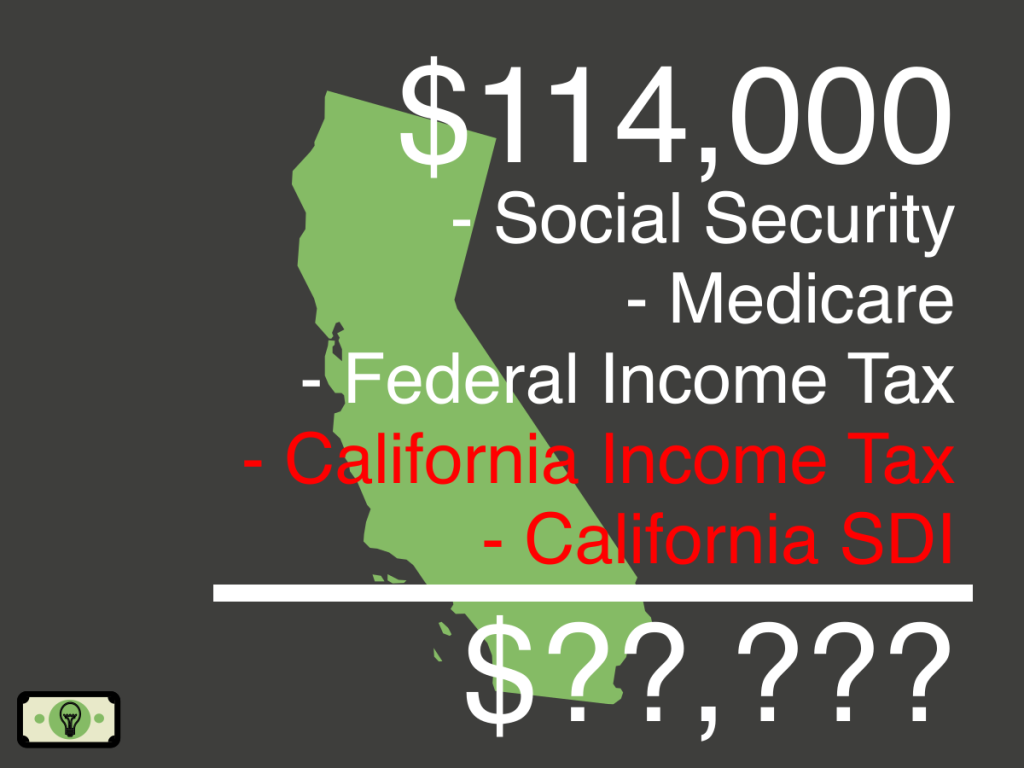

114K Salary After Taxes In California single 2023 Smart

https://smartpersonalfinance.info/wp-content/uploads/2022/08/ca-114000-after-taxes-2-sm-1024x768.png

How Much Is 250k After Taxes In California - 250 000 00 After Tax This income tax calculation for an individual earning a 250 000 00 salary per year The calculations illustrate the standard Federal Tax State Tax Social Security and Medicare paid during the year assuming no changes to salary or circumstance California Salary and Tax Illustration