How Much Is 26 An Hour Annually After Taxes Key Takeaways An hourly wage of 26 per hour equals a yearly salary of 54 080 before taxes assuming a 40 hour work week After accounting for an estimated 26 54 tax rate the yearly after tax salary is approximately 39 725 74 On a monthly basis before taxes 26 per hour equals 4 506 67 per month

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major In the year 2024 in the United States 26 an hour gross salary after tax is 45 361 annual 3 434 monthly 789 8 weekly 157 96 daily and 19 75 hourly gross based on the information provided in the calculator above Check the table below for a breakdown of 26 an hour after tax in the United States If you re interested in discovering

How Much Is 26 An Hour Annually After Taxes

How Much Is 26 An Hour Annually After Taxes

https://us-static.z-dn.net/files/db5/640baf321cfea588fce95603e784e432.png

How Much Is 26 An Hour Annually YouTube

https://i.ytimg.com/vi/HvIHZ90q8Fg/maxresdefault.jpg

26 An Hour Is How Much A Year Budget Billz

https://budgetandbillz.com/wp-content/uploads/2022/03/26-an-Hour-is-How-Much-a-Year-1024x576.jpg

Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly They are used to fund social Security and Medicare For example in the 2020 tax year the Social Security tax is 6 2 for employees and 1 45 for the Medicare tax In our example your annual salary would be 35 455 20 680 per week times 52 14 weeks per year Or if you work 40 hours per week and you work every week during the year you can multiply your hourly rate by 2 080 hours which is the often used number of work hours in a year 2 085 6 to be more precise considering 365 days 7 52 14

For each payroll federal income tax is calculated based on the answers provided on the W 4 and year to date income which is then referenced to the tax tables in IRS Publication 15 T For 2024 rates are 0 10 12 22 24 32 35 or 37 To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left hand table above In the Weekly hours field enter the number of hours you do each week excluding any overtime If you do any overtime enter the number of hours you do each month and the rate you get

More picture related to How Much Is 26 An Hour Annually After Taxes

How Much Is 70 An Hour Annually

https://thefinanceboost.com/wp-content/uploads/2021/04/60k-_hour.jpg

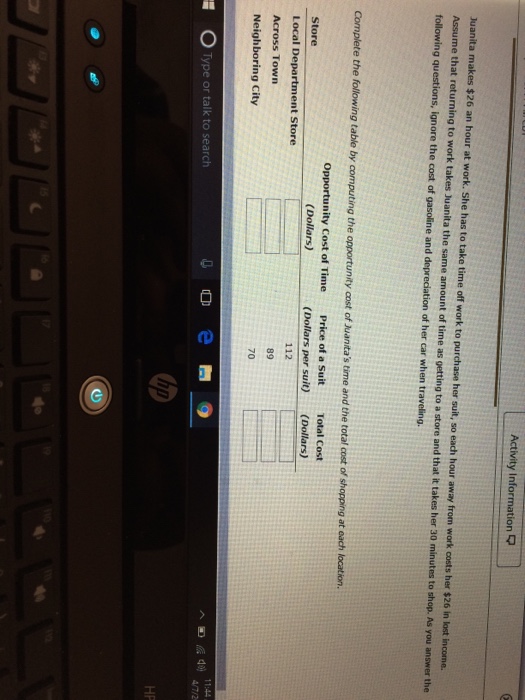

Juanita Makes 26 An Hour At Work She Has To Take Chegg

https://media.cheggcdn.com/media/81f/81fa25fa-cfff-4c50-ab78-d5aa4a9f4af8/image

How Much Is 30 An Hour Annually GET LOOT

https://getloot.io/wp-content/uploads/2022/07/30-An-Hour-768x512.jpg

The formula of calculating annual salary and hourly wage is as follow Annual Salary Hourly Wage Hours per workweek 52 weeks Quarterly Salary Annual Salary 4 Monthly Salary Annual Salary 12 Semi Monthly Salary Annual Salary 24 Biweekly Salary Annual Salary 26 The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator

Multiply By Number of Work Weeks Per Year The typical work year is approximately 52 weeks Multiply your weekly earnings by 52 1 040 per week 52 weeks 54 080 per year So if you make 26 an hour and work full time 40 hours per week your annual pre tax income would be approximately 54 080 per year The average annual salary in the United States is 69 368 which is around 4 537 a month after taxes and contributions depending on where you live However extremely high earners tend to bias averages Likewise average salaries vary state by state such as California s salaries averaging 83 876 a year compared to Florida s at 63 336

How Much Is 20 Dollars An Hour Annually Finawareness

https://www.moneysmartguides.com/wp-content/uploads/2023/01/20-Dollars-Hourly-Annual-Salary.png

How Much Is 15 Dollars An Hour Annually MoneySmartGuides

https://www.moneysmartguides.com/wp-content/uploads/2021/03/15-Dollars-An-Hour.png

How Much Is 26 An Hour Annually After Taxes - 26 an hour is how much a month If you make 26 an hour your monthly salary would be 4 506 67 Assuming that you work 40 hours per week we calculated this number by taking into consideration your hourly rate 26 an hour the number of hours you work per week 40 hours the number of weeks per year 52 weeks and the number of months per year 12 months