How Much Is 30 An Hour Annually After Taxes Convert Your Hourly Wage To Salary Yearly salary 30 per hour is 62 400 per year Monthly salary 30 per hour is 4 800 per month Biweekly salary 30 per hour is 2 400 biweekly Weekly salary 30 per hour is 1200 per week Daily salary 30 per hour is 240 per day Salary after taxes 30 hr is 46 800 a year after taxes

This is based on working 40 working hours per week 52 weeks per year 30 dollars an hour is how much a year long answer Let s go through all the calculations for 30 an hour pay let s assume an 8 hour workday at 40 hours a week 30 an hour is how much a day 30 hour 240 for an 8 hour workday 30 an hour is how much a week 30 an hour is an annual income of 62 400 a year before taxes Don t believe us Check our math 40 hours of work per week multiplied by 52 the number of weeks in a year equals 2 080 hours worked per year on average If you multiply the total number of hours worked per year 2 080 by 30 you get 62 400

How Much Is 30 An Hour Annually After Taxes

How Much Is 30 An Hour Annually After Taxes

https://todaysworkathomemom.com/wp-content/uploads/2022/05/Brainy-gains-post-image-21.png

How Much An Hour Is 15000 A Year New Update Linksofstrathaven

https://i.ytimg.com/vi/R5XU4R6Mm1g/maxresdefault.jpg

30 Dollars An Hour Is How Much A Year After Taxes

https://vagalreply.com/wp-content/uploads/2022/08/13.jpg

Assuming you are a full time employee and work 40 hours a week with an hourly rate of 30 your yearly salary would be 62 400 before taxes and deductions 30 an Hour is How Much a Year After Taxes First of all you need to understand the federal tax rates and deductions How much a year after taxes is a wage of 30 an hour 56 160 or less We must consider the tax rate and working hours to know the exact answer Assuming 40 weekly working hours For a 10 tax rate the net annual income is 56 160 For a 12 tax rate it is 54 912

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major US Hourly Wage Tax Calculator 2023 The Hourly Wage Tax Calculator uses tax information from the tax year 2023 to show you take home pay See where that hard earned money goes Federal Income Tax Social Security and other deductions More information about the calculations performed is available on the about page Hourly Wage

More picture related to How Much Is 30 An Hour Annually After Taxes

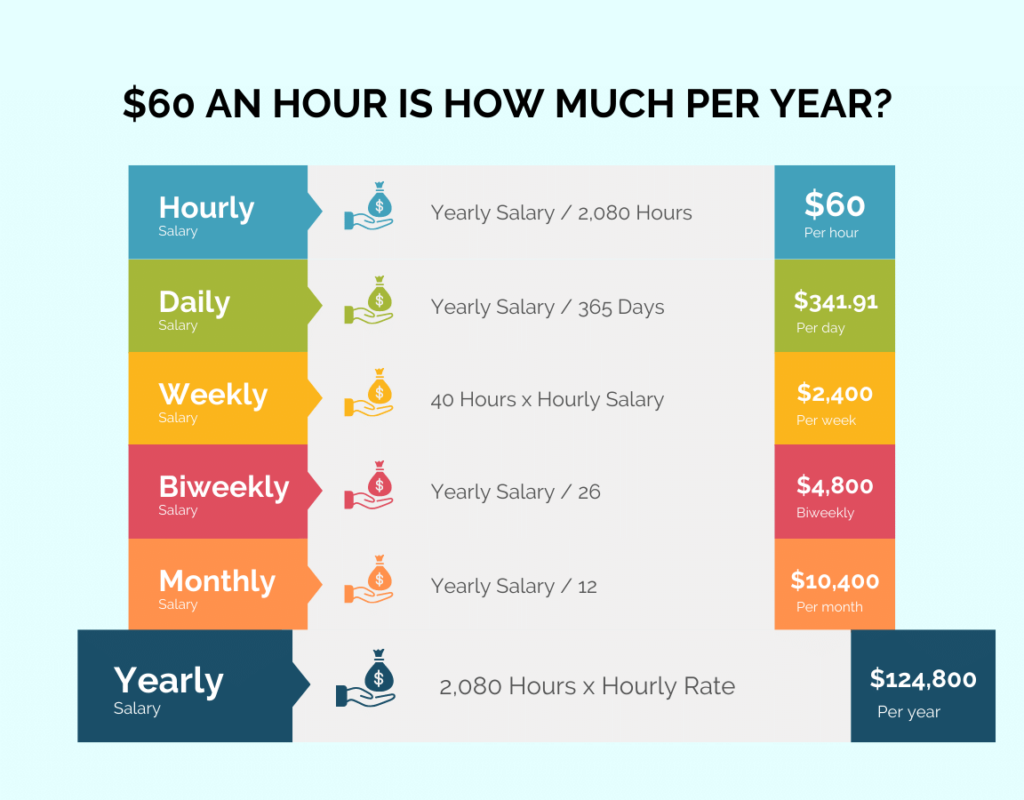

60 An Hour Is How Much A Year How To FIRE Online Library GoSpring

https://www.howtofire.com/wp-content/uploads/60-dollars-an-hour-1024x800.png

30 An Hour Is How Much A Year

https://www.savvyhoney.com/wp-content/uploads/2022/06/30-an-Hour-is-How-Much-a-Year.jpg

30 An Hour Is How Much A Year Income Breakdown This Mama Blogs

https://thismamablogs.com/wp-content/uploads/2021/10/30-an-hour-is-how-much-per-year.png

KEY POINTS A yearly salary of 30 per hour working full time is 62 400 before taxes Many variables impact your salary including working overtime getting paid time off and more Using a budget can help you survive on this income whether you are single or have a family When making 30 an hour you ll pay about 20 of your paycheck to Federal Social Security and Medicare taxes At 62 400 in annual pay minus 20 in taxes 30 an hour pays about 49 920 a year after taxes At 5 190 in monthly pay minus 20 in taxes 30 an hour pays about 4 152 per month after taxes 30 an Hour to Salary Calculator

The annual pre tax salary for 30 an hour with a 40 hour workweek is 62 400 After taxes the take home salary could be around 46 800 depending on the tax bracket and other deductions 40 hours x 52 weeks x 30 62 400 62 400 is the gross annual salary with a 30 per hour wage As of June 2023 the average hourly wage is 33 58 source Is this a good salary for single person Let s break down how that number is calculated Typically the average workweek is 40 hours and you can work 52 weeks a year

30 An Hour Is How Much A Year Convert 30 Per Hourly Rate To Yearly

https://expertcareerguides.com/wp-content/uploads/2022/01/30-an-Hour-Is-How-Much-a-Year.png

How Much Income For A 600k Mortgage MortgageInfoGuide

https://www.mortgageinfoguide.com/wp-content/uploads/heres-how-to-figure-out-how-much-home-you-can-afford.jpeg

How Much Is 30 An Hour Annually After Taxes - Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major