How Much Is 150k After Taxes In California The table below summarizes the calculated figures for an annual income of 150 000 00 in California for a Single filer in the 2024 tax year which pertains to the 2025 Tax Return Calculations Detailed computations including tax credits and standard deductions are available for review beneath the table Income Tax Calculation in 2024

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The tax calculation below shows exactly how much California State Tax Federal Tax and Medicare you will pay when earning 150 000 00 per annum when living and paying your taxes in California The 150 000 00 California tax example uses standard assumptions for the tax calculation

How Much Is 150k After Taxes In California

How Much Is 150k After Taxes In California

https://www.mortgageinfoguide.com/wp-content/uploads/how-much-house-can-i-afford-on-150k-salary-swohm.jpeg

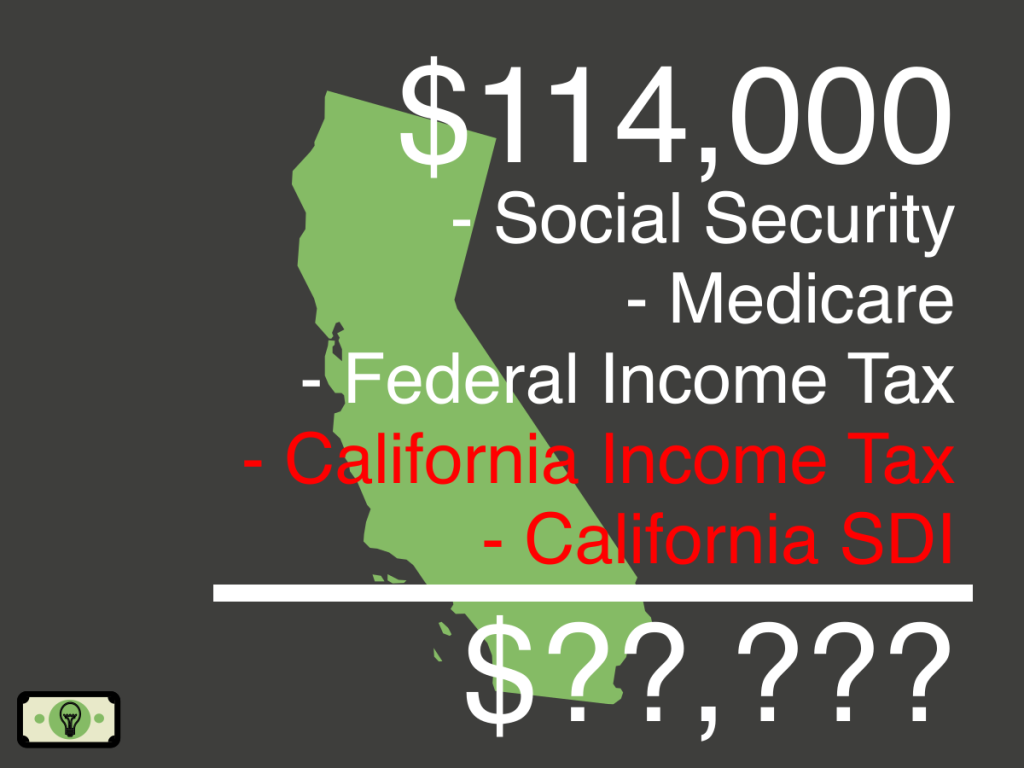

114K Salary After Taxes In California single 2023 Smart

https://smartpersonalfinance.info/wp-content/uploads/2022/08/ca-114000-after-taxes-2-sm-1024x768.png

Megatix Ladies Night

https://d1629ugb7moz2f.cloudfront.net/events/5103/NVYxTQZhhux64ZJHNCoaNVEswy0fUQ2b51ZxZUn6.jpg

Your employer withholds a 6 2 Social Security tax and a 1 45 Medicare tax from your earnings after each pay period Individuals earning over 200 000 as well as joint filers over 250 000 and those married but filing separately with incomes above 125 000 also pay a 0 9 Medicare surtax Federal Paycheck Calculator Federal income tax rates range from 10 up to a top marginal rate of 37 The U S real median household income adjusted for inflation in 2022 was 74 580 9 U S states don t impose their own income tax for tax year 2023

2023 US Tax Calculation for 2024 Tax Return 150k Salary Example If you were looking for the 150k Salary After Tax Example for your 2023 Tax Return it s here Brace yourselves for a surprise Given you file as a single taxpayer 150 000 will net you 101 028 58 after federal and California state income taxes This means you pay 48 971 42 in taxes on an annual salary of 150 000 dollars Your average tax rate will be 32 65 and your marginal rate will be 35 65 Income taxes depend on your filing status

More picture related to How Much Is 150k After Taxes In California

How Much To Retire Early Age 55 With 150K Savings YouTube

https://i.ytimg.com/vi/AqwHvXJVkxg/maxresdefault.jpg

How Much Are Transfer Taxes In California Update September 2022

https://justiceisduckblind.com/wp-content/uploads/2022/02/how-much-are-transfer-taxes-in-california.png

How Much Income For A 600k Mortgage MortgageInfoGuide

https://www.mortgageinfoguide.com/wp-content/uploads/heres-how-to-figure-out-how-much-home-you-can-afford.jpeg

Simply enter your taxable income filing status and the state you reside in to find out how much you can expect to pay Generally if your taxable income is below the 2022 2023 standard deduction Summary If you make 55 000 a year living in the region of California USA you will be taxed 11 676 That means that your net pay will be 43 324 per year or 3 610 per month Your average tax rate is 21 2 and your marginal tax rate is 39 6 This marginal tax rate means that your immediate additional income will be taxed at this rate

If you earn 150 000 00 or earn close to it and live in California then this will give you a rough idea of how much you will be paying in taxes on an annual basis However an annual monthly weekly and daily breakdown of your tax amounts will be provided in the written breakdown What is a 150k after tax 150000 Federal and State Tax Calculation by the US Salary Calculator which can be used to calculate your 2021 tax return and tax refund calculations 111 962 40 net salary is 150 000 00 gross salary

Betking Should Be Able To Design A Kingship Cap For Jay Jay Career

https://www.nairaland.com/attachments/15448343_images20220519t081623_776_jpeg_jpeg0f0db682713a2ef227c2531a56da1848

How Much Tax Is Taken Out Of Paycheck In Texas TaxesTalk

https://www.taxestalk.net/wp-content/uploads/see-what-a-100k-salary-looks-like-after-taxes-in-your-state.jpeg

How Much Is 150k After Taxes In California - Choose the Number of Salary Comparisons you with to make For example select 1 to compare 1 salary to the default salary entered into the calculator Enter a Salary that you wish to compare and select the tax year for comparison This is where the tools flexibility in calculations is very useful allowing you to compare the same salary