How Much Is 100k A Year After Taxes In California Your employer withholds a 6 2 Social Security tax and a 1 45 Medicare tax from your earnings after each pay period Take note Individuals earning over 200 000 as well as joint filers over 250 000 and those married but filing separately with incomes above 125 000 also pay a 0 9 Medicare surtax

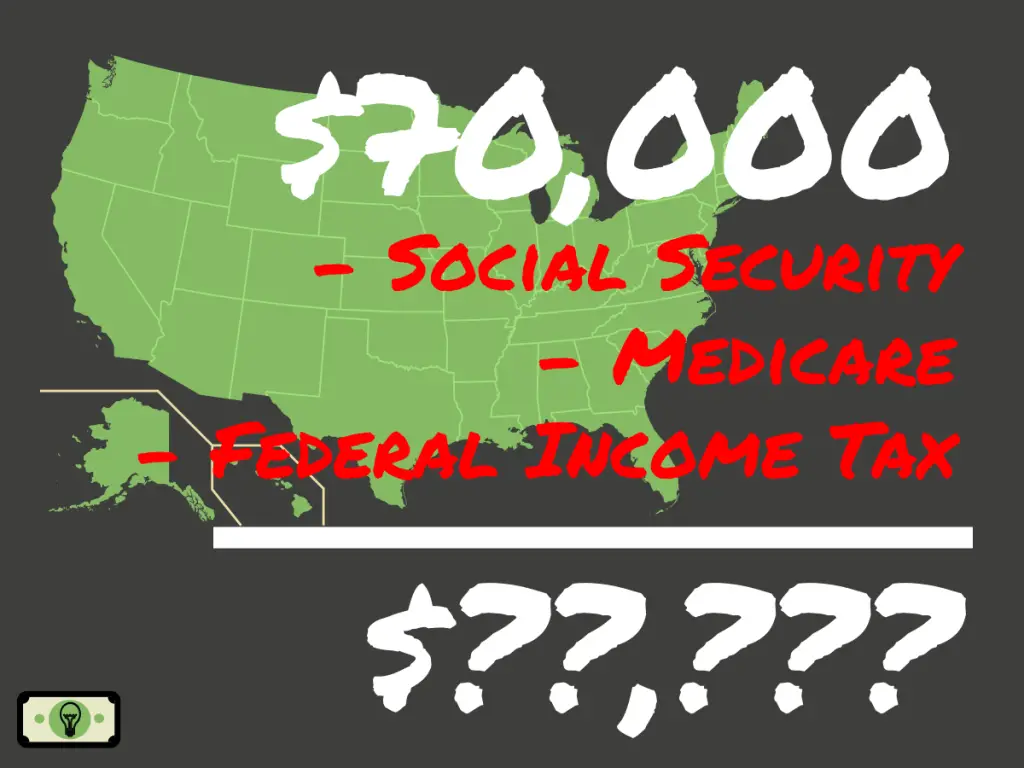

100 000 00 Salary Income Tax Calculation for California This tax calculation produced using the CAS Tax Calculator is for a single filer earning 100 000 00 per year The California income tax example and payroll calculations are provided to illustrate the standard Federal Tax State Tax Social Security and Medicare paid during the year when filing a tax return in California for 100 000 00 California Income Tax Calculator 2023 2024 Learn More On TurboTax s Website If you make 70 000 a year living in California you will be taxed 10 448 Your average tax rate is 10 94 and your

How Much Is 100k A Year After Taxes In California

How Much Is 100k A Year After Taxes In California

https://solberginvest.com/wp-content/uploads/2022/08/FI-1-1536x1024.jpg

7 Realistic Ways To Make 100k A Month Ultimate 2023 Guide

https://www.dontworkanotherday.com/wp-content/uploads/2022/06/How-Much-is-100k-a-Month.jpg

What s My Take Home Pay On 100 000 Annual Salary Moneywise

https://media1.moneywise.com/a/2762/take-home-pay-from-a-100000-salary_facebook_thumb_1200x628_v20220926135744.jpg

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major Filing 100 000 00 of earnings will result in 7 650 00 being taxed for FICA purposes California State Tax Filing 100 000 00 of earnings will result in 5 440 70 of your earnings being taxed as state tax calculation based on 2024 California State Tax Tables This results in roughly 26 932 of your earnings being taxed in total although

This California salary after tax example is based on a 100 000 00 annual salary for the 2024 tax year in California using the State and Federal income tax rates published in the California tax tables The 100k salary example provides a breakdown of the amounts earned and illustrates the typical amounts paid each month week day and hour FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024

More picture related to How Much Is 100k A Year After Taxes In California

How Much Is 70 000 A Year After Taxes filing Single 2023 Smart

https://smartpersonalfinance.info/wp-content/uploads/2022/08/after-tax-income-on-70000-dollars-sm-2-1024x768.png

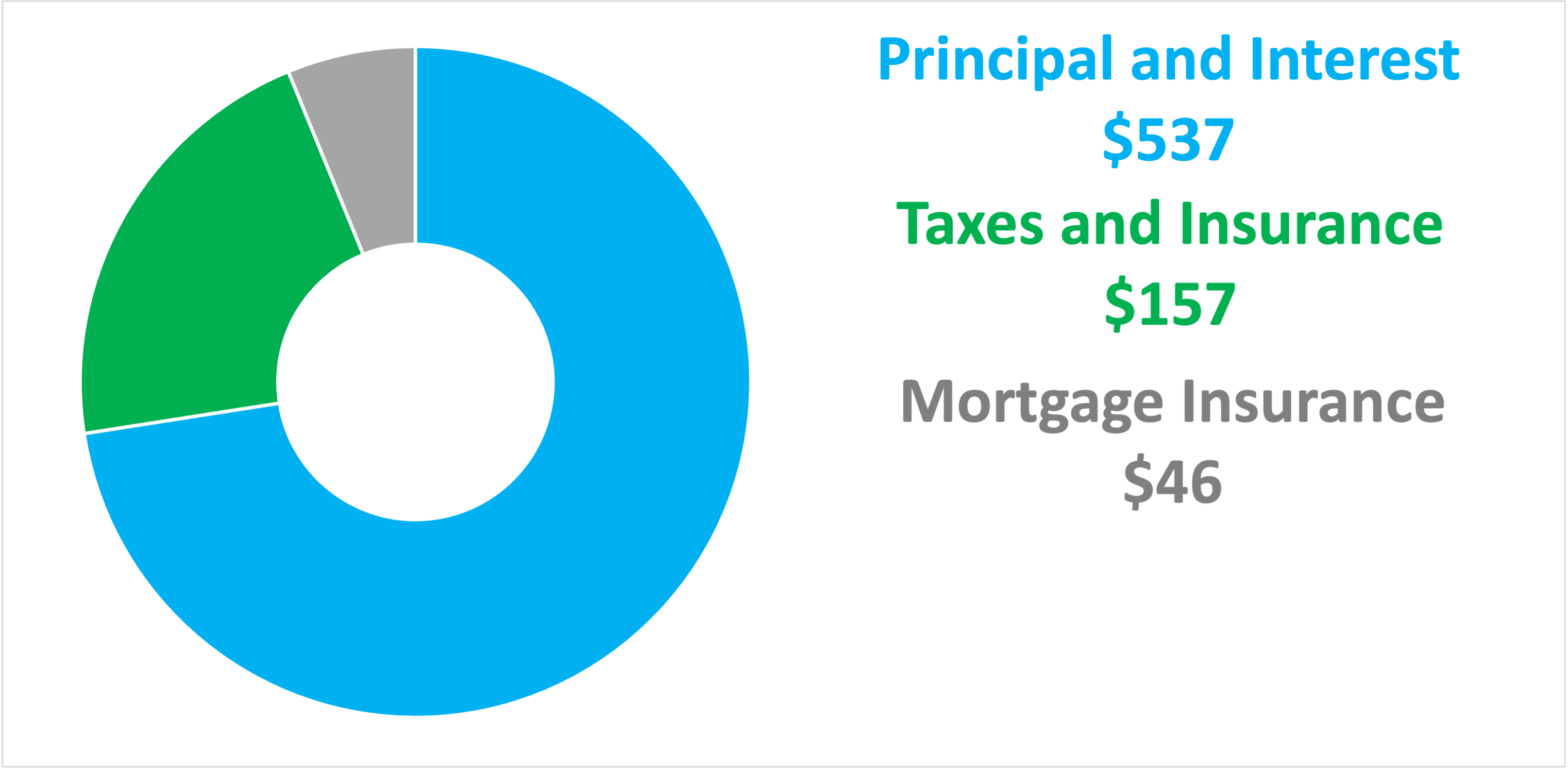

100k Mortgage Mortgage On 100k Bundle

https://bundleloan.com/blog/wp-content/uploads/2020/11/100kmortgage.png

How Far A 100 000 Salary Goes In America s 50 Largest Cities

https://s.yimg.com/ny/api/res/1.2/5G.SwFYcJLX1u63lCVkFeA--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD02NzU-/https://media.zenfs.com/en-US/video/gobankingrates_644/c5ec7b93674bf3d86a2156b030117a19

State income tax 1 to 13 3 Social Security 6 2 Medicare 1 45 to 2 35 state disability insurance 1 2 The total tax varies depending on your earnings number of dependents and other factors The combined tax percentage usually ranges from 20 to 35 Updated on Jul 06 2024 California s base sales tax is 6 00 This means that regardless of where you are in the state you will pay an additional 6 00 of the purchase price of any taxable good Many cities and counties also enact their own sales taxes ranging from 1 25 to 4 75 So the maximum combined rate is 10 75

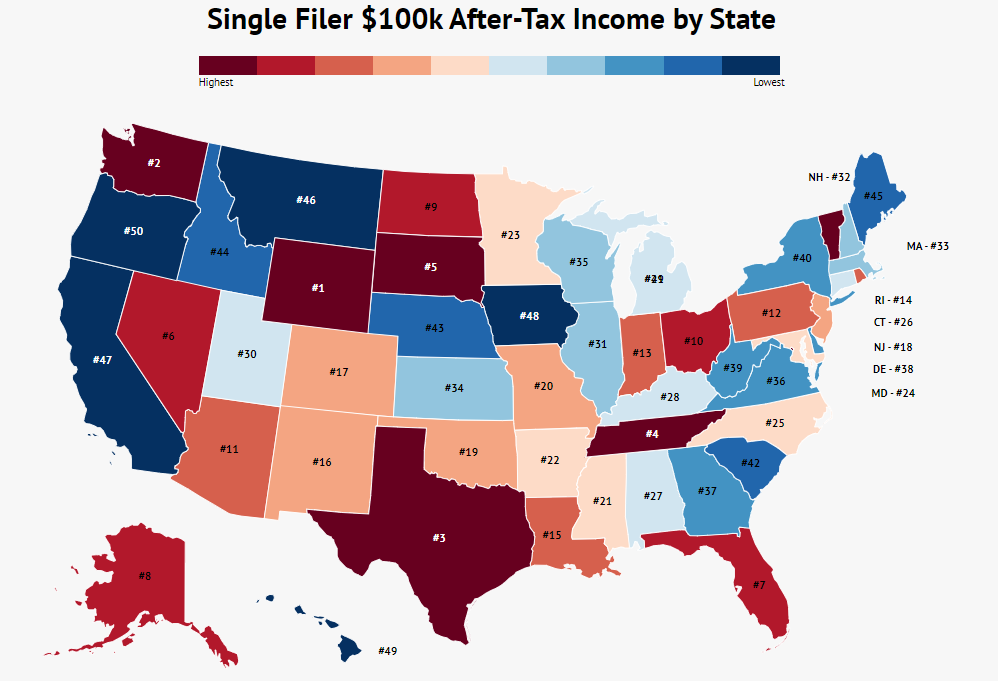

For Social Security the tax is 6 2 of your earnings up to a certain limit 160 200 in 2023 and for Medicare the tax is 1 45 of your earnings with no limit Some high income earners may also have to pay an additional 0 9 Medicare surtax Take home salary for single filers 69 808 Take home salary for married filers 76 301 Oregon residents pay the highest taxes in the nation with single filers earning 100 000 a year paying 30 96 of their income and joint filers paying 24 22 The effective tax rate for single filers is a steep 8 28

How Much YouTube Paid Me For 100k Views YouTube

https://i.ytimg.com/vi/yzUoLUfNtx0/maxresdefault.jpg

100k After Tax Income By State 2023 Zippia

https://www.zippia.com/wp-content/uploads/2023/03/single-filer-after-tax-income.png

How Much Is 100k A Year After Taxes In California - FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024