How Much Is 100k After Taxes In Ca Your employer withholds a 6 2 Social Security tax and a 1 45 Medicare tax from your earnings after each pay period Take note Individuals earning over 200 000 as well as joint filers over 250 000 and those married but filing separately with incomes above 125 000 also pay a 0 9 Medicare surtax

Filing 100 000 00 of earnings will result in 7 650 00 being taxed for FICA purposes California State Tax Filing 100 000 00 of earnings will result in 5 440 70 of your earnings being taxed as state tax calculation based on 2024 California State Tax Tables This results in roughly 26 932 of your earnings being taxed in total although Take home salary for single filers 69 808 Take home salary for married filers 76 301 Oregon residents pay the highest taxes in the nation with single filers earning 100 000 a year paying 30 96 of their income and joint filers paying 24 22 The effective tax rate for single filers is a steep 8 28

How Much Is 100k After Taxes In Ca

How Much Is 100k After Taxes In Ca

https://i.ytimg.com/vi/hzbXt7UkRtw/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ac4FgAKACooCDAgAEAEYSyBUKGUwDw==&rs=AOn4CLBi7rpDRYXAUp3lYHFn3noFdU093Q

What s My Take Home Pay On 100 000 Annual Salary Moneywise

https://media1.moneywise.com/a/2762/take-home-pay-from-a-100000-salary_facebook_thumb_1200x628_v20220926135744.jpg

Living On 100k After Taxes In Washington washington blowthisup

https://i.ytimg.com/vi/aO02VGhoXdg/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ac4FgAKACooCDAgAEAEYZSBcKFYwDw==&rs=AOn4CLDct-nJywIoTJD5-tIn0zijUTk0Iw

The tax calculation below shows exactly how much California State Tax Federal Tax and Medicare you will pay when earning 100 000 00 per annum when living and paying your taxes in California The 100 000 00 California tax example uses standard assumptions for the tax calculation 100k after tax in California CA Tax Calculator Tip State income tax 1 to 13 3 Social Security 6 2 Medicare 1 45 to 2 35 state disability insurance 1 2 The total tax varies depending on your earnings number of dependents and other factors The combined tax percentage usually ranges from 20 to 35 Updated on Jul 06 2024

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major California Income Tax Calculator 2023 2024 Learn More On TurboTax s Website If you make 70 000 a year living in California you will be taxed 10 448 Your average tax rate is 10 94 and your

More picture related to How Much Is 100k After Taxes In Ca

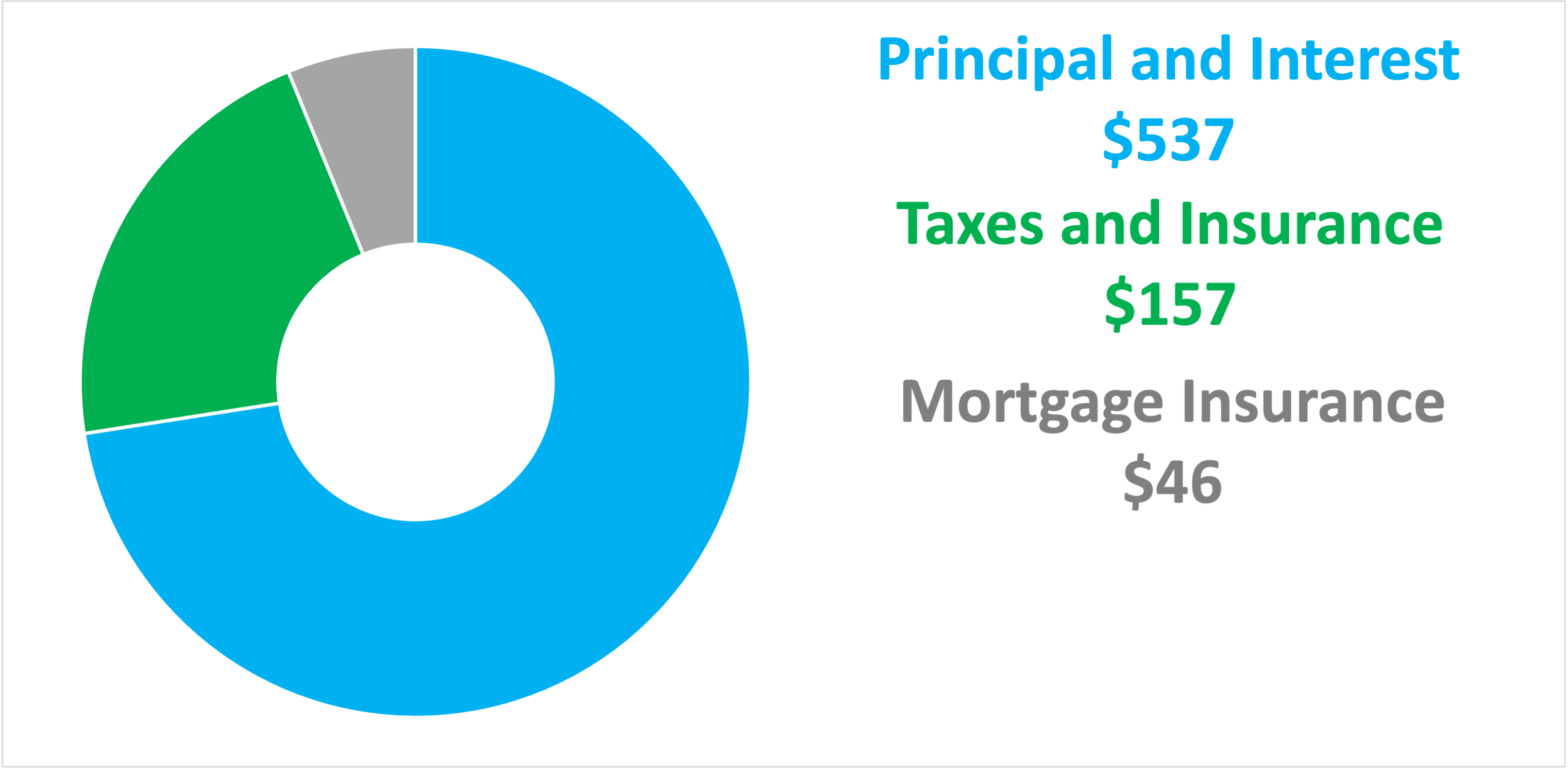

100k Mortgage Mortgage On 100k Bundle

https://bundleloan.com/blog/wp-content/uploads/2020/11/100kmortgage.png

How Much Is 100k After Taxes In Nebraska republican nebraska

https://i.ytimg.com/vi/4iXjFI9Wbtc/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AbYIgAKAD4oCDAgAEAEYZSBcKFYwDw==&rs=AOn4CLD6PvUO5WplgYQgsUim7hDq95I6Og

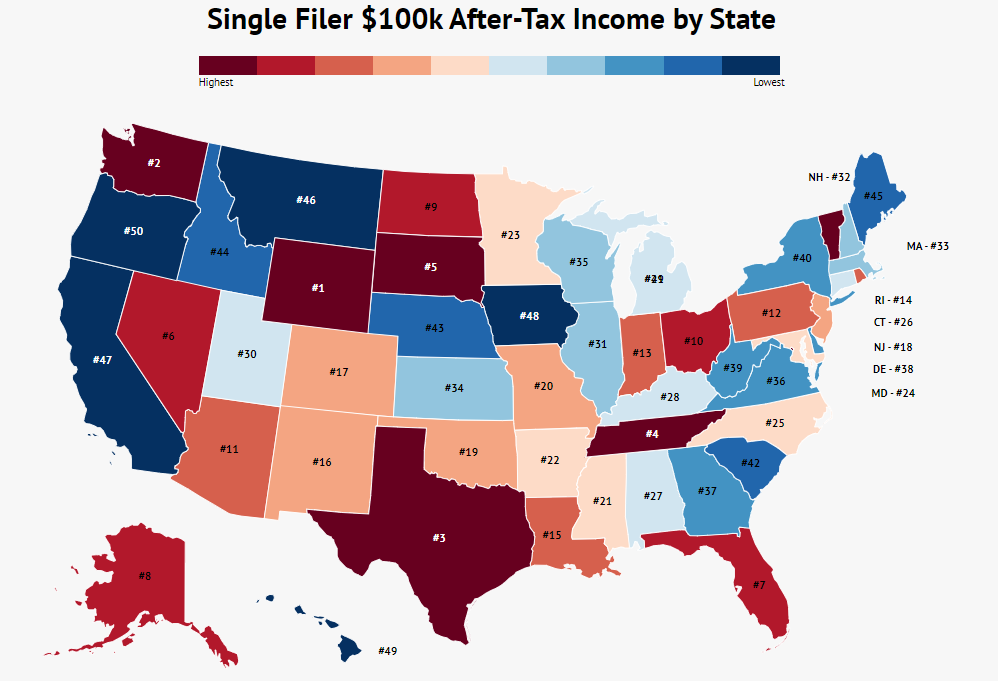

100k After Tax Income By State 2023 Zippia

https://www.zippia.com/wp-content/uploads/2023/03/single-filer-after-tax-income.png

California s base sales tax is 6 00 This means that regardless of where you are in the state you will pay an additional 6 00 of the purchase price of any taxable good Many cities and counties also enact their own sales taxes ranging from 1 25 to 4 75 So the maximum combined rate is 10 75 FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024

100k Salary After Tax in California 2024 This California salary after tax example is based on a 100 000 00 annual salary for the 2024 tax year in California using the State and Federal income tax rates published in the California tax tables The 100k salary example provides a breakdown of the amounts earned and illustrates the typical amounts paid each month week day and hour It should be good news then that the average salary in the United States is over 100 000 according to 2022 US Census data Not really Don t be fooled as the vast majority of Americans earn

Living On 100k After Taxes In Indiana indiana taxes democrat

https://i.ytimg.com/vi/Wr1o05Aeric/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ac4FgAKACooCDAgAEAEYTiBXKGUwDw==&rs=AOn4CLDHsfllxVKSrTi4-ti0leW3lFZQAA

How Many People Make Over 100k In The United States In 2023

https://trinity-core.s3.us-west-1.amazonaws.com/webtribunal/4717/How-Many-People-Make-Over-100k-in-the-United-States-Featured.jpg.jpg

How Much Is 100k After Taxes In Ca - Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W 4 form This calculator is intended for use by U S residents The calculation is based on the 2024 tax brackets and the new W 4 which in 2020 has had its first major