How Much Do You Take Home On 50000 Take home pay 50 000 State income tax paid for single person 0 Marginal state income tax 2 Effective state income tax 0 Jordan Rosenfeld contributed to the reporting of this article Methodology For this study GOBankingRates analyzed the 2024 tax rates to find the average amount the average person pays in state taxes in each state

FICA contributions are shared between the employee and the employer 6 2 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6 2 However the 6 2 that you pay only applies to income up to the Social Security tax cap which for 2023 is 160 200 168 600 for 2024 Take home pay 35 914 State income tax paid for single person 2 086 Marginal state income ta x 2 00 Effective state income tax 4 17 Here s What the US Minimum Wage Was the Year You

How Much Do You Take Home On 50000

How Much Do You Take Home On 50000

https://cdn.mondestuff.com/wp-content/uploads/2022/04/GettyImages-1205804031-1-500x334.jpg

How To Take Screenshots In Windows 10

https://sm.pcmag.com/pcmag_in/photo/u/use-the-wi/use-the-windows-key-print-screen-shortcut_3269.jpg

52 Week Savings Challenge Cash Envelope Insert Ubicaciondepersonas

https://i.etsystatic.com/27378410/r/il/5b0b44/3236584008/il_fullxfull.3236584008_7job.jpg

Take Home Pay for 2024 39 574 00 We hope you found this salary example useful and now feel your can work out taxes on 50k salary if you did it would be great if you could share it and let others know about iCalculator We depend on word of mouth to help us grow and keep the US Tax Calculator free to use The paycheck tax calculator is a free online tool that helps you to calculate your net pay based on your gross pay marital status state and federal tax and pay frequency After using these inputs you can estimate your take home pay after taxes The inputs you need to provide to use a paycheck tax calculator

This calculator helps you determine the gross paycheck needed to provide a required net amount First enter the net paycheck you require Then enter your current payroll information and deductions The Salary Calculator tells you monthly take home or annual earnings considering UK Tax National Insurance and Student Loan The latest budget information from April 2024 is used to show you exactly what you need to know Hourly rates weekly pay and bonuses are also catered for Why not find your dream salary too

More picture related to How Much Do You Take Home On 50000

Today s Tech

https://akm-img-a-in.tosshub.com/sites/btmt/images/stories/bill_gates_660_011219115004.jpg

Living Large On 50 000 A Year Get Ahead On A 50 000 Budget Action

https://actionecon.com/wp-content/uploads/2015/07/Living-Large-On-50000-A-Year-50000-Budget.jpg

Say Sue Me Take Home On The Road On Their New Single Good People

https://thefader-res.cloudinary.com/private_images/c_limit,w_1024/c_crop,h_606,w_1018,x_6,y_48,f_auto,q_auto:eco/unnamed_srxdcf/unnamed_srxdcf.jpg

If you are single or married and filing separately in New Jersey there are seven tax brackets that apply to you At the lower end you will pay at a rate of 1 40 on the first 20 000 of your taxable income Meanwhile the highest tax bracket reaches 10 75 on income over 1 million After Tax If your salary is 50 000 then after tax and national insurance you will be left with 38 022 This means that after tax you will take home 3 169 every month or 731 per week 146 20 per day and your hourly rate will be 24 05 if you re working 40 hours week Scroll down to see more details about your 50 000 salary

And in the case of a bonus amount of more than 1 million 37 is deducted from the remaining amount For example if you receive a 2 million bonus then 22 is taxed on the first million which is 1000000 0 22 220000 and 37 is taxed on the rest of the bonus amount which is 2000000 1000000 0 37 370000 The amount of money you spend upfront to purchase a home Most home loans require a down payment of at least 3 A 20 down payment is ideal to lower your monthly payment avoid private mortgage insurance and increase your affordability For a 250 000 home a down payment of 3 is 7 500 and a down payment of 20 is 50 000

Can You Take Home Canned Food On A Plane Design authentic

http://www.100daysofrealfood.com/wp-content/uploads/2012/05/Finished-Jam2.jpg

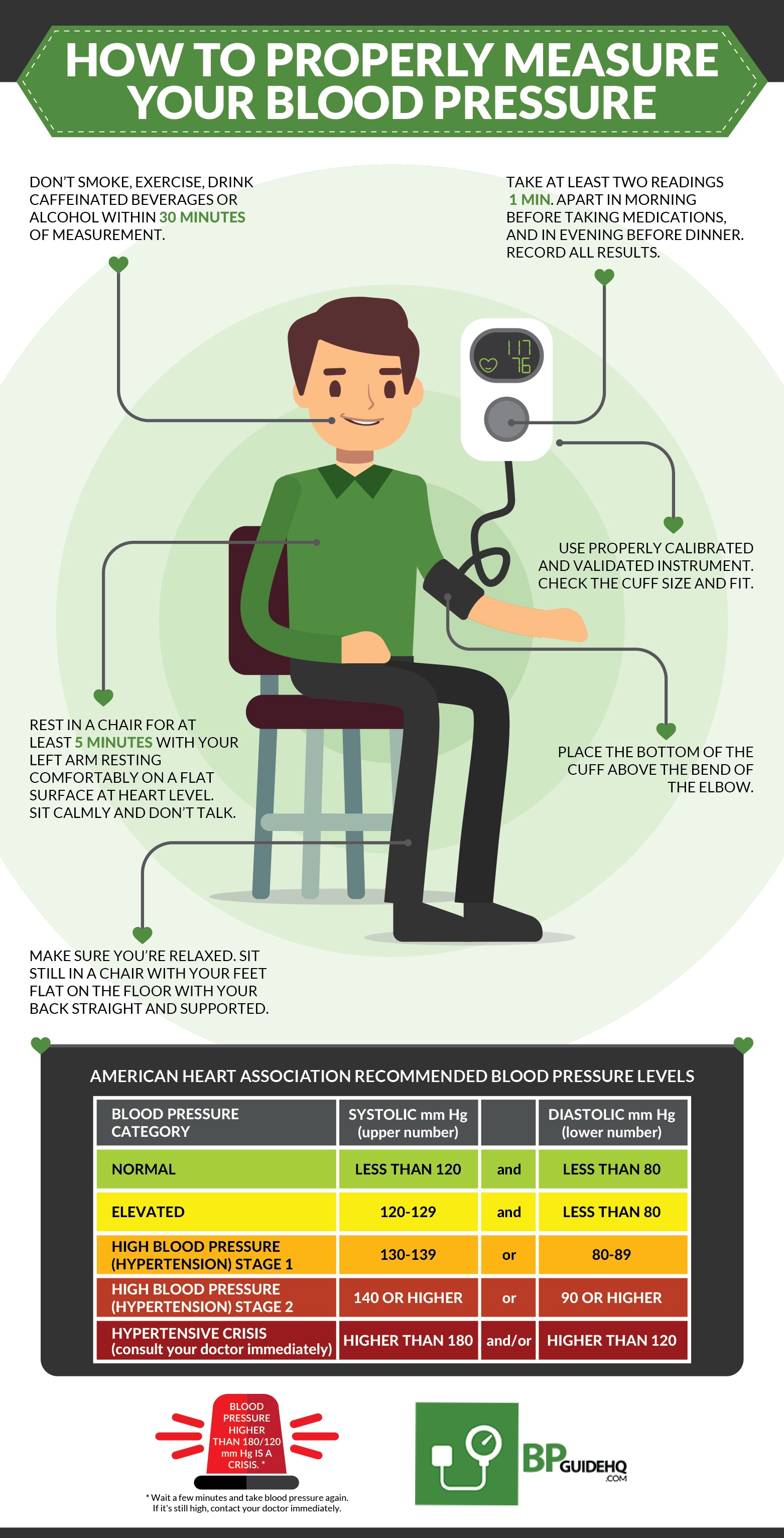

How take blood pressure home Content Geek

https://contentgeek.com/wp-content/uploads/sites/2/2018/08/how-take-blood-pressure-home.jpg

How Much Do You Take Home On 50000 - The average annual salary in the United States is 69 368 which is around 4 537 a month after taxes and contributions depending on where you live However extremely high earners tend to bias averages Likewise average salaries vary state by state such as California s salaries averaging 83 876 a year compared to Florida s at 63 336